Creating the Bridge Between Transfer Pricing and the Valuation of Intangibles

Mergers and acquisitions (M&A) have continued growing since 2008’s financial crisis. Through the first three months of 2016, the value of worldwide M&A totaled nearly $750 billion. Cross-border M&A activity totaled $308 billion—accounting for a quarterly record-high 41% share of global M&A value. As in previous years, M&A in industries with hefty intangible assets—such as pharmaceuticals and technology, media and telecom—dominated deal making.[1]

[su_pullquote align=”right”]Resources:

[su_pullquote align=”right”]Resources:

Advanced Mergers and Acquisitions Workshop[/su_pullquote]

Against this backdrop, strong cross-border M&A activity and the importance of acquired intangible assets in these transactions have made tax valuations more visible. The dynamics of cross-border M&A activity have heightened transfer pricing concerns, especially as multinational companies seek to integrate horizontally or vertically and commonly undertake global planning, structuring, and restructuring—including shifting ownership of acquired intangible assets from one (or multiple) legal entity(ies) to another, and from one (or multiple) jurisdiction(s) to another. Simultaneously, and equally important, are financial reporting valuations involving purchase price allocations and subsequent annual goodwill impairment testing. The repercussions of transfer pricing valuation, as well as the tax consequences, play a pivotal role in a company’s financial accounting results during the transactional planning process, including the allocation of the purchase price among the target company’s tangible and intangible assets, the selection of the financing structure for the proposed transaction and the determination of a global tax effective rate.

Given that the interaction between transfer pricing and financial reporting creates discrepancy vis a vis the valuation of intangibles, we should ask whether the financial accounting standards used for the valuation of intangible assets in purchase price allocations could legitimately be used for transfer pricing purposes, or whether the same valuation could be modified to address transfer pricing requirements for intangible assets.

Differences: Devil is in the Details

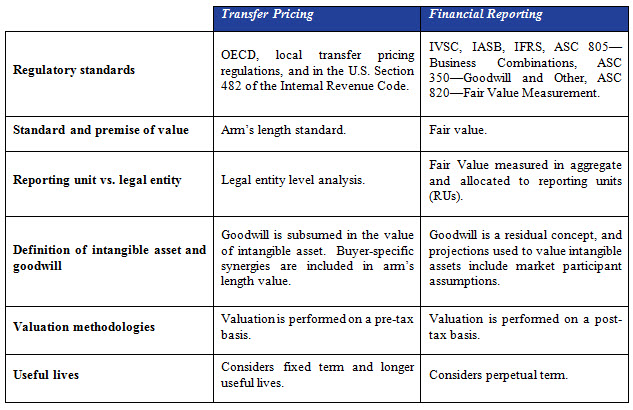

Regulatory Standards: The discrepancy, or divergence, begins when financial reporting and transfer pricing standards are established by differing, unaffiliated regulatory bodies with different objectives.

The global arbiter in transfer pricing is the Organization for Economic Cooperation and Development (OECD), which has issued transfer pricing guidelines adopted by more than 50 countries, including the United States. Tax authorities in many countries have issued local transfer pricing regulations with country-specific requirements that follow the OECD framework. For example, Section 482 of the U.S. Internal Revenue Code and its regulations govern the pricing of intercompany transactions.

In financial reporting, global standards are set by valuation industry bodies such as the International Valuation Standards Council (IVSC) and international accounting standards bodies such as the International Accounting Standards Board (IASB), which issues the International Financial Reporting Standards (IFRS). The relevant reporting standards are IFRS 3—Business Combinations; IAS 36—Impairment of Assets; IAS 38—Intangible Assets; and IFRS 13—Fair Value Measurement. In the U.S., multiple sources generate the body of literature referred to as Generally Accepted Accounting Principles (GAAP), including pronouncements and interpretations of the SEC, CAP, APB, and FASB, as well as AICPA industry guides, bulletins, and interpretations. The Accounting Standards Codification (ASC) relevant for purposes of this article are ASC 805—Business Combinations; ASC 350—Intangibles—Goodwill and Other; ASC 820—Fair Value Measurement; and ASC 360—Impairment or Disposal of Long-Lived Assets.

Regulatory Comments and Opinion: In recently published papers, the IRS and tax authorities in many countries are drawing a distinction between valuations for financial reporting purposes and valuations for transfer pricing purposes. They assert that financial reporting valuations, specifically purchase price allocations, should only be used as a “starting point” for transfer pricing purposes and may not be probative. The recent U.S. tax cases involving Veritas[2] and Xilinx[3] sharply demonstrate the difference between the two perspectives.

In 2013, the OECD issued its discussion draft on intangibles, which largely abrogated the principles established by valuation standards-setting bodies (such as the IVSC) and international accounting standards bodies (such as the IASB). On the other hand, the tax authorities of several important countries took the opposite position and together, asserted material deficiencies based on valuation of intangibles that have been transferred to affiliates in low-tax countries. Such deficiencies often result from a reliance on prior financial reporting valuation studies, or concepts borrowed from non-transfer pricing disciplines.

The OECD is moving in a direction similar to the IRS, in tightening controls and making sure that OECD member countries do not assign a low value to intangible assets for purposes of transferring it from one jurisdiction to a more favorable tax jurisdiction. In recent years, the OECD has expressed concern over practices that artificially segregate taxable income from the activities that generate it. The OECD’s position is that profits should be going to the jurisdiction where the profit is being generated.[4]

To ensure that OECD member countries are not subject to “unfair base erosion practices and profit shifting,” the OECD developed the Base-Erosion and Profit Shifting (BEPS) Action Plan, which was finalized and released in October 2015. Regarding transfer pricing, the OECD’s main objective is to “assure that transfer pricing outcomes are in line with value creation.” In its action plan, the OECD described its goals, such as adopting a broad and clearly delineated definition of intangibles; ensuring that profits associated with the transfer and use of intangibles are appropriately allocated in accordance with (rather than divorced from) value creation; developing transfer pricing rules or special measures for transfers of hard-to-value intangibles; updating the guidance on cost contribution arrangements; and adopting transfer pricing rules or special measures to ensure inappropriate returns will not accrue to an entity solely because it contractually assumed risks or provided capital.[5]

The valuation industry bodies have not yet reacted to the OECD final report, but if the OECD were to completely ignore financial valuation standards, it would, in essence, be endorsing differentiation with transfer pricing and increasing the likelihood of tax controversy. The OECD may also align its position with certain member countries and seek to coordinate financial reporting and transfer pricing valuation concepts.

Standard and Premise of Value: In transfer pricing, the valuation standard is the arm’s length value in accordance with Treas. Reg. 1.482-1(b)(1): “A controlled transaction meets the arm’s length standard if the results of the transaction are consistent with the results that would have been realized if uncontrolled taxpayers have engaged in the same transaction under the same circumstances (arm’s length result)”. The arm’s length standard is the estimated arm’s length price that would be paid by a specific buyer to a specific seller at arm’s length.

In financial reporting, the standard of value is fair value, which according to IFRS 13, is the “price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.” Fair value estimates the price that an asset can be sold for with a market participant buyer.

In a transactional context, the premise of value in financial reporting is the intangible asset is treated as a standalone asset and its highest and best use. In transfer pricing, it is in aggregation with other intangible assets per legal entity and actual use. Transfer pricing transactions involve closely-linked transactions that are difficult to consider separately for tax and financial reporting purposes.

Reporting Unit vs. Legal Entity: In financial reporting, fair value of the enterprise and the intangible assets is measured in aggregate, and then assigned to reporting units (RUs) or cash generating units (CGUs). RUs or CGUs may be based on either product or geographic divisions, or other criteria, and a reporting unit may have several legal entities.

In transfer pricing, analysis is performed at the legal entity level, and that entity may have several reporting units. Because of this difference, care should be taken when developing projections for transfer pricing versus financial reporting purposes.

Definitions of Intangible Asset and Goodwill: An intangible asset, as per IAS 38, requires that it is identifiable, but separate from goodwill. Goodwill recognized in a business combination is an asset representing the future economic benefits arising from other assets acquired in a business combination that are not individually identified or separately recognized.

An asset is identifiable if it either: a) is separable, i.e., is capable of being separated or divided from the entity and sold, transferred, licensed, rented or exchanged, either individually or together with a related contract, identifiable asset or liability, regardless of whether the entity intends to do so; or b) arises from contractual or other legal rights, regardless of whether those rights are transferable or separable from the entity or from other rights or obligations. An intangible asset shall be recognized if, and only if: a) it is probable that the expected future economic benefits that are attributable to the asset will flow to the entity; and b) the cost of the asset can be measured reliably.

In financial reporting, goodwill is a residual concept, as projections used to value assets only include market participant assumptions and exclude buyer-specific synergies.

In transfer pricing, intangible property is defined in Treas. Reg. 1.482, which comprises of any of the following items and has substantial value independent of the services of any individual. According to Treas. Reg. 1.482-7T(c)(1), a platform contribution is any resource, capability, or right that a controlled participant has developed, maintained, or acquired externally to the intangible development activity that is reasonably anticipated to contribute to developing cost shared intangibles.

The OECD definition of intangible property includes rights to use industrial assets. These intangibles are assets that may have considerable value, even though that may have no book value. When applying the arm’s length principle to business restructurings, the question is whether there is a transfer of something of value (rights or other assets) or a termination or substantial renegotiation of existing arrangements and that transfer, termination, or substantial renegotiation would be compensated between independent parties in comparable circumstances.

In transfer pricing, intangibles include goodwill, which consists of buyer-specific synergies, future customer relationships, and future technology; future opportunities, which are part of residual goodwill value, are not considered goodwill in transfer pricing. In transfer pricing, there is a broader view of the definition and what comprises intangible asset value.

For instance, the IRS views technology, such as software, as something that never fully amortizes. Thus, the income stream would go out further and impact the valuation. In financial reporting, all future technology, except for IPR&D, accrues to goodwill; amortization begins immediately, and if pre-existing technology contributes to future technology, the value contributions will be captured and included as part of value.

In a transfer pricing context, valuations capture not only contributions of technology as it exists currently, but also the contributions of that technology to future development efforts.

In transfer pricing, buyer-specific synergies may be included in the arm’s length price—to the extent they would affect the arm’s length outcome, which may lead to higher value for the intangible asset. The IRS perspective believes that some goodwill should be included as part of intangibles. If a U.S.-based intangible asset is going to be transferred to another country, the IRS wants the value placed on that intangible property to be as high as possible.

The new cost-sharing regulations highlight the differences between the application of the income method for transfer pricing purposes versus financial reporting purposes. In a purchase price allocation, there is a delineation between intangibles and goodwill. For transfer pricing purposes, the distinction between intangibles and goodwill is blurred. The valuation involves consideration of not only what the value is today, but also what the value will be post-acquisition. For example, what will the value of the intangible be once the buyer has integrated it into their distribution channels or product line? In a transfer pricing situation, the value of the intangibles might include all of goodwill.

The difference in the treatments of goodwill and the definition of an intangible asset from the perspective of a specific buyer (transfer pricing) versus a market participant buyer (financial reporting), lead to higher valuations for transfer pricing purposes than those performed for financial reporting.

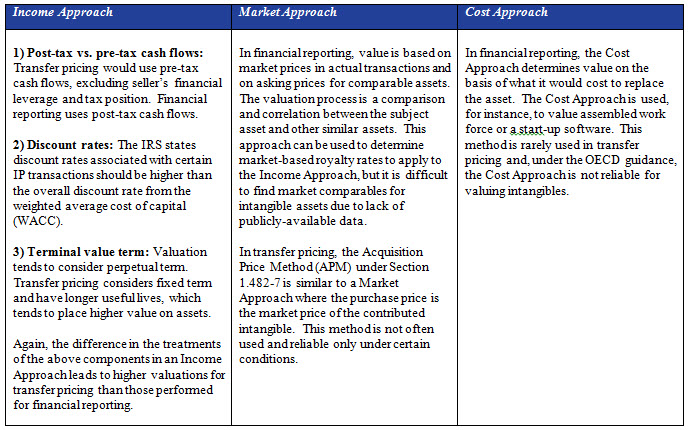

Valuation Methodologies: In addition to the above, there are differences in the application of valuation methodologies.

Similarities: Shall the Twain Ever Meet?

Given the differences outlined above, financial reporting valuations share general concepts with transfer pricing valuation, such as the concept of comparables in a Market Approach, use of present value and discounting under an Income Approach; and the fact-finding process, i.e., the industry analysis and functional analysis in transfer pricing are conducted and performed in a similar fashion as part of due diligence in financial reporting. In addition, the documentation process is very similar: Transfer pricing contemporaneous documentation requirements (Treas. Reg. 1.6662) mirror the standards set by the ASA and AICPA on components of a comprehensive valuation report.

It is clear that valuations performed for financial reporting purposes should not be fully relied upon for transfer pricing purposes. However, aligning the two disciplines and finding areas of commonality are important. It is more efficient to document areas of convergence (or divergence) in the methodologies early in the process, rather than having to justify different approaches later, when potentially material tax consequences may arise. The divergence between financial and transfer pricing valuation standards can actually provide opportunities for companies to arrange and defend their transfer pricing and global effective tax rate using different approaches from those utilized in intangibles valuation. Streamlining both endeavors is key, since the absence of any consensus between the respective disciplines—coupled with the fact that different analyses may be performed by different project teams for different purposes—can result in widely-divergent intangible asset valuations.

The lack of agreement between financial valuation and transfer pricing is a waste of time and resources, since it often requires different databases and sources, different accounting approaches, different discount rates, different comparable sets, and generally inconsistent valuations. The difference in values between analyses and misalignment of the placement of intangible assets when setting a company’s global transfer pricing policy can create considerable risk. In addition—and more importantly—audit risks increase because of inconsistent values of intellectual property, and challenges to transfer intellectual property post

acquisition. Because of more rigorous regulatory audit procedures, transfer pricing has become one of the riskiest areas for companies from both compliance and tax planning perspectives.

Relying on valuation from purchase price allocation results in undervaluation of transferred intangibles for transfer pricing purposes because of differing treatments and definitions of intangible life, buyer-specific synergies, pre-tax vs. post-tax analyses etc., as outlined above.

Aligning the two approaches saves time and costs, as fact-finding and due diligence meetings can be conducted as one, and both disciplines leverage the same information using the same set of projections, as well as a similar set of market comparables, other inputs, and assumptions. Since there are many intersecting portions between the reporting requirements of transfer pricing and financial reporting valuation, the documentation requirements of both can also be synchronized and performed jointly. As a result, it is easier to support tax positions and reduce audit risks. Finally, there is demonstrable consistency in the information provided to investors and signed off by company auditors.

[1] Dealogic M&A Review, First Quarter 2016 Final Results, April 2016.

[2] Veritas Software Corp. & Subs. v. Commissioner, 133 T.C. No. 14 (2009).

[3] Xilinx v. Commissioner, 125 T.C. 37 (2005) and Xilinx v. Commissioner 598 F.3d 1191 (2010).

[4] Aligning Transfer Pricing Outcomes with Value Creation, Actions 8-10 2015 Final Reports, http://www.oecd.org

[5] Ibid.

Angela Sadang, CFA, ASA, is a Director at Marks Paneth LLP. She is a Chartered Financial Analyst and an Accredited Senior Appraiser in Business Valuation and is in the process of obtaining an intangible asset valuation certification from the American Society of Appraisers. She was involved in numerous transfer pricing and valuation projects while at PwC and BDO, and valuation for tax and financial reporting purposes in her current position.

Ms. Sadang can be contacted at (212) 201-3012 or by e-mail to asadang@markspaneth.com.