Sale Options for Senior Physicians

Healthcare Practices Still Command Significant Goodwill Value. Here’s How Owners Can Successfully Plan an Exit.

According to The Health Care Group’s Goodwill Registry, a database of buy-in and sale transactions, medical and dental practices are still commanding significant prices for intangible value/goodwill. Here’s the detail on the numbers and guidance for optimal ways owners can find a successor, partner firm to merge with, or effect an outright sale.

As the baby boomer generation begins to retire, increasing numbers of senior doctors will be evaluating their options for sale of their private practices. Is this a good time to sell? A bad time? Can you get anything for your practice, or is goodwill a “thing of the past,” as some consultants say? What are your options?

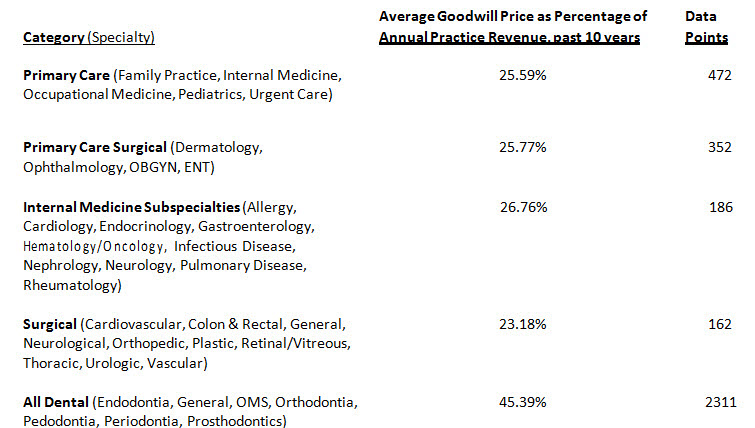

Despite health care reform, electronic medical records (EMR), and other recent changes, the big picture view for sale of your practice is still quite good, in our view. According to The Health Care Group’s Goodwill Registry (2010), a database of buy-in and sale transactions, medical and dental practices are still commanding significant prices for intangible value/goodwill. The amount varies by specialty, location, practice profitability, and other variables but consider these general numbers:

Such payments are in addition to payment for equipment and accounts receivable.

Of course, these numbers are general benchmarks for intangible values. Individual practice goodwill values are going to depend on individual practice characteristics, such as specific specialty, location, profitability, existence of non-compete clauses on any associate physicians, and other factors. Some practices will have values well in excess of these averages. Some may have far smaller values. But the point is that in many instances, substantial values can still be realized in a sale transaction.

In our work, we routinely hear of consultants who have told doctors that “there really is no such thing as goodwill” or similar statements. That simply is not true. The young doctors who we see paying hundreds of thousands of dollars for buy-ins and practice purchases are not doing so out of the goodness of their hearts. They are doing so because they feel that the buy-in or purchase is the best opportunity available to them. They rightly perceive that a properly priced buy-in or sale still leaves them substantial profits left over to earn a good living.

How do senior physicians find such buyers? A great deal depends on timing. Ideally, the senior physician starts looking for a successor years in advance—perhaps five to eight years or more. That is sufficient lead time to bring in an associate, evaluate them, and do the buy-in. Having done a buy-in, the young doctor is financially and psychologically committed to the practice. The senior physician can safely retire, and trigger the pre-agreed “back end” buyout.

What if the senior physician does not have five to eight years remaining before retirement? It still may be possible to do a “speeded up” buy-in/pay-out deal with a new associate. The associate is hired, works for two years on a salaried basis, and then does an outright purchase of the practice as an asset acquisition. This is eminently “doable,” although the total acquisition price may not be as high as a traditional, extended six to eight year buy-in/ pay-out plan (With the extended plan, there is more time to transfer dollars from buyer to seller.).

Another buyout-type transaction is a merger. The solo or two doctor practice merges into a larger group. The solo doctor is not given cash for his practice upfront; rather he signs a buy-sell agreement with the group that commits the group to pay him out, when he retires in two to four years. The solo’s practice has been “pre-sold.” No further worries about finding a buyer. The acquiring practice feels good, too; it has taken the senior doctor’s practice “off the market” and made sure that it does not fall into a competitor’s hands.

And finally there is the traditional “sale.” The senior physician finds an outside physician, group practice, or hospital that buys the senior’s practice with cash and notes. Senior walks off into the sunset.

In a way, this traditional sale transaction may be the hardest to pull off, at least with a good price tag. Why? Because senior is likely under some time pressure. Perhaps senior has health issues. Perhaps he does not want to invest in EMR, and yet worries that if he continues to practice, he will be forced to acquire it, one way or another. Perhaps he fears future reimbursement cuts. Perhaps he just wants to get out—now. In any event, there is less time to find a buyer, negotiate, and complete the transaction.

In our experience, the best way to accomplish a traditional sale is to commit to it, jumping in with “both feet.” This is no time for tentativeness. The worst thing to do is invest a lot of time and money in developing a price and finding a buyer and then decide you aren’t quite ready to retire. You have to be ready to accommodate your buyer. If the buyer wants you to go immediately, then you need to be ready to turn over the keys.

A firm commitment to the sale process will also help you generate interest from multiple sources, and a better price. Nothing motivates a bidder more than the knowledge that he may lose the opportunity to some other bidder. And to entice multiple offers, you need to explore all possible offers, with complete commitment to the end result: sale.

Who might these buyers be? The traditional practice buyer has been a newly trained physician who wants to own his own shop. Unfortunately, that breed of young doctors has grown scarce in recent years. Many young doctors are unwilling to commit to the long hours and business pressures of running a sole proprietorship. They are more interested in group practice, or in a buy-in followed by years of side-by- side practice with senior, before the ultimate buyout. An additional challenge is that whatever physician buyer candidates exist have to be found from scratch. They are generally not local and not known. They must be sought out, through training programs, brokers, professional societies, or advertisements.

An easier buyer to locate is a local competitor or hospital. These parties are best approached well in advance of the desired retirement date to avoid hardball offers. The pitch to such a buyer is that you are entertaining bids from all directions, including other competitors and other hospitals. Such an institutional-type buyer is desirable because of their greater creditworthiness versus an individual physician buyer. You’ll probably be content to take substantial “paper” (promissory notes) in lieu of cash because you know such a buyer has the financial resources to carry through on its commitments.

If you are planning an outright sale of your practice, consider what other assets should be sold at the same time. For example, you may own the building or condominium in which your office is located. The buyer may be interested in acquiring that too. Perhaps you own an interest in a surgery center that can be conveyed to the buyer.

With respect to such other assets, recognize that the most important asset to sell is your medical or dental practice. Your building or condo is far less perishable; it will still be there, even if you retire. Plus the universe of potential buyers is much larger than just physicians or hospitals; you can sell to anyone. Recognize also that the buyer of your medical or dental practice may not have enough cash to buy both your practice and the building. Better to sell the practice now and the building later with a long-term lease bridging the gap.

Daniel M. Bernick, JD, MBA, is a principal of The Health Care Group and Health Care Law Associates. He has extensive experience in medical practice valuation and in structuring, planning, and drafting various physician and health care contractual arrangements. Visit www.thehealthcaregroup.com. This article first published in the Winter 2011 edition of Issues & Updates, a publication of The Health Care Group, which has offered legal and business advice for physicians and dentists since 1970. It is also available in the KVD articles database, which contains thousands of articles on valuation, financial forensics, M&A, and other related disciplines.