New Data Offer Support for Appraisal Assumptions

Added Ammunition Support Appraisal Assumptions

Sherry Smith offers a look at data sources that can deepen and add credibility to valuations, M&A offers, and more. Pepperdine Private Capital Markets Survey, Sageworks, and a number of Secondary Markets for Private Companies (SecondMarket, Sharespost, and Triago) all offer illuminating information.

As appraisers, we are always on the lookout for actual market observations to support our valuation assumptions. Here are some interesting data sources that I am following:

Pepperdine Private Capital Markets Survey

Launched in 2009, the Pepperdine Private Capital Markets survey is the first comprehensive investigation into the decision-making behavior of private capital providers. Rob Slee, an investment banker who authored the authoritative text¬† ‚ÄúPrivate Capital Markets,‚ÄĚ teamed up with Pepperdine professor John K. Paglia to poll senior cash flow lenders, asset-based¬† lenders, factors, mezzanine funds, private¬† equity groups, venture capital firms, and¬† angel investors. ¬†All of these various capital providers have described the types of deals that they seek and the financial returns that they expect. ¬†The survey is updated semiannually.¬†

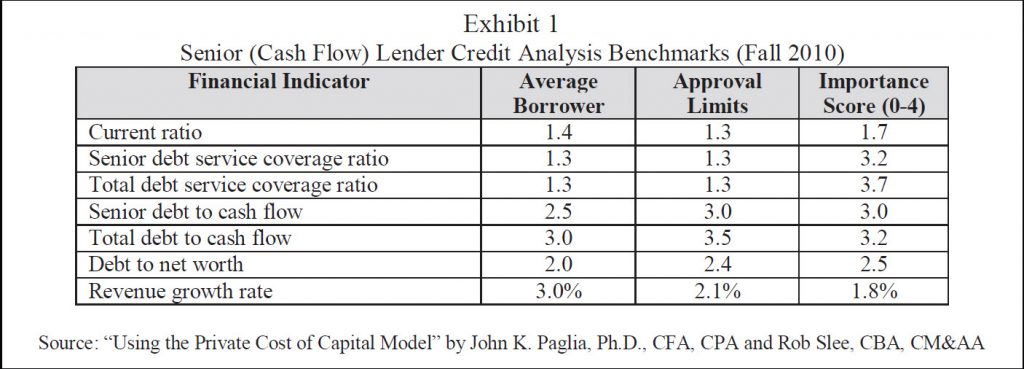

For example, the Fall 2010 survey found the following ‚Äúcredit box‚ÄĚ (which contains important benchmarks that must be met in order to qualify for capital) for senior cash flow lenders:

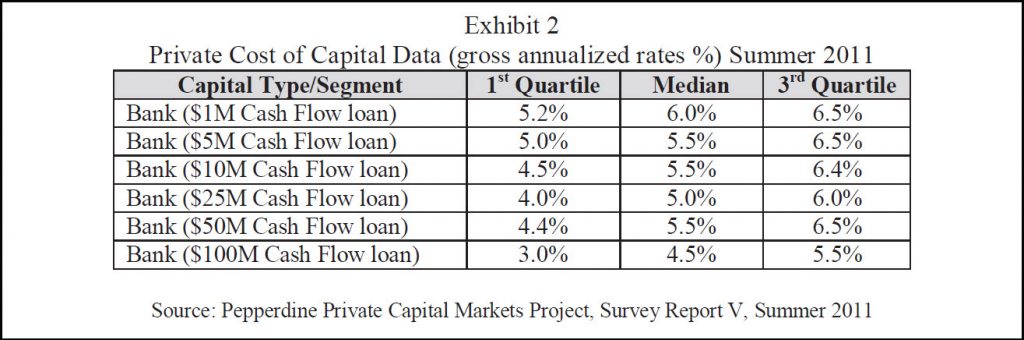

For borrowers who fit in this credit box, the  senior cash flow lenders expect to earn the  returns shown in Exhibit 2 below, which  have been updated through the summer of  2011, showing first quartile (top 25%),  median (50%) and third quartile (bottom  25%).

The Private Capital Markets survey shows similar data points for credit boxes and expected returns of all of the other capital providers.

This information can be very useful to business appraisers, so Slee and Paglia have created the Private Cost of Capital (PCOC) model for our use. ¬†If a company that we are appraising fits into the credit box for a private equity group, we know the market cost of capital required by that type of capital provider. Similarly, if we are estimating weighted average cost of capital for a company, the senior lender returns shown in Exhibit 1 can be helpful. ¬†This ‚Äúreal world‚ÄĚ measurable cost of capital in the private markets seems much more meaningful than a cost of capital interpolated from public company markets. ¬†As Rob says, ‚ÄúIf¬† you want to know how deep a pond is, why¬† would you measure the Pacific Ocean of¬† public companies and make adjustments?‚Ä̬†

For a free copy of the full Pepperdine Private Capital Markets Summer 2011 report as well as subsequent semiannual reports, see http://bschool.pepperdine.edu/

Sageworks

Sageworks develops financial analysis products for bankers, certified public accountants, company owners, and financial officers. ¬†It possesses the largest database of aggregated financial data by industry on privately-held companies. ¬†One of their products is called ‚ÄúSnapshot,‚ÄĚ and it was developed for CPAs to add value to their services for tax and audit clients. ¬†The CPA enters a client‚Äôs tax returns or financial statements (and some additional information) into the Snapshot program, and Snapshot generates a plain-English financial analysis, complete with bar charts, showing how the client compares to its industry peers by:¬†

- Current ratio

- Quick ratio

- Accounts receivable days

- Accounts payable days

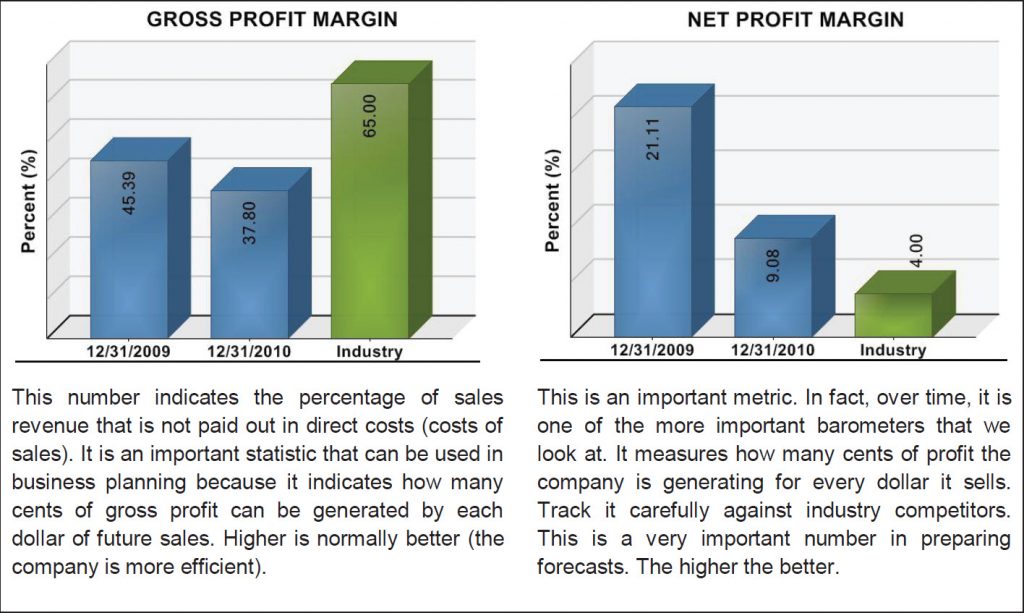

- Gross profit margin

- Net profit margin

- Rent to sales

- General and administrative payroll to sales

- Interest coverage ratio

- Debt-to-equity ratio

- Debt leverage ratio

- Return on equity

- Return on assets

- Fixed asset turnover

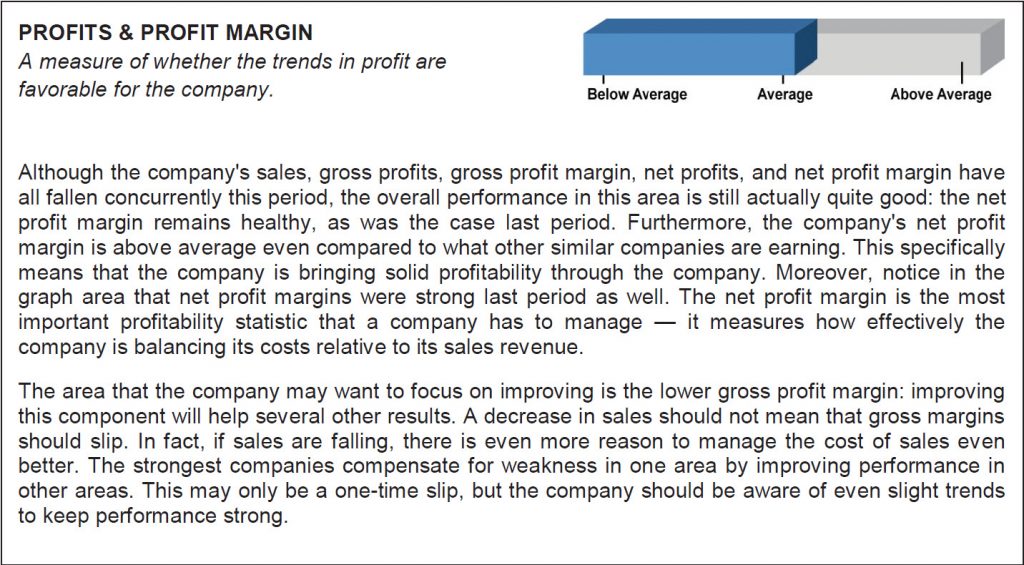

These reports can be downloaded as stand-alone PDFs, or as Word documents that can be cut and pasted into other reports.  As more and more tax returns and financial statements are loaded into the system (at the rate of approximately 1,000 per day), the Sageworks database is getting huge.  Here is an excerpt from a Snapshot report on a sample company that operates as a mortgage broker:

Exhibit 3: Snapshot Excerpt

Exhibit 3: Snapshot Excerpt (Continued)

Sageworks has realized that their data and analysis tools can be valuable for business appraisers, and they are exploring opportunities to tailor their products more specifically to our needs.  Obviously, this Snapshot product gives us a good, plain language financial analysis section for our appraisal reports. Sageworks also has a Counselor product that generates financial projections and discounted cash flow model valuations.

These Sageworks products are offered on a fee basis. See www.sageworksinc.com

Secondary Markets for Private Company Interests

Here are some new exchanges that match sellers and buyers of interests in private companies, and they have collected some interesting data:

- SecondMarket (www.secondmarket.com) is the largest marketplace for alternative investments, including private company stock. According to its website, SecondMarket has completed over 550 private stock transactions, amounting to nearly $700 million in total sales. Users can sign up  to follow trades in private company  stocks, and the most-watched companies  during the first quarter of 2011 were  Facebook, Twitter, Groupon, LinkedIn,  Zynga, Foursquare, Skype, Pandora,  Yelp, and Gilt Groupe, in that order. (Of course, Groupon and LinkedIn have since gone public.) SecondMarket has recently launched an on-line magazine named Alchemy, which has a department on valuation, plus other articles of interest to appraisers.

¬† - Sharespost (www.sharespost.com) is another exchange for private company stock which claims to ‚Äúconnect more than 70,000 institutional and angel investors with more than $1 billion in private company securities.‚ÄĚ The companies tracked in their index are Bloom Energy, EHarmony, Facebook, Linden Lab, Serious Metals, Twitter, and Zynga. Sharespost‚Äôs website includes an extensive research section with analyst opinions on these companies.

¬† - Triago (www.triago.com) is a specialist agent exclusively dedicated to the private equity community. It was founded in Europe in 1992, and it offers a secondary market for private equity interests. One of the publications on¬† their website is entitled, ‚ÄúSecondary¬† White Paper: Accessing the Private¬† Equity Secondary Market 2010,‚ÄĚ which¬† shows pricing as a percentage of net¬† asset value for the different types of¬† private equity (large buyout, venture capital, mid-market buyout, early¬† secondaries, and others).

Depending on the appraisal engagement at hand, this data can be useful.  For instance, if the appraisal subject is a company similar to those traded on SecondMarket and SharesPost, direct comparisons may be made.  The Triago white paper data can be used for estimating marketability discounts.  As these exchanges collect more and more data, their offerings should become even more useful for appraisers.

Enhanced Services

Strong data not only confirms our valuation assumptions, it can also help appraisers offer actionable consulting advice to our clients.  For instance, the Pepperdine private capital markets data shows business owners their true cost of capital so they can know whether they are earning an acceptable return on that capital. Similarly, the Sageworks data shows business owners how they compare to their peers.

Of course, appraisers should always tread carefully when using data sources that have not yet been blessed by the compliance authorities.  Check these out and see if they are useful to you in some of your valuation assignments.

The data in this article is reprinted with permission from Rob Slee and from Sageworks.  Neither this author nor the Institute of Business Appraisers has any financial ties with any of the data sources referenced in this article.

Sherry C. Smith, CBA, BVAL, MBA is the President of Zephyr Financial Corp., a business valuation firm in Myrtle Beach, SC. Her firm is also an independent member of the American Business Appraisers national network.

This article first appeared in the Third Quarter, 2011 edition of Business Appraisal Practice (BAP).  For more information visit www.go-iba.org.