Post-M&A Disputes

What Financial Advisors and Quantum Experts Should Consider in this Growing Market

Neither the seller nor the buyer intends a dispute to arise as a result of a successful or failed M&A transaction. However, due to the economic importance of M&A decisions and the high purchase prices paid, contentious situations can be observed in around ten percent of all M&A transactions as studies have shown. In this article, leading M&A advisors and attorneys, from Munich, Germany, share their views on the drivers that may explain the source of contention and specifics which need to be addressed by the financial advisors often involved in legal proceedings.

Post-M&A disputes might arise from a discussion about specific issues or a diverging understanding of certain facts in the due diligence, to renegotiation of the purchase price or even an arbitral proceeding for compensation by the Claimant. In addition to external legal counsels which are almost mandatory in dispute resolutions, the arguing parties frequently involve financial advisors or quantum experts who specialize in the quantification of the alleged damages and the financial impact the matters in dispute have on the parties.

Why M&A disputes will become more frequent in the future

Due to the financial importance of M&A transactions and consequently M&A disputes, the waiving of several million Euros purchase price (-recovery) is almost never an alternative. The two authors have witnessed purchase price adjustments of fifty percent or more during M&A transactions. Therefore, it is no surprise that recent studies[1] on M&A disputes predict an increase in the number of controversies and renegotiations for the future.

The large compensation amounts that are often paid in post-M&A disputes are certainly one driver but there are a number of other factors that mean post-M&A disputes are likely to soar in the future.

- Average purchase price reduction of eight to ten percentIn the past, certain buyers who have systematically reconciled the financial results and guarantees granted with the associated provisions in the purchase agreements, had achieved average price reductions in the order of about eight percent. In practice, purchase price reductions of more than fifty percent can be observed. This means that the predominant and limited focus of the acquirers on the integration of the target company might prevent them from reclaiming millions of dollars.

- High purchase prices lead to high expectationsThe current excessive liquidity in the financial markets, especially with institutional investors, has led to an observable investment pressure. To get a decent return on the funds available, high purchase prices are paid. The high purchase prices paid are accompanied by high expectations of the future profitability. If the expected profitability does not materialize for whatever reason, a conflict is often inevitable.

- Management liability to pursue legal proceedings?The current tight economic environment and the intensified personal liabilities of the board members and managers to investigate all business matters potentially relevant for their business, has left many market participants no choice but to analyze transactions for million dollar purchase price recoveries. It is still unclear whether managers who renounce such checks may be held liable at a later point in time or not.  But by the time of closing, the buyer has first unrestricted access to all information of the target. With this information, it is possible for every buyer to verify the compliance with the representations and warranties listed in the purchase agreement. This often takes place in so-called “price tests” or “post-closing due diligence“.

- Internationalization and institutionalization of post-M&A departmentsUnlike in the U.S. or the European economic area, there are cultures in which a subsequent purchase price negotiation is not unusual. International corporations and some international private equity investors have already gained some experience in this regard. In response to this development, such investor groups have established their own specialists and in some cases even their own departments, to deal with legal and economic issues in M&A disputes.  With eight to ten percent average purchase price reduction on the table, we expect to see more in house departments develop.

Even if conflicts in M&A transactions can be diminished through an intensive due diligence and excellent legal advice in contract negotiations, it cannot be totally prevented. Financial advisors need to have a clear understanding of the specifics which need to be addressed in legal proceedings.

Assessing controversial contractual clauses and financial impacts in M&A disputes

The success of a claimant in a legal dispute significantly depends on whether the claimant is able to expose and prove the facts justifying his or her claim. Especially in complex M&A disputes, the opposing parties and the financial advisors involved often underestimate the difficulty in presenting the evidence. Every case is won by the facts, so every damages assessment has to start with a profound analysis of the facts which requires large amounts of human and financial resources.

First, it has to be determined what the parties really wanted when they agreed upon a certain contract clause. The legally relevant meaning of the clause has to be determined by interpretation and the quantum experts will be regularly involved with the correct interpretation of financially relevant clauses. The initial basis for each interpretation is the wording of the declaration. Nevertheless, a court or tribunal might not limit its interpretation to the wording of a clause, and often also considers the surrounding circumstances at the time the agreement was made.[2]  Amongst other things, a tribunal or court is interested in the purpose of the party’s intended transaction and the historical development and origins of the contract clause.

It is essential to review the documents evidencing the course of negotiations, for example: the handwritten notes, the minutes of hearings or conference calls, e-mails, and drafts of contracts (so-called “mark-ups”). In legal proceedings, such documents can help to prove what had been intended, which party had originally suggested, prevented or modified the clause, and what the clause’s meaning should ultimately be. Therefore, such documents should definitely be analyzed by the financial advisor before an independent assessment of the damages can be made.

Preservation of evidence at the time of closing

At the time of closing, the seller usually loses access to all of the target company’s data as well as to its employees. This means that he simultaneously loses important pieces of evidence for a possible lawsuit. In contrast, at the time of closing the buyer is granted unlimited access to the target for the first time. Then, the compliance of the actual financial situation with the catalogue of guarantees and warranties from the share and purchase agreement should be assessed as of the effective date in a so-called “post-closing due diligence” or “price test”. With experienced and professional international investors this is often done by a joint team of legal and financial experts. It is recommended to closely inspect issues which were heavily disputed in the contract negotiations and for which the seller did not want to give a guarantee. Here, the buyer should make sure that the seller has provided him with correct information on the actual situation.

Forensic investigations to eliminate liability limitations

The fundamental objective of every damage assessment is to restore the injured party; i.e., put them in a position they would have been in without the injuring event. However, this relatively simple principle of damage determination must be adjusted depending on the jurisdiction and the underlying Sales and Purchase Agreement (SPA). And these adjustments may be relatively complicated.

Not each and every damage can be determined and certainly cannot be proved the same way. A flawed purchase price adjustment or the violation of a balance sheet warranty can be relatively easy to identify and document on the basis of closing accounts, financial data, financial statements, and due diligence documents. In cases of suspected balance sheet manipulation, fraud, or an “unlawful sugarcoated” business plan however, the evidence is much harder to find. In this second category of damages, most often forensic e-mail reviews and interviews of key personnel are required in addition to the regular data analysis. In practice, e.g., the e-mail from an accountant to a colleague or the thoughtless statement of an operating manager have been the sought after evidence for purchase price reductions worth millions of dollars.

In these cases in which the buyer claims that he has willfully—thus intentionally—been deceived by the seller, another aspect becomes important for the damages claimable. Such a claim enables the buyer to lever out contractually agreed liability limitations of the SPA (as for example so-called caps and de-minimis clauses) and to rely on legal bases for claims which are actually excluded in the contract. Especially relevant are claims due to failures during contract negotiations (culpa in contrahendo) regarding a breach of disclosure obligations as well as the challenge of a decision due to willful deception. These become relevant in the case of intent, because liability for intent in most jurisdictions cannot be excluded in a contract.[3]  Consequently, the real damages incurred can be claimed without any limit.

Damage quantification—often incorrectly calculated

If an M&A-related dispute occurred, then beyond the need for evidence, the question how to quantify the compensation must be answered. If, for example, a provision was omitted in the balance sheet, even some experienced litigators still believe that the damage represents “only” the shortfall in the account balance—leading to a euro-for-euro indemnity. For example, if a provision was omitted amounting to USD one million, it is quite often seen in practice that claimants claim exactly the same amount as damages. However, the provision might be influenced by interest rate effects, tax effects, consequential damages, and (overlooked) mitigations. These effects can quickly accumulate to deviations of +/- forty percent or more compared to the simplified euro-for-euro approach. When you are confronted with material accounting errors and high impact breaches of balance sheet guarantees, it is advisable to opt for a more precise approach to quantify damages.

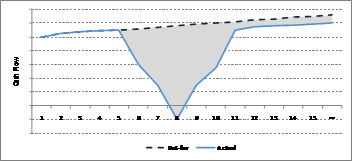

The most commonly used form of the damage assessment is the “but-for-analysis”. It represents the actual situation (including the damage) compared to the counterfactual (without damage). The following chart corresponds to the compensation as the difference between the cash flows with and without damage (gray shaded area).

The “but-for-analysis” takes into consideration even the above mentioned indirect effects like taxes, interest, consequential damages, and mitigations. If confronted with larger indemnifications the “but-for-analysis” is often the best approach due to its increased accuracy.

The fortune and misfortune of purchase price adjustment mechanisms

Corporate transactions are frequently associated with very material purchase price payments. Therefore, it is understandable that both buyers and sellers often agree to adjust the purchase price on the date of economic transfer given the actual financial situation. This is done by means of contractually agreed purchase price adjustment mechanisms. However, such purchase price adjustment mechanisms should include key financial parameters such as net debt, net working capital, investments, capital expenditures, and off-balance sheet items to cover significant price-related aspects. In practice, the parties frequently agree on a simplified purchase price adjustment mechanism for the sake of a reduction in complexity. This simplified purchase price adjustment might be limited, for example, only to the net financial debt and selected items of the working capital. This simplification comes at a price: it allows the shrewd seller as well as the price-conscious buyer to influence the purchase price payable and to open a discussion for a price adjustment, depending on the party which prepares the transaction accounts.

No financial statement and no balance sheet are free of subjective assessments of the party who prepared the financial statement. Pugnacious valuation assumptions, or still tolerable inaccuracies accepted by auditors, give rise to subsequent purchase price reductions for the buyer. With full access to all information of the transaction object as well as with updated knowledge since the last financial statement was prepared, many buyers come to different conclusions on the value of the acquired target than at the time of the signing of the purchase agreement. However, even sellers can use simplified purchase price adjustment mechanisms to their advantage, i.e., when they use accounting discretion in the preparation of the transaction financial statements.

Purchase price multipliers—when damages soar

Purchase price multiples have a special status in M&A disputes. If the damage related to the normalized EBIT or EBITDA which was the basis for the purchase price derived by a EBIT-/EBITDA-multiplier, then the question arises whether the damage is to be compensated only once or several times (equal to the EBIT-/EBITDA-multiplier). This is an extremely interesting question from a legal and a financial perspective. A remarkable leverage effect for the buyer can be noted if the data is able to support the reimbursement of damages based on a multiplier. Even relatively minor EBIT-/EBITDA-adjustments suddenly have large claims to follow. Financial advisors should watch out in the SPA if single damages might be reimbursable several times.

Some final tips from the daily M&A practice

It cannot be stressed enough how important it is to collaborate with experienced litigators in post-M&A disputes. They already set the stage for the best possible burden of proof in the case of subsequent legal proceedings and can provide guidance in the interpretation of the different contractual clauses.

From the buyer’s perspective, it also provides transparency to reveal the purchase price determination in the purchase agreement. From the perspective of the seller, the SPA should enable access to the relevant documents in the case of a dispute.

Due to the increasing number of post-M&A disputes, the storage of documents and especially the documentation of the deal communication are of critical importance. It has to be noted that some post-M&A lawsuits fail solely on a lack of necessary evidence.

For larger disputed amounts it is advisable for buyers and sellers to verify whether the damage was calculated correctly. Were tax effects, interests, mitigations, and consequential damages included?  The practice shows that there is still a great need for awareness-raising.

[1] Alvarez & Marsal, Baker & McKenzie: Post-M&A dispute study, 2013/2014.

[2] In Germany for example, the intent of the parties has to be considered by law; cf. BGH NJW-RR 2000, 1002, 1003.

[3] e.g. in Germany: Section 276 para. 3 German Civil Code (BGB).

Kai Schumacher is a member of the Board of Management of AlixPartners in Germany and Director in AlixPartners’ Financial Advisory Services practice in Munich. Mr. Schumacher specializes as a quantum expert witness and corporate finance consultant and has more than 16 years of experience in international arbitration, litigation, valuation, forensic investigations, and mergers and acquisitions (M&A). Kai has (co-) led more than 150 national and international corporate finance projects dealing with entities from 53 different countries. Moreover, Mr. Schumacher is one of the five “most highly regarded individuals” in Europe for 2015//2016 and one of 165 world’s leading experts in commercial arbitration according to “The International Who’s Who of Commercial Arbitration” since 2012/2013.

Mr. Schumacher can be reached at kschumacher@alixpartners.com or at +49 172 8 25 6041.

Dr. Alice Broichmann is Counsel with P+P Pollath+Partners, a Munich-based law firm. Dr. Broichmann is a Member of the German Institution of Arbitration (DIS), member of the International Bar Association (IBA), member of Arbitral Women, member of the Austrian Arbitration Association, member of the Alternative Dispute Resolution Committee of the German Bar Association. Dr. Broichmann was recognized as the 2016 Lawyer of the Year in International Arbitration–Bayern.

Dr. Broichmann can be reached at Alice.Broichman@pplaw.com.

The opinions expressed are those of the authors and do not necessarily reflect the views of P+P Pollath +Partners, AlixPartners, LLP, their affiliates or any of their respective other professionals or clients.