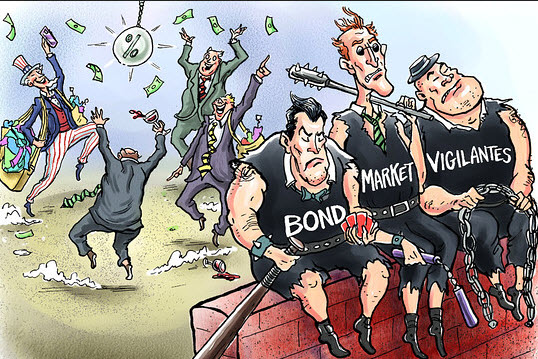

The Bond Vigilantes Have Been Taken Out Back And Shot —Seeking Alpha

Fed Buying Is Having Profound Implications. Bond Vigilantes Have Been Selling Heavily and May Continue. That Means We Still We Won’t See Much of an Impact on Interest Rates.

Paul Santos at Seeking Alpha claims you don’t need to worry about the bond vigilantes anymore. I, personally, have always been a big fan, and think they will return. But hey: This is Mr. Santos’ opinion piece, not mine, so I’ll let him cut to the chase. Santos doesn’t claim they’re in hiding. He simply claims they’re gone.

Santos asks: “So when did the mass killings take place in the U.S.? When were these bond vigilantes taken out back and shot? Why do I say they were shot? The answers lie in the numbers.” Here’s more:

It’s not unusual to hear talk about the bond vigilantes, those mythical creatures which, through their buying and selling in the bond markets, enforce fiscal prudence. It’s also not unusual to hear the contrary arguments, namely by Paul Krugman, that the bond vigilantes are not to be feared in the liquidity trap we find ourselves in right now.

What I will show here, however, is a third option. It’s not that the bond vigilantes are not ready to act. The problem is, most of the bond vigilantes are already dead and the few that are left are held in detainment.

The supposed bond vigilantes have an effect through interest rates, and they influence interest rates by their selling and not buying. What happens is that when a given state leaves fiscal prudence and plunges itself into a fiscal orgy where no debt ever seems too much to bear, then those actors supposed to take on that debt instead take their business elsewhere. By selling whatever debt they hold and not buying new issues, these investors make the debt prices be lower and yields higher. The higher yields, when applied to a large stock of debt, quickly render the whole thing unsustainable. This dynamic was seen in Europe’s periphery, but, amazingly, not in the U.S.- even with the U.S. routinely running $1+ trillion fiscal deficits.

So what happened? And more important, will it continue forever? Santos’ theory:

The numbers

When we hear talk about the bond vigilantes and their actions, this usually refers to their actions in the long side of the maturity curve. Say in 5 year maturities or longer, up to 30 years. This is so because the short side of the curve is usually mostly dictated by Fed policy and arbitrage of this policy (borrowing at short-term rates enforced by the Fed to buy short-term maturities).

The thing is, Fed’s policy as of late has extended mostly to the long side of the maturity curve as well. This is where the killing of the bond vigilantes took place. Ever since the Fed launched QE1, it has been buying up long-term issues. Quite often the Fed buys MBS, but as these mature, the Fed reinvests into long-term bonds. The Fed has also been buying long-term bonds outright, as well as selling short-term bonds and buying more long-term bonds (during “Operation Twist”).

The end result of all these Fed actions, was the near-extinguishment of the bond vigilantes. Why do I say so? Because of two effects:

One, the Fed bought a substantial part of the 5-30 year existing stock of bond debt. Taking into account a projection for the existence of close to $3.6 trillion in these debt maturities at YE 2012, the Fed presently owns 36.4% of the outstanding stock ($1.31 trillion). Not only that, but the Fed then owns a further $1 trillion in long-maturity MBS, whose sellers probably substantially substituted for by buying U.S. bonds;

And two, the Fed is buying $40 billion in MBS and $45 billion in long-term treasuries monthly. This makes for $1.02 billion per year in Fed buying which easily exceeds the expected issuance in the 5-30 year maturity zone over the next few years (see table below for a rough calculation of 5-30 year issuance)

Read his full argument here. See his chart backing up data. Consider his analysis (predictably, it has something to do with the Fed drowning the market with money.)

And let the rest of us know what you think.

Watch Out if the Bond Vigilantes Come Back!

see also:

- Yield Hike Has Institutional Investors Anticipating a New Dawn —Pensions & Investments [02/04/2013]

- Uncooperative Bond Market Is Fed’s Worst Fear —New York Sun [02/04/2013]

- Paul Krugman Changed His Mind About Bond Vigilantes — One Of The Most Important Issues In The Economy Today —Business Insider [12/24/2012]

- Is the Bond Market Starting to Fight the Fed? —CNN Money [12/18/2012]

- Bond Market May Be Obama’s #1 Political Threat —New York Sun [02/26/2012]

- Prowling Bond Vigilantes Should Stress Out Big U.S. Banks —Wall Street Journal [11/28/2011]

- Will The Bond Vigilantes Visit America? —The Atlantic [11/28/2011]

- Europe Needs the Bond Vigilantes —Wall Street Journal [4/9/2011]

- Where Are the Bond Vigilantes? —Wall Street Journal [9/30/2011]

- Wrong and Wrong —Krugman in Wonderland [08/04/2011]

- Know Thy Bond Vigilante —Wall Street Journal [5/25/2011]

- Remember the Bond Vigilantes? They’re Back! —Barron’s [11/17/2010]

- Are Bloodthirsty ‘Bond Vigilantes’ on the Way? —The Atlantic [2/25/2010]

- The Bond Vigilantes Are Back —Wall Street Journal [5/29/2009]

This article probably makes the strongest case in Krugman’s defense for the position he held in recent years:

- MIA: Bond Vigilantes —Ritzholtz [5/10/2012]

Questions? Comments? Critiques?

Interested in contributing on an alternate topic?

Write editor Dave Dix.