Winning the Report Writing Derby

Winning Skills and Strategies in Writing Exceptional Reports

Tom Helling shows how to enhance your own reputation, build future business, and help clients solve problems in your written report. Key ingredients are careful logic, strong research, and good writing. Learn how to do it all.

Winning the Report Writing Derby

By Tom Helling, MBA, CPA, MCBA

This article is adapted from a speech delivered to a meeting of the members of the North Central Chapter of the Institute of Business Appraisers, the American Society of Appraisers, and the National Association of Certified Valuators and  Analysts on January 19, 2012.

The late business philosopher Jim Rohn said: “Refinement of your skills can make you a fortune” and “Success is 20 percent skills and 80 percent strategy.” Which is more important—skill or strategy—when it comes to writing business valuation reports? I am going to share strategies that work for me and, at the end, I’ll share my “horserace betting sheet” for winning strategies to write a good report. It’s a bit bizarre, so stay with me because I talk fast and my mind races . . .

A report should make the reader’s job easier. The client pays us to develop a report addressing multiple and complex issues for a purpose and function. As a writer, I have a process and specific strategies that make the report more valuable. The process involves organizing the information, creating a draft, and refining the report. Additionally, I seek out criticism from great editors, mentors, and colleagues who read and reread my reports. They do marvelous work, have excellent skills, and years of experience!

Â

Who reads or edits your draft report and why? (Hint—it should include someone who has owned, bought, or sold a business and is a skilled proofreader.)

This talk is not about detailed instructions or checklists, types of reports, preparation for sales and acquisitions, divorce work, Internal Revenue Service testimony, how to do footnotes, or reference case law. My points are strategic.

- Why will a well-written report benefit you?

- Is there a good book on how to write? Yes, it’s called How to Write!

- What skills and strategies make your business valuation report better?

- Do you have fun writing “winning” reports or do you find it boring? Each person in life and in business valuation has his or her special areas of expertise. Do you have empathy for those who might read your work, but may not have your special expertise or experience? Would a layperson understand what you wrote? They should!

Why  Will a Well-written Report Benefit You?

Well written reports:

- Show your clients how to solve problems and/or advance their goals. This will increase client appreciation for your service

- Enhance your reputation and respect amongst peers and clients. Respect and integrity generate ongoing referrals

- Produce peace of mind because you know you have followed high professional standards. You sleep well at night knowing your report stands alone

- Convince a buyer, seller, or judge of your thoughts and conclusion

- Bring comfort and joy. You will know the relief a finished report can provide, “Thank God it is done!”

- Result in more money for your valuation work. If you find no joy in writing, go do other things that you enjoy!

Winning Skills and Strategies

- Logic

Writing is a skill rarely refined. I have found that most books about writing are not useful. Last month, I was in Barnes & Noble and was guided to the business writing section. There, I quickly scanned all ten books and found that nine had no value. The tenth, a proposals presentation book, discussed logic in the first chapter and noted that logic must be understood to understand everything that follows. How very refreshing! Logic is crucial to depth of understanding because logic “connects the dots.” Using logic is like drinking a fine wine or crystal clear water with a great meal. It adds to the depth of the meal and is enjoyable!

A book that, to me, is a classic on the subject of writing is How to Write by Herb and Jill Meyer. The book is 25 years old, but I have never found a better short book on writing. Jill taught English in Canada and the United States. Both Jill and Herb spot patterns well. Herb wrote for the Wall Street Journal, was an editor for Fortune magazine, and was Vice-Chairman of National Intelligence under President Reagan.

He won the highest award from the intelligence community for forecasting the fall of the Soviet Union six to eight years in advance of the event. How is that for making a forecast of the future?

The work that we do in business valuation is also a forecast of the future. A report that synthesizes critical findings for the reader will be well-received. A well-received report leads the reader to make better conclusions and business decisions.

- Strong Research (Gather, Synthesize and Present in Report Format)

- Executive Summary

Business valuators are either researchers themselves or they analyze the research of others. One of my mentors taught me that good business valuation is 75 percent research and 25 percent numbers. Valuators often reverse the two and, as a result, create boring or irrelevant reports that do not cover what a prospective buyer wants to know. Do your report and executive summary answer the who, what, when, where, why, and how much . . . ?

- Report Length

A business valuation is, in essence, a short story. My opinion is that a valuation report should only be twenty to forty pages total with a strong executive summary. If you remember one thing today, remember “Less is more!” One way I seek to improve my own work is by reading short stories and other examples of great reporting and writing.

I like to read chapters from Tyndale’s New Living Translation Bible. It is a clear, well-written translation supported by extensive research in both the Old and New Testament. I also enjoy reading well-written secular texts such as Ernest Hemingway’s Old Man and the Sea and Will and Ariel Durant’s The Lessons of History. All three are masterpieces of great writing. They are creative, strategic, and short. For example, The Lessons of History compresses 100 centuries of recorded history into about 100 pages.

- Critical Thinking

Herb Meyer, author of How to Write, feels that, not only have we failed to teach people how to write, but we also lack in teaching them how to develop critical thinking skills. Today, we are taught to value information, but we do not learn how to process the accumulated information effectively . . . We do not learn how to think. It is simply not true that information, in and of itself, is of the highest value. Insights and understanding gained from information have the most value.

- Writing Well (The Ability to Convey Information Clearly and Concisely)Â

- Management Interviews and Listening

Listening is the key to a good interview. In today’s information-saturated society, the more clearly information can be conveyed without sacrificing quality, the more powerful that information is. If you want to write better business valuations, Google less! The point is not just to accumulate information, but to couple it with insights that help you tell the story, i.e., why it is a good or bad business compared to medians. Make sure your information sources include live interviews of top management and other key people, asking them poignant questions about the business. Listen carefully so you can gain a better understanding of the business and write about it. I challenge you to prepare more and think more. Challenge yourself to condense your writing!

- Business Intelligence

In another book written by Herb Meyer, Real World Intelligence, we learn that business intelligence is getting the right information to the right people at the right time. Does your report have business intelligence in it? How many times does the reader say, “Wow, I never knew that!” when reading your report?

- Reconciliation of Value and Return on Investment to Clients

Let me give you an example of how intelligence maximizes the value of your work. A medical software company owner and president, age 38, wanted to know what the business was worth. We did a well-researched summary report dated June 30, 2009. He asked: “Do you think you can really sell it for that?!” to which I replied: “Yes or I would not have valued it for that.” He wanted to sell immediately, but I suggested waiting until January, 2010 so he could show prospective buyers another full year of continuing great numbers. I sold it in June, 2010 to a public company for 33 percent higher than the valuation, and the owners received 90 percent cash down. The other 10 percent was withheld for one year. The four owners received 80 percent of the 10 percent  withheld in the summer of 2011. Thus, they received 98 percent cash in one year. Great research identified the strengths, share of market, and the factors that made this business so valuable.

I have another client who sold five businesses in 2011. All of them sold within four months of the valuation for the valuation price. What does that tell you about the seller’s outlook for the businesses? The board did not see much future in these businesses and they needed cash. What about the buyers? The buyers saw value in certain assets held by the seller (employees and revenue) and felt that they could run the business better. All parties are pleased as they got cash and value from the report, and they remarked that there were no surprises in the transition.

Summary

What about your business experience? Most appraisers are accountants who have never sold or operated a business. If you have not already, I recommend you start at least one business and then broker or sell a business in the next three years. In this way, you will develop empathy, compassion, and understanding of owners, buyers, sellers, and brokers in the market. If you will not take the risk of ownership (being “in the market”), go talk to those who have done it and paid the price. What relevant knowledge of the facts would you as a buyer want to know, and is that in your valuation? What is most relevant to you in the real world of ownership? Private capital markets (i.e. Pepperdine University’s Private Cost of Capital ongoing studies)? Public capital markets? Relevant information such as non-compete con- tracts, competition or share of market is paramount, as that is the information from which the reader derives the most benefit. It is not just about the stats and final conclusion.

After having participated in more than 580 successful transitions, I am still learning what works well and what does not—through follow-ups with clients. Heart surgeon and cardiologist clients taught me the value of follow-ups and post-mortems. They had the guts, wisdom, and foresight to share their experiences with the goal of enhancing patient outcomes. They took risks sharing their successes and failures to help those in their profession. We have tried to do the same through annual satisfaction surveys. For the past 16 years, we have tracked outcomes, and we continue to learn how we can do better on our next project.

Value is based on anticipated future benefits. Therefore, determining value requires thorough research on markets. Whether in valuation mode or deal-making mode, you are trying to get to a cash or cash equivalents value. Are you looking at the big picture in your research? How hard is it for your clients to get bank credit or private equity capital to buy or sell a business or obtain additional credit to expand and create future jobs? Is the industry over-regulated, nationalized, declining, or growing? What key variables impact the owner’s ability to someday capture value for their business?

What terms are sellers willing to accept today? In deal making, EBITDA (earnings before interest, taxes, depreciation, and amortization) multiples have changed. If the market for closely-held businesses in the industry commands a 25 to 35 percent return on investment (cap rate), why would you make a conclusion based on a public information software model that only gets you to 20 percent? Consider both. It is not fair market value if the business is overvalued and will never sell in six to twelve months.

Kentucky Derby Betting Sheet

Now let’s have some fun. Let’s pretend you are at Churchill Downs in Louisville, Kentucky, watching the Kentucky Derby events. I have been to horse races at Churchill, and it is exciting!

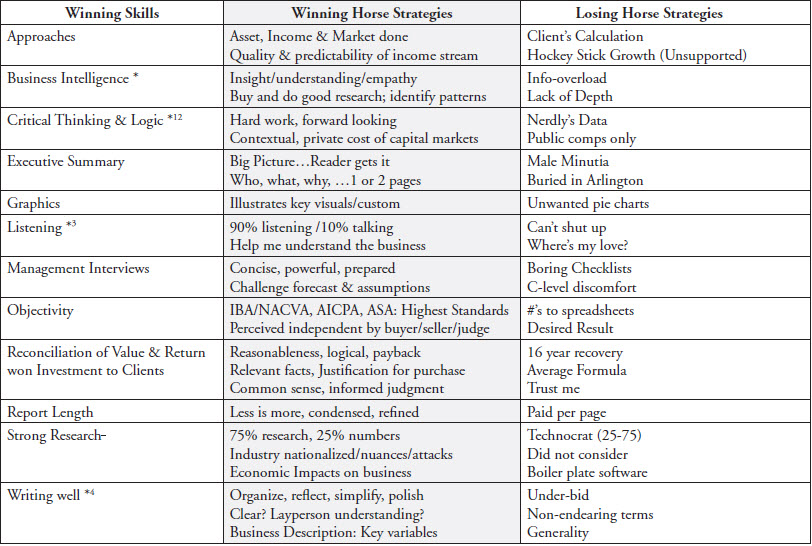

We are in the last race: The Big One—The Kentucky Derby. They are just about to sing “My Old Kentucky Home.” Please look now at the betting sheet some old guy sold you for $1 (see Exhibit One)

Â

Remember: “Success is 20 percent skills and 80 percent strategy.” You can place your bet on a winning horse (highly-developed, proven report-writing strategies) or on a losing horse (generic report-writing strategies): it is your choice, and honorable people can disagree. Fact is, the losing horse strategies have catchy names! Personally, I have bet on all of the strategies in the winner’s (middle) column. All of the jockeys in the derby ride winning horses. In short (no pun intended to jockeys), they use winning strategies. As for winning skills (left column), my favorites are Writing Well, Listening, Critical Thinking and Logic, and Business Intelligence. You will also need skill to win.

I believe the bottom line to “Winning the Report Writing Derby” is writing strategy first and skill second. The names of the winning horse strategies are not flashy but they are strong in the finish . . . and the earnings are higher than you will ever make at Churchill Downs during the Kentucky Derby!

Tom Helling, MBA, CPA, MCBA is president and founder of Presidents Solutions, Inc. in Minneapolis, MN. After 30 years of conducting over 580 ownership transitions and business valuations, Tom has succeeded (and failed) in selling firms of clients and businesses he started. He has also written and facilitated over 300 business plans. Tom was a founder of the North Central Chapter of the Institute of Business Appraisers (IBA) and started the annual valuation contest—a fun way of learning from the real world market and our colleagues. He served 5 years on the Quality Review Committee reviewing reports for the Certified Business Appraiser credential and was elected to the Professional Standards Board of the IBA in 2011. Tom can be reached at tom@presidentssolutions.com.

*The original footnotes are not available.