Successful Exit Planning for Main Street Business Owners

Main Street Businesses: Smart Strategies for Exit Plan

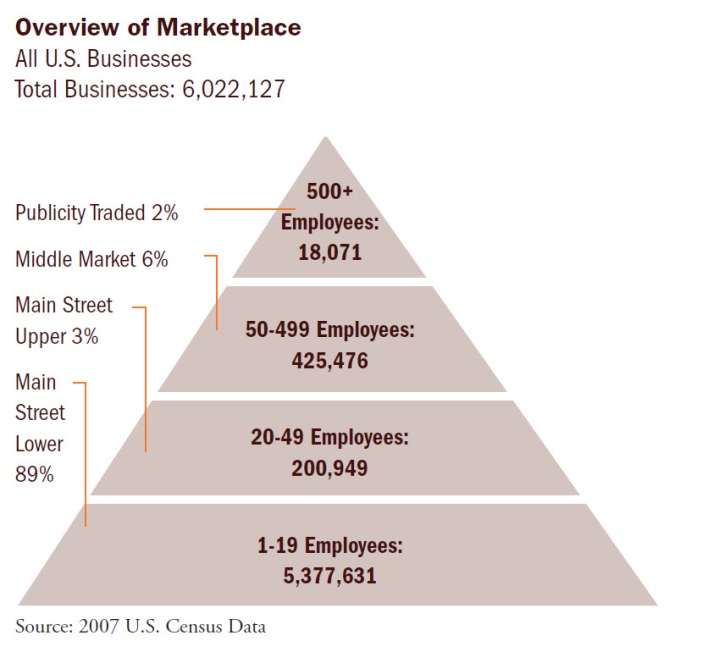

Main Street businesses are those with less than $3 million in annual sales and less than 20 employees. While Main Street businesses are the backbone of the U.S. economy, the U.S. Small Business Administration reports that four out of five of these businesses liquidate when the owner decides to retire rather than ending in a profitable sale to a new owner.

If you’re a Main Street business owner, key challenges you may face when creating an effective exit plan may include: becoming financially secure enough to be able to leave your business, profiling your ideal buyer and developing a plan to sell or transfer to them, and understanding how and when you will get paid and the risks involved. Thomas Griffiths explains how consultants can work with owners to plan and cash out at a maximum price.

[pullquote]”…identifying the best type of buyer and transaction terms for your needs.”[/pullquote]Values for your business can vary widely depending on the type of buyer and the type of transaction involved. That’s why it’s important to explore a range of possible outcomes while taking a flexible approach to identifying the best type of buyer and transaction terms for your needs. This white paper will explore the potential outcomes of successful exit planning for Main Street business owners. Using a matrix, this paper will illustrate the range of results we most commonly see when working with Main Street business owners.

While creating an effective exit plan from your business can be complex, the good news is that you don’t have to tackle it alone. Working with an experienced advisor can help you increase the investment value of your enterprise. Most importantly, finding an advisor who understands your wealth preservation and personal income needs in retirement, as well as the unique challenges and opportunities associated with the future sale of your business, can help you create a more comprehensive plan.

Getting Started

If you are like most business owners, your business is your biggest investment and you are counting on being able to cash out some day when you are ready to retire or move on. As such, the most significant financial planning issue for you as a business owner is planning for the eventual exit from your business. The sale or transfer of a business can be a big financial event—one that frequently becomes  part of your legacy. Much like saving for retirement, the earlier you start your exit plan, the better chance of creating the best outcome. As a Main Street business owner, how do you plan for the eventual exit from your business?

To achieve a successful exit, you need to know:

- The difference between a Main Street and Middle Market business

- The three major surprises responsible for most exit plan failures

- How to select an appropriate advisor

Keep in mind that exit plans are not a “one–size-fits-all” concept, so the selection of an advisor suitable for your particular exit style is important to achieving the best outcome. The right advisor can help you avoid exit strategies that aren’t a good fit for your business, eliminate unnecessary expenses in the planning process, and focus on the exit strategies that make the most sense for you. An experienced advisor can also help you maximum enterprise value, helping you sell your business to the buyer you want, at the price you want, according to your personal timeline.

Exit Planning Options: The Matrix

Main Street v. Middle Market

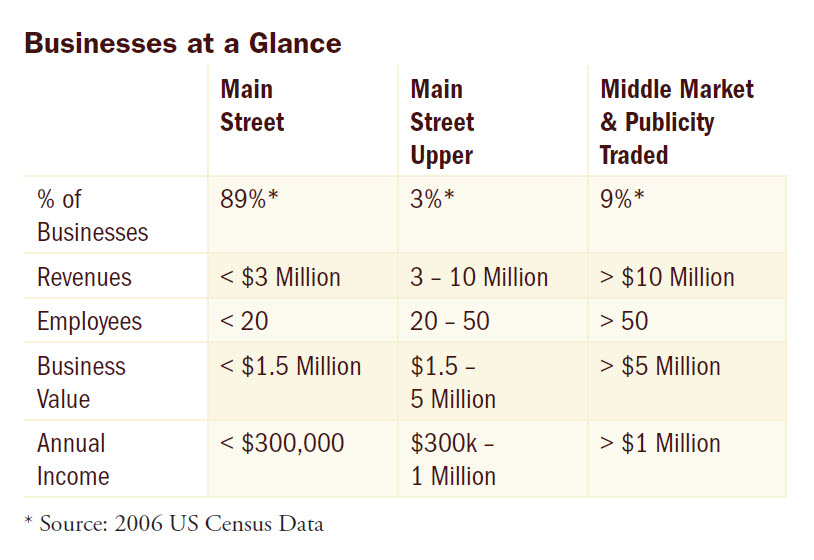

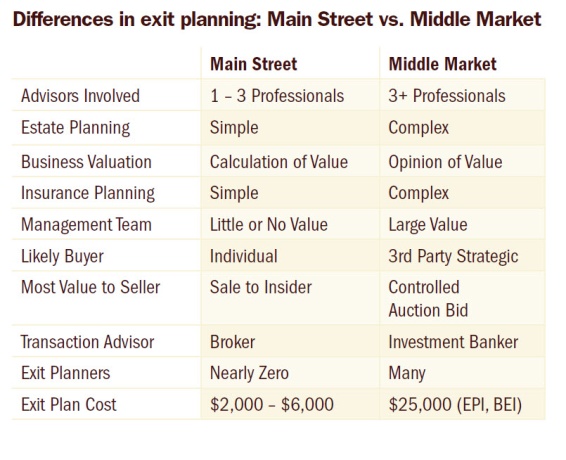

Main Street Businesses account for a very significant number of all businesses in the U.S. So what’s the difference between Main Street and Middle Market? Main Street businesses are those with less than $3 million in sales and less than 20 employees. Middle Market companies have more than $10 million in sales and more than 50 employees. In between, are businesses I call “Main Street Upper” with 3-10 million of sales and 20-50 employees.

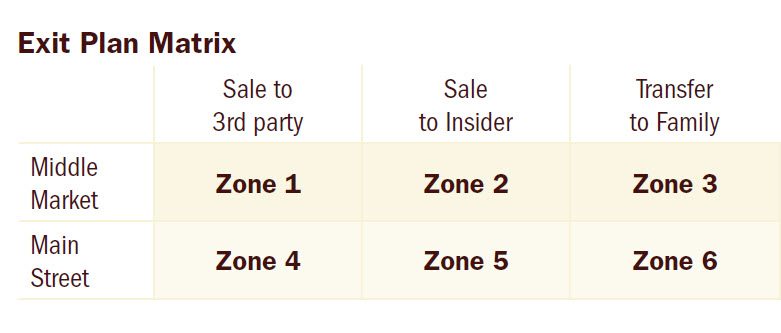

- Middle Market companies will generally have an exit plan in zones 1, 2, or 3 of the matrix

- Main Street companies in zones 4, 5, or 6 of the matrix

- Main Street Upper businesses might be in any of the 6 zones of the matrix

What’s Your Business Worth?

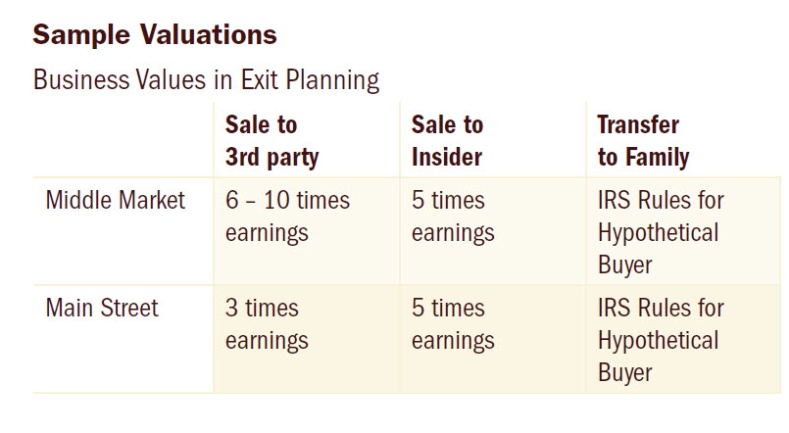

The value of your business depends on the anticipated buyer. In exit planning there is always more than one potential buyer, so your business will always have more than one value at the same time. Keep in mind that most published information regarding business valuation for exit planning assumes an exit plan for Zone 1—Middle Market sales to a third party. Zone 1 is where a business could achieve the highest possible value in a sale. However, many Main Street businesses won’t qualify because of minimum size requirements.  If you are a Main Street business, it’s important to have realistic expectations for the value of your business and consider a flexible range of values, rather than a single, fixed value

Investment Value v. Fair Market Value

When hiring an analyst or advisor to help estimate the value of your business, be sure you understand the exact type of valuation the professional you’re engaging specializes in before signing a contract. [pullquote]”The IRS fair market value seeks to identify a single market value for a company, and then heavily discounts it for lack of marketability…”[/pullquote]What most Main Street business owners need to know when planning an exit strategy is the “investment value” of their business. Investment value represents a range of reasonable values that you could potentially expect when selling your businesses to a well-qualified buyer. Investment value reports take into consideration multiple factors in each exit zone, including the size of your business, the different types of buyers present in the marketplace, and current market value trends. Because there is more than one potential buyer for your business, a thorough investment value report should generate more than one potential value for your business.

Many business valuation analysts tend to produce an IRS “fair market value” report, which is very different from investment value. The IRS fair market value seeks to identify a single market value for a company, and then heavily discounts it for lack of marketability to a value to be used for estate taxes based on the assumption that the business must sell very quickly and therefore at a big discount.  Fair value is sometimes required in cases of divorce, but typically isn’t the best tool for a planned sale.

Avoiding Surprises

Exiting your business requires a business owner to answer three key questions:

- How much money do you need?

- Who do you want to sell to?

- When do you want to leave your business?

Â

The answers to these questions are not as obvious as they seem and frequently have some big surprises in store for the business owner. Turn the page for some real-life examples to help illustrate how these questions come into play.

How Much Money Do You Need?

Bob was 65 and ready to retire. For over 30 years, he had been running a small specialty machine shop. He enjoyed his business immensely over the years and had great pride in what he had accomplished. However, he found himself increasingly thinking that it was time to do the traveling with his wife they had always talked about. Over the years, a couple of his main customers had commented that when he was ready, they would be interested in buying his business. Like most business owners, Bob had re-invested heavily in his business over the years and the business represented most of his wealth. He figured that since his business was so solid and had provided him with such a good lifestyle that it would fetch a price that would allow him to continue this lifestyle in retirement.

Surprise #1:

Your business is only worth about 3-5 years of its earningsSince Bob had been living on most of what his business made, he hadn’t accumulated any wealth outside his business and had almost nothing else to support his retirement. Bob won’t retire. He will continue to work his business because the sale of his business would require giving up the income that supports his lifestyle and it just won’t seem worth it. If you are like Bob and have most of your wealth tied up in your business, you will likely continue in your business until you are no longer able to work, and then leave it while making significant reductions to your standard of living. According to the Exit Planning Institute, 50 percent of business owners leave their business due to one of the 4 Ds—death, disability, divorce, or distress. Accumulating wealth during your business years and leaving your business on purpose to retire is far more enjoyable than becoming a member of the 4D club.

Exit Planning Step #1:

Make a plan to accumulate wealth outside your business

Ideally, you should plan to accumulate at least 2/3 of your wealth outside your business during your business years. As part of this progression, a logical sequence is:

- First, establish the business

- Second, purchase real estate for the business to operate in

- Third, begin investing in stocks and bonds

Â

Once you have achieved a balance of a third of your wealth in your business, a third in real estate, and a third in stocks and bonds, you will be in a good position to exit your business when you want. According to the book Get Rich, Stay Rich, Pass It On: The Wealth-Accumulation Secrets of America’s Richest Families by Catherine McBreen and George Walper, America’s wealthy households achieve an allocation of wealth similar to this.

Who Do You Want To Sell Your Business To?

Susan was 55 and the owner of a successful wholesale supply company. She had two key employees that were instrumental in building and running her business. Susan was fairly conservative financially and had always lived on less than her business made. She had accumulated 50 percent of her wealth outside of her business. With the sale of her business, she expected that she could be financially independent. Over the years she had hinted to these two key employees that when she was ready to leave, she would sell the company to them. Susan knew that if she sold to an outside third party, that the new buyer would likely make significant changes and employees might lose their jobs. She was proud of the business she had started and wanted her legacy to continue. She cared deeply about the employees and the families of the people who had helped her become a success and felt she owed it to them to sell to these two key employees.

Surprise #2:Â

Your buyers have no money and poor creditSusan had failed to fully develop her buyers. Her two key employees were willing to buy the company, and they had the management skills to run it, but they had no money to buy the business and their credit was not good enough to obtain financing. Susan could not become financially independent without getting at least a portion of the money up front from the sale. She was deeply disappointed and is faced with some difficult decisions. She will either have to postpone her plans and work several years longer while helping her key employees develop better credit and obtain the means for a down payment. Or, she will have to sell to a third party putting at risk her employees’ jobs and the legacy she created.

Exit Planning Step #2:

Make a plan to develop your buyer

Ask yourself this question: “What characteristics does the ideal buyer for my business have?” You must investigate this early in the process so that you can target and develop the best buyer for your business. Owners commonly don’t think about developing their buyer—they think of this as the buyer’s responsibility. But the buyers in this situation don’t see it coming any more than the selling owner does. When the buyer is not ready, it becomes the seller’s problem. Developing your buyer can mean a lot of different things depending on who you plan to sell to. In addition working with buyers on creditworthiness and down payment accumulation, exit planning has a variety of mechanisms to help you develop your buyer such as phased sales of non-voting stock, stock bonuses, deferred compensation programs, estate planning gifting techniques and others. Most take time, so start early.

When Do You Want To Leave Your Business?

Paul was a 56-year-old owner of a small manufacturing company. He had been in business for over 25 years and had always lived on less than his business made, allowing him to accumulate wealth outside his business. His two adult children worked in the business and for years he had developed them as buyers by grooming them to take over. The day came and Paul decided it was time to leave. After 25 years in business, he was excited about the freedom he would enjoy and the thought of not having to worry about the business anymore. He didn’t need top dollar from the sale of the business to become financially independent and wanted to sell to his children for less than full value.

The children were ready to buy, had good credit, and a decent down payments. He had done everything right, but Paul was disappointed to find out that the bank wouldn’t finance his children for the purchase of the business without his personal guarantees on the notes taken to pay him. How could he stop worrying about the business and enjoy his freedom if he was going to repay the notes if the business failed after he left?

Surprise #3:

You will probably have trailing financial riskYou probably won’t feel like you have left your business until you have been paid and any personal guarantees are gone. For the most part, selling a business to insiders generally involves attaching to post sale payment streams from the business. Whether it is a seller financed note, personal guarantee of the buyer’s loan, an unfunded deferred compensation, or something else, you will bear a risk of loss after the sale for a period of time, and it will make you feel as if you have not yet left your business. So you can see how answering the question “When do you want to leave your business?” can be tricky to answer.

Exit Planning Step #3:

Make a plan to deal with post-sale financial risk

According to How to Run You Business So You Can Leave It in Style by John Brown of Business Enterprise Institute, insider buyers with 100 percent cash at close are rare, especially if you are getting good value for your company.

You will most likely have post-sale financial risk. One way to manage the question of “When do I want to leave?” is to sell your business 2-3 years before you want to leave and stick around to babysit your risks until you get paid. Banks will often release personal guarantees at 2-3 years into the note or when it is paid down to a certain point, provided they agree to these terms to begin with.

Most owners don’t realize that they can retain control of the company after the sale by selling most of the company stock as non-voting stock and keeping the voting stock until they are paid, this even works in an S-Corporation. There are many exit planning mechanisms to help manage post-sale financial risk. The best way to eliminate post-sale financial risk is to get the clock started ticking.Â

Finding the Right Advisor

Exit planning is a long-term, multi-disciplinary process. Working with an experienced advisor with a long-term view can help you ensure a seamless transition to the next stage of your life, which could include retirement, volunteer work, or starting another business. As there are often many different professionals involved in a transaction—including lawyers, tax professionals and financial planners—you may want to consider identifying one advisor as the lead advisor on your exit plan.

As with any advisory relationship, the following should be part of your due diligence process:

- Ask other business owners which advisors they’ve found to be most valuable to work with

- Ask any advisors you’re interviewing about the exact services they are providing; the more detail they can provide you, the better

- Be sure you have a clear understanding of how an advisor is paid

- Try to get a feel for the type of clients an advisor typically serves

- Look for any potential conflicts of interest between you and your advisor

- Ask for three references and, more importantly, call them

Â

The main reason that exit plans fail is simply a lack of planning. Necessary steps that need to take place before the successful sale of a business typically include developing wealth outside the business and developing qualified buyers. The key distinction is often whether or not you can be financially independent with the sale of your business. If you can, creating a short range plan with your advisor that details specific exit steps is appropriate. If not, a long-range plan that focuses on wealth creation and diversification is appropriate.

Many business owners interested in exit planning have not developed enough overall wealth to be able to sell their business and be financially independent. When they begin to analyze their business as an investment, they find that very steps that make the business more valuable provide the cash for them to invest outside their business, which further enhances their overall wealth. In fact, the value of a business is most frequently measured by the cash profit it generates for owners that can be invested elsewhere. Re-investing profit in the business only increases the value if the return is increased.

The natural evolution of business owner wealth development is to start and grow a successful business, then purchase commercial real estate to run the business from, invest in stocks and bonds, and sell or transfer the business interest when at exit. In order to be successful at selling the business at exit rather than liquidating, a business owner needs to be effective in long-range exit planning during their wealth enhancement stage of business. An experienced advisor can help you create that long-range plan.

As a business owner, your business is part of your legacy as well as your financial security. Take the time to create comprehensive exit plan. Be patient and explore all of your options. And look for an advisor who can help you manage your total financial picture—not only your exit plan, but also your retirement plan and your overall financial advisory needs.

Tom Griffiths is a Certified Public Accountant (CPA), Certified Financial Planner (CFP), is accredited in Business Valuation (ABV) and is a Certified Exit Planning Advisor (CEPA). He is also the founder of Griffiths, Dreher & Evans, P.S., a Spokane- based certified public accounting & wealth management firm specializing in meeting the needs of today’s Main Street business owners. To learn more, contact Tom at (509) 326-4054.