Financial Experts in Chapter 11 Bankruptcies

Unique Situations from Common Assignments

The assessment of interest rates and appraising the value of a business are assignments not limited to bankruptcy work alone. Most financial experts are familiar with the methods required to perform these tasks. Even in the application of these basic analyses, Chapter 11 bankruptcy may present unusual assignments. This article discusses two unique situations that may arise from these common assignments. The first is the application of the cram down interest rate model when a creditor makes the 1111(b) election. The second considers the concept that the âhighest bidder may not be the best bidderâ when selling a bankrupt business.

When a business enters Chapter 11 bankruptcy, its intention is to move out of bankruptcy protection and go forward as a successful entity. For this to happen, the businessâs reorganization plan must be confirmed by the court. The bankruptcy code allows a reorganization plan to be confirmed if:

- The holder of a claim accepts the plan;

- The plan provides that the holder of such claim retains the lien securing such claim and the value, as of the effective date of the plan, to be distributed under the plan on account of such claim is not less than the allowed amount of such claims or the property is surrendered to the holder of the claim. (11 U.S.C. 1129(b)(2)(A))

In the majority of Chapter 11 cases, the debtor and creditors agree to the reorganization plan. However, in some cases, one or more of the classes of creditors object to the reorganization plan. Because of this rejection, the debtor may seek a cram down hearing asking the court to force the creditors to accept the plan.

When these disagreements arise, legal counsel for the debtor and/or the creditors may seek financial experts to provide information relative to their positions. While engagements of economic experts may cover a broad spectrum of analyses, these engagements generally fall into two areas: determining the appropriate interest rate for the repayment of a secured claim, and the liquidation and /or fair market value of certain assets of the bankrupt estate or the business as a whole.

The assessment of interest rates and appraisal of the value of a business are assignments not limited to bankruptcy work alone. Most financial experts are familiar with the methods required to perform these tasks. Even in the application of these basic analyses, Chapter 11 bankruptcy may present unusual assignments. This article discusses two unique situations that may arise from these common assignments. The first is the application of the cram down interest rate model when a creditor makes an 1111(b) election. The second considers the concept that the âhighest bidder may not be the best bidderâ when selling a bankrupt business.

Unique Situation One â An 1111(b) Election

In some Chapter 11 cases, the secured claim is in excess of the value of the collateral. This happens when the value of the collateral has declined at a rate greater than the principal repayment of the debt. Under the Bankruptcy Code, a creditor has a secured claim to the extent of the value of its collateral and has an unsecured claim to the extent the amount of the claim exceeds the value of that collateral.

As an example, if the creditor has a claim of $900,000 and the securing collateral is valued at $1,000,000, the claim is fully secured. This is because the value of the collateral is greater than the amount of the claim. If the creditorâs claim is $1,200,000 and the securing collateral is valued at $1,000,000, the creditor is under secured. This is because the claim is greater than the collateralâs value. In this situation, the creditor has a secured claim of $1,000,000 and an unsecured claim of $200,000.

In a cram down matter, the bankruptcy judge will determine the amount of the debt that is allowed as a secured claim. This amount will be based on the current value of the collateral securing the debt and filings made to the court discussing the unpaid balance, accrued interest, and associated expenses. On review, should the claim be greater than the value of the collateral, the remaining amount of the claim would then be listed as an unsecured claim.

Section 1111(b) of the Bankruptcy Code allows a secured creditor to elect to have the total allowed amount of its claim treated as secured. A creditor makes such an election to insure that the total allowed claim (i.e. all of the debt) will be paid before the lien on the collateral is released.

There is some controversy regarding interest payments and more specifically the application of the interest payments with this election.

âSome authorities indicate that the electing creditor must receive principal payments equaling the total amount of the creditorâs allowed claim and that the interest payments cannot serve double duty, and thereby also satisfy the principal portion of that claim. ⌠Other authorities, however, indicate that interest, in addition to payments on principal, can be used to satisfy the principal portion of the claim. The view that interest payments can be applied to principal is the majority rule, reflecting the commonly accepted approach to the 1111(b)(2) election.â (Brighton, 424)

This majority position allows the interest paid on this claim to serve double duty. This means that the interest paid by the debtor will be considered an interest payment on the portion of the claim equal to the value of the collateral and as a principal payment reducing the amount of the claim that exceeds the value of the collateral. When the excess amount of the claim (i.e. the amount in excess of the collateral value) has been reduced to zero, the remaining interest payments return to single duty, providing interest for the time value of money on the collateralized portion of the claim.

The interest rate is usually based on the value of the collateral and its relationship to the secured claim (the loan to value ratio). In the previous example, the claim was for $1,200,000 and the value of the collateral was $1,000,000. If the court allowed a secured claim of $1,000,000, the interest rate would be based on a 100 percent loan to value ratio.

In Re: Brice Road Development, LLC, 392 B.R. 274, 285 (6th Cir. B.A.P. 2008), the Sixth Circuit Courtâs Bankruptcy Appellate Panel discussed the process once an 1111(b) election has been made.

âIn order for a reorganization plan to now comply with the cram down requirements of 1129(b)(2)(A)(i)(1), the electing creditor must retain a lien equal to the total amount of its claim. The lien is not stripped down by 506(d). Subsection (II) of 1129(b)(2)(A)(i) guarantees an electing creditor a stream of payments equal to its total claim. However, the stream of payments need only have the present value âof at least the value of such holderâs interest in the estateâs interest in such property,â i.e. the value of the collateral. ⌠In other words, the present value of the electing creditorâs stream of payments need only equal the present value of the collateral, which is the same amount that must be received by the non-electing creditor, but the sum of the payments must be in an amount equal [to] at least the creditorâs total claim.â

The Brice Road appellant court went on to say, âthe interest payments made to provide present value of the collateral must be applied to reduce [the creditorâs] total allowed claim.â (392 B.R. at 288-89)

The following is an example of applying the double duty concept for interest payments when an 1111(b) election has been made. These figures are taken from a bankruptcy matter in which I was retained as an expert to provide the cram down interest rate and 1111(b) assessment for the secured creditor.

The creditor had a claim of $3,441,276.21. The collateral for this claim was valued at $2,100,000. Therefore, the creditor had a secured claim of $2,100,000 and an unsecured claim of $1,341,276.21. Because of this under secured status, the creditor made an 1111(b) election.

As a part of the reorganization plan, the debtor offered to make 59 equal monthly payments of principal and interest based on a 20 year amortization with a balloon payment on the 60th month. The cram down interest rate proposed by the creditor and accepted by the court was 7.67percent.

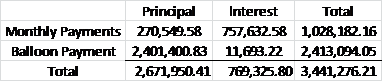

Based on the proposed repayment plan and an interest rate of 7.67 percent, the principal and interest paid over the life of this repayment schedule would be as follows:

With the interest serving double duty, the amount of payments made to reduce the claim prior to the final balloon principal payment would be $1,039,875.38.

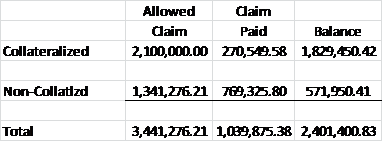

These payments would be applied in this way.

When the 60th payment is due, the $270,549.58 received in monthly principal payment will have been reduced by the collateralized portion of the claim to $1,829,450.42. The interest payments totaling $769,325.80 will have been applied as principal payments against the non-collateralized portion of the claim reducing that portion to $571,950.41. That would leave a balloon principal payment of $2,401,400.83 to be paid on the 60th month.

If the repayment plan had called for monthly payments over the entire 20 year amortization period, the non-collateralized portion of the claim would have been fully paid by the monthly interest payments prior to the end of the amortization period. With the non-collateralized portion of the claim reduced to zero, the remaining interest payments perform only single duty as interest payments on the collateralized portion of the claim.

The 1111(b) election requires a complex analysis of the collateral and repayment plan before assessing the appropriate interest rate. An expert will need to work closely with the retaining attorney to insure all involved have a clear understanding of how the interest rate has been determined and how the interest payments are to be applied. Having a general knowledge of how the 1111(b) election works enhances the services provided by a financial expert in these types of Chapter 11 bankruptcies.

Unique Situation Two – Economic Impact on Sale of Assets or Business

Under the Bankruptcy Code, the trustee or debtor-in-possession may sell property of the bankrupt estate after notice is given of the request to sell and a hearing held to approve such a transaction. (11 U.S.C. 363(b)) At the hearing, a âgood business reasonâ must be shown for the sale. Key factors considered by the court before granting such a request are whether the purchase price is reasonable and whether the asset is decreasing or increasing in value. Because the trustee or debtor-in-possession has a duty to maximize the value from the sale of an asset, the highest bid will almost always be the winning bid if the competing bids are comparable. However, when the competing bids differ in price, terms, and contingencies, the bankruptcy courts may take into consideration more than just the âhighest and best bid.â

âAccordingly, courts take into account the ability of a bidder to close the transaction quickly, whether regulatory approval may be problematic, the preservation of jobs and in the case of a healthcare facility, the public interest, needs of the community and the healthcare facilityâs mission.â (Berman, Peterman)

In these matters, a financial expert may be asked to not only determine the fair market value of the business to be sold but also to opine on the economic impact of opposing bids. When comparing bids, the expert will be asked to consider not only the amount being offered but the other factors which will impact the asset or business, the claimants, and possibly the local community after the sale. This analysis may include examining the merger and acquisition history of the bidders, examining the contingencies included in the bids, the ability of the bidder to finance and close the transaction, and the impact of the sale on the employees of the business being acquired, its vendors and the community at large (e.g. lay-offs, closings, termination of vendor contracts).

In the case In re Bakalis, the court accepted a lower dollar amount stating that the highest bid is not always the âhighest and best bid.â The court agreed with the trustee that the highest bid contained too many contingencies and created a greater risk of market disruption and litigation than the accepted bid.

In re Untied Healthcare System, Inc., the district court overturned a bankruptcy courtâs acceptance of the highest bid in the sale of a bankrupt hospital. The district court noted, â[m]ere financial analysis of the two bids, with the clarity of hindsight, failed to examine the totality of the circumstances.â In re United Healthcare System, Inc. pn the bankruptcy courtâs acceptance of a higher bid, it had not considered the public health emergency brought about by the bankruptcy of this childrenâs hospital. The bankruptcy court also rejected the hospitalâs Board of Directorâs recommendation to accept the lesser dollar bid. The Board felt the second highest bidder would provide better service to the community served by the hospital. On appeal, the district court agreed with the Board.

In reviewing bids for bankrupt businesses, some courts have held that job preservation is an important part of the bidding process. In re Schutt Sports, Inc., the debtor was one of the largest employers in two small towns in Illinois and Easton, PA. The second highest bidder guaranteed one year employment for almost all of the bankrupt estateâs 400 employees and to continue using local trade vendors for six months. This lessened the economic impact to these three communities. The court said, â[T]he retention of existing employees is a factor that has come into play more frequently in recent years and that âsaving jobs is a very tangible thing ⌠ââ

Several years ago, I was retained by the debtor in the bankruptcy of a medical equipment manufacturing firm. The bankrupt firm had one location and employed approximately 50 people. Â Creditors requested the sale of the business to provide funds for the payment of their claims. An out-of=town competitor was the top bidder. Research showed the potential buyer had recently acquired three other companies in the United States and closed their production facilities. The jobs relating to the acquired companies had moved to Puerto Rico and/or the Philippines. The judge took this information into consideration when denying the sale of the bankrupt firm to that prospective buyer.

In a Chapter 11 bankruptcy matter, a financial expert may be asked to value a business to insure that the bidders are paying fair market value. As a part of this process, the expert may also be asked to assess the economic impact of the winning bid on the claimants, the employees of the business being sold, and perhaps, even the local community of that business. This expands the role of the expert beyond those normally attached to non-bankrupt business valuation assignments. Understanding how to assess the economic impact of such a sale increases the value and worth of the services provided by a financial expert in a Chapter 11 business bankruptcy matter.

Conclusion

Financial experts can provide a number of services to the parties involved in a Chapter 11 bankruptcy matter. One of the most common is the analysis of the interest rate to be applied to secured claims as they are repaid. This type of engagement may include determining the interest rate, discussing the repayment terms, and assessing the ability of the debtor to complete the repayment plan. Other engagements may call for the valuation of a business or portion of a business (e.g. a particular asset) that has been transferred or may be sold.

None of these functions are exclusive to the bankruptcy courts. Experts may already provide these or similar services to clients in litigious or non-litigious matters. However, in applying these commonly used techniques, an expert must become aware of how they are applied in bankruptcy court along with the rules governing the presentation of such analyses.

In addition, the bankruptcy assignment may provide situations that are unique to the bankruptcy process. The circumstances may dictate a creditor making the 1111(b) election. A financial expert may be asked to assess appropriate interest rate and application of principal and interest payments under 1111(b). In other cases, the sale of the bankrupt business or a key asset may be required. In these matters, an expert may be asked to value the business or asset being sold and assess the economic impact of the various bids because the highest bid may not be the best bid.

For an expert to be successful, a good working relationship with the hiring attorney is necessary. Adding a working knowledge of these unique bankruptcy related situations to augment general knowledge of cram down interest rate assessment and business valuation will assist an expert in developing that good working relationship and the ability to provide a value added service to any bankruptcy engagement.

Allyn Needham, Ph.D., CEA, is a principal at Shipp, Needham & Durham, LLC (Fort Worth, Texas). For the past 17 years, he has worked in the area of litigation support. Prior to that, he worked more than 20 years in the area of banking and risk management. Dr. Needham has also been an Adjunct Professor of Economics at Texas Christian University and Weatherford College. As an expert, he has testified on various matters relating to commercial damages, personal damages, business bankruptcy, and business valuation. Dr. Needham can be reached at aneedham@shippneedham.com and 817-348-0213.

References

Berman, Howard, Peterman, Nancy, âHighest Dollar Bid Not Always Best Bid,â New York Law Journal, 6/27/2011, www.nylj.com

Brighton, Jo Ann, âThe Resurrection of Section 1111(B) in a Depressed Economy,â Norton Annual Survey of Bankruptcy Law, 2010, pages 407-432

11 U.S.C. 363 (b)

11 U.S.C. 1111 (b) (2)

11 U.S.C. 1129 (b) 2 (A)

Legal Cases

In re: Bakalis, 220 B.R. 525, (Bankr. E.D. N.Y. 1998)

In re: Brice Roads Developments, LLC, 392 B.R. 274; 2008 Bankr. LEXIS 2135; 50 Bankr. Ct. Dec. 103, (6th Circuit Court of Appeals, 8/14/2008)

In re: Schutt Sports, Inc., No. 10-12795 KJH (Bankr. D. Del. 9/6/2010)

In re: United Healthcare System, Inc., 1997 WL 176574, No. 97-1159, (D. N.J. 3/26/1997)