Financial Forensics, Certified Fraud Examiners, and Master Analyst in Financial Forensics

It is far broader than forensic accounting

While financial forensics may share some common ground with forensic accounting, these professions are far from identical twins. D. Larry Crumbley, CPA, MAFF lays out the differences between these often misunderstood professions and explores the academic factors that may be contributing to the confusion.

Financial Forensics

There is confusion as to what, exactly, is financial forensics or forensic accounting—especially among the academic ranks. Financial forensics is similar to forensic accounting. Practitioners must educate the academic community that forensic accounting is not merely fraud. Much of this disconnect comes from an early narrow model published by West Virginia University.

Their report took a very narrow position of the definition of forensic accounting, basically equating it to fraud investigation. I believe that forensic accounting’s scope is much broader than fraud detection. Even in the area of fraud, a forensic accountant may be employed in a wide variety of risk-management engagements within business enterprises as a matter of right, without the necessity of allegations. In other words, predication is not an absolute step in forensic accounting, so our practice is both preventive and proactive.

West Virginia University used a $600,000 grant to develop a narrow model curriculum for training university students in fraud and forensic accounting. In fact, the report is an investigative curriculum and not a forensic accounting curriculum. For example, the report gives nine ‘‘Model Curriculum Working Definitions,’’ and eight of the nine involve fraud. The report does define forensic accounting as ‘‘the application of accounting principles, theories and discipline to facts or hypotheses at issue in a legal dispute and encompasses every branch of accounting knowledge.’’ There were no definitions for valuation, damages, lost profits, lost value, litigation services, and so on.

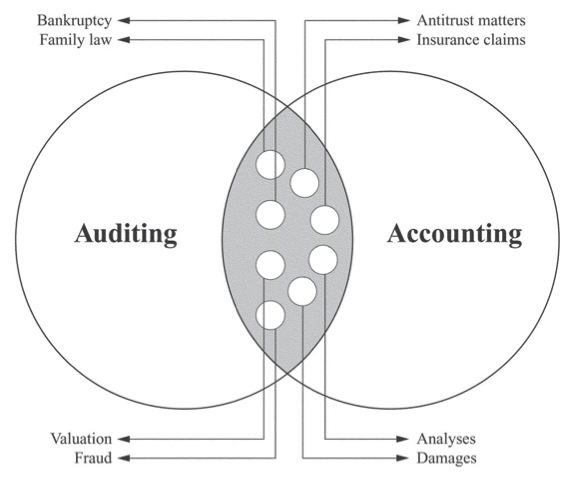

A graphic provided in the report demonstrates the narrow approach taken, and one wonders how a 14-member planning panel could have accepted such a graphic. The report does state, however, that the ‘‘level of overlap between forensic accounting and fraud may be larger than depicted here.’’ At least four of the 14 members of the planning panel were Certified Fraud Examiners (CFEs). There were no representatives who held the Certified Forensic Accountant (Cr.Fa), Master Analyst in Financial Forensics (MAFF), Certified in Financial Forensics (CFF), Certified Valuation Analyst (CVA), or Certified Fraud Specialist (CFS) credential. Although one may argue as to how small the fraud circle should be with respect to areas such as valuation, damages, bankruptcy, family law, general consulting, analyses, and anti-trust analyses (some of the 31 categories in the 1986 AICPA Practice Aid No. 7), a corrective graphic should appear somewhat as shown below.

Figure One:

Financial Forensics

An AICPA report as early as 1986 showed fraud to be only one small category among 31 different categories. A 2009 survey found that course developers need to understand the conceptual difference between fraud examination and forensic accounting. Forensic accounting is broad and far-ranging. Accounting curriculum developers need to determine whether they should base their program revisions on a fraud model, a more wide-ranging financial forensics model, or a combination of the two approaches. Such decisions affect the direction of learning and topic coverage in the accounting curriculum. Practitioners must educate accounting professors as to the broad approaches to financial forensics.

An educational novel that teaches forensic accounting entitled The Big R: A Forensic Accounting Action Adventure provides a description of a forensic accountant character called Fred Campbell:

Now he did more than just disputed divorce-settlement work. His areas included antitrust analysis, general consulting, and cost allocation. Anytime someone had to dig into the books and records, he was available. Super Accountant Campbell! Maybe he should get a special cape to wear like Superman; or was that Batman? He packed a HP 12-X pocket calculator and a notebook computer. He thought of himself like the forensic anthropologist in a Patricia Cornwell or Kathy Reichs novel.

In summary, financial forensics is the action of identifying, recording, settling, extracting, sorting, reporting, and verifying past financial data, or other accounting activities for settling current or prospective legal disputes, or using such past financial data for projecting future financial data to settle legal disputes—both civil and criminal.

[author] [author_image timthumb=’on’]http://business.lsu.edu/includes/Faculty_Staff/Images1/Crumbley_Larry_250x350.JPG[/author_image] [author_info]D. Larry Crumbley is a KPMG-endowed professor at Louisiana State University. He is the co-author of the Forensic and Investigative Accounting textbook, published by Commerce Clearing House, well as 13 educational novels, six of which were published by Carolina Academic Press. Larry can be reached at dcrumbl@lsu.edu[/author_info] [/author]