A Market of Lemmings: BV for the Litigation Practitioner

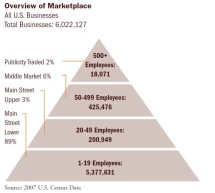

Caveats that Careful Valuators and Consultants to Keep in Mind When Using the Market Approach to Valuation Authoritative sources such as the IRS, SEC, FASB, and professional appraisal associations consistently advocate market prices to be the best indications of value. But is that always true? Gregory R. Marsh argues that in some financial markets—at various times—there’s plenty of evidence that both buyers ...

Read more ›