In re Appraisal of DFC Global

A Study of the Experts’ Inputs and Court Opinion

How does a court go about deciding a valuation case when two experts oppose each other? The author examines the DFC Global Corporation decision to see what that reveals and how that may impact an expert’s future engagement. The author finds three takeaways for readers.

[su_pullquote align=”right”]Resources:

Advanced Valuation: Applications and Models Workshop

Opposing Experts Without Standards: What To Expect And How To Challenge Them

[/su_pullquote]

Many are familiar with Delaware corporate law, specifically Section 262 which generally allows for appraisal rights, pursuant to a merger, to any stockholder of record of a Delaware corporation. Â Many are also familiar with the fundamental discounted cash flow (DCF) analysis used to value companies.

I found an interesting case regarding DFC Global Corporation and the Delaware Chancery Court’s decision and opinion when the court compared the two opposing valuation experts’ discounted cash flow valuation analysis.  The formal name of the cases is Appraisal of DFC Global Corp. Consolidated C.A. No. 10107–CB.

To avoid confusion between the acronym DCF and DFC Global, I will refer to DFC Global as Dollar Financial. I believe there are a few lessons we can learn from the court’s decision on something as fundamental as the DCF method.

Background

Dollar Financial was a publicly traded payday lender that was acquired and taken private by private equity firm Lone Star in June 2014. Dollar Financial was formed in 1999 and initially operated entirely in the United States. Over time, it made more than 100 acquisitions and by the time of the sale, Dollar Financial operated in 10 countries with more than 1,500 locations, in addition to having a substantial internet lending business.

The bulk of Dollar Financial’s revenue came from three main markets: the United Kingdom (40%), Canada (31%), and the US (12%). In the US, at the time of the merger, Dollar Financial operated 292 stores in 14 states with most of the business in California, Louisiana, and Arizona. Dollar Financial was subject to regulations from different regulatory authorities across its markets. This was a textbook case of high regulatory risk from changes or potential changes in regulations. Although in the US the Consumer Financial Protection Bureau began to supervise and regulate Dollar Financial, its greatest exposure, both financially and regulatory, was in the UK.

Dollar Financial entered the UK market in 1999 and had 152 stores by 2005 which more than doubled to 330 stores by 2009 and then again nearly doubled to 601 stores at the time of the merger. Effective April 1, 2015, a new regulatory body, the Financial Conduct Authority, assumed regulation of the payday industry. This was the culmination of UK regulatory action began by the predecessor regulator, known as the Office of Fair Trading, in February 2012, with in-depth reviews of the larger players in the industry, including Dollar Financial.[1]  The most significant and impacting regulatory change in the UK was to limit the number of loan rollovers allowed to two and to restrict the lenders’ ability to extract funds from borrower accounts.

Dollar Financial experienced rapid growth and operated on a June 30 fiscal year end. In 2004, its last fiscal year before becoming a public company, Dollar Financial had total revenue of about $271 million. As of 2013, last fiscal year before the merger, its total revenue had increased to $1.12 billion.

Dollar Financial funded its growth with debt. At the time of the merger, Dollar Financial had about $1.1 billion debt compared to about $367 million equity market capitalization. This is a debt-to-equity ratio of 300% and debt to total capitalization of 75%.

In August 2013, Dollar Financial provided fiscal year June 2014 adjusted EBITDA guidance of $200 to $240 million. Rather than provide typical earnings per share guidance, Dollar Financial’s explanation for the EBITDA guidance was that it needed “clearer visibility as to the amount and timing of these regulatory issues”, and that it expected to operate at a “continuing competitive disadvantage” in the United Kingdom until all industry providers are required to operate consistently under the new framework.[2]

The Sales Process

In the spring of 2012, Dollar Financial engaged an investment banker to sell the company. Three of six parties expressed interest but by October, none were interested. Over the next year, the investment bank contacted 35 financial sponsors and three strategic buyers.

In the fall of 2013, Dollar Financial attempted to refinance about $600 million in senior notes, but the offering was terminated because of insufficient investor interest at the coupon rate offered by Dollar Financial. Also, in the fall, Dollar Financial began discussions with a prior interested buyer as well as Lone Star, the ultimate buyer. In November, Dollar Financial provided the interested parties with financial projections based on EBITDA for the upcoming fiscal year ending June 30, 2014.

Over the next several months, Dollar Financial communicated worsening EBITDA projections to the interested buyer(s); this occurred in mid-February 2014 and March 26, 2014. The next day, Lone Star offered $9.50 per share which was the ultimate transaction price. On April 1, Dollar Financial’s board approved the merger at $9.50 per share; the total deal was valued at about $1.3 billion, including $1.04 billion of debt. On April 2, Dollar Financial announced the merger and cut its earnings outlook once again. The merger closed June 13, 2014. The actual EBITDA for the fiscal year ended June 30, 2014 was about $139 million compared to $153 million projected on March 26, 2014.

Litigation: Two Experts with Two Vastly Different Values

Eventually, former stockholders of Dollar Financial sought to have their shares appraised under 8 Del. C. § 262. The court opinion stated, “An action seeking appraisal is intended to provide shareholders who dissent from a merger, based on the inadequacy of the offering price, with a judicial determination of the fair value of their shares.”

“In an appraisal action, the Court will determine the fair value of the dissenting stockholders’ shares exclusive of any element of value arising from the accomplishment or expectation of the merger or consolidation, together with interest, if any, to be paid upon the amount determined to be the fair value. In determining such fair value, the Court shall take into account all relevant factors. The appraisal excludes any value resulting from the merger itself because its purpose is to compensate dissenting stockholders for what was taken from them. Consequently, the value of the stock must be appraised on a going concern basis”.[3]

How could one expert have arrived at $17.90 per share and the other at $7.81 per share, with both using the DCF method? Â The difference in price is more than a hundred percent and more than the deal price itself of $9.50.

The petitioners’ expert (representing the former shareholders of Dollar Financial) performed both a DCF analysis as well as a multiples-based comparable company analysis for his valuation. In the end, he gave 100% weight to the DCF analysis and valued Dollar Financial at $17.90 per share.

Dollar Financial’s expert also performed both a DCF analysis ($7.81 per share) as well as a multiples-based comparable company analysis ($7.94 per share). This expert gave 50-50 weighting to each method, resulting in a splitting of the difference, or a final fair value of $7.94 per share.

The court expressed its seeming frustration by stating, “Unfortunately, the existence of drastic differences between experts’ valuations is not an uncommon issue”. The court referred to the appraisal of Dell Inc. and cited a study of that opinion that showed that respondents’ experts produce valuations, on average, 22% below the deal price, and petitioners’ experts produced valuations, on average, 186% above the deal price. “Two highly distinguished scholars of valuation science, applying similar valuation principles, thus generated opinions that differed by 126%, or approximately $28 billion. This is a recurring problem”.[4]

Examination of Each Valuator’s DCF Inputs and the Court’s Input

Capital Structure

Rather than using an optimal industry capital structure, the petitioners’ expert used Dollar Financial’s then current debt to capital ratio of 74%. Dollar Financial’s expert used three different capital structure scenarios but ultimately agreed that 74% was reasonable. The court decided not to conduct its own analysis and used 74%.

Cost of Debt

Since Dollar Financial had issued senior notes, both experts use their yield to maturity to estimate the cost of debt; however, Dollar Financial’s expert used a date closer to, but still before, the announcement of the transaction. Petitioners’ expert conceded on this point, and therefore the court agreed to use the date closest to the announced transaction, which was a yield 10.0% versus 9.1%.

Risk Free Rate

Both experts agreed on a 3.14% risk-free rate (20-year Total Constant Maturity Treasury Yield) and an equity risk premium of 6.18% (Duff & Phelps Supply-Side Equity Risk Premium).

Areas of Disagreement

Weighted average cost of capital (WACC): the primary areas of disagreement being factors used to calculate WACC were: mainly beta, the method of unlevering and relevering beta, the size premium, and the tax rate.

Adjustments to projected cash flows: the experts disagreed on changes to net working capital and adjustments to account for stock-based compensation expense.

Growth model: the experts disagreed on whether to use a two-stage model or a three-stage model.

Next, we will examine what the court decided and what takeaways we can learn from this.

- Each expert had different approaches revolving around the following: (1) whether to include Barra beta or only use Bloomberg beta; (2) which companies to include in the beta estimate; (3) whether to use a two-year or a five-year historical period; and (4) whether to use raw beta or a smooth beta.a. Barra beta vs. Bloomberg beta. The Barra betas are from a subscription-based provider and is more of a black box result. In other words, the model is proprietary and is not easily replicated. In the Golden Telecom, the Chancery Court previously rejected the use of Barra betas because Barra did not publicly disclose the weight of each factor used in its proprietary model. Bloomberg calculates its beta using a regression of the historical trading prices of the stock against the S&P 500 using weekly data over a two-year period. Given the lack of transparency in beta and the expert’s inability to explain it in court, the court in this case rejected the use of Barra betas and only used Bloomberg betas.b. Use of peer companies to compute beta. One expert used six companies in his analysis and the other expert used nine companies, including the same six that the other used. The court reasoned that the three additional peers used by the other expert were not as comparable as the six that they both agreed on. Therefore, the court used the six peer companies that both experts utilized and excluded the other three. One area where the experts disagreed was whether to use Dollar Financial’s own beta in the analysis. The court opined that it was reasonable to factor Dollar Financial’s beta into the analysis but not to use it in isolation. The court added a seventh beta which was the Dollar Financial’s beta.c. Measurement period. The petitioners’ expert used a two-year measurement period on the basis that the shorter period was more reflective of the regulatory uncertainty in the market. The court agreed with the Dollar Financial’s expert who countered that a shorter period was more appropriate when there was a fundamental change in business operations, not when an industry is continuously going through regulatory change. Thus, the court used a five-year measurement period in its beta calculation.d. Raw betas vs. smoothed betas. One expert uses raw betas while the other used smoothed betas. The beta smoothing technique that the Dollar Financial’s expert used adjusted the historical raw beta to a forward-looking beta estimate by averaging historical estimate (weighted two thirds) with the market beta of 1.0 (weighted by one third). The concept behind this is based on the belief that betas revert to a market mean of 1.0 over time. The court decided to use the adjusted smoothed betas since they have a forward-looking component to them and the court believed this was consistent with a forward-looking WACC.

- Beta Unlevering Method. The court cited and relied on Shannon Pratt’s and Roger Grabowski’s Cost of Capital: Applications and Examples (5th edition, 2014). The opinion stated that published betas “for publicly traded stocks typically reflect the leverage of each respective company, which means that these betas incorporate both business risk and capital structure risk. All things being equal, the equity of companies with higher levels of debt is generally riskier than that of companies with lower levels of debt. In order to properly apply the betas of peer companies to a subject company, those companies’ betas must be adjusted to account for the differences between the capital structures of the peer companies and of the subject company.”[5]  (This is accomplished by levering the peer group companies as well as the subject company’s beta and then re-levering that beta to reflect the subject company’s capital structure.)

While I will not get into the differences, one expert used the Hamada formula while the other used the Fernandez formula. The court could see instances where either formula could be used. Ultimately, the court decided that the Hamada formula was more appropriate in this case since it is widely accepted, readily understood, and not subject to dispute about whether it is properly calculated, even if it is an arguably imperfect tool. The court noted the Cost of Capital (at 266) cautioned that the Hamada formula is inconsistent with capital structure theory and practice, and recommended that practitioners instead use one of several other formulas, including the Fernandez formula.

- Size Premium. Given that the standard of value and the Delaware corporate law preclude factoring the effects of the merger into the value, April 1 was the date that was used for the size premium. The buyer’s offer was accepted on April 1 and it was announced on April 2. Therefore, April 1 was the last day that the stock price was unaffected by the potential buyout. However, there is a wrinkle here in that, on April 2, the company announced a further reduction in estimated EBITDA along with the announcement of the buyout from Lone Star at $9.50.

On April 1, Dollar Financial was resting on the edge between the 9th and 10th deciles. A decline of less than $7 million (about 2%) in market capitalization would have caused Dollar Financial to drop in to the 10th decile.  The petitioners’ expert used the 9th decile size premium of 2.81% from the Duff & Phelps Valuation Handbook. At that time, the 9th decile was from $340 million to $633 million.

Dollar Financial’s experts used the midpoint of two sources: 3.87% from the 2014 Duff & Phelps Valuation Handbook and 4.60% from the Duff & Phelps Risk Premium Report. The midpoint of this was 4.24%. The 3.87% used was a blending of the 9th and 10th deciles and attempted to capture the reduced earnings announcement on April 2. The court agreed that, on April 1, the market was missing an important piece of information; that is the reduced guidance that was announced on April 2. The court simply decided to assume that the earnings reduction, exclusive of for the announced transaction, would have pushed Dollar Financial into the 10w subdecile, and used the 10w size premium of 3.52%

- Tax Rate. The petitioners’ expert used a tax rate of 32% which was the rate that Dollar Financial’s management provided to its investment banker to calculate the WACC in its fairness opinion. Dollar Financial’s expert went through a very detailed calculation in which he tried to compute tax rates based on the amount of debt that Dollar Financial had in various jurisdictions. The court rejected this approach since it did not address the amount of interest paid, which is more influential in taxes than the actual outstanding debt. The court simply agreed that management’s 32% was the best rate to use.

WACC Result

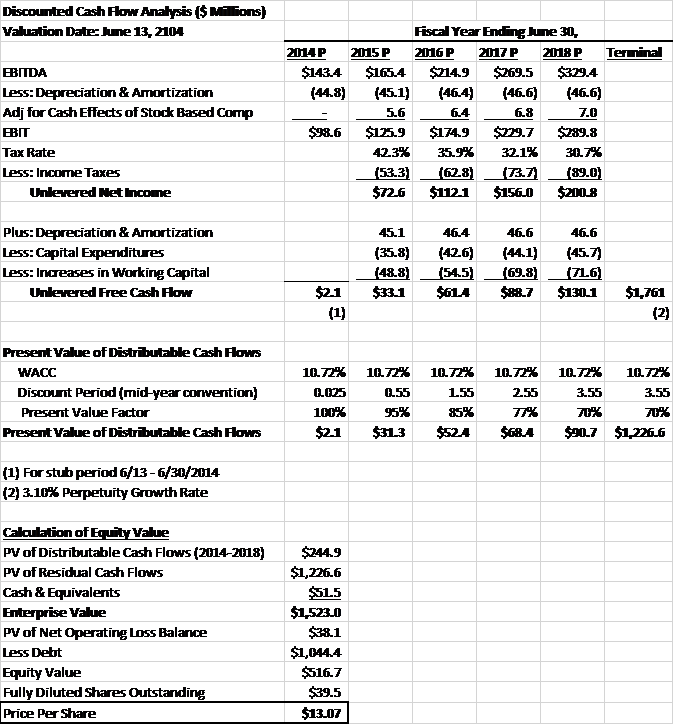

The court calculated Dollar Financial’s WACC as 10.72%, coincidentally about the mid-point between the two experts of 9.5% and 12.4%. Lastly, we will address the other disputed inputs into the DCF model

- Net Working Capital. The petitioners’ expert used the balance sheet projection that management provided and that the investment banker used in its fairness opinion, whereas, Dollar Financial’s experts estimated the net working capital required at the end of each year as 52% of total revenue. The court reasoned that since both experts used the March financial projections for the income statement, it was inconsistent for Dollar Financial’s expert to not use the projected balance sheet for the working capital projection. Ultimately the court used the investment banker’s operating cash requirements and excess cash level of $51 million compared to the petitioners’ calculated excess cash of $80 million and Dollar Financial’s calculated excess cash of $0 (on the calculation assumption that Dollar Financial had deficit working capital on the date the transaction closed).

- Two or Three Stage Model. Management’s projections were for the fiscal years 2014 to 2018. Dollar Financial’s expert used a two-stage model with the first stage being management’s projections from 2014 to 2017 and the second stage simply being a terminal value calculation with convergence assumptions beginning in 2018, with an implied perpetuity growth rate of 4.5%.

The petitioners’ experts used a three-stage model with stage one being management’s projections from 2014 to 2018; stage two used the expert’s own projections for 2019 through 2023, which he calculated by applying a linear decline to step the growth rate down by 1.8% per year from management’s projection of 11.7% in 2018 to the perpetuity growth rate of 2.7% in 2023; the third stage was a terminal value calculated using the Gordon growth model with a 2.7% perpetuity growth rate.

The court reasoned that it was preferable to use a two-stage model rather than a three-stage model that attempted to create a third stage by extrapolating new data from already imperfect projections. Although the court felt that the sharp decline in the growth rate from the projection period to the terminal period was not ideal, it did not find it problematic.

In deciding on a perpetuity growth rate, the court relied on its past practice to select a perpetuity growth rate based on a reasonable premium (say 100 maximum basis points) to inflation and a view that the risk-free rate is the ceiling for a stable, long-term growth rate. The petitioners’ expert also used a two-stage model with a 3.10% perpetuity. Given that 3.10% was 79 basis points over the inflation data the expert compiled and that it was below the risk-free rate (ceiling) of 3.14%, the court used 3.10%. %. On appeal, The Delaware Supreme Court was critical of the 3.10% (i.e., equal to the ceiling), given Dollar Financial’s unsteady state.

- Stock-Based Compensations. Stock-based compensation is a non-cash expense that must be added back in the calculation of net cash flows. In this case, the petitioners’ expert forecasted this expense using historical data. Dollar Financial’s expert used management’s estimates.  Ultimately, the court sided with the petitioners’ expert and estimates as being more conservative and less likely than Dollar Financial’s estimates to overstate total cash flows.

The Court’s Final DCF-Based Value

The court’s final DCF-based value, as shown at the end of this article, was $13.07 per share, compared to $17.91 (petitioner’s expert) and $7.90 (Dollar Financial’s expert). Note that the Court’s final value also used a multiples-based comparable company valuation of $8.07 and the actual deal price of $9.50 to arrive at a final value of $10.21 per share, giving equal 1/3 weight to each approach. As mentioned, Dollar Financial has appealed the decision, mainly arguing (among other issues) that more than 1/3 weight should have been given to the actual deal price. The Delaware (and others) Supreme Court agreed on this issue and has sent the case back to the Chancery Court for review. I have not been able to find a revised decision by the Chancery Court.

What We Can Learn

While every case and jurisdiction is unique, and there are a number of methods and data sets available to valuation professionals; I believe we can apply these lessons.

- The courts prefer methods that are more transparent and that err on the side of conservatism. If an expert cannot explain how the underlying data produced a result, the court will also be confused (e.g., Barra betas vs. Bloomberg betas; Hamada formula vs. Fernandez formula.

- Do not lose sight of “keeping it simple”. For example, use of the debt date closest to the transaction; the rejection of the expert who created his own estimates as part of a three-stage model.

- Use of management estimates. Even though Dollar Financial had a poor track record of forecasting, the court tended to prefer management forecasts; for example, the projected balance sheet. However, with the stock-based compensation, the court accepted the expert that rejected management’s stock-based compensation forecast because it was concerned it could overstate value.

[1] DFC Global, Form 10 K, 2008 at 32; DFC Global Form 10K, 2013 at 39.

[2] In re Appraisal of DFC Global Corporation, 2016, at 5–6 (Del. Ch. Jul 8, 2016).

[3]  Ibid, at 13–14 (Del. Ch. Jul 8, 2016).

[4] Â In re Appraisal of Dell Inc., 2016 WL 3183538, at 45 (Del. Ch. May 31, 2016).

[5] Cost of Capital: Applications and Examples at 243, 244

Michael Bankus, MBA, CVA, AFSB, is principal of Goriano Experts & Advisors, a consulting firm serving the legal and business communities with business valuation, business consulting, and litigation support services, mainly to the construction industry. Previously, Mr. Bankus held senior finance roles at The Bank of New York Mellon, PNC Financial, CentiMark Roofing, USF&G Insurance, and Rite Aid Corporation.

Mr. Bankus can be contacted at (484) 557-6644 or by e-mail to Mike@GorianoLLC.net.