Commercial Real Estate, Chapter 11 Bankruptcy

Cram Down Interest Rates (Part II of II)

In this two-part series the author provides as overview of the issues confronted by courts and financial experts involved in a commercial real estate (CRE) bankruptcy. Read the first part in this series here. In this second part, the author continues the discussion regarding how a financial expert may go about to determine the appropriate interest rate for the underlying claims and analyze the CRE market. In addition, the author provides an example to illustrate the issues that will arise in the court proceeding.

In this second part of this two-part series article, the author continues the discussion started in Part I regarding how a financial expert may ago about developing an interest rate in connection with a commercial real estate (CRE) Chapter 11 bankruptcy. The author focuses on mezzanine financing challenges and provides an example of the blended rate approach.

The blended rate approach divides a secured claim into levels or tranches with each ascending tranche receiving a greater risk factor than the one prior. These tranches are commonly referred to as senior (first tranche), mezzanine (second tranche), and equity (third tranche). The resulting interest rate factors for each tranche are combined proportionately to provide the blended interest rate. This approach has found wide acceptance in the courts for determining the interest rates on claims with high loan-to-value (LTV) ratios (See, In Re: North Valley Mall, LLC, In Re: Village at Camp Bowie I, LP, In Re: Prussia Associates, LP, In Re: Rainbow 215, LLC).

The first tranche (senior) contains the majority amount of the debt (65 percent to 75 percent of the LTV ratio). This tranche reflects the portion of the secured claim that would normally be financed under normal lending practices. The interest rate applied to this tranche is similar to current market rates. Surveys and other data sources can provide interest rates for recent loans in various CRE sub-sectors. These interest rates may be applied to the senior tranche.

Other courts have preferred a build-up method to determine the senior tranche rate beginning with the risk-free rate and adding risk premia specific to the debtor. Either way, the first tranche rate should reflect an interest rate comparable to the current market rate on a comparable non-bankrupt CRE loan.

The second tranche (mezzanine) contains up to 20 percent of the LTV ratio in excess of the first tranche. This means the second band may run from the LTV ratio of 65 percent to 85 percent or 75 percent to 90 percent depending on the size of the first tranche. The second tranche’s rate reflects a greater level of risk; therefore, the interest rate is greater than the senior rate.

The selection of the interest rate to be used for the second tranche will always be controversial. This is because in general practice mezzanine financing is a hybrid of debt and equity financing. It is structured as subordinated debt and falls in the capital structure between senior debt and equity. Therefore, mezzanine financing may not only include debt repayments but also equity participation. For that reason, it is important to be mindful that this mezzanine rate in this calculation will not be subordinated but part of the calculation for the primary secured creditor’s rate. The second tranche rate should not reflect the current lending rates for subordinated lenders and/or projected equity participation rates of return.

The third (equity) tranche covers the final secured portion of the claim. This band reflects the greatest risk of default to the creditor. The amount of the debt covered by this tranche is the remaining LTV ratio up to 100 percent. Because it reflects the greatest risk to the creditor, the tranche receives the greatest interest rate. The rate applied to the third tranche must be greater than the second tranche because the claim and the collateral securing the claim are approaching a one-to-one relationship (100 percent LTV ratio) and any decrease in collateral value would reduce the creditor’s security and increase the lender’s risk.

Example

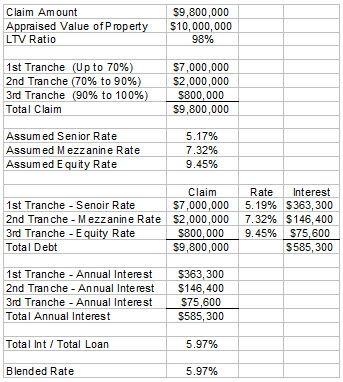

The following table provides an example of how the blended rate approach could be used for a CRE property with a 98 percent LTV ratio. Assume an entity that owns an office building currently valued at $10,000,000 seeks Chapter 11 bankruptcy protection with a secured claim of $9,800,000 on the property. The debtor’s reorganization plan offers a five-year note based on a 25-year amortization paying monthly principal and interest with a balloon payment on the sixtieth month.

Any cram down analysis should rely on current market data. This provides both the debtor and creditor with a cram down interest rate that reflects the economic conditions at the time of the confirmation hearing.

Assume that research shows the average current market interest rate on permanent financing for office buildings is 5.19 percent. Additional research finds the capitalization rate for office property is 9.45 percent. Based on this information, 5.19 percent has been used as the senior tranche rate and 9.45 percent as the equity tranche rate. A rate of 7.32 percent has been applied as the mezzanine rate. The second tranche rate was the mid-point between the senior and equity rates. It meant the second tranche had a risk premium 2.13 percent greater than the first tranche and the third tranche rate was 2.13 percent.

The first tranche contained the portion of the debt up to 70 percent of the LTV ratio. The second tranche included the portion of the claim between 70 percent and 90 percent of the LTV ratio. The third tranche contained all of the debt in excess of the 90 percent LTV ratio. The resulting blended interest rate that would be offered as the cram down rate was 5.97 percent.

The U.S. Bankruptcy Code provides an opportunity for many commercial real estate entities to reorganize under the protection of Chapter 11. While in Chapter 11, the debtor may seek to renegotiate a loan or series of loans secured by the CRE property. Should the debtor’s reorganization plan be approved, the restructured debt is paid according to the terms of the confirmed plan.

“Upon confirmation of a plan of reorganization, a new bargain is made, albeit not at arms’ length but under the cram down provisions of the Bankruptcy Code, and 1129 (b) requires that a creditor simply receive the ‘present value’ of his secured claim for a cram down confirmation to succeed—there is nothing in the Bankruptcy Code to suggest that this value should change with the debtor’s level of financial solvency, or to require that the present value pay the creditor a contractual profit margin” (In Re: SJT Ventures, LLC).

Not all bankruptcy cases will be able to settle on repayment terms and interest rates prior to confirmation. Contested hearings will be held to determine the appropriate interest rate to be paid on a specific claim that will allow the creditor to receive “the present value of the total claim.” In many of these cram down hearings, financial experts will be asked to offer an opinion as to the appropriate interest rate. In many of these CRE cases, the outstanding claim may be close or equal to the value of the securing collateral. For these situations, the blended rate approach may provide the best method for determining the appropriate cram down interest rate for the repayment of the secured claim.

This article has provided an introduction to the information, methods, and case-specific data needed to begin such an interest rate analysis. Armed with a general knowledge of the CRE market, current economic trends and interest rates, and facts specific to the case, an expert may calculate an appropriate cram down interest rate based on the tranches and risk adjusted interest rates applicable to that particular property. The resulting blended rate should provide the creditor with the risk adjusted, present value of its claim while allowing the debtor an opportunity to continue to operate while paying off its debt.

References

Bankruptcy Abuse Prevention and Consumer Protection Act of 2005, (BAPCPA)

Board of Governors of the Federal Reserve System, Mortgage Debt Outstanding, (Dec. 2009)

Congressional Oversight Panel, Commercial Real Estate and the Risk to Financial Stability, February Oversight Report, February 10, 2010

Eisnebach, III, Robert L, Who’s SARE Now? Bankruptcy’s Single Asset Real Estate Rules and Their Impact on Commercial Real Estate, February 17, 2010, http://bankruptcy.cooley.com

Needham, Allyn, Schroeder, Kristin, Cram Down Interest Rate Analysis in Chapter 11 Bankruptcy Matters: An Overview, The Earnings Analyst, Volume 12, 2012, 21-40

Cases

In re: Cellular Information Systems, Inc., 171 B.R. 926 (Bankr. S.D.N.Y. 1994)

In re: North Valley Mall, LLC, Bankr. LEXIS 1927, *; 53 Bankr. Ct. Dec. 109 (Bankr. C. D. Cal. 2010)

In re: Northwest Timberline Enterprises, Inc., 348 B.R. 412, (Bankr. N.D. Tex. 2006)

In re: Prussia Associates, LP, 322 B.R. 572 (Bankr. E.D. Pa. 2005)

In re: Rainbow 215, LLC, BK-S-09-23414-BAM, Memorandum Opinion, March 25, 2011 (Bankr. Nevada 2011)

In re: Scotia Pacific Company, LLC, 508 F.3d 214 (5th Cir. 2007)

In re: SJT Ventures, LLC, 2010 WL 3342206 (Bankr. N.D. Tex. 2010)

In re: Texas Grand Prairie Hotel Realty, LLC, 710 F.3d 324; 2013 U.S. App. LEXIS 4514; 57 Bankr. Ct. Dec. 177 (5th Cir. 2013)

In re: Village at Camp Bowie I, LP, 454 B.R. 702; 2011 Bankr. LEXIS 3033; 55 Bankr. Ct. Dec. 84 (Bankr. N. D. Tex. 2011)

Till v SCS Credit Corp., 541 U.S. 465, 479-80, 124 S, Ct. 1951, 158 L/ Ed. 2d 787 (2004)

Examples of these sources are ReatlyRates.com Investor Survey, www.realtyrates.com, CMBS (Commercial Mortgage Backed Securities) Weekly, Citi Investment Research & Analysis and Bank Survey Information, Duff & Phelps Risk Premium Report, Duff & Phelps, LLC, Private Capital Markets Project, Pepperdine University, http://bschool.pepperdine.edu/privatecapital

Allyn Needham, Ph.D., CEA, is a principal at Shipp, Needham & Durham, LLC (Fort Worth, Texas). For the past 17 years, he has worked in the area of litigation support. Prior to that, he worked more than 20 years in the area of banking and risk management. Dr. Needham has also been an Adjunct Professor of Economics at Texas Christian University and Weatherford College. As an expert, he has testified on various matters relating to commercial damages, personal damages, business bankruptcy and business valuation. Dr. Needham can be reached at aneedham@shippneedham.com and (817) 348-0213.