How Charitable Remainder Trusts Reduce Tax, Ensure Regular Income

This Long Term Plan Is of Particular Use to Owners of Illiquid Privately Held Companies

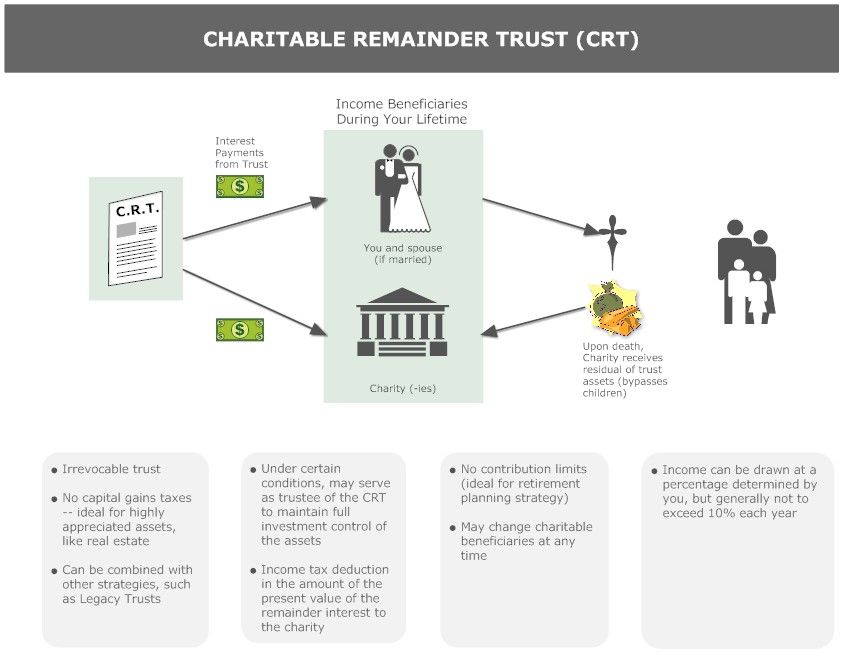

Consultants can help business owners planning a sale by helping them understand how a charitable remainder trust might help. These trusts can significantly reduce owed taxes and ensure owners receive regular income in return for donating cash, securities, or real estate to a charity. It’s of particular use for owners of illiquid privately held companies. Here’s how it works.

If you are thinking about selling your company, a charitable remainder trust is an option that helps reduce your payout to the Internal Revenue Service. Charitable remainder trusts allows you significantly reduce your tax and ensure that you receive regular income in return for donating cash, securities, or real estate to a charity. Because you are giving assets to charity, you qualify for a charitable deduction on your income tax.

Benefits to You and Charity

The name “charitable remainder trust” is derived from the fact that after you die (having received regular income from the trust throughout your lifetime), the remainder of the trust goes to the charity or charities of your choice.These trusts essentially provide for two sets of beneficiaries: 1) the income beneficiaries (you and your spouse) and 2) the charities you name, which receive the principal of the trust after the income beneficiaries die.

Consider the example of Bob and Terry. “Asset rich and cash poor” describes them in a nutshell. By far the largest asset they own is stock in a real estate construction company Terry inherited from her parents, where Bob works as vice president of sales. The business has prospered, and its value has grown dramatically in recent years. But the stock pays no dividends, so Bob and Terry’s income is based largely on Bob’s salary and commissions.

Bob and Terry could sell their stock now or at retirement and put the proceeds in income-producing investments. But it is hard to sell a minority interest in a privately owned company, even a highly profitable one. The most likely buyers—other key employees of the business—usually don’t have the financial resources to buy a significant portion of the business. Bob and Terry could look for a third-party investor, but investors rarely want to pay what the company is worth and typically want some level of management control.

Furthermore, if they sell, Bob and Terry will lose a substantial amount of the stock’s appreciation to capital gains tax. The tax rate on capital gains held longer than one year is generally 15 percent.

A better strategy might be to establish a charitable remainder trust. In this arrangement, Terry would transfer the stock to an irrevocable trust created to provide lifetime payments to her and Bob. At the death of the surviving spouse, the trust property would be transferred to the charitable organization Terry has named in her trust agreement. If necessary, the property can be sold by the trustee (in this case, Terry, but it could be someone she named) for cash needed to meet the trust’s built-in obligation to pay out regular income. This sale is not subject to capital gains tax.

Bolstering Retirement

People often choose charitable remainder trusts to augment their current retirement plan. By taking this route, Bob and Terry would have more money invested toward retirement than if they sold the stock and invested the proceeds themselves. They would likely be able to claim a charitable deduction for the value of the stock property on their income tax that year and could invest their tax savings outside the trust to produce additional income.

Although a charitable remainder trust is an irrevocable trust, you can change the charitable beneficiaries at any time. Charitable remainder trusts bypass any children, but you can implement other strategies to see that heirs are provided for.

A charitable remainder trust can be structured as either an annuity trust or a unitrust. The type you choose determines how payments from the trust are calculated. In a charitable remainder annuity trust (CRAT), you receive annual payments of a set percentage of the trust’s initial fair market value (see Business Valuation 101). The percentage must be at least 5 percent and cannot exceed 50 percent. A charitable remainder unitrust (CRUT) pays an annual income based on the fair market value of the trust property, revalued each year. If the trust investments perform well, the income increases. Some people prefer to use a CRUT because it can provide a hedge against inflation and it can accept additional gifts, which a CRAT cannot.

A Good Valuation Is Essential

This and other financial strategies involving stock in privately owned companies depend on knowing what the stock is worth. The problem is that stockholders often think they know what their companies are worth, but, in reality, they are shockingly misinformed. For example, a leading M&A firm, surveyed 2,000 business owners and found that most misjudged the value of their businesses by 50 percent or more—often by millions of dollars. So be sure your business is properly appraised before selling your company, making gifts of stock or implementing any financial plan.