Freeze Entities

Use of Synthetic Credit Ratings to Determine the Appropriate Market Yield for the Preferred Equity Interest

Among the estate tax planning methods that include grants of “carried” or profit interests, grantor retained annuity trusts, outright gifts, etc., entity freeze is a less known, or perhaps, less utilized tool. Yet, in certain circumstances, a freeze entity can be a compelling wealth transfer mechanism. This article presents an overview of a freeze entity structure, its economics, and a valuation framework specific to freeze entities. The article also offers an example of how practitioners can deal with an important element of the freeze entity’s valuation analysis—determination of a synthetic credit rating of the entity and a preferred stock.

Introduction

Among the estate tax planning methods that include grants of “carried” or profit interests, grantor retained annuity trusts, outright gifts, etc., entity freeze is a less known, or perhaps, less utilized tool. Yet, in certain circumstances, a freeze entity can be a compelling wealth transfer mechanism. An example of such circumstance is when the assets held by the entity generate current income, and are expected to appreciate significantly. This article presents an overview of a freeze entity structure, its economics, and a valuation framework specific to freeze entities. The article also offers an example of how practitioners can deal with an important element of the freeze entity’s valuation analysis—a determination of a synthetic credit rating of the entity and a preferred stock.

Background

In a typical estate tax planning scenario, the older members of a family owning a business want to transfer wealth (i.e., the interest in the business) to a younger generation in a tax-efficient manner. The younger generation is expected to gradually take over management of the business, but the transferring senior family members’ desire a continued stream of fixed income. The entity freeze is a form of a corporate recapitalization that can allow the family to accomplish these objectives. As part of the freeze, the business (or an entity holding the family assets) is recapitalized with at least two classes of equity, including a preferred and a common class. The senior generation exchanges its pre-recapitalization interest in the entity for the preferred, controlling interest. The noncontrolling common equity interest is transferred (gifted or sold outright or on terms) to the younger generation. The essence of the “freeze” in this transaction is that the value of the senior generation’s interest is locked in, or “frozen” at, the fair market value of the preferred interest, and all of the upside from the future appreciation of the assets (or the increase in the value of the business) is transferred to the noncontrolling common equity interest transferred and now owned by the younger generation.

The following example illustrates this concept:

As the above example illustrates, the entity freeze allowed the senior generation to secure an annual income of $90,000 in the form of preferred cumulative dividend and to transfer at least $1.8 million of value to the younger generation.[1]

Of course, like with any tax planning, it is important to seek advice from experienced tax counsel, as structuring freeze entities requires consideration of relevant tax regulations, specifically IRC Section 2701. Section 2701 outlines a set of rules for the retained preferred and the transferred common equity interests. For example, the retained preferred interest must have a mandatory preferential right to receive “qualified” payments, which Section 2701 defines as “any dividend payable on a periodic basis under any cumulative preferred stock (or a comparable payment under any partnership interest) to the extent that such dividend (or comparable payment) is determined at a fixed rate.”[2]  Thus, to comply with Section 2701, the preferred interest in the freeze entities is typically structured to pay a fixed, cumulative, annual preferred dividend, and to have a liquidation preference upon dissolution of an entity. On the other hand, the value of the transferred common “junior” equity interest must be at least 10 percent of the sum of: (i) the total value of all of the equity interests in the entity, and (ii) the total amount of debt owed by the entity to family members.[3]

It is (Almost) All About a Market Yield

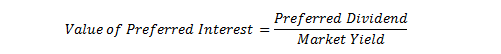

A critical component of the valuation analysis specific to the freeze entities is valuation of the preferred interest, or essentially a determination of the appropriate market yield. This is because the value of the preferred interest is a function of the preferred dividend and a market yield. Mathematically, this relationship can be expressed as follows:

Revenue Ruling 59-60 establishes the general guidelines for valuation of interests in closely held entities. Revenue Ruling 83-120 establishes the general guidelines for valuing preferred stock of closely held entities in certain corporate reorganizations, and its provisions are relevant to the valuation of preferred interests in freeze entities. Among the factors outlined by Revenue Ruling 83-120 that should be considered in valuation of preferred stock are:

- The adequacy of the stated dividend rate and the risk related to dividend payments (including the risk that the entity will not be able to pay the dividends);

- Cumulative vs. noncumulative nature of the preferred dividends;

- The entity’s ability to pay the full liquidation preference at liquidation;

- Voting rights;

- Specific covenants and provisions of the preferred stock that could inhibit the marketability of the stock or the power of the holder to enforce dividend or liquidation rights; and

- Redemption privileges.

In summary, the factors outlined in Revenue Ruling 83-120 assess the primary risk considerations of the preferred stock (and the adequacy of the stated dividend rate) as the level of income protection and the ability to pay a liquidation preference. Revenue Ruling 83-120 essentially establishes the following analytical framework for determining the appropriate market yield for the preferred stock:

- Performance of a credit analysis of the entity by calculating and examining the relevant financial ratios, and a determination of the entity’s synthetic[4] credit rating (see below for an example);

- Determination of the preferred stock credit rating based on the entity’s synthetic credit rating and the entity’s capital structure;

- Analysis of benchmark yields, such as yields on publicly traded preferred stock with comparable features and credit ratings, and/or yields on corporate bond indexes with comparable credit ratings;

- Selection of a base yield based on the analysis of the benchmark yields; and

- Determination of the market yield by adjusting the selected base yield based on the factors presented above.

Synthetic Credit Rating as a Means to Determining the Market Yield

Based on the analytical framework we have just presented, the credit analysis of the entity and a determination of the synthetic credit rating of the entity are important steps in the determination of the market yield. These steps, however, often present challenges to valuation practitioners. Therefore, we offer an example of a simplified credit analysis and a determination of a company’s synthetic credit rating to provide readers with a road map of how to tackle these challenges.

Derive a Synthetic Credit Rating—Glacier, Inc, Hypothetical Case

In our example, we will perform a credit analysis and determine a synthetic credit rating for Glacier, Inc. (“Glacier”), an industrial machinery manufacturing company that has just been recapitalized as a freeze entity. Glacier is a small closely held entity, naturally, it does not maintain a corporate credit rating. Therefore, in our role as valuation analysts, we calculated its financial ratios corresponding with the commonly considered ratios within its industry to determine Glacier’s economic strength. Certain financial ratios were considered and calculated for Glacier based on its most recent fiscal year ended.

There are two ways to analyze the appropriate credit rating of the preferred equity of Glacier. First, one needs to determine the synthetic long-term debt credit rating of Glacier. Since credit rating agencies (e.g., Moody’s and Standard & Poor’s) do not issue ratings for preferred equity, we do this as follows. Initially, review the aggregated key financial ratios of companies in the subject company’s industry and the corresponding credit ratings. Here, we gather data of companies competing in Glacier’s industry and the corresponding credit ratings. For instance, analysts will review financial ratios such as EBIT Interest Coverage, Debt-to-EBITDA, or Return on Capital, and the credit ratings of the companies which are components of the aggregated ratios. Assume for illustrative purposes that after reviewing these ratios, the analyst determines that Glacier’s ratios are most closely matched with the industries aggregated financial ratios of companies that carry a credit rating of “Baa2”—a credit rating by Moody’s, for instance. Therefore, it may be appropriate to select a synthetic credit rating of Baa2 for Glacier.

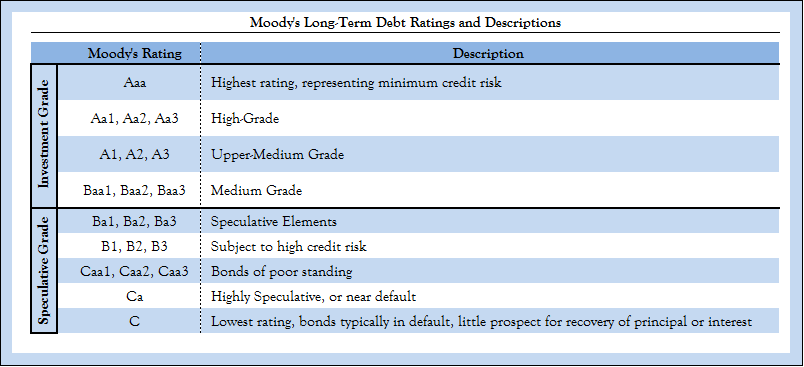

The following table presents Moody’s long-term debt ratings and descriptions, providing credit ratings based on the creditworthiness of the obligor with respect to a certain financial obligation or debt. These ratings consider the debt service obligation of a company, but not the preferred stock obligation. Debt obligations are senior to preferred stock issuances of a company; meaning any debt obligation receives available cash flow before the preferred stock issuances.

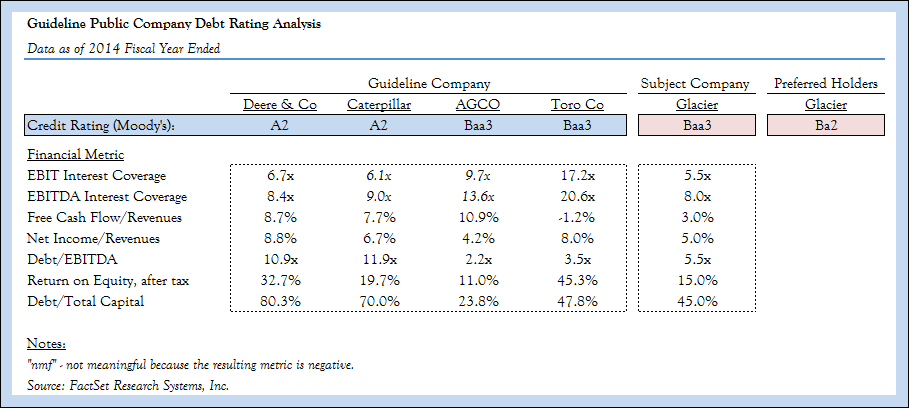

If the aforementioned analysis of aggregated financial metrics by credit rating is not available, then a second approach may be used to determine the synthetic credit rating of a company. This approach requires: (i) the identification and analysis of Glacier’s publicly traded comparable companies (“Comps”), and (ii) a review of the Comps’ respective credit ratings. To illustrate the above, assume the analyst in our example, identified four Comps and that their credit ratings are as illustrated in the table below.

After review of Glacier’s financial ratios as compared to the Comps, the analyst determined a synthetic long-term credit rating of Glacier to be Baa3. Further, after reviewing Glacier’s financial metrics as compared to the Comps, it appears that Glacier seems to be more “risky” than two of the four Comps, and carries a similar level of risk as the other two Comps. For instance, Glacier’s EBIT Interest Coverage of 5.5x is lower than the same ratio for Deere & Co and Caterpillar, indicating Glacier may have a more difficult time covering interest payments on its debt obligations going forward. The ratios in the analysis were identified as those commonly considered by industry analysts in evaluating the economic strength of companies, and therefore, are utilized in this analysis when selecting the synthetic credit rating of Glacier.

As discussed earlier, since debt obligations are senior to preferred stock issuances of a company, after reviewing Glacier’s financial ratios with the ratios and corresponding long-term debt ratings within its industry, the analyst determines that the company’s preferred equity rating is closer to Ba2; this is two notches lower[5] than the determined synthetic credit rating of long-term debt. It is important to note that this adjustment considers the priority of cash flows, being that a company’s cash flows generally first services a company’s debt obligations rather than preferred equity and, as a result, the credit ratings of preferred issuances are generally rated lower than debt.

The credit rating of preferred equity is then used to determine its market yield. Once the market yield is determined, the fair market value of the preferred stock is calculated by capitalizing the stock’s annual preferred dividend by the market yield. If the estate planning transaction includes a gift of a noncontrolling common equity interest in the entity, the value of the gifted common equity interest is determined by subtracting the value of the preferred stock from the total value of the entity’s equity and applying valuation discounts (such as a discount for lack of control and/or a discount for lack of marketability).

Summary

Although freeze entities appear to be utilized less frequently than other wealth transfer techniques in this post-ATRA world, they may be advantageous in certain cases involving income producing assets that are expected to appreciate significantly. Freeze entities, however, are subject to IRC Section 2701, so care must be exercised in structuring them to ensure that they fulfill their purpose. Valuation analysis of the preferred interest in the entity that is retained by the senior generation is a critical component of structuring freeze entities. Therefore, it is important that a valuation analyst engaged in these transactions possess deep understanding of the relevant tax regulations and experience with these entities.

[1] The transfer of value in this example is likely to be more than $1.8 million, because the example does not explicitly consider any discounts to the value of the noncontrolling common equity interest transferred to the younger generation upon the freeze.

[2] Section 2701(c)(3)(A).

[3] Section 2701(a)(4).

[4] We refer to a freeze entity’s credit rating as “synthetic,” because it represents a hypothetical rating developed based on the rating framework used by the credit rating agencies.

[5] Moody’s recommends lowering the credit rating for preferred stock by two notches if the credit rating is Ba2 or higher to account for the consideration of subordination. If the credit rating is Ba3 or lower, Moody’s recommends reducing the credit rating by three or four notches (Source: Updated Summary Guidance for Notching Bonds, Preferred Stocks and Hybrid Securities of Corporate Issuers, Jerome Fons, February 2007).

Vladimir Korobov, CPA, ABV, ASA, is a Partner in the Connecticut office of Meyers, Harrison & Pia Valuation and Litigation Support, LLC. He has performed valuations of business interests for a variety of purposes including, but not limited to, family law matters, estate and gift tax, fairness opinions, transactions, solvency determination, employee stock ownership plan formation and updates, financial reporting, and litigation. The subjects of his valuation assignments have included entire enterprises and partial business interests, preferred and debt securities, portfolios of assets, derivative instruments, and intangible assets.

Mr. Korobov can be reached at: (203) 466-8363 or e-mail to: vkorobov@mhpbv.com.

Peter Rahe, AM, is a Senior Analyst in the Connecticut office of Meyers, Harrison & Pia Valuation and Litigation Support, LLC. He has performed valuations of business interests for a variety of purposes including, but not limited to, family law matters, business damages, mergers and acquisitions, and estate and gift tax matters. The subjects of his valuation assignments have included valuations of entire enterprises, partial business interests, public and Pre-IPO companies, preferred and debt securities, derivative instruments, and intangible assets.

Mr. Rahe can be reached at: (203) 466-8373 or e-mail to: prahe@mhpbv.com.