Valuation of Promissory Notes

It’s not as simple as it seems

This article explores the fact that the valuation of a simple debt instrument, such as a promissory note, can be anything but simple. It is observed that the sum of unpaid debt, as well as accrued interest, may well overstate the value of the promissory note. Also covered is whether assets tied to notes need to be valued separately.

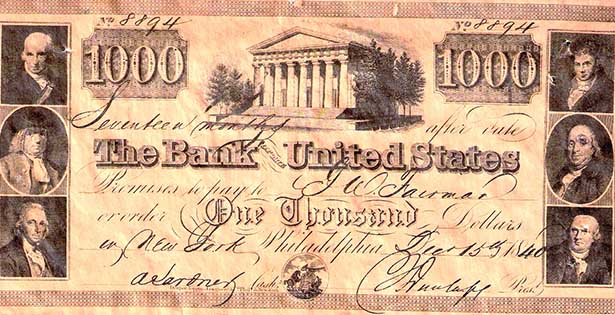

The valuation of a debt instrument should incorporate not just the amount and timing of future payments, but also a detailed analysis of the instrument’s terms and conditions, the underlying collateral, and factors that impact the instrument’s risk profile, Promissory notes are not something that appraisers are frequently asked to value, but the calculation seems simple enough: the unpaid principal plus accrued interest. Right?

Not usually.

The value of a simple debt instrument is equal to the present value of the future cash flow, discounted back to present value using a discount rate that incorporates the debt instrument’s underlying risk profile. (Typically, only if the stated coupon or interest rate on the debt is equal to the discount rate will the value of the debt equal the face value of the debt or the unpaid principal amount of the debt.)

When a note is secured by an asset, the asset may need to be separately valued, as the value of the underlying collateral also impacts the value of the note. Collateral helps mitigate the default risk and would typically result in a secured note being priced at a lower yield than an uncollateralized debt security. The value of the collateral may also represent the floor value of a note if (a) the note is in default, or (b) the repayment terms require interest-only payments over the term of the note and a large balloon due at maturity.

It may come as a surprise that, under certain circumstances, the sum of the unpaid principal plus accrued interest may actually overstate the value of the promissory note. In these cases, a thorough, well-authenticated valuation analysis should be prepared to support a fair market value that is less than the carrying value of the note. We believe that such an analysis should, at a minimum, incorporate an analysis of the underlying collateral and an independent determination of an appropriate discount rate. The discount rate should be supported by an analysis of empirical market data that compares the subject debt instrument to market metrics.

The discount rate is an important variable in the determination of the value of a promissory note. Because there is a significant amount of publicly traded debt, there is adequate information that can be utilized to estimate the appropriate discount rate for the subject debt instrument. This approach relies on the evaluation of the borrower’s risk profile as compared to credit rating criteria and the attributes and pricing of guideline public debt as a proxy for the appropriate required rate of return, or discount rate.

An adjustment is then made to this market proxy to account for the specific attributes of the subject debt, including:

- Debt subordination,

- Note-specific repayment risk,

- Borrower financial condition,

- Lack of marketability,

- Lack of security/collateral, or

- Lack of protective covenants

This type of analysis is often referred to as a “synthetic” debt rating, which utilizes specific borrower financial metrics and compares them to financial ratios utilized by rating agencies to price or rate public debt. This estimated discount rate is then applied to the projected future cash flows of the note to determine its fair market value.

Challenges

As with any valuation engagement, appraisers face predictable challenges in determining the value of a promissory note. In particular, private company promissory notes are often issued (a) without adequate borrower review, (b) contain terms that do not exist in the public marketplace (such as below-market interest rates, insufficient security, or repayment terms favorable to the borrower and not the lender), and (c) lack a formal secondary market from which to draw proxy transactions.

These hurdles can be overcome if the appraiser performs the proper analysis and research, and has relevant experience. With increased IRS scrutiny and power to impose appraisal penalties in tax-related valuation engagements, it has become increasingly important for financial and legal professionals to seek out qualified appraisers and for those appraisers to conduct their analysis in accordance with IRS guidelines and appraisal industry standards.

Gift and Estate Tax Implications

Treasury regulations utilize a fair market value standard that is defined in §§ 20.2031-4 and 25.2512-4: “[T]he fair market value of notes, secured or unsecured, is presumed to be the amount of unpaid principal, plus interest accrued to the date of death [or the date of the gift], unless the executor [donor] establishes that the value is lower or that the notes are worthless.”

The IRS provides no safe harbor guidelines as to appropriate market interest rates, discounts, or methodology, except for Revenue Ruling 67-276, which specifically precludes a market survey as conclusive evidence of fair market value. (Market surveys can be useful as reasonableness tests to support a more fundamental analysis, but they should not be used in isolation.)

Many firms offering to appraise promissory notes are secondary market brokers who regularly buy private notes for their own portfolios or have a pool of private buyers to match with sellers. Often, their analysis does not conform to fair market value and consists only of a market survey, which, as noted above, the IRS has rejected as conclusive evidence of fair market value.

Conclusion

Debt valuations are required for a number of purposes. Irrespective of the purpose, the valuation process should incorporate an analysis of the terms and conditions of the instrument, the amount and timing of future payments, an analysis of the underlying collateral and a detailed analysis of the factors that impact the instrument’s risk profile.

Lynton Kotzin, CPA, ABV, CFA, ASA, CBA, CFF, CIRA, is managing partner with Kotzin Valuation Partners in Phoenix, AZ. His extensive background includes business valuation and litigation services such as estate and gift taxes, stock option valuation, marital dissolutions, mergers and acquisitions, purchase price allocation, collateral determination for asset securitization and bankruptcy proceedings, among others. His diverse experience includes the industry sectors of manufacturing, retail, wholesale, service, professional practice and real estate. Mr. Kotzin has been a guest speaker for the State Bar of Arizona and provided expert testimony is deposition and trial. He can be reached at lkotzin@kotzinvaluation.com.