Why Bad Multiples Happen to Good Companies—McKinsey Quarterly

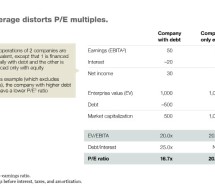

A Premium Multiple is Hard to Come By and Harder to Keep;  Owners Should Worry More About Improving Performance Susan Nolen Foushee, Tim Koller, and Anand Mehta make the case in McKinsey Quarterly that executives considering company value often worry too much about their company's multiple (e.g., a P/E ratio, or EV/EBIDTA, etc.) instead of focusing on company growth.  It isn't that multiples aren't legiti ...

Read more ›