Pass-Through Entity Valuations and Fair Market Value: A New Perspective

How to apply the landmark cases Delaware MRI (2007) and Bernier (2012)

Eric J. Barr, CPA/ABV/CFF, CVA, CFE, analyzes two landmark court decisionsâDelaware MRI and Bernierâand offers more clarity on the proper way to value an ownership interest in a pass-through entity under the fair market standard of value.Â

Â

Â

In the landmark cases Delaware MRI (2007) and Bernier (2012), both courts applied the same formulaic approach to determine the appropriate hypothetical C corporation income tax rate to be applied when valuing an ownership interest in an S corporation under the âvalue to the holderâ standard of value.1

In my article âPass-Through Entity Valuations and âValue to the Holderâ: A New Perspectiveâ (The Value Examiner, September/October 2012), I discussed the applicability of the models used in Delaware MRI and Bernier when valuing an equity ownership interest in an S corporation, partnership, limited liability company (LLC) or other pass-through entity (PTE) under the value to the holder standard of value. This article discusses the applicability of the Delaware MRI and Bernier models when valuing equity ownership interests in PTEs under the fair market value standard of value.

Background

The value to the holder standard differs from the fair market value standard of value. This newer standardââvalue to the holderââconsiders the value of a known, specific holderâs equity ownership interest in a business. On the other hand, fair market value is defined in IRS Revenue Ruling 59-60 as the amount at which property would change hands between a willing buyer and a willing seller, each having reasonable knowledge of the relevant facts and neither being under any compulsion to buy or sell. In addition, various federal court and U.S. Tax Court decisions frequently state that the hypothetical buyer and hypothetical seller are assumed to be able and willing to consummate the transaction and that both are assumed to be informed about the property and the market for it. Also implied in this definition of fair market value is that the value represents a cash or cash equivalent amount.

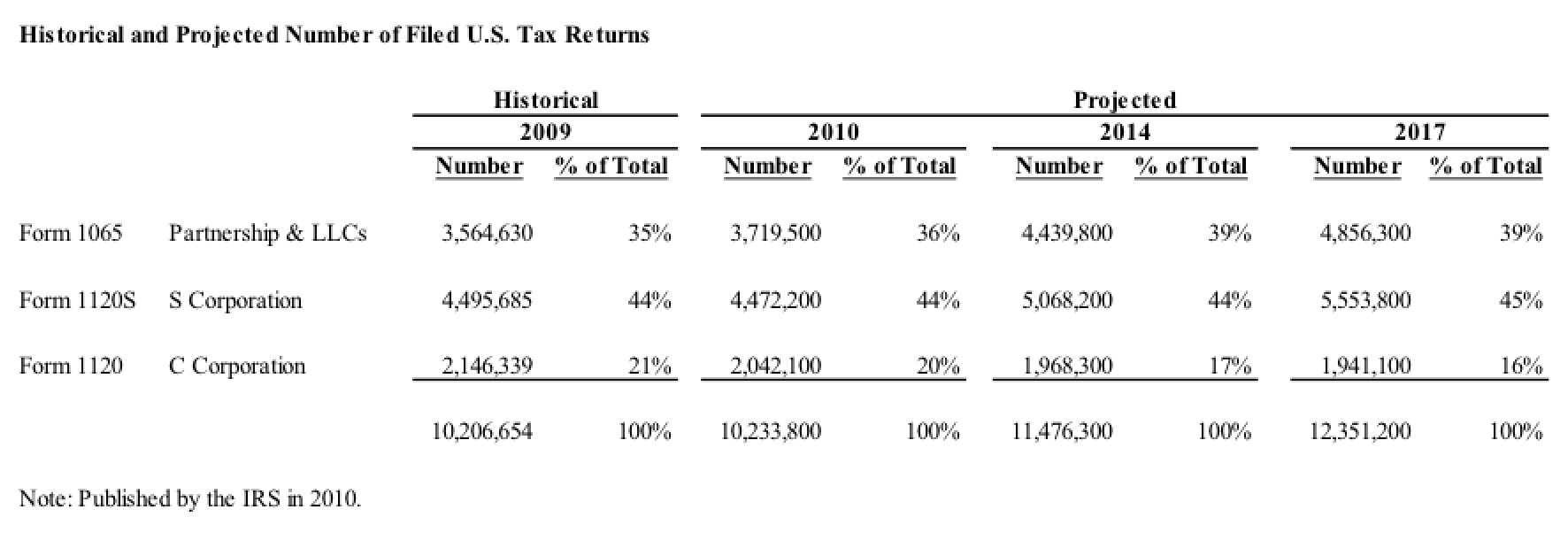

The issue of whether a PTE should be tax-affected under the fair market value standard is of critical importance because, as the following table shows, approximately 80 percent of all business entities filing U.S. federal income tax returns are PTEs. (See Table 1.)Â

Table 1: Historical and Projected Number of Filed U.S. Tax Returns

When one takes into consideration the number of business entities that are not included in Table 1, meaning  single-member LLCs or sole proprietorships, the percentage of PTE business entities exceeds 80 percent. That percentage is growing.

When one takes into consideration the number of business entities that are not included in Table 1, meaning  single-member LLCs or sole proprietorships, the percentage of PTE business entities exceeds 80 percent. That percentage is growing.

Hypothetical Holder, Buyer and Price

Letâs examine the valuation and tax issues that need to be considered when tax-affecting PTEs under the fair market value standard of value. The definition of fair market value in Revenue Ruling 59-60 requires valuation consultants to consider three different perspectives when valuing a business ownership interest:

- Value to the hypothetical holder

- Value to the hypothetical buyer

- The price that would be agreed upon by the hypothetical holder and the hypothetical buyer

A discussion of the valuation and tax issues impacting each of these different perspectives follows.

Value to Hypothetical Holder

The value of a business ownership interest to a hypothetical holder is often determined under the income approach by either capitalizing or discounting the normalized historical and projected earnings or cash flows of the subject company. Normalization adjustments eliminate nonrecurring events, change methods/bases of accounting (i.e., cash to accrual method), correct errors and more in order to convert the reported results of operations to earnings or cash flows that better reflect the economic results that would occur in the hands of a hypothetical holder. The valuatorâs assessment of the riskiness of prospectively achieving such normalized results of operations impacts the hypothetical holderâs capitalization/discount rate. These factors impact the inputs but not the methodology needed for tax-affecting.

To determine value to the hypothetical holder under fair market value, the modified Delaware MRI formula presented in my previously published article should be used for tax-affecting. The modified Delaware MRI model is based on the concept that âunder an earnings valuation analysis, what is important to an investor is what the investor can keep in his pocketâ (paragraph 88). As noted in my previous analysis, the courtâs calculations in Delaware MRI considered the amount that was ultimately available to the stockholders after accounting for corporate and individual income taxes as an S corporation. The court then âreverse-engineeredâ the effective federal and state corporation income tax to arrive at the amount that would be needed to derive the same result if the subject business operated as a C corporation. In other words, the court first determined the amount that the holder realized on an after-tax basis3 and then calculated the effective federal and state C corporation income tax rate.4

The modified Delaware MRI model can be expressed algebraically, as follows: Â

[PTIs * (1-Ts) * (1-Ti)] â IR = [(PTIs)* (1-Tc) â IR)]* (1-Td)

Where:

PTIs is pre-tax income of S corporation

Ts is effective federal and state corporation income tax imposed on S corporation income

Ti is effective combined federal and state individual income tax rate

IR is income retained in company

Tc is effective combined federal and state C corporation income tax

Td is effective combined federal and state qualified dividend tax rate

When Ts and IR are equal to zero, this formula simplifies to:5Â

Ti = Tc + Td â (Tc*Td)

For example, when valuing an S corporation (where the resident state has no state franchise tax on S corporation taxable income) and assuming maximum statutory 2012 federal and state individual income tax rates (Ti = 44%)6 and dividend tax rates (Td = 24%), the effective combined hypothetical effective federal and state C corporation income tax rate would be 26 percent, calculated as follows:

44% = Tc + 24% – (Tc * 24%)

20% = 76% * Tc

Tc = 26%

In applying this formula, consider the form of the PTE. If the subject company is an S corporation, for example, the hypothetical holder must be an entity that qualifies as an S corporation stockholder. In most instances, the S corporation stockholder will be an individual. In those situations where the subject PTE is a partnership, LLC or sole proprietorship, the valuator should carefully consider the form of entity that would be the hypothetical owner and appropriately modify Ti and Td.

Once Tc is determined, the value of the PTE ownership interest to the hypothetical holder can be determined. The value of the ownership interest to the hypothetical holder of a business ownership interest is the floor value under the fair market value standard of value. Clearly, if the hypothetical holder is under no compulsion to sell, then there will be no transaction unless a price can be realized that is at least equal to the value of the business ownership interest in the hands of the hypothetical holder. Without compulsion, why would anyone sell a business that was worth $5 million for $4 million?

Value to Hypothetical Buyer

Whereas the floor value of an ownership interest in a business under the fair market value standard is the value of the ownership interest to the hypothetical holder, the ceiling value of a business ownership interest under fair market value is the value of the ownership interest to the hypothetical buyer. Clearly, if the hypothetical buyer is under no compulsion to buy, then there will be no transaction unless a price can be negotiated that is not greater than the value of the business ownership interest in the hands of the hypothetical buyer.

Value to the hypothetical buyer is often determined under the income approach by either capitalizing or discounting normalized historical or projected earnings or cash flows, similar to the methodology used to determine value to the hypothetical holder. However, the normalized earnings/cash flows of a PTE to a hypothetical buyer may be significantly greater than the earnings/cash flows to the hypothetical holder. Such earnings/cash flow differences may result from differences in earning power and synergies with other operations. Estimates of earnings growth may also be different. The capitalization/discount rate of the hypothetical buyer may also be different than that of the hypothetical holder due to different perceptions of the degree of risk and required rate of return. In addition, the hypothetical buyerâs financing costs may be different, which could also impact the capitalization/discount rate. Such differences result in different normalized historical/projected pre-tax earnings and capitalization/discount rates when estimating/calculating value to the hypothetical buyer.

In addition, similar to determining value to the hypothetical holder, in order to determine the value to the hypothetical buyer under the fair market value standard, the valuator must consider the effective income tax rate that applies to the subject companyâs normalized earnings/cash flows. If the hypothetical buyer is an entity that does not qualify as an S corporation shareholder or LLC member of the subject company, then the modified Delaware MRI methodology is inapplicable and the subject companyâs earnings are tax-affected based on the hypothetical buyerâs marginal federal and state income tax rates. However, if the hypothetical buyer is an entity that qualifies as an owner of the subject company PTE and the PTE is able to retain its PTE status, the modified Delaware MRI methodology is applicable. Different inputs may be needed for the hypothetical buyer from those used for the hypothetical holder in determining the hypothetical effective combined federal and state C corporation income tax rate.Â

When applying the modified Delaware MRI method, valuators must be careful to properly match the effective combined federal and state C corporation income tax rate to the corresponding normalized earnings/cash flows. For example, the hypothetical buyerâs derived effective federal and state C corporation income tax rate should be matched with the normalized earnings/cash flows of the subject interest to the hypothetical buyer (and not the normalized earnings/cash flows of the subject interest to the hypothetical holder).Â

Note that the only way that the effective C corporation income tax rate of the hypothetical buyer can be greater than the hypothetical holderâs income tax rate is if the higher C corporation income tax rate is offset by higher normalized historical/projected pre-tax earnings from other synergies and value enhancing strategies of the hypothetical buyer, or if the hypothetical buyer employs a smaller capitalization/discount rate. Otherwise the floor value will exceed the ceiling value.

Price Agreed to by Holder and Buyer

We know that business valuators often estimate fair market value using different approaches, and that a reconciliation process is required if there are widely divergent indicated values under such different approaches. Valuators also need to employ a reconciliation process when the value to the hypothetical holder differs from the value to the hypothetical buyer. There are a number of factors that should be considered when performing this reconciliation, including those discussed below.

The number and quality of potential hypothetical buyers may impact the negotiating leverage of the hypothetical holder. There are times when multiple hypothetical buyers enter a negotiation. The greater numbers tend to enhancethe leverage of the hypothetical holder. Some hypothetical buyers may be able to realize a greater economic benefit from a transaction than others as a result of the above.Other companies may be part of an industry that is experiencing financial difficulties, while some may be part of an industry where there are multiple buyers seeking to gain entrance or increase market share. Certain hypothetical buyers may have limited access to financing and are less able to complete a transaction than other hypothetical buyers. The valuator needs to consider these factors among others, and the relative negotiating leverage of the hypothetical holder and the hypothetical buyer when estimating the price (or range of prices) under fair market value.Â

The valuator may decide, based on the facts and circumstances of a particular matter, to not estimate the value of a business ownership interest to a hypothetical buyer. There are reasons for not performing this analysis which may include but are not limited to matters where the valuator (a) is unable to quantify earnings enhancement opportunities of the subject interest by the hypothetical buyer,7 or (b) believes that the hypothetical holder would be unable to sell the subject equity ownership interest for more than the value to the hypothetical holder based on historical market transactions.

Conclusion

PTEs account for more than 80 percent of all business entities. The issue of how or if a valuator should tax-affect is therefore of paramount importance.

When valuing an ownership interest in a PTE under the fair market value standard of value, the valuator should follow the guidance found in Revenue Ruling 59-60. That ruling requires the valuator to consider, among other things, value to the hypothetical holder, value to the hypothetical buyer and the price that would be agreed upon by the hypothetical holder and hypothetical buyer.

When determining value to the hypothetical holder and value to the hypothetical buyer, the valuator must take into consideration facts and circumstances specific to each. The modified Delaware MRI model should be employed for tax-affecting purposes when determining or calculating value to the hypothetical holder and (where the subject company will remain a PTE after the transaction) value to the hypothetical buyer, using assumptions and inputs specific to each. The effective combined federal and state C corporation income tax rate of the hypothetical buyer is not to be applied to the hypothetical holderâs normalized cash flows/earnings and vice-versa.

Finally, the subject ownership interest may have a significantly different value to the hypothetical holder than to the hypothetical buyer. Valuators need to consider many different factors when estimating the price (or range of prices) at which the hypothetical holder and hypothetical buyer would agree to a transaction.

Eric J. Barr, CPA/ABV/CFF, CVA, CFE, is a co-managing member of Fischer Barr & Wissinger, and is the director of the firmâs Business Valuation Department. He has 40 years of public accounting experience and specializes in consulting with owner-managed and venture-capital-funded businesses. He has testified as an expert in the areas of business valuation, commercial litigation, forensic accounting and lost profits analysis. E-mail: ebarr@fbwcpas.com.

[1] Delaware Open MRI Radiology Associates, Petitioner, v. Howard B. Kessler, et al; and Bernier v. Bernier.

[2] See Revenue Ruling 59-60, 1959-1 C.B. 237.

[3] The left side of the following equation.

[4] Tc in the right side of the following equation.

[5] The modified Delaware MRI approach presented herein used to derive the effective C corporation tax rate of an ownership interest in an S corporation can also be used to derive the effective C corporation tax rate of partnerships or LLCs. If this formulaic approach is used when valuing a partnership or LLC, (a) the effective combined federal and state unincorporated business tax rate of the subject company is used in place of the effective combined federal and state S corporation tax rate (Ts); and (b) in the event that the holder is a C corporation and not an individual, the effective combined federal and state C corporation income and dividend tax rates of the holder are used in place of the effective combined federal and state individual income (Ti) and dividend (Td) tax rates, respectively.

[6] Assuming a state individual income and dividend tax rate of 9 percent.

[7] In certain instances where a non-controlling minority ownership interest is being valued, the hypothetical buyer may be unable to enhance the earnings of the subject business ownership interest.