The Application of Guideline Publicly Traded Company Risk Adjustment

Quantifying the Risk Adjustment

Depending on the valuation assignment facts and circumstances, the valuation analyst (analyst) may encounter a unique valuation problem: a problem that is well outside the ordinary scope of typical valuation issues. Unique problems provide the analyst an opportunity to develop thought leadership solutions in a manner that (1) provides value to the client and (2) assists the reader of the valuation report. These thought leadership solutions (1) can provide context to the identified problems and (2) can help to measure the effect of the problem on the subject investment interest.

[su_pullquote align=”right”]Resources:

Assessing Risk in Valuing a Business

The Three Valuation Approaches—Challenges and Issues

How to Effectively Use Market Data in Your Valuation Reports

10 Common Errors in Valuation and How to Address These Issues

[/su_pullquote]

Introduction

Sometimes, during the process of a valuation assignment, a unique issue or problem may be identified. The problem may be well outside the normal operations of the subject business enterprise. In addition, the problem may be well outside the scope of normal operations of most comparative-type business operations. In most cases, such unique problems often require unique solutions.

This discussion provides a summary of one method that a valuation analyst (analyst) may consider to quantify the effect that a significant negative event may have on a company’s stock value. For example, in the illustrative case described below, the company management has just learned of a U.S. Department of Justice investigation. The investigation relates to the company’s government contracting business operations. The negative event occurred a little more than one year prior to the valuation date.

First, this discussion reviews the subject company operations at the time of valuation. Second, this discussion identifies and summarizes the unique problem at issue. Third, this discussion presents several possible solutions to address the effect that the unique problem had on subject stock valuation. And, finally, this discussion examines one possible valuation solution and describes how that solution may be implemented.

Hypothetical Company Description

Foxtrot Tango Charlie Company (FTCC) was incorporated in 1975 in Ohio. From its beginning, the company developed and sold products for the aerospace industry, primarily electromechanical devices. In 1984, the company acquired the military products business of Allen Co.

FTCC manufactures products to customer specifications, which often involve intricate handcrafted details. Until approximately 1990, FTCC generated nearly 75% of its total revenue as a subcontractor for the domestic defense industry.

In response to the U.S. government decision to decrease defense spending, FTCC management decided to diversify by developing products for the commercial aircraft market. After that time, the FTCC revenue was then generated equally by defense-related products and by commercial-related products.

FTCC employed a full-time staff in the areas of engineering, design, sales, manufacturing, and accounting and administration. Nearly all of the employees worked at the FTCC facilities in Cleveland, Ohio. As of the valuation date, FTCC had approximately 1,500 full-time employees.

FTCC sold products directly to large aerospace customers and acted as a subcontractor for defense-related projects. FTCC products could be found on aircraft manufactured by Lockheed Martin, Boeing, Northrop/Grumman, and General Dynamics.

The Investigation and Related Issues

FTCC had a significant litigation matter pending as of the valuation date. In November 2005, the U.S. Attorney’s Office for the Northern District of Ohio sent Federal Bureau of Investigation (FBI) agents to the FTCC headquarters to seize the FTCC main computer server and other records subject to a subpoena.

According to FTCC management, the U.S. Attorney’s Office investigation is described in the following paragraph:

An investigation into the FTCC pricing and costing practices with respect to government contracts or subcontracts is presently being conducted by the United States Attorney’s Office for the Northern District of Ohio (the Investigation). No charges or indictments have been filed. FTCC is cooperating fully with the government. Lead counsel to FTCC in this matter is Legal Firm not named. FTCC cannot express an opinion as to the outcome of the Investigation.

Because of the Investigation, the Auditor #1 Company (Audit 1), the FTCC former auditing firm, delayed filing its fiscal 2005 audit report until January 21, 2007. Audit 1 stated that it was not provided “sufficient evidential matter relating to the scope, observations, and findings, if any, of its investigations into the uncertainty related to the Investigation.”

As a result, Audit 1 did not express an audit opinion of the FTCC fiscal year 2005 financial statements.

Regarding the Investigation, Audit 1 stated that an unfavorable judgment with respect to the charges could have a materially adverse effect on the FTCC financial condition.

Audit 1 also stated the following in its 2005 report:

This matter could divert the time and attention of management and could cause FTCC to incur substantial legal and other costs. Further, FTCC’s reputation could be adversely affected. FTCC relies on its long-term customer relationships to maintain its operations. FTCC is devoting resources to maintain its current customer satisfaction in order to avoid the loss of confidence by the FTCC customers, which could reduce the FTCC economic growth and adversely impact its ability to maintain its current customers and potentially attract new ones. The existence of the government investigation has been published in the media. As a result, most of the FTCC major customers have inquired about the Investigation. To date (January 21, 2007), FTCC believes each inquiring customer has been satisfied that FTCC will continue to supply product, and FTCC has not suffered any loss of business and sales volume as the result of the investigation. FTCC’s ability to obtain financing could also be adversely affected. Therefore, it is possible that the results of operations and liquidity in a particular period could be materially affected as a result of this matter.

FTCC replaced Audit 1 with Auditor #2 Company (Audit 2) as its independent auditor. Audit 2 provided an audit opinion for the FTCC balance sheet as of December 31, 2006.

However, Audit 2 withheld its opinion regarding the results of operations and statement of cash flow for the year ended December 31, 2006.

It was understood that the Audit 2 reason for withholding its opinion was that it did not audit the 2005 balance sheet and amounts from the 2005 balance sheet enter materially into the determination of the results of operations and cash flow for the year ended December 31, 2006.

FTCC generated approximately 50% of its total revenue as a subcontractor to manufacturers of U.S. government aircraft. The Investigation was, therefore, a significant event that posed a considerable risk to any investor in the FTCC stock.

To the date of valuation, FTCC experienced little short-term repercussion from the Investigation. The primary quantifiable effects included approximately $3.5 million of legal fees related to the Investigation.

Long-term implications, such as damage to reputation and loss of customer opportunities, were not known as of the valuation date. However, FTCC management stated that it is not unreasonable to assume that FTCC could potentially lose all its U.S. government contract work.

Other significant events triggered by the Investigation included the following:

- The changing of the FTCC auditing firm

- The withholding of audit opinions by both (the old and the new) auditors

Both factors would be viewed as significant risk factors by a hypothetical buyer of the FTCC stock.

Valuation Approaches and Methods to Consider

As previously mentioned, as of the valuation date, the FTCC product pricing and costing practices were the subject of a pending investigation by the U.S. Attorney’s Office. And, as of the valuation date, no formal charges had been brought against FTCC relating to the Investigation.

However, the potentially damaging consequences of the Investigation likely would have a negative effect on the value of the FTCC common stock as of the valuation date.

Under a worst-case scenario, these negative consequences might include the U.S. government barring FTCC as a government contractor. This was an extreme scenario example, as it would result in a loss of approximately 50% of the FTCC business.

A hypothetical buyer of the FTCC common stock would certainly be concerned about the potential outcome of the Investigation. The buyer would also likely factor the potential outcome of the Investigation into the price he/she was willing to pay for the FTCC stock as of the valuation date.

According to a whitepaper titled “Penalizing Corporate Misconduct: Empirical Evidence,” SEC enforcement actions, on average, result in a decrease in stock value.

Approximately 20% of the average decrease in stock value occurred on announcement of the event that triggered the SEC investigation. An additional 10% of the average decrease in stock value occurred upon announcement of the subsequent SEC enforcement action.1

The decrease in stock value can be primarily attributed to the following:

- Adjustments to financial statements from corrective accounting action

- The anticipated impairment of operations (e.g., damage to reputation, increase in cost of capital, damage of supplier, and/or customer relationships)

- The expense of regulatory fines and penalties

While on many occasions the amount of monetary fines and penalties are greater for larger companies, smaller companies are generally more adversely affected.

Other research published in the Journal of Political Economy states that smaller contractors subject to defense procurement fraud are more adversely affected than the larger contractors.2

The authors of that publication state that while media coverage of fraud, indictments, and suspension of military procurement are associated with significant negative average abnormal stock returns (i.e., significant decreases in stock value), the market value of the top 100 defense contractors are not as severely impacted as the market value of the smaller companies.

The authors’ research found that, on average, companies investigated for procurement fraud reported statistically significant decreased market value.

FTCC was not a top 100 government contractor. In addition, FTCC was relatively small compared to other companies in the industry. Therefore, one would expect a hypothetical buyer of the FTCC common stock to severely discount the price that the buyer would be willing to pay for the stock because of the Investigation.

Until this point in the analysis, the valuation of FTCC could be prepared as though the company was not subject to any extraordinary pending litigation or investigations.

Faced with the FTCC facts and circumstances, it would not be unusual for an analyst to incorporate the investment risk due to the Investigation into the FTCC valuation analysis by:

- Increasing an alpha factor related to the analysis present value discount rate

- Incorporating investment risk through the application of a discount related to investment marketability

- Estimating the cost to cure the negative event

- Developing a risk adjustment derived from market-based evidence of public companies that were subject to similar negative events

In the case of FTCC, based on the quality and quantity of available information, an analysis of market-based evidence from public companies subject to similar negative events was performed. The decision to rely on a risk adjustment based on public company evidence was primarily due to the transparency of the data and simplicity of its application.

As of the valuation date, there was significant uncertainty involving the Investigation. This uncertainty made it impractical to quantify the cost to cure. And, the Investigation both:

- Increased the FTCC required rate of return—to compensate for increased risk—and, at the same time,

- Decreased the marketability of the FTCC stock.

Accordingly, the adjustments related to these factors are sometimes not as transparent as a risk adjustment derived from market-based evidence of guideline publicly traded company information.

The comparative guideline publicly traded company risk adjustment (GPTCRA) analysis example provided herein is similar to published event study analyses.

A published event study can be defined as follows:

An event study is a statistical method to assess the impact of an event on the value of a firm. For example, the announcement of a merger between two business entities can be analyzed to see whether investors believe the merger will create or destroy value. The basic idea is to find the abnormal return attributable to the event being studied by adjusting for the return that stems from the price fluctuation of the market as a whole.3

While similar in certain aspects to an event study, the GPTCRA analysis should not be referred to as an event study. The GPTCRA analysis is meant to provide a simplistic means for identifying significant events—events that bear similar fact patterns identified to the subject business fact patterns—and quantifying a market-based discount (or risk adjustment) to apply to privately held business interests.

In an event study, there may be more sophisticated procedures used than employed in the GPTCRA analysis.

Guideline Publicly Traded Company Risk Adjustment Analysis, Part I

In the instant case, the GPTCRA analysis was used to quantify the effect that both (1) the Investigation and (2) the withholding of audit opinions by both Audit 1 and Audit 2 had on the value of the FTCC common stock as of the valuation date.

Within the GPTCRA analysis, significant negative events that were announced by publicly traded companies (i.e., guideline events) were identified. Next, the effect that each guideline event announcement had on the market price of the company’s common stock was analyzed.

For purposes of this GPTCRA analysis, the guideline events included publicly traded company announcements of the following:

- Fraud

- Investigation

- The delaying of financial statement filings

- The change of auditors

- Investigations by government agencies including the Department of Justice, the FBI, the Internal Revenue Service, the Securities and Exchange Commission, and/or the U.S. Attorney’s Office

For each negative event announcement, the percentage change in the publicly traded company stock price was quantified for the following time periods:

- Three days before the announcement to three days after the announcement

- One day before the announcement to one day after the announcement

- The announcement date to one day after the announcement

The sources of information used to identify the companies and events used in the GPTCRAs analysis included the following:

- The U.S. Department of Justice Corporate Fraud Task Force Significant Criminal Cases and Charging Documents4

- The Bloomberg database

- Westlaw articles

- Securities and Exchange Commission filings

For this analysis, the Department of Justice website provided useful information. A link to “Significant Criminal Cases and Charging Documents” is a useful web page to find information related to guideline events. After compiling a list of guideline events, the next step is to review various publicly available documents to determine the appropriate date of each guideline event.

In compiling the guideline event list for this GPTCRA analysis, the analyst excluded noncomparable events such as events involving:

- Non-publicly-traded companies

- Insider trading

- Egregious fraudulent activity (e.g., Enron, etc.)

- The halting of trading activity in the subject company stock or a delisting of the subject company stock

Publicly Traded Company Risk Adjustment Analysis, Part II

The next part of the GPTCRA analysis requires the development of a normalization adjustment based on the percentage change in the publicly traded company stock price due to the guideline events. For this GPTCRA analysis example, a simplified adjustment was performed using the following four procedures.

The first procedure was to quantify the appropriate beta for each of the identified publicly traded companies. For this GPTCRA analysis, a one-year beta was estimated based on daily stock prices for the one-year period prior to the day of the identified guideline event.

The second procedure was to quantify the percentage change in the S&P 500 for each identified guideline event date for the following time periods:

- Three days before the announcement to three days after the announcement

- One day before the announcement to one day after the announcement

- The announcement date to one day after the announcement

The third procedure was to multiply (1) the percentage change in the S&P 500 for each identified guideline event date by (2) the corresponding beta estimate for each of the identified publicly traded companies.

By applying the calculation provided in this procedure, the normalized return on each publicly traded security was estimated.

The fourth and final procedure was to estimate the percentage change in stock price—due to the identified guideline event—relative to the normalized return on the subject security.

For nearly all of the guideline events analyzed in the FTCC analysis, the price of the publicly traded company common stock decreased upon announcement of the identified guideline event. These guideline event data were used as a basis for adjusting the FTCC common stock value to account for the risk of the Investigation.

Conclusion of Guideline Publicly Traded Company Risk Adjustment

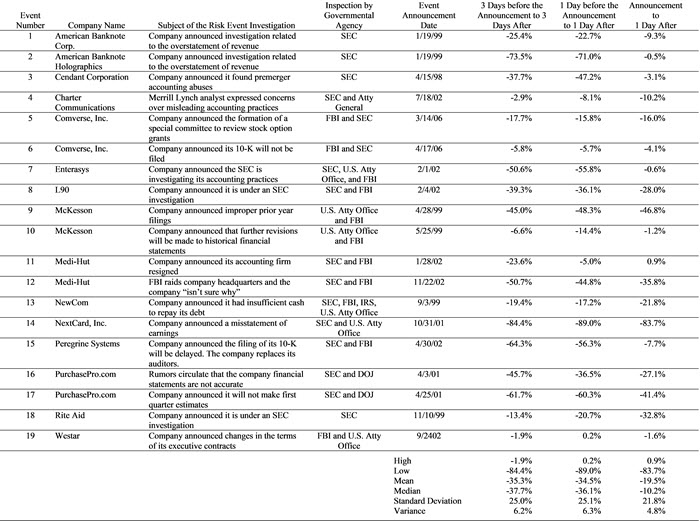

Exhibit 1 presents a list of 19 guideline events that were analyzed to estimate the FTCC risk adjustment. These data were used as a basis for estimating the risk adjustment attributable to the Investigation.

It is noteworthy that some of the companies included in this GPTCRA analysis eventually recovered from the announced significant negative event and experienced a subsequent increase in stock price. Other companies included in this GPTCRA analysis did not recover from the announced significant negative event and subsequently filed for bankruptcy protection.

In either case, the primary purpose of this GPTCRA analysis was to estimate the appropriate risk adjustment attributable to the Investigation.

As presented on Exhibit 1, the 19 guideline events resulted in a normalized average and a normalized median decrease in the stock price of the selected companies of 35.3% and 37.7%, respectively, over the period of three days before the announcement to three days after the announcement.

Over the period of one day before the announcement to one day after the announcement, the 19 guideline events resulted in a normalized average and a normalized median decrease in the stock price of the selected companies of 34.5% and 36.1%.

From the announcement date to one day after the announcement date, the 19 guideline events resulted in an average and a median decrease in the stock price of the selected companies of 19.5% and 10.2%.

To select and conclude the GPTCRA discount, the following factors related to the FTCC common stock were considered:

- As of the valuation date, FTCC management was unable to provide a reliable estimate as to the possible outcome of the Investigation.

- FTCC was subject to four significant events related to the Investigation:

- The announcement of the Investigation in November 2005

- The withholding by Audit 1 of its audit opinion

- The replacement of Audit 1 with Audit 2

- The withholding by Audit 2 of its audit opinion on certain of the FTCC financial statements

- Approximately 50% of the FTCC business was from government contracts.

- In guideline event 11 and guideline event 12 on Exhibit 1, Medi-Hut announced the resignation of its accounting firm and the raid of its company headquarters by the FBI, respectively.

- The announcement of the resignation of the Medi-Hut accounting firm resulted in a decrease in the Medi-Hut stock price of 23.6% (as measured three days before the event to three days after the event) and five percent (as measured one day before the event to one day after the event).

- The announcement of the FBI raid resulted in a decrease in the Medi-Hut stock price of:

- 50.7% (as measured three days before the event to three days after the event),

- 44.8% (as measured one day before the event to one day after the event), and

- 35.8% (as measured from the announcement date to one day after the announcement date).

- In guideline event 15 on Exhibit 1, Peregrine Systems announced a delay in the filing of its SEC Form 10-K and the replacement of its independent auditing firm.

- The announcement of the filing delay and the replacement of its auditing firm resulted in a decrease in the Peregrine stock price of 64.3% (as measured three days before the event to three days after the event) and 56.3% (as measured one day before the event to one day after the event).

We concluded that a GPTCRA discount of 35% was appropriate for the FTCC common stock. This conclusion considered the following factors:

- The normalized average decrease in the stock price of the selected guideline companies of 35.3% over the period of three days before the announcement to three days after the announcement

- The normalized average decrease in the stock price of the selected guideline companies of 34.5% over the period of one day before the announcement to one day after the announcement

- The 35.8% normalized decrease in the Medi-Hut stock price following the FBI raid on its company headquarters

Summary and Conclusion

In the FTCC valuation example, the subject company is a made-up company with an identified significant negative event—a government investigation.

The investigation is an event that an investor would most likely consider by applying a pricing discount to the FTCC stock value due to the perceived risk and uncertainty of the event outcome.

Faced with the FTCC facts and circumstances, it would not be unusual for an analyst to incorporate into the FTCC valuation the investment risk due to the Investigation by:

- Increasing an alpha factor related to the analysis present value discount rate

- Incorporating investment risk through the application of a discount related to investment marketability

- Estimating the cost to cure the issue

- Developing a risk adjustment discount derived from market-based evidence of public companies that have been subject to similar negative events

In the FTCC analysis, based on the quality and quantity of available information, an analysis of market-based evidence from public companies’ subject to similar negative events was performed. This guideline publicly traded company method was referred to as GPTCRA.

The GPTCRA methodology is simple to explain and easy to implement. Using a GPTCRA analysis, a market-based analysis was used to address the unique subject company issue. The results of the GPTCRA analysis provided support for a 35% discount application to the subject company stock.

The GPTCRA analysis and the related risk adjustment discount should not be double counted in the discount for lack of marketability analysis. In other words, the discount for the lack marketability is discretely addressed and is not combined with the GPTCRA analysis risk adjustment.

Likewise, under this perspective approach, additional pricing discounts related to the Investigation should not be double counted in a present value discount rate calculation.

Notes

- Karpoff, Lee, Mahajan, Martin, “Penalizing Corporate Misconduct: Empirical Evidence,” February 4, 2004 (an update to this paper by Karpoff, Lee, and Martin, “The Cost to Firms of Cooking the Books,” December 31, 2006, concurs that losses are significant and much of the loss is due to damaged reputation).

- Karpoff, Lee, Vendrzyk, “Defense Procurement Fraud, Penalties, and Contractor Influence,” Journal of Political Economy (University of Chicago, 1999).

- Ronald J. Gilson and Bernard S. Black, The Law and Finance of Corporate Acquisitions, 2nd ed. (1995), 194–195.

- www.doj.com

This article was previously published in Willamette Insights, Summer 2017

Kevin Zanni is a director in the Chicago office of Willamette Management Associates.

Mr. Zanni can be contacted at (773) 399-4333 or by e-mail to kmzanni@willamette.com.