The Imperative of Considering the Concept of Highest and Best Use in Healthcare Valuation (Part 1 of 2)

Traditional valuation methodologies have relied upon the analysis of historical accounting and other data as predictive of future performance and value. However, this may not hold true with every economy, industry, or even every enterprise within an industry, over time. For example, the turbulent status of the healthcare industry over the last five decades, since the passage of Medicare in the 1960s, has introduced intervening events and circumstances that have had a dramatic effect on the revenue, expense, and subsequent net economic benefit stream of enterprises operating in the healthcare marketplace. Accordingly, the ‚Äúroad map of historical performance‚ÄĚ of healthcare related enterprises becomes less predictive of future performance. In this first article, of a two-part series, the authors focus on the various standards of value applicable to healthcare engagement and conclude discussing the highest and best use standard.

The fundamental economic facts and circumstances, and economic behavior, that will occur under certain conditions form the basis of the economic laws that dictate what would objectively be expected to prevail in certain specified economic situations.  Within this concept, it can be said that the basis of all economic values derive from some form of economic usefulness, also termed utility.[i]  Thus, it has been said that this Principle of Utility may be stated as an object can have no value unless it has utility.

The fundamental economic facts and circumstances, and economic behavior, that will occur under certain conditions form the basis of the economic laws that dictate what would objectively be expected to prevail in certain specified economic situations.  Within this concept, it can be said that the basis of all economic values derive from some form of economic usefulness, also termed utility.[i]  Thus, it has been said that this Principle of Utility may be stated as an object can have no value unless it has utility.

In conjunction with this principle of utility, there are certain basic valuation tenets the considerations of which are important to the valuation process, for example,:

- All value is the expectation of future benefit(s), therefore value is forward looking.

- The best indicator of future performance is usually the performance of the immediate past.

- Historical accounting and other data are useful primarily as a road map to the future.

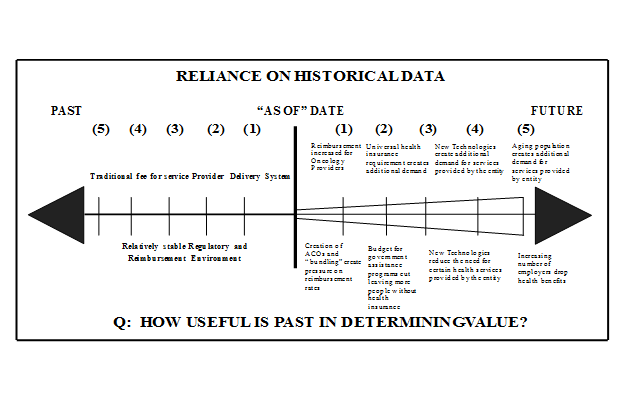

Traditional valuation methodologies have relied upon the analysis of historical accounting and other data as predictive of future performance and value.¬† However, this may not hold true with every economy, industry, or even every enterprise within an industry, over time.¬† For example, the turbulent status of the healthcare industry over the last five decades, since the passage of Medicare in the 1960s, has introduced intervening events and circumstances that have had a dramatic effect on the revenue, expense, and subsequent net economic benefit stream of enterprises operating in the healthcare marketplace.¬† Accordingly, the ‚Äúroad map of historical performance‚ÄĚ of healthcare related enterprises becomes less predictive of future performance. An illustration of how events may change the prediction of future performance is shown in Exhibit 1..

Exhibit 1:   Reliance on Historical Data in a Professional Medical Practice[ii]

A thorough understanding of financial valuation concepts is a requisite foundation for a well-reasoned and defensible valuation analysis.[iii] At the outset of each valuation engagement, it is critical to appropriately define the standard of value and premise of value to be employed in developing the valuation opinion.[iv] The standard of value defines the type of value to be determined and answers the question, ‚Äúvalue to whom?‚ÄĚ Several standards of value may be sought by the analyst, including:

- Fair Market Value

- Fair Value

- Investment Value,

- Fundamental (Intrinsic) Value[v]

However, due to regulatory edicts contained within the Internal Revenue Code (IRC), Stark Law, and Anti-Kickback Statute, and False Claims Act, most types of healthcare transactions are required to adhere to the standard of Fair Market Value.

In general business valuation terminology, Fair Market Value is defined as ‚Äúthe price, expressed in terms of cash equivalents, at which property would change hands between a hypothetical willing and able buyer and a hypothetical willing and able seller, acting at arm‚Äôs length in an open and unrestricted market, when neither is under compulsion to buy or sell and when both have reasonable knowledge of the relevant facts.‚ÄĚ[vi]

However, for purposes of healthcare valuation, the standard of Fair Market Value is further defined by the IRC, Stark Law, and Anti-Kickback Statute as follows:

- The IRC and accompanying Treasury Regulations, IRS revenue rulings and other IRS gives guidance pertaining to Fair Market Value for transactions involving tax-exempt organizations, e.g., in an excess benefit transaction:

- (a) ‚Äúthe general rule for the valuation of property, including the right to use property, is fair market value (i.e., the price at which property or the right to use property would change hands between a willing buyer and willing seller, neither being under any compulsion to buy, sell or transfer property or the right to use property, and both having reasonable knowledge of relevant facts)‚ÄĚ;[vii]

- An ‚Äúexcess benefit transaction‚ÄĚ is a ‚Äútransaction in which an economic benefit is provided by an applicable tax-exempt organization, directly or indirectly, to or for the use of a disqualified person, and the value of the economic benefit provided by the organization exceeds the value of the consideration received by the organization‚ÄĚ;[viii]

- (b) The hypothetical transaction contemplates a universe of typical potential purchasers for the subject property and not a specific purchaser or specific class of purchaser;[ix]

- (c) Buyer and seller are typically motivated;[x] and,

- (d) Both parties are well informed and acting in their respective rational economic self-interests.[xi]

- (a) ‚Äúthe general rule for the valuation of property, including the right to use property, is fair market value (i.e., the price at which property or the right to use property would change hands between a willing buyer and willing seller, neither being under any compulsion to buy, sell or transfer property or the right to use property, and both having reasonable knowledge of relevant facts)‚ÄĚ;[vii]

- The Stark Law and accompanying regulations define Fair Market Value as:

- (a) The ‚Äúvalue in arm‚Äôs length transactions, consistent with the general market value. ‚ÄėGeneral Market Value‚Äô means the price that an asset would bring as the result of bona fide bargaining between well-informed buyers and sellers who are not otherwise in a position to generate business for the other party‚Ķ‚ÄĚ[xii] [Emphasis added];

- (b) The most probable price that the subject interest should bring if exposed for sale on the open market, as of the valuation date, but exclusive of any element of value arising from the accomplishment or expectation of the sale.[xiii] This standard of value assumes an anticipated hypothetical transaction, in which the buyer and seller are each acting prudently with a reasonable equivalence of knowledge, and that the price is not affected by any undue stimulus or coercion;[xiv] and,

- (c) An anticipated hypothetical transaction conducted in compliance with ‚ÄúStark I & II‚ÄĚ legislation prohibiting physicians from making referrals for ‚Äúdesignated health services‚ÄĚ reimbursable under Medicare or Medicaid to an entity with which the referring physician has a financial relationship.[xv]

- The Anti-Kickback Statute requires the payment of ‚Äúfair market value in arms-length transactions‚Ķ[and that any compensation is] not determined in a manner that takes into account the volume or value of any referrals or business otherwise generated between the parties for which payment may be made in whole or in part under Medicare, Medicaid or other Federal health care programs‚ÄĚ[xvi] [Emphasis added.]

In addition to identifying the standard of value to be used in the valuation engagement, it is imperative that the premise of value, that is, an assumption further defining the standard of value to be used and under which a valuation is conducted, also be determined at the outset of the valuation engagement. The premise of value defines the hypothetical terms of the sale, that is, ‚Äú‚Ķthe most likely set of transactional circumstances that may be applicable to the subject valuation; e.g., going concern, liquidation,‚ÄĚ[xvii] and answers the question of ‚Äúvalue under what further defining circumstances?‚ÄĚ The selection of the premise of value can have a significant effect on its application in the valuation process. As set forth in Exhibit 2,¬† two general concepts relate to the consideration and selection of the premise of value: (1) value in use; and, (2) value in exchange.

Exhibit 2: Premises of Value

Value in use is the premise of value which assumes that the assets will continue to be used as part of an ongoing business enterprise, producing profits as a benefit of ownership of a going concern. As defined by Dr. Shannon Pratt, CEO of Shannon Pratt Valuations, Inc.: ‚ÄúValue as a going concern‚ÄĚ is ‚Äúvalue in continued use, as a mass assemblage of income-producing assets, and as a going-concern business enterprise.‚ÄĚ[xviii] It should be noted that in order to use the premise of value in use as a going concern:

- There must be a reasonable likelihood that the subject enterprise will generate sufficient net margin to generate an economic cash flow

- There must be a reasonable likelihood that this would occur in the reasonably foreseeable future

- The cash flow must be supported by the tangible assets utilized to generate the revenue stream and support the value of the investment[xix]

In the absence of a reasonable expectancy of sufficient economic cash flow to support the value of the investment represented by the tangible assets utilized to generate the revenue stream of the enterprise, the highest and best use of the assets may be under, and the appraiser may select, a premise of value of ‚ÄúValue-in-exchange as an orderly disposition of a mass assemblage of assets, in place‚ÄĚ, which includes all individually identifiable tangible and intangible assets. [xx]

The concept of highest and best use is defined as:

‚Äú‚Ķthat use among possible alternatives which is legally permissible, socially acceptable, physically possible, and financially feasible, resulting in the highest economic return.‚ÄĚ[xxi]¬†

As Dr. Pratt points out, the concept of highest and best use drives the selection of the valuation premise, which may apply under the Standard of Value of Fair Market Value, to wit:

‚ÄúEach of these alternative premises of value may apply under the same standard, or definition, of value.¬† For example, the fair market value standard calls for a ‚Äėwilling buyer‚Äô and a ‚Äėwilling seller.‚Äô¬† Yet, these willing buyers and sellers have to make an informed economic decision as to how they will transact with each other with regard to the subject business.¬† In other words, is the subject business worth more to the buyer and the seller as a going concern that will continue to operate as such, or as a collection of individual assets to be put to separate uses?¬† In either case, the buyer and seller are still ‚Äėwilling.‚Äô¬† And, in both cases, they have concluded a set of transactional circumstances that will maximize the value of the collective assets of the subject business enterprise.‚ÄĚ[xxii] [Emphasis added]

Dr. Pratt goes on to explain that:

‚Äú‚Ķ[t]ypically, in a controlling interest valuation, the selection of the appropriate premise of value is a function of the highest and best use of the collective assets of the subject business enterprise.¬† The decision regarding the appropriate premise of value is usually made by the appraiser, based upon experience, judgment and analysis.‚ÄĚ [Emphasis added]

Robert James Cimasi, MHA, ASA, MCBA, FRICS, CVA, CM&AA, serves as Chief Executive Officer of Health Capital Consultants¬†(HCC), a nationally recognized healthcare financial and economic consulting firm headquartered in St. Louis, MO, serving clients in 49 states since 1993. Mr. Cimasi has over thirty years of experience in serving clients, with a professional focus on the financial and economic aspects of healthcare service sector entities. He is the author of several books the most recent book, entitled¬†“Healthcare Valuation: The Financial Appraisal of Enterprises, Assets, and Services”¬†was published by John Wiley & Sons in March of 2014. ¬†Mr. Cimasi can be reached at (314) 994-7641 or by e-mail at RCimasi@healthcapital.com.

Todd A. Zigrang, MBA, MHA, FACHE, ASA, is the President of HEALTH CAPITAL CONSULTANTS (HCC), where he focuses on the areas of valuation and financial analysis for hospitals, physician practices, and other healthcare enterprises. Mr. Zigrang has over 20 years of experience providing valuation, financial, transaction and strategic advisory services nationwide. He is the author of ‚ÄúAdviser‚Äôs Guide to Healthcare ‚Äď 2nd Edition‚ÄĚ (AICPA, 2014). . Mr. Zigrnang can be reached at (313) 994-7641 or by e-mail at TZigrang@healthcapital.com.

Matthew J. Wagner, MBA, CFA, s Senior Vice President of HEALTH CAPITAL CONSULTANTS (HCC), where he focuses on the areas of valuation and financial analysis. Mr. Wagner has provided valuation services regarding various healthcare related enterprises, assets and services. Mr. Wagner can be reached at (313) 994-7641 or by e-mail at MWagner@healthcapital.com.

Notes

[i] ¬†¬†¬†¬†¬†¬†¬†¬†¬† ‚ÄúValuation of Property: A Treatise on the Appraisal of Property‚ÄĚ by James C. Bonbright, New York and London: McGraw Hill Book Company, Inc., 1937, p. 16-17.

[ii] ¬†¬†¬†¬†¬†¬†¬†¬† ‚ÄúHealthcare Valuation: The Financial Appraisal of Enterprises, Assets, and Services‚ÄĚ By Robert James Cimasi, MHA, ASA, FRICS, MCBA, AVA, CM&AA, Hoboken, NJ: John Wiley & Sons, 2014, Volume II, p. 53.

[iii]¬†¬† ¬†¬†¬†¬† ‚ÄúHealthcare Valuation: The Financial Appraisal of Enterprises, Assets, and Services‚ÄĚ By Robert James Cimasi, MHA, ASA, FRICS, MCBA, AVA, CM&AA, Hoboken, NJ: John Wiley & Sons, 2014, p. 17-18, 26.

[iv]¬†¬† ¬†¬†¬†¬† ‚ÄúHealthcare Valuation: The Financial Appraisal of Enterprises, Assets, and Services‚ÄĚ By Robert James Cimasi, MHA, ASA, FRICS, MCBA, AVA, CM&AA, Hoboken, NJ: John Wiley & Sons, 2014, p. 17.

[v]¬†¬† ¬†¬†¬†¬†¬† ‚ÄúHealthcare Valuation: The Financial Appraisal of Enterprises, Assets, and Services‚ÄĚ By Robert James Cimasi, MHA, ASA, FRICS, MCBA, AVA, CM&AA, Hoboken, NJ: John Wiley & Sons, 2014, p. 17-18.

[vi] ¬†¬†¬†¬†¬†¬†¬† ‚ÄúASA Business Valuation Standards,‚ÄĚ American Society of Appraisers, Accessed at http://www.appraisers.org/docs/default-source/discipline_bv/bv-standards.pdf?sfvrsn=0 (Accessed 8/29/14), p.27.

[vii]        Treasury Regulation § 53.4958-4(b)(i) (2002).

[viii] ¬†¬†¬†¬†¬†¬† ‚ÄúIntermediate Sanctions ‚Äď Excess Benefit Transactions,‚ÄĚ Internal Revenue Service, Aug. 28, 2014, http://www.irs.gov/Charities-&-Non-Profits/Charitable-Organizations/Intermediate-Sanctions-Excess-Benefit-Transactions (Accessed 8/29/14).

[ix]                     Investment Value may be defined as:

‚Äú‚Ķthe specific value of an investment to a particular investor or class of investors based on individual investment requirements; distinguished from market value, which is impersonal and detached.‚ÄĚ Source:‚ÄúInvestment Value‚ÄĚ The Appraisal Institute, The Dictionary of Real Estate Appraisal, 4th ed., 2002, p. 152.

[x]          Revenue Ruling 59-60, 1959-1 C.B. 237.

[xi]         Revenue Ruling 59-60, 1959-1 C.B. 237.

[xii] ¬†¬†¬†¬†¬†¬†¬† ‚ÄúDefinitions‚ÄĚ 42 C.F.R. 411.351 (2009).

[xiii]¬†¬† ¬†¬† ‚ÄúLimitation on Certain Physician Referrals‚ÄĚ 42 U.S.C. ¬ß 1395nn(b)-(e); ‚ÄúGeneral exceptions to the referral prohibition related to both ownership/investment and compensation‚ÄĚ 42 C.F.R. ¬ß 411.355(a)-(i); ‚ÄúExceptions to the referral prohibition related to ownership or investment interests‚ÄĚ 42 C.F.R. ¬ß 411.356(a)-(c); ‚ÄúExceptions to the referral prohibition related to compensation arrangements‚ÄĚ 42 C.F.R. ¬ß 411.357(a)-(p); ‚ÄúExceptions‚ÄĚ 42 C.F.R. ¬ß 1001.952.

[xiv]¬†¬† ¬†¬†¬† ‚ÄúHealthcare Valuation: The Financial Appraisal of Enterprises, Assets, and Services‚ÄĚ By Robert James Cimasi, MHA, ASA, FRICS, MCBA, AVA, CM&AA, Hoboken, NJ: John Wiley & Sons, 2014, p.18-19.

[xv]         42 U.S.C.A. § 1395nn(a); Social Security Act § 1877(a).

[xvi]        42 C.F.R. 1001.952(d)(5).

[xvii]¬†¬† ¬†¬† ‚ÄúThe Principles and Concepts of Valuation: Theory of Utility and Value, Value Influences, and Value Concepts‚ÄĚ By Richard Rickert, Appraisal and Valuation: An Interdisciplinary Approach, Volume I, Washington, D.C.: American Society of Appraisers, 1987, p. 6-7.

[xviii]¬†¬† ¬† ‚ÄúValuing a Business: The Analysis and Appraisal of Closely Held Companies‚ÄĚ By Shannon Pratt, 5th ed., New York, NY: McGraw-Hill, 2008, p. 47.

[xix]¬†¬† ¬†¬†¬† ‚ÄúHealthcare Valuation: The Financial Appraisal of Enterprises, Assets, and Services‚ÄĚ By Robert James Cimasi, MHA, ASA, FRICS, MCBA, AVA, CM&AA, Hoboken, NJ: John Wiley & Sons, 2014, p. 27.

[xx] ¬†¬†¬†¬†¬†¬†¬† ‚ÄúHealthcare Valuation: The Financial Appraisal of Enterprises, Assets, and Services‚ÄĚ by Robert James Cimasi, Volume II, Hoboken, NJ: John Wiley & Sons, 2014, p. 28.

[xxi] ¬†¬†¬†¬†¬†¬† ‚ÄúThe Principles and Concepts of Valuation: Theory of Utility and Value, Value Influences, and Value Concepts‚ÄĚ By Richard Rickert, Appraisal and Valuation: An Interdisciplinary Approach, Volume I, Washington, D.C.: American Society of Appraisers, 1987, p. 55.

[xxii] ¬†¬†¬†¬†¬† ‚ÄúValuing a Business: The Analysis and Appraisal of Closely Held Companies‚ÄĚ By Shannon Pratt, Fifth Edition, New York, NY: McGraw-Hill, 2008, p. 48.

Image courtesy of cooldesign/FreeDigitalPhotos.net