12 Metrics All CPAs Should Track —AICPA Insights

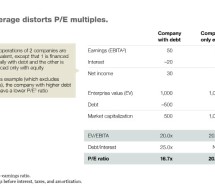

Consider Lifetime Client Value, Cost of Client Acquisition, and Retention Rate Is your CPA firm making the most of current relationships and doing all it can to expand into new ones? Â Â While there are many metrics CPA firms use to evaluate quantitative performance, AICPA Insights suggests 12 metrics than can provide more qualitative feedback. These metrics can help CPA firms measure their reach with clients ...

Read more ›