Family Business Challenge: Bringing in External Leadership —Forbes

When Do Too Many Active Shareholders Hurt Instead of Help?

At Forbes, Lawrence Siff relates his conversations with CEOs of two family businesses, discusses the challenge of bringing in new leadership, and offers tips on how and when to go about it:

`Sometimes it’s a business; sometimes it’s a family,’ lamented one of my clients (who I’ll call CEO No. 1) when I asked him what it’s like to be an outside CEO running a family-controlled business.

I asked him to elaborate: `Lots of time is wasted with nonsense projects, phone calls, and emails about things that have absolutely nothing to do with the business but are important to family members. Because there are so many family members on the board, the meetings get hijacked easily,’ he continued. `Often I react with passive resistance, saying ‘that’s a great idea’ or ‘I’m happy to look at this but just get me the data to prove it makes sense for the company.’

More often than not, CEO No. 1 never hears back from them about these ancillary matters, but he’s frustrated by the amount of time and energy he spends on non-essential things. For example, setting up just one board meeting can take 50 emails. The business that CEO No. 1 runs is successful, but he is convinced he could do even more for the business—and the family shareholders—if he were allowed to focus exclusively on what’s important to the company.

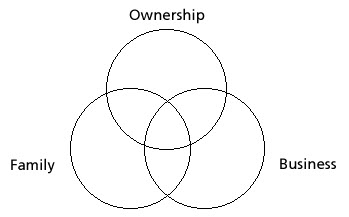

Contrast this with the sixth-generation family-controlled business CEO No. 2 runs: This business has 90-plus family members who are active shareholders. The family has both a family council and a family council steering committee. The council’s role is to represent all the family shareholders; just one member of the steering committee is a member of the company’s board. There is A (voting) stock and B (non-voting) stock. Just a few family members control the vast majority of the voting shares.

The company only put this structure in place eight years ago, as before that, there was a lot of chaos and confusion.

So what’s the solution? Siff recommends five steps management should go through:

1. Define the new head’s role and responsibilities.

2. Make sure the chemistry is right.

3. Build a sense of trust.

4. Give your new hire space.

5. Be sure you’re genuinely ready and willing to let go.

Read the full piece for details.

Balancing Family and Business Can Be Tough. Here are Some Tips.