Reasonably Certain Foreseeable Future Events and the Standard of Value

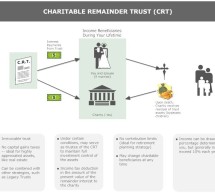

In Berquist v. Commissioner, Judge Swift Finds a Company’s Pending Liquidation is Relevant and Foreseeable. The Tax Court valued closely-held stock in an anesthesiology practice donated to a hospital for charitable contribution purposes at its liquidation value since the anesthesiology practice would no longer exist after the physician-stockholders were consolidated into a newly-formed umbrella physician ma ...

Read more ›