Mercer: Understanding The Income Approach to Marketability Discounts—Valuation Speak

Enterprise Value is a Perpetuity Concept, but Shareholder Level Values Depend on Expected Holding Periods. Here’s Why the Difference Matters.

The conceptual logic regarding the income approach is difficult to refute, writes Chris Mercer on the Valuation Speak blog. What can cause expected cash flows to minority shareholders to be less than the expected cash flows of the enterprise? What can cause the expected growth in value, from the minority shareholder’s perspective, to be less than the expected growth in value for the enterprise from the viewpoint of a purchaser today? What factors create additional risks for minority shareholders, in addition to the need to bear the risks of the enterprise? Mercer explains how a myriad of factors are involved. In this post, Mercer takes time to discuss—in detail and with the backing of sophisticated mathematical logic—the income approach to marketability discounts.

The first four posts in this series introduced the marketability discount, or discount for lack of marketability, and set the direction for the next several posts. This post addresses the marketability discount in the context of the income approach to valuation. The next post will discuss the market approach.

Many appraisers do not think of valuation approaches when valuing minority interests in businesses. Such interests are often referred to as “partial interests.

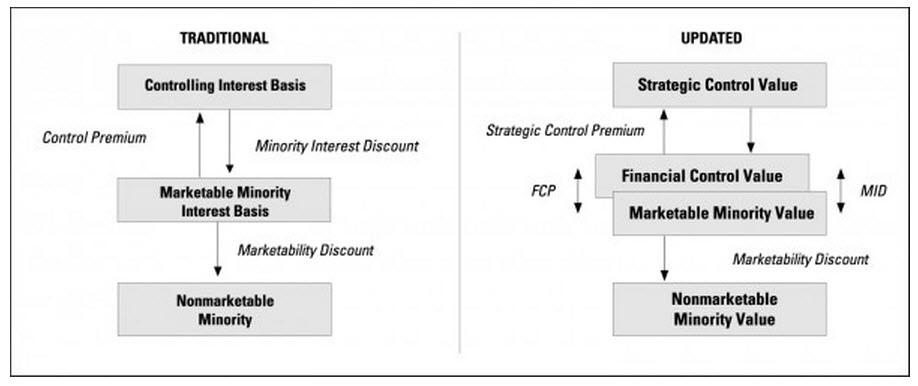

This Level of Value Chart is Key to Understanding How to Value Partial Interests

Mercer dives into the math:

The first equation below introduces conceptual math describing the shareholder – or nonmarketable minority – level of value — expressed in the context of the Gordon Model. The expression is imperfect because, unlike the valuation of businesses, which is a perpetuity concept (i.e., the expected cash flows go on forever), minority investments are typically made with finite investment horizons. We deal with this below.

The terms in the conceptual definition of value at the nonmarketable minority level are defined:

- Vsh is the value of minority equity interest of an enterprise that lacks an active market for its shares, from the viewpoint of the owner of the interest. Note, at this level, the minority interest, like all publicly traded minority interests, lack power, or control over the affairs of an enterprise. Appraisers typically develop indications of value at this level by subtracting a marketability discount from a marketable minority interest value. We will explore how appraisers do this in detail in future posts.

- CFsh is the portion of the enterprise cash flow expected to be received pro rata by the shareholders, including both interim distributions and any expected terminal value. CFsh is a symbolic notation to describe all expected interim cash flows and any expected terminal value at the end of the holding period for the investment. In other words, the equation cannot be literally used to determine the value of a nonmarketable minority business interest. Actual notation for the two stage, shareholder level DCF model can be shown as follows:

The left portion of the equation represents the present value of interim cash flows (PVICF) for a finite expected holding period ending in year f. The right portion of the equation represents the present value of the terminal value (PVTV), which is, for purposes of this discussion, the marketable minority (enterprise) value at the end of year f. Rational investors do not enter into a minority investment absent the expectation of achieving the objective of the investment, which is an enterprise value at some point, even an indeterminable point, in the future.

- Rhp is the discount rate of the minority investor in a nonmarketable equity security for the expected holding period, or the required holding period return. Logic suggests that Rhp will be equal to or greater than Rmm. It makes sense that a minority shareholder’s investment is exposed to risks that are incremental to those of the entire business. This incremental required return can be stated symbolically as in the next equation, where HPP is the indicated holding period premium. What we are suggesting is that the required holding period return is the sum of the enterprise discount rate and the holding period premium. Note that if HPP is equal to zero, meaning there are no holding period risks, as with a liquid, publicly traded security, then Rhp is equal to Rmm.

- Gv is the expected growth rate in value of the enterprise, which yields the terminal value of the enterprise at the end of the expected holding period. The objective of every investor (dare I be absolute here?) is to sell his or her investment at an enterprise level and to receive the benefits of the risks that were endured during the holding period for the investment. Tennis?? is the second statement of this premise and I repeat it because it is so important.

If we work with the Gordon Model, we can see that for a publicly traded security, the expected growth rate in value is equal to Rmm less the dividend yield. If not all enterprise cash flows are distributed to, or invested for the benefit of, the minority shareholders (if, for example, above-market compensation is paid to a controlling shareholder), then Gv will be less than Rmm(adjusted for the dividend yield).

The same result will occur if a company’s expected reinvestment rate is less than its discount rate (e.g., as with the accumulation of low-yielding cash assets, vacation homes, or other assets providing no yield or a yield less than the discount rate).

For a more in-depth discussion of this issue, see Z. Christopher Mercer and Travis W. Harms, “Marketability Discount Analysis at a Fork in the Road,” Business Valuation Review, Vol. 20, No. 4 (2001): pp. 21-22.

Read the whole piece here.