The Role of Earnouts in Acquisitions

Earnout Variables Often Account for 15 to 25 percent of Purchase Price in many Middle Market Acquisitions. Here are Tips for Structuring Them Carefully

Earnouts typically appear in a large number of middle-market deals, usually accounting for 15 to 25 percent of the total purchase price. While an earnout can to be an elegant solution to “close the gap” between seller and buyer, the fact is earnouts are complicated and subject to a number of limitations. Ron Stacey explains some issues surrounding earnouts, including their appeal, shortcomings, possible structures, appropriate metrics, duration, tax treatment, and value.Â

Earnouts, like the late great Rodney Dangerfield, “don’t get no respect.”  But, nevertheless, earnouts appear in a large number of middle market transactions.  In this article, discover the appeal and dread of the earnout. Explore the pitfalls of earnouts, learn how to calculate the expected value of an earnout and how to structure and execute successful earnout strategies.  Find out how to get capital gains treatment for earnouts. And see a comprehensive case example of an earnout in action!

A Sample Situation

During a rather contentious round of price negotiations, the seller, Absolute Certain, repeatedly emphasized that next year’s earnings were all but in the bag; in spite of the fact that Certain’s business was performing slightly under (but not deal killer under) budget for the current year. The buyer, Not So Sure, was justifiably skeptical. The highly creative and charming investment banker proposed an earnout.

While an earnout appears to be an elegant solution to “close the gap” between seller and buyer, the fact is earnouts are complicated and subject to a number of limitations. Nonetheless, earnouts typically appear in a large number of middle market deals usually accounting for 15 percent to 25 percent of the total purchase price. In this article, we address some issues surrounding earnouts including the appeal of earnouts, shortcomings, pitfalls of buyer’s remorse, structuring an earnout, choosing the right metrics to measure the earnout, duration, probability of collection, tax treatment, and valuing the earnout.Â

The Appeal

An earnout is a deal catalyst that transforms a flagging transaction into a successful closing. The appeal of the earnout is manifest in the belief by the seller that the earnout is a certainty and in the belief by the buyer that the earnout will only be paid if the deal is a homerun. Beauty is in the eye of the beholder. While the earnout is a purchase price set aside by the buyer subject to payment only if certain performance hurdles are achieved, the buyer really sees the purchase price as X while the seller sees X plus the earnout.

The Dread

The financial mechanics of an earnout are highly subjective, difficult to incorporate into the definitive agreement, vulnerable to misinterpretation, and potentially subject to manipulation by more often the buyer, but sometimes the seller. The earnout can hinder the buyer’s ability to integrate the business to achieve synergies since measuring the earnout typically involves either an actual or virtual preservation of the seller’s business model including the accounting systems needed to measure the performance associated with the earnout. For the seller, how the buyer operates the business post closing may or may not be in keeping with the seller’s vision.

While the earnout is initially appealing in getting the deal closed, once the deal closes the interests of the seller and buyer diverge. The ideal for the seller is 100 percent cash up front and once that wire hits the seller’s bank account, adios amigos! The buyer, on the other hand, wants to keep the seller close with hold backs and earnouts, just in case the business turns out to be something other than advertised. This risk allocation, so to speak, is a complex exercise of negotiating earnout terms and representations and warranties, as well as liability “caps” and “baskets” in the definitive agreements.

Post-closing, the “appeal” of the earnout for the buyer can quickly fade. Seller’s remorse can kill a deal at any point, but buyer’s remorse can be just as bad; the buyer is stuck with the deal. Fact is, the business holds the most appeal to the buyer right at the time of purchase (It looked a lot better in the dealer’s showroom than it does in my garage.). The ownership changes, the customer base is eroding, employees are defecting, vendors are tightening terms, or the industry experiences a disruptive change. And those price increases the buyer was counting on just aren’t sticking. Now the buyer is unhappy and may even feel cheated. The seller is unhappy with how the buyer is running the business. The earnout is in jeopardy; collectability is significantly diminished. If the negotiations for the business were particularly contentious and if the principals were involved (instead of charming investment bankers), then hard feelings can become even worse.

The Elements of an Earnout

The first step in developing an earnout is determining how to measure the target performance hurdle. The farther down the income statement, the more susceptible the hurdle is to manipulation by whoever is controlling the spending through the income statement. Accordingly, the most desirable metric for the seller is to measure the earnout hurdle as a function of revenue or sales. For the buyer, sales are not the earnings that the buyer is buying, and a better metric for the buyer is EBITDA (earnings before interest depreciation taxes and amortization) or, at the extreme, net income. A good compromise is to measure the performance hurdle at the gross profit level with cost of goods sold computed in accordance with GAPP (generally accepted accounting principles) consistently applied.

If the seller and buyer are having trouble setting the earnout hurdle, the creative investment banker may suggest a mixed metric earnout or a metric based on units produced or sold to avoid the contentious elements of the income statement. For example, a mixed metric earnout might be a minimum of gross profit and a minimum of EBITDA; if both conditions are met, then the earnout is awarded some percentage of the gross profit above the minimum to some maximum amount. The unit earnout is simply a dollar payout for every unit shipped above a certain level. This model is also useful if the buyer in integrating the business into an existing operation and the seller wants to track the units from the acquired business separately.

After the deal closes, the buyer controls the company and is entitled to manage the business without regard to how that management affects the seller’s earnout. The seller is at the buyer’s mercy in this respect. The only mitigating factor is the reasonable assumption that the buyer is motivated to maximize the business performance to earn as much profit as possible. That aside, the only way the seller can guard against buyer mismanagement or, worse, manipulation, is to contractually set a precise formula as to how the earnout is calculated. For example, any administrative expense beyond the contractual level is disregarded for purposes of calculating the payment to the earnout. Lawyers love this approach to calculating the earnout, buyers not so much.Â

A number of other issues are involved with earnouts. Typically, the payout is a percentage of or proportion of the performance in excess of the hurdle, but earnouts can be structured as all or nothing. Duration of the time to which the earnout applies can be a single year or several years; a multiyear earnout might include provisions for “carry forward” or “carry back” of excesses or deficiencies. The earnout may be capped at a certain amount or be unlimited. In the world of earnouts, no real conventions apply, and most earnouts are negotiated on a deal by deal basis.

The probability of collecting on an earnout depends on several factors. How well the earnout is negotiated and documented is crucial; a clearly defined and universally understood earnout has a higher probability of paying off. The skill of the investment banker in choosing the performance measurement metric and setting the hurdle and the skill of the transaction attorney writing up the earnout are of great importance. The wise investment banker carefully counsels the seller on the vagaries of earnouts to get a sense of the seller’s expectations on which to base the negotiation.

Overall, by incorporating all the relevant factors into an evaluation of the earnout, the investment banker can “handicap” the likelihood of a payout with a probability weighted, year-by-year scenario. A rationale and reasonably well negotiated earnout can expect to payout with a 90 percent probability in the first year and declining by 10 to 20 percent per year thereafter.

Tax Treatment of Earnouts

Generally, any payment on an earnout should be treated as eligible for capital gains treatment as opposed to ordinary income. Payouts viewed as installment payments in uncertain amounts are typically considered capital gains in tax case law precedent. The earnout should be referenced throughout the transaction documentation as part of the purchase price. It’s important that the transaction attorney get the right language in the earnout description to avoid any confusion. If the seller is staying on in an employment capacity, the Internal Revenue Service ( IRS)  may have a better case to tax the earnout as ordinary income by characterizing it as employment incentive competition.Â

Earnout Example Case

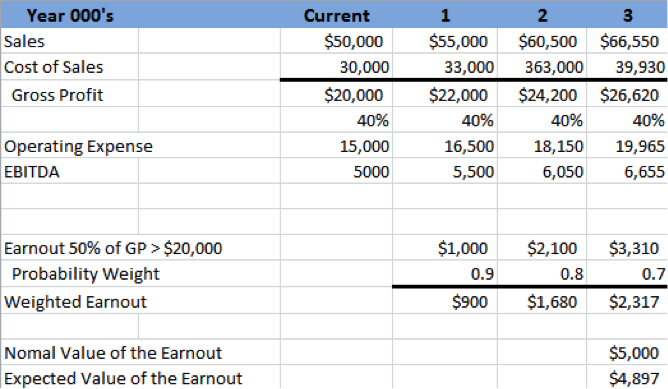

The seller, Absolute Certain, and the buyer, Not So Sure, agree on the concept of an earnout. Certain’s aerospace manufacturing business has been growing at a rate of 10 percent per year and is expected to achieve $50 million in revenue in the current year and earn $5 million in EBITDA. Not So Sure has offered $25 million, but Certain believes the business is worth $5 million more ($30 million total), and the parties agree on the concept of an earnout. The investment banker develops the following information for Certain’s consideration.

Taking note of the high gross margins, the investment banker proposes the following earnout: Certain is to receive 50 percent of the gross profit, computed in accordance with generally accepted accounting principles consistently applied, in excess of $20 million for each of the three years subsequent to the closing subject to the earlier of achieving $5 million in earnout payments or the expiration of the earnout agreement at the end of year three. The nominal value of the earnout is set at its contractual limit. The investment banker calculates the probability weighted expected value at $4.9 million.

Summary

Properly conceived, an earnout can be an elegant solution to bridging a valuation gap between buyer and seller. Both parties must be fully cognizant of the strengths and weaknesses of earnouts. The deal team, including the investment banker that structures the earnout, and the transaction attorney that drafts the documentation, must be well experienced in earnouts. A properly crafted and drafted earnout agreement has a high probability of collection and, done properly, is taxed to the seller at capital gains rates. In the final analysis, the dreaded earnout is really a handy tool in the investment banker’s toolbox that can bring a transaction to fruition to the benefit of everyone.

Ron Stacey is the Founder and a Managing Director at Legacy Advisors, a Dallas-based boutique investment bank. Please contact him at rstacey@legacyadvisors.org or call (214) 705-1112 with comments or to request copies of excel spreadsheets used in this article.Â

Â

GeorgeP

This is a good common sense white paper that reflects buyer/seller reality in M&A transactions, plus describes realistic considerations and potential solutions..