Terminating Terminal Value

Capturing value within the horizon using accounting-based valuation

This article examines two alternative approaches to the Discounted Cash Flow (DCF)Â Method when seeking to capture the majority of total value within the horizon. A closer look is given to the Residual Enterprise Income (REI) Method as well as the Abnormal Enterprise Income Growth Method (AGR) in comparison to the DCF Method, and a determination is made as to which method is most effective.

The Discounted Cash Flow (DCF) Method is a standard Income Approach when valuing a healthcare business as a going concern.  However, one of the common pitfalls in the DCF Method is the disproportionate amount of the enterprise value indication produced beyond the projection horizon (i.e. terminal or continuing value), often times well over 50 percent of total value.  Valuation is meant to capture the future payoffs based on what we know now, so why not root as much of  the value as possible based on the accounting numbers of the business that we know today?  Why rely so much on terminal value that is derived from beyond the projection horizon, when a majority of the total value can be captured within the horizon?  Which leads to the next question: how can the majority of the total value be captured within the horizon?  The answer lies in two alternative approaches to the DCF Method: the Residual Enterprise Income (REI) Method and the Abnormal Enterprise Income Growth (AGR) Method.  Both of these methods are rooted in accounting-based valuation methodology.  A comparison of the three methods will show how more of the value can be captured within the projection horizon based on real, present accounting numbers.

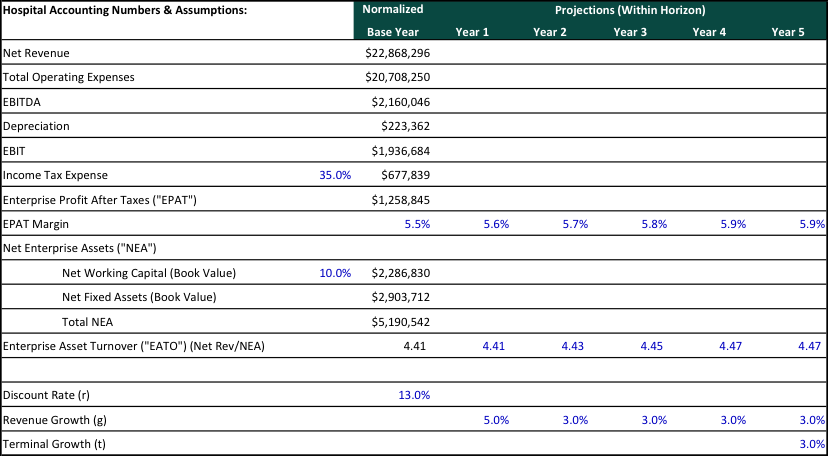

The projections and assumptions below for a hypothetical hospital (Hospital) are applied to the normalized base year accounting numbers to illustrate that each of the three methods can be used when forecasting specific operations. Â This example assumes some enterprise profits after taxes (EPAT) margin improvement each year, improvement in enterprise asset turnover (EATO) (i.e. efficiency in deployment of assets), and variable revenue growth. Â The fact that each of the subject methods can be used to arrive at the same enterprise value under precise variable forecasting conditions is what sets them apart from a simple cap rate method applied to Year 1 free cash flow. Â Note, all three models hold true regardless of the EPAT margin, EATO, and revenue projections, assuming steady state is achieved in the last year of the projection period.

Steady state is defined as:

- Volume and revenue are growing at a constant rate;

- The EPAT from each dollar of operating revenue is constant; and

- The NEA required for each dollar of operating revenue is constant.Â

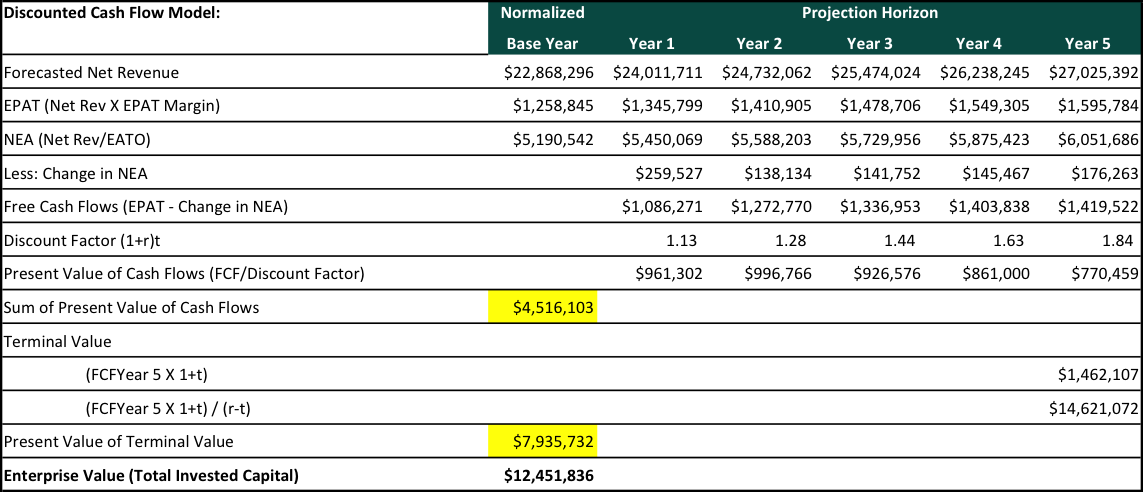

Discounted Cash Flow Method

Under the DCF Method, free cash flows are calculated by subtracting the year-over-year change in NEA from EPAT.  NEA is comprised of current and long-term enterprise assets less current and long-term enterprise liabilities, or enterprise net working capital plus long-term net enterprise assets. The change in NEA from one year to the next captures the incremental net working capital, depreciation of existing fixed assets, and additional fixed asset capital expenditures, which are projected based on the EATO ratio (Net Revenue / NEA).  Note: Additional specific capital expenditure assumptions can be made in each year of the projection horizon, which would impact the respective EATO ratios. Enterprise profit after taxes is an adjusted figure that represents only enterprise revenues and operating expenses (included depreciation and amortization, excluding interest expense and non-operating income and expenses).

Applying these assumptions and accounting numbers to the DCF method, the present value of the future cash flows are $4,516,103, and the present value of the terminal value is $7,935,732 for a total enterprise value indication of $12,451,836.  In the DCF Method, the present value of the future cash flows (Years  1–5) is the portion of the total enterprise value (36.3 percent) that lies within the horizon, while the present value of the terminal value is the portion of the total enterprise value (63.7 percent) that is beyond the horizon.

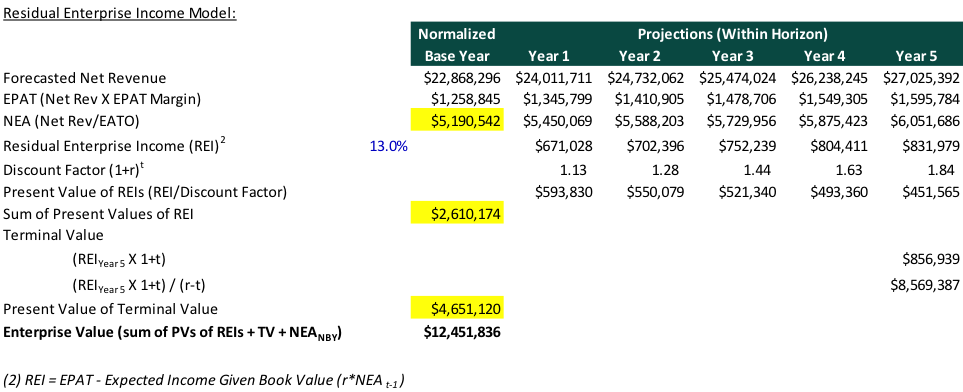

Residual Enterprise Income Method

The enterprise value formula according to the Residual Enterprise Income Method is comprised of the sum of the value of the NEA in the normalized base year, which serves as the anchor of value, the sum of the present values of the REI in Years 1–5 of the projection horizon, and the terminal value of the Year 5 REI.  Note, REI is defined as EPAT less expected income given book value (r*NEAt-1), or, in other words, residual earnings in excess of the expected return on net enterprise assets. The REI Method anchors the enterprise value in the value of the normalized base year NEA and then adds the present values of the REI, resulting in a higher percentage of the enterprise value being captured within the projection horizon.Â

Under the REI Method, for example, Hospital, NEA in the normalized base year is $5,190,542, and the sum of the present values of REI is $2,610,174, which together comprise the value before and within the projection horizon, or 62.6 percent of the total enterprise value. The present value of the terminal REI is $4,651,120, which represents 37.4 percent of the total enterprise value.

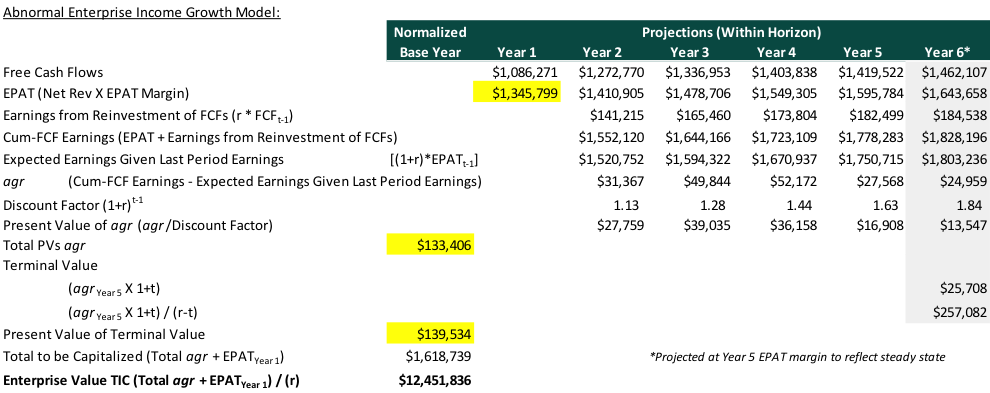

Abnormal Enterprise Income Growth Method

Abnormal enterprise income (“agr”) is a comparison of cum-free-cash-flow earnings next year [EPATt+1 + (r*FCFt)] to the expected amount of earnings given the current period’s earnings [(1+r) * EPATt], which assumes that normally earnings would be expected to grow at the required rate of return, or the discount rate. The cum-free-cash-flow earnings is essentially an adjustment to expected enterprise earnings by adding the earnings that may be reasonably expected to accrue outside of the enterprise as a result of the re-investment of the FCFt-1 from the prior period.

The enterprise value formula according to the abnormal enterprise income growth method consists of the capitalization of Year 1 projected EPAT, the present values of abnormal enterprise income (“agr”), and the present value of the agr terminal value. Given the Hospital example, the total amount to be capitalized consists of 83.1% EPATYear 1 (the anchor in agr valuation method), 8.2% present values within the projection horizon of agr, and 8.6% present value of the terminal value agr.Â

Reconciliation of Values

The table above illustrates the values under the DCF, REI, and AGR methods allocated among three periods: today (no forecast necessary), within horizon projections (5 year period for our example), and beyond the horizon projection (terminal value). In terms of value indication produced beyond the projection horizon, the DCF method produces the most and the AGR method produces the least. The REI method is unique in the fact that it anchors significant value in today’s current NEANBY value, 41.7% of the total value in the Hospital example. NEANBY is a present value that we know today. The projection horizon provides opportunity to discretely and explicitly forecast operations until steady state, but the farther we move out on the horizon, the less confidence we have in the forecast and value at the horizon. We can increase our confidence in the valuation with the REI and AGR methods as they provide alternatives to capture and rely on valuations based on numbers we know today.

Adam Portacci is a manager at the Dallas office of VMG Health.  His valuation experience includes physician practices, acute care and specialty hospitals, ambulatory surgery centers, diagnostic imaging centers, radiation oncology centers, and other ancillary services. Mr. Portacci earned a master of business administration with a concentration in accounting and a bachelor of business administration in finance from Southern Methodist University Cox School of Business. He can be reached at adamp@vmghealth.com or ( 214) 369-4888.