Caution: Be Sure to Consider Tax Structure

When Using Guideline Transaction Data

Income taxes play a major role in the pricing and structure of business transactions because income tax consequences associated with the sale or purchase of a business can substantially reduce the seller’s net proceeds and/or lower the net cost of a purchased ownership interest to the buyer. Because of this issue, it seems appropriate to assume that actual transactions are structured by buyers and sellers to address such income tax consequences. This article addresses the impact of federal income taxes on transaction prices and terms, and considers the impact of taxation on the selling prices reported in guideline transaction databases.

Income taxes play a major role in the pricing and structure of business transactions because income tax consequences associated with the sale or purchase of a business can substantially reduce the seller’s net proceeds and/or lower the net cost of a purchased ownership interest to the buyer. Because of this issue, it seems appropriate to assume that actual transactions are structured by buyers and sellers to address such income tax consequences. This article addresses the impact of federal income taxes on transaction prices and terms, and considers the impact of taxation on the selling prices reported in guideline transaction databases.[1]

Income taxes play a major role in the pricing and structure of business transactions because income tax consequences associated with the sale or purchase of a business can substantially reduce the seller’s net proceeds and/or lower the net cost of a purchased ownership interest to the buyer. Because of this issue, it seems appropriate to assume that actual transactions are structured by buyers and sellers to address such income tax consequences. This article addresses the impact of federal income taxes on transaction prices and terms, and considers the impact of taxation on the selling prices reported in guideline transaction databases.[1]

Transaction databases provide various pricing multiples of potential guideline company transactions; some include information about the selling terms, whether or not a non-compete was involved, and if there are any contingencies that have been reported for the specific transaction.

However, there is the risk the transaction price or deal terms reported in the transaction databases reflect material adjustments by both the buyers and sellers regarding income tax consequences. These income tax consequences are primarily focused around: (1) the entity form of the seller, and (2) the negotiations between buyers and sellers that influence whether the buyer buys assets, or the seller sells the net equity (or stock) of the subject business. Using the transactions in the databases to formulate an indicated value for another business of similar characteristics and failing to consider the tax consequences of the entity form of the seller or the decision to buy/sell assets or equity embedded in the transaction multiples may result in an improper valuation conclusion by an analyst.Â

The entity form of the business being sold dictates whether the seller (equity owner in the business being sold) incurs one or two levels of taxation on the sale of business assets. The decision to sell assets versus equity dictates whether the gain on sale of certain assets involved in the transaction is recognized as ordinary income or capital gains.

When assets are purchased, the buyer will realize a “step-up” in basis to fair market value of the acquired assets. When equity (stock) is purchased in a C corporation or an S corporation, absent an IRC 338 election, the buyer does not receive a step-up in basis.

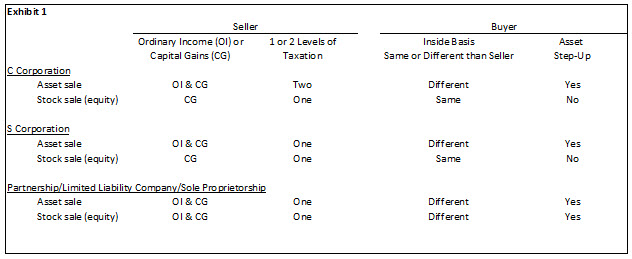

Exhibit 1 summarizes the income tax consequences to buyers and sellers of: (1) equity ownership interests in C corporations, S corporations, partnerships, limited liability companies, and sole proprietorships; and (2) assets of C corporations, S corporations, partnerships, limited liability companies, and sole proprietorships.

Examples

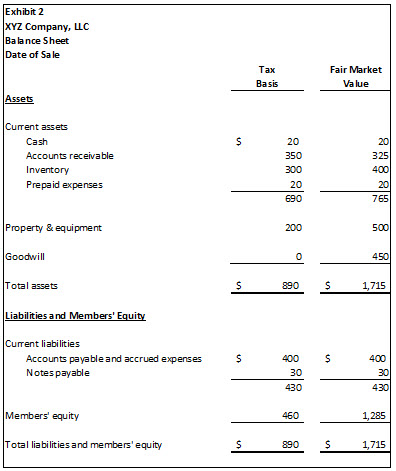

We’ll apply these concepts to two examples. XYZ Company, LLC (taxed as a partnership), with an inside equity tax basis of $460 is sold for $1,285 (See Exhibit 2). Based on the fair market value of the assets and liabilities, the seller realizes an ordinary loss of $25 on the sale of accounts receivable, an ordinary gain of $100 on the sale of inventory, and a capital gain of $750 on the sale of property and equipment ($300)[2], and goodwill ($450). The buyer realizes a step-up in basis equal to the fair market value of the assets and liabilities acquired.

Let’s consider the following questions:

- If the transaction involved a sale of equity by a C corporation stockholder, would the negotiated selling price be greater or less than $1,285?[3]

Based on Exhibit 1, we know the C corporation equity buyer would not be able to realize an inside basis increase of $825. Accordingly, the buyer of a C or S corporation equity interest would realize a substantially reduced tax benefit. This would likely result in a lower offer by the buyer.

The seller would receive capital gains treatment for one hundred percent (100%) of the gain on sale, instead of capital gains treatment on $750 (profit on sale of property, equipment, and goodwill) and ordinary income treatment of $75 (profit [loss] on sale of accounts receivable and inventory). Thus, the after-tax proceeds from sale of this ownership interest would be greater.

This result would provide the seller with more flexibility to lower the selling price and still receive an acceptable after-tax return on sale.

- If the transaction involved a sale of assets by a C corporation stockholder, would the negotiated selling price be greater than or less than $1,285?

If the buyer purchased the assets of a C corporation, they would still be able to realize an inside basis increase of $825. Accordingly, the buyer of the assets of a C corporation equity interest would still realize the same tax benefit that they would realize by purchasing the assets or equity of a partnership.

The seller would be adversely affected. The C corporation would realize an ordinary gain/capital gain on sale of the difference between the tax basis and fair market value of all assets, and would then pay a second level of taxation on the liquidating dividend distribution. Thus, the after-tax proceeds from a sale of assets would be substantially less.

This result would require the seller to have an increased selling price to achieve the same after-tax return on sale.

Conclusion

Transaction databases include sales of assets and equity by C corporations, S corporations, partnerships, limited liability companies and sole proprietorships. The sellers’ after-tax proceeds and the buyers’ after-tax cost in these transactions are substantially impacted by seller’s entity form and whether assets or equity are sold. Selling prices are often modified due to these factors. Accordingly, the valuation analyst must take into consideration the tax savings component of each transaction’s selling price in order to avoid over or under stating the pricing multiples inferred by the transactions. For these reasons, when using guideline transaction databases, it is imperative to sort the transactions; to separately address the stock versus asset sales provided; and to sort the transactions by entity type (C corporation versus S corporation versus LLC/Partnerships) in order to properly identify the distinction in the price multiples based on these tax consequences.

Eric J. Barr is the Partner-in-Charge of Valuation Services at Marks Paneth LLP, in the Financial Advisory Services group. Â Mr. Barr has more than 40 years of public accounting experience, specializing in litigation support, consulting, and traditional accounting and auditing services. Â He has held multiple leadership positions in the New Jersey Society of Certified Public Accountants. Â Mr. Barr is a nationally sought after thought leader, lecturer, and webinar presenter on accounting, forensic, and valuation issues of businesses, including S corporations and Limited Liability Companies. Â

Mr. Barr can be reached at: (973) 630-5031 or e-mail: ebarr@fbwcpas.com

[1]Â This article does not address the impact of state, local, and foreign jurisdiction income taxes on transaction pricing and terms.

[2]Â Assuming no depreciation is recaptured as ordinary income.

[3]Â This discussion also applies to a sale of equity by an S corporation stockholder.