Considerations in the Valuation of Alternative Asset Management Firms and Carried Interest

Issues in Hedge Fund Valuations

The proliferation of hedge funds presents an opportunity for valuation analysts. In this article, the author provides an overview of the hedge fund industry, compares the manner in which hedge funds operate vis-Ă -vis private equity and venture capital, and outlines the opportunities and challenges for valuation analysts interested in serving this market sector.

Introduction

The alternative asset management industry, which includes hedge funds, private equity (PE) and venture capital (VC) firms, commodity pool operators, etc., has been a prominent feature in, and an important element of the economies of, Connecticut, New York, and other major metropolitan areas of the United States. While the industry has had its ups and downs in the last decade, reflecting, in many respects, the shocks impacting a broader financial services sector of the United States’ economy, it has, by and large, generated significant wealth for professionals involved in this industry sector.

Alternative asset management firms1 and their principals have a great need for sophisticated legal, tax planning, and valuation advice. This need presents unique business opportunities for valuation professionals, financial planners, and attorneys practicing tax, corporate, matrimonial, and other branches of law. These opportunities, however, almost always come with significant challenges related to the complexities of the firms’ operating structures and unique valuation issues that the hedge funds pose. To successfully tackle these challenges and effectively advise their clients, legal counsel, financial planners and, most importantly, valuation professionals must have the necessary expertise in the hedge fund arena.

What Is A Hedge Fund?

Hedge funds and similar alternative asset management firms are investment companies that sponsor and manage pooled investment vehicles (i.e. investment funds). They generate income by charging management and performance-based fees (referred to as “performance or incentive fees”, “carried interest” or simply “carry”) to the funds under their management.2 Unlike traditional asset management companies, hedge funds are less regulated; they can invest in a wide range of asset classes (for example, commodities, derivatives, etc.) and pursue a variety of investment strategies (for example, equity long-short, event-driven, macro, etc.). However, these firms are prohibited from marketing their investment funds to the general public, and can only accept capital from qualified investors.3

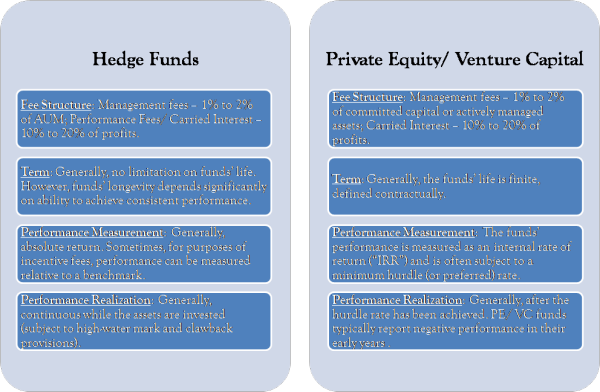

Although hedge funds and PE/VC fund complexes have similar organizational structures, these types of firms differ significantly from the operational perspective. The chart below compares some of the key operating metrics of hedge funds and PE/VC firms.

Two of the referenced metrics are worth highlighting, because they have a profound impact on the value of a carried interest in the fund and the value of the alternative asset management firm.

First, an assumption of perpetual operation—a typical premise in valuation of non-distressed traditional businesses—is often not valid, or at least needs to be evaluated in every case, in the context of valuing hedge funds. These firms ability to raise new funds—and thus to perpetuate their existence—depends largely on their investment performance. In addition, PE and VC funds have finite lives, usually no more than 10-12 years. Furthermore, the firms’ longevity depends on the size of the assets under management (AUM), the type and diversity of the investor base, the age and intentions of the firms’ principals, the principals’ ability and willingness to transition their duties to others within the firm, among other factors

Second, a pattern of cash flows of hedge funds and PE/VC firms in the early stages of the funds lives can be dramatically different. During this time, PE/VC funds make capital calls and use cash, as they deploy the capital committed by the investors and make investments. As a result, although the PE/VC firms collect management fees, at this stage of the funds’ lifecycles (which can last several years) they report negative investment returns and, thus, do not earn performance fees. The hedge fund firms, on the other hand, do not usually go through such a prolonged capital drawdown phase and, therefore, can earn performance fees immediately following a launch of a new fund, provided, of course, that the new fund generates investment profits.

Overview of Approaches to Valuation of Hedge Funds

When referring to the “valuation of a hedge fund,” we refer to the valuation of an ownership interest in a hedge fund management company and/or carried interest, and not the valuation of the hedge fund’s investments or the valuation of the limited partnership interests in the hedge fund.

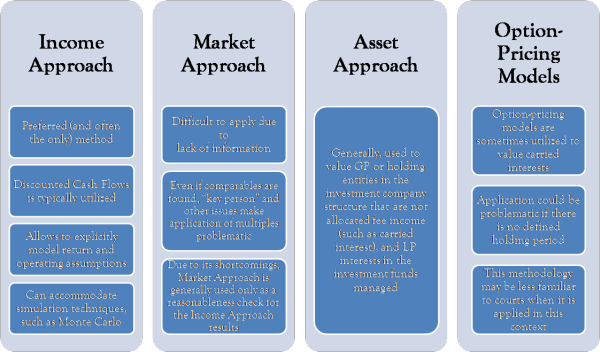

Traditionally, in the valuation of a business, the three generally accepted methodologies are an Income Approach, a Market Approach, and an Asset Approach. The Income Approach focuses on the income-producing capability of the business; the Market Approach focuses on the prices of similar assets; and the Asset Approach focuses on the net asset value of the enterprise. While each of these approaches is initially considered in the valuation analysis, the selection of a particular approach or approaches is dependent on the nature of the business and the characteristics of a subject interest, among other factors.

As mentioned earlier, the focus of our discussion is on the valuation of ownership interests in hedge fund management companies and carried interests. Thus, we will review the application of the valuation methodologies for these types of interests separately.

Interests in Hedge Fund Management Companies

The Market Approach is poorly suited for valuing interests in hedge fund management companies for several reasons. First, publicly traded hedge fund and PE firms typically manage multiple funds that invest across many asset classes and investment strategies. A typical privately held hedge fund management firm, on the other hand, lacks such diversification and a large asset base. Second, unlike their publicly traded counterparts, private hedge fund management companies typically have “key person” issues—their success depends significantly on their “star” founders/portfolio managers. Finally, sufficient information about the acquired hedge fund firms rarely, if ever, exists to determine meaningful valuation multiples.

The Asset Approach is generally not appropriate for valuing profitable, operating companies.4 Thus, the Income Approach—specifically, the Discounted Cash Flow (DCF) method—is the preferred and, often, only viable valuation technique. However, valuation professionals need to be certain that the cash flow projections used in the DCF method will be credible, appropriate and, in litigation, admissible.

The application of the DCF method typically involves the following steps:

- Forecasting the funds’ AUM, which considers the future expected investment returns, investors’ contributions and redemptions from the fund, fund closures or new fund launches as well as other factors that are known or knowable as of the date of valuation;

- Forecasting management fees (and carried interest distributions) based on the forecast of AUM;

- Forecasting the company’s operating expenses, based on the analysis of historical costs, expected expense levels, and giving proper consideration to reasonable compensation issues;

- A development of the appropriate discount rate;

- A determination of value of the business as the present value of the expected cash flows;

- A determination of value of the subject ownership interest in the hedge fund management company given consideration to the appropriate discounts (such as a discount for lack of control and/or a discount for lack of marketability).

Carried Interests

The Market and Asset approaches are generally not appropriate for valuing carried interests for the same reasons that we outlined in the discussion of valuation of ownership interests in management companies. The carried interests can be valued using the DCF Method. In addition, option-pricing methods, such as the Black-Scholes Model, can also be utilized for this purpose.

The following chart provides a summary of the valuation methodologies that we have discussed:

Typical Issues in Hedge Fund Valuations

A valuation of a hedge fund is a complex exercise. It requires not only highly technical valuation acumen and finance skills, but also a thorough knowledge of industry practices. This is why many otherwise qualified business appraisers do not have the necessary skills to perform hedge fund valuations. Unfortunately, all too often legal counsel fails to recognize the specialized nature of the skills and knowledge that an expert must possess to perform a credible hedge fund valuation. In this case, a valuation specialist’s lack of expertise turns into a headache for attorneys in a dispute or litigation. While two qualified experts may—and often do—reach different opinions of value for the same interest, a direct result of failure to engage a qualified expert is often wild and irreconcilable differences between the experts. Such differences almost always become significant hurdles to a successful resolution of the cases in litigation.

So, what are the issues that often cause problems? Here are a few examples from our experience.

Failure to Link Valuation Analysis and Conclusions to the AUM and Investment Returns

The expected levels of AUM and future investment returns are the fundamental value drivers for hedge funds. Unfortunately, all too often, experts mistakenly forget or ignore this fact. As a result, their analysis is often internally inconsistent. Consider the following example. An expert develops a forecast of the hedge fund’s cash flows based on the entity’s historical earnings (both management and performance fees). The historical earnings, however, exhibited significant growth due to the fact that the fund was able to attract several large investors. An outlook as of the date of valuation, however, is such that capital raising success is highly unlikely in the future and, in fact, the fund is no longer actively marketed to potential investors. The expert ignores this fact and assumes that the earnings will continue to grow at the historical rate. Setting an investment return aside, the expert’s earnings forecast implies that the fund will continue adding new investors; thus, the forecast contradicts the outlook and expectations as of the date of valuation.

Unreasonable Investment Return Assumption

The investment return assumption is, arguably, one of the most frequent sources of disagreements between the experts in the context of the hedge fund valuations. Experts often assume that when a hedge fund earns high investment returns historically, it will continue earning exceptional returns in the future. Such simplistic view of the world by some experts is even more puzzling, considering the fact that (a) a phrase “past performance is no guarantee of future results—an investment may lose value” accompanies a prospectus of virtually every mutual fund available for purchase by the general public in this country; and (b) the last fund that promised consistent high investment performance turned out to be Bernie Madoff’s Ponzi Scheme. So why do some experts simply assume unsustainable investment returns based solely on the history of high performance? In our experience, this occurs when the expert does not possess the necessary industry knowledge and valuation skills to formulate and support a reasonable and defensible investment return assumption.

Reliance on a Capitalization of Earnings Method of the Income Approach to Value a Hedge Fund

Valuation experts that rely on a capitalization of earnings method to value hedge funds, often justify their selection of method by arguing that its simplicity makes it more easily understandable for the judges. A capitalization of earnings method5 is a valid valuation technique that has merits in certain limited circumstances. An example of such circumstance is when a business generates stable, predictable earnings year after year. The critical assumptions that form the basis of this method are that (a) the business has a perpetual life; and (b) the earnings grow at a long-term, sustainable rate, which is generally considered to approximate a rate of inflation.

A seeming simplicity of the assumptions, however, is what makes this method completely inappropriate for valuing hedge funds. The reason for this is twofold. First, the assumption of perpetual life of the business implicit in the method is often invalid, especially for private equity funds. Second, while an inflation rate may be a reasonable expectation of long-term growth in earnings of a traditional business, it is not an appropriate gauge of the long-term earnings of a hedge fund firm. After all, why would anyone invest in a hedge fund that promises to earn a rate of return that is close to a rate of inflation?

Failure to Distinguish Between Economic and Ownership Interests

A common error made by experts (and attorneys) inexperienced with hedge funds is that they automatically assume that a tax form K-1 issued to an employee is evidence and proof of the employee’s equity ownership in the hedge fund entity that issued the form. While, in general, the tax form K-1 is consistent with the equity ownership in a partnership or a limited liability company, this is not always the case for hedge funds. Often, a hedge fund employee who is granted carried interest receives a treatment as a partner of the hedge fund’s GP entity for tax purposes. As such, the employee receives a K-1 form from the GP entity even though the employee does not actually have equity ownership interest in the entity. Thus, the employee has an economic interest in the hedge fund’s GP entity in the form of a capital account balance and a right to a portion of the carried interest.

Summary

The above are just a few examples of valuation challenges that hedge funds and other alternative asset management firms pose. These challenges require that valuation analysts and experts have specialized knowledge of industry practices and the application of valuation theory. Consequences for ignoring these prerequisites could be significant. In litigation, these consequences are often an unnecessary animosity and, potentially, a failure to accomplish a legal objective.

Vladimir Korobov, CPA, ASA, ABV, is managing director of Meyers, Harrison & Pia, LLC, located in New Haven, Connecticut. Mr. Korobov can be reached at (203) 789-1040 and by e-mail at vkorobov@mhpcpa.com.

1 For the sake of ease of reference, we’ll be referring to these firms collectively as “hedge funds,” even though there are many subtle and important differences among the firms in the industry.

2 Typically, management fees range between 1.0 percent and 2.0 percent of assets under management, while the performance fees are 10.0 percent to 20.0 percent of the net investment profits of the funds.

3 Qualified investors are typically institutions (e.g. sovereign wealth funds, pension funds, endowments, family offices, etc.) and high net-worth individuals.

4 While the asset approach is generally not appropriate for valuing carried interests and the interests in management companies, this approach may be used for valuing holding entities in the hedge fund complexes and limited partnership interests in the investment funds.

5 According to the International Glossary of Business Valuation Terms, adopted by the majority of the professional organizations representing business valuation appraisers in the United States, a Capitalization of Earnings Method is a method within the Income Approach whereby economic benefits for a representative single period are converted to value through division by a capitalization rate.