The Fed Gets a Bubble Cop —New York Times

Watch Out, Wall Street! The Federal Reserve, a Primary Banking Regulator, is Trying Harder to Spot Speculative Excesses

Peter Eavis at The New York Times Dealbook reports: In a speech on Thursday, governor Jeremy C. Stein, who joined the Fed last year, focused on parts of the financial markets that show signs of overheating. He went into considerable detail, citing metrics that appear designed to spot bubbles. Specifically, Mr. Stein raised a red flag about junk bonds and mortgage-backed securities, and how investors are financing their purchases of such assets.

Wall Street has often been a facilitator of bubbles, and in their formation, financiers find plenty of seemingly sound justifications for strongly rising asset prices. Of course, the Fed is against rampant speculation weakening the banks and distorting the wider economy. But central bank officials say they don’t want to take tough action like raising interest rates to stamp out speculation in specific asset classes, because such a response may unnecessarily cool large sectors of the real economy that aren’t frothy.

Testifying before the Financial Crisis Inquiry Commission in 2010, Fed Chairman Ben Bernanke explained why, in the middle of the last decade, the central bank didn’t raise interest rates to stifle what appeared to be an overheating housing market. “Monetary policy is a blunt tool,” he said. “Raising the general level of interest rates to manage a single asset price would undoubtedly have had large side effects on other assets and sectors of the economy.”

But that stance carries a big risk: What if the Fed fails to spot when localized speculation has tipped into something much more dangerous? Mr. Stein’s speech shows that the Fed wants to get better at making that distinction.

Of course, many sorts of actions carry risk. Instead of making things better, they can, however well intentioned, make things worse. And that’s certainly how some critics view the Fed’s current stance of keeping rates low for an extended period of time (i.e., the QE3 strategy). The simple argument is that QE3 hurts people on pensions stuck with low bond yields, meddles in the market by removing risk (arguably, in the same way that federal policy once encouraged subprime lending), and more. Expect to see more articles and opinions on that angle in coming weeks.

As Eavis notes:

But for all the forensics, Mr. Stein didn’t say whether there was frothiness in United States Treasuries. With its enormous bond buying programs, designed to whip up economic growth, the Fed has driven up the price of government bonds.

Critics say this is creating a bubble in Treasuries, which has to be serious because they make up such a large asset class. Skeptics add that all the big central banks are buying large amounts of government debt, encouraging unstable levels of government borrowing. This could harm the wider economy in the same was as excessive mortgage debt did, they say.

One critic is Kevin Duffy, a portfolio manager at Bearing Asset Management, a hedge fund. In response to Mr. Stein’s speech, he asks, “Where is the mention of debt buildups at the government level that the central banks are enabling?”

Federal Reserve Governor Jeremy Stein

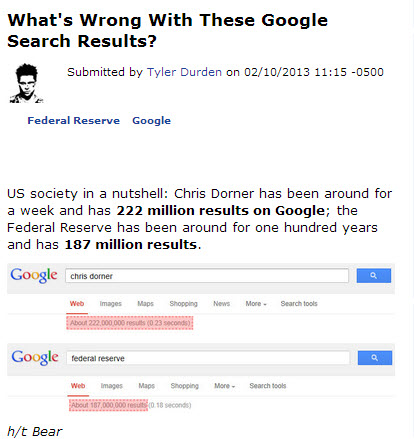

Meanwhile, here’s a fun fact from Tyler Durden at Zero Hedge:

Maybe the Problem is Cosmo and US Weekly Don’t Offer Sufficient Fed Coverage