Valuing David Einhorn’s Portfolio—The Discounted Cash Flow Model —NASDAQ Community Site

GuruFocus Adds New Valuation Tab to Site; New Feature Automatically Calculates DCF Valuation. What are Top 10

The Nasdaq Community site notes the appearance of a new Valuation tab at its GuruFocus web site. Learn about how DCF analysis works, why it’s considered a reliable method of analysis, and view some top current stock picks of an investor who uses the method:

Discounted Cash Flow, a feature on GuruFocus’ new Valuations Tab , is a more encompassing method of valuing businesses than isolated ratios because it takes into account book value, current free cash flow, business growth rate and terminal value. The model arrives at an intrinsic value of a business that includes balance sheet value, future business earnings and earnings growth.

Calculating the entire value of the business in this way gives a number that is comparable to the stock price. For instance, if a company has a DCF value of $10 and the stock is trading for $15, the stock is undervalued.

Warren Buffett commented on the DCF valuation model in his 1992 Berkshire Hathaway ( BRK.A )(BRK.B) annual letter: “In the Theory of Investment Value, written over 50 years ago, John Burr Williams set forth the equation for value, which we condense here: The value of any stock, bond or business today is determined by the cash inflows and outflows – discounted at an appropriate interest rate – that can be expected to occur during the remaining life of the asset.”

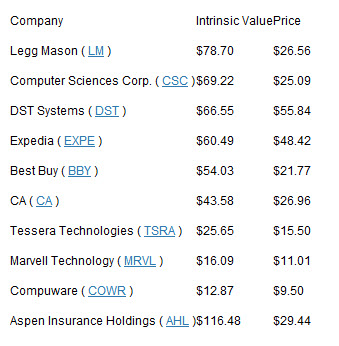

You can read about the actual math involved in calculating DCF and find a list of some of David Einhorn’s picks. David Einhorn is a well-known value investor famous for, among other things, his ability to identify undervalued or overvalued companies and taking corresponding long or short positions in them. Einhorn has a proprietary process for valuing stocks, but within his portfolio are a number of stocks trading below their intrinsic value based on the DCF model. Here are the top 10:

Each of these Stocks Currently Trades Below Intrinsic Value as Calculated by DCF