Mercer Report Details “Levels of Value”—Mercer Capital

Why Estate Planners Need to Understand This Critical Valuation Element of a Buy Sell Agreement

All businesses with more than one shareholder should have a current, well-written buy-sell agreement, asserts Mercer Capital. And for clients with valuation processes as part of their agreements, it is critical to understand “levels of value”: Strategic Control Value, Financial Control Value, Marketable Minority Value, and Nonmarkettable Minority Value. Here’s more:

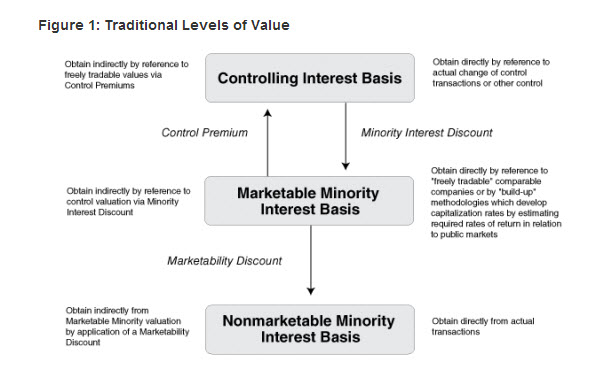

The levels of value chart has been an established model since the early 1990s. The original chart showed three levels [per figure] In current thinking, there are four conceptual levels of value . . .

- Strategic control value refers to the value of an enterprise as a whole, incorporating strategic features that may motivate particular buyers and capturing the expected business and financial synergies that may result from its acquisition. Higher expected cash flows relative to financial buyers may enable strategic (or synergistic) purchasers to pay premiums, often called strategic control premiums, relative to financial control values. Strategic buyers may also increase the price they will pay based on the use of their own, presumably lower, cost of capital.

- Financial control value refers to the value of an enterprise, excluding any synergies that may accrue to a strategic buyer. This level of value is viewed from the perspective of a financial buyer, who may expect to benefit from improving the enterprise’s cash flow but not through any synergies that may be available to a strategic buyer.

Many business appraisers believe that the marketable minority and the financial control levels of value are, if not synonymous, essentially the same. One way of describing the financial control value is that buyers are willing to pay for the expected cash flows of enterprises and will pay no more than the marketable minority value. However, they may believe they can run a company better and if the competitive bidding situation requires that they share a portion of potential improvements with the seller, these two levels can diverge somewhat.

- FCP is the financial control premium. The financial control premium is shown, conceptually, to be nil, or at least very small in Figure 2.

- MID is the minority interest discount. The minority interest discount is also shown to be conceptually nil or very small. This is consistent with the discount being the conceptual inverse of the financial control premium, which is itself nil or very small.

Read the whole piece at the Mercer site.

The Traditional Model of the “Levels of Value,” Shown Above, Asserts Mercer, Should Be Expanded to Include Four Concepts. Find Out How at the Mercer Site.