Business Valuations in the Middle Market Have Not Declined

There Has Been a Drop in Deal Volume, per GF Data. But Here’s Why it Hasn’t Affected Prevalent Values.

Bob Wegbreit offers data confirming what private equity buyers and financial professionals have sensed since the beginning of the year—that the explosion in deal activity heading into the end of 2012 carried no momentum into 2013. Still: while deal volume has declined, valuations haven’t. Find out more.

GF Data®’s first quarter analysis confirms what private equity buyers and financial professionals have sensed since the beginning of the year—that the explosion in deal activity heading into the end of 2012 carried no momentum into 2013.

The valuation, leverage and deal term information GF Data publishes on completed, lower middle-market acquisitions from over 200 contributing private equity firms provides strong support for the proposition that once the market has fully absorbed these short-term convulsions in supply and demand, it will be clear that business valuations have not declined and, for more desirable properties, in fact remain quite strong.

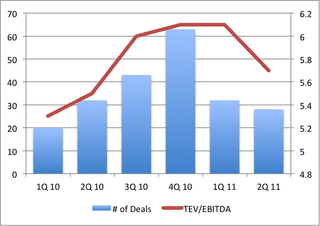

Overall multiples for Q1 were 5.9 times trailing twelve months (TTM) adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA), essentially in line with 6.0 times in Q4 2012, but well off the 6.8 times mark in Q3.

Non-institutional sellers drove a disproportionate share of the volume in Q4, and we saw the drop in aggregate pricing. This trend continued in Q1. It seems clear that pricing is, at worst, holding steady once these calendar-driven sellers come out of the mix.

GF Data enters 2013 with a subscriber group of investment banks, lawyers, valuation professionals, lenders and other professionals who value their access to the most reliable information on completed private transactions in the $10-250 million range.

Bob Wegbreit is principal at GF Data, which provides private equity firms and other users reliable external information to accurately value and assess M&A transactions of companies with enterprise values in the $10-$250 million range. Reach Mr. Wegbreit at (610) 260-6263 or at bw@gfdataresources.com.