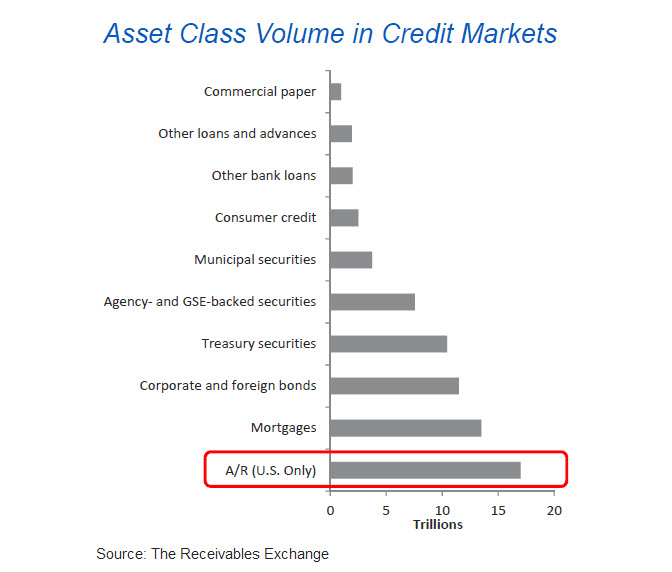

Guess Which Credit Market is Bigger than Treasuries, Mortgages, and Corporate Bonds? —Business Insider

It’s Not Municipal Securities, Consumer Credit, or Commercial Paper: It’s the $17 Trillion Trade Receivables Market

Walter Kurtz at Business Insider writes that it turns out that the biggest financing market is not in corporate bonds or even mortgages. It’s trade receivables. According to the Receivables Exchange, $11 trillion of trade receivables is originated by small and mid-size businesses and another $6 trillion by large corporations, for a whopping total market size of $17 trillion.

As US money market funds are squeezed by new regulation, the types of commercial paper (CP) these funds can buy is limited to the top-rated corporations and banks. The smaller or lower rated firms have limited or no access to the CP markets. And banks sometimes have a limited appetite to finance corporate receivables on their balance sheets.

Quite Possibly The Biggest Credit Market You’ve Never Heard Of

By opening up receivables financing to end-users directly, the exchange effectively creates an alternative to CP or money markets for investors to park their cash. The receivables term tends to be quite short (typically under 2 months), but there is clearly credit risk associated with these transactions. Many of these firms are smaller and/or sub-investment-grade or unrated – so credit work needs to be done prior to investing.

One way to mitigate the risk is by pooling these receivables (effectively disintermediating money market funds) to create diversification which is what the exchange allows investors to do (see presentation below).

Read more Walter Kurtz at his Sober Look blog here.