A Testifying Expert Believes the 76ers Will Make the 2015-16 Playoffs

Could that Opinion Survive a Daubert Challenge? (Part I)

This article is comprised of three parts. Part I provides background for this thought exercise and identifies the size of the hole the 76ers had to climb out of to make the playoffs. Part II will address the path an expert might take to arrive at his or her opinion. Part III will address the implications of this thought exercise on valuation-related Daubert challenges.

This article blazes the path for a testifying expert to opine that one of the worst teams in NBA history was expected to qualify for the playoffs. Of course, there is probably no need for such an opinion to ever be proffered in a courtroom. However, this thought exercise may help crystalize arguments for and against excluding certain expert testimony under Daubert (and its progeny) grounds.

Introduction

A Daubert challenge is an attempt by opposing counsel to exclude a testifying expert’s testimony. In order to prevail, opposing counsel must establish that the testifying expert’s opinion is not based on reasoning or methodology that is scientifically valid and properly applied to the facts at issue.[1] The spirit of a Daubert challenge from some practitioners’ perspective is to exclude so-called “junk science”-based expert testimony.

Other practitioners highlight that, “Daubert was intended to eliminate a high bar to the introduction of scientific evidence and substitute a more forgiving, more liberal standard.”[2] This view suggests judges have freedom to allow testimony that may appear unorthodox, yet nevertheless be scientifically valid and properly applied to the facts at issue.

It seems absurd for anyone to opine the 76ers will make the 2015-16 playoffs. The team started the season with only a three percent probability of making the playoffs.[3] These meager odds declined as the season progressed and the team’s losses accumulated.[4]  The regular season is over and the team finished thirty-four wins short of making the playoffs. Thus, an opinion that the 76ers will make the 2015-16 playoffs appears to be the textbook example of an opinion based on “junk science” ripe for a successful Daubert challenge.

However, it is possible to posit a realistic scenario where the 76ers were expected to qualify for the 2015-16 playoffs. A change in strategic direction, which the team began to take one quarter of the way through the season, could go a long way towards accomplishing this goal. The expert’s assignment may also require an unorthodox approach to assess the situation. This is why an assessment of this historically bad 76ers team may test the limits of a testifying expert’s ability to survive a Daubert challenge.

This thought exercise may have far-reaching consequences. Assume for a moment that our expert’s opinion regarding the 76ers making the playoffs survives a Daubert challenge. Could other opinions that appear to be absurd nevertheless survive a Daubert challenge? A valuation-related dispute will be used to demonstrate the potential implications.

This article is comprised of three parts. Part I provides background for this thought exercise and identifies the size of the hole the 76ers had to climb out of to make the playoffs. Part II will address the path an expert might take to arrive at his or her opinion. Part III will address the implications of this thought exercise on valuation-related Daubert challenges.

Overview of the 2015-16 Philadelphia 76ers

The 2015-16 Philadelphia 76ers were historically bad and did not come close to qualifying for the playoffs. They tied the league record for most losses to begin a season[5] and finished only one loss away from tying the league record for most losses in an entire season.[6] All of this losing resulted in the 76ers being mathematically eliminated from the 2016 playoffs in February[7] and finishing thirty-four games out of playoff contention.[8] Simply put, the 2015-16 Philadelphia 76ers were one of the worst teams in NBA history.

The 2015-16 Philadelphia 76ers were historically bad, mostly on purpose, as the team sacrificed wins over the past few years to collect future assets. This was accomplished through three main steps. First, trade productive players primarily for current (e.g., Jrue Holliday trade) or future (e.g., Michael Carter Williams trade) draft picks. Second, use many of the top draft picks to select high upside/injured players (e.g., Nerlens Noel and Joel Embid) or players stashed in Europe (e.g., Dario Saric). Third, use the mandated minimum that must be spent on player salaries[9] to effectively purchase future draft picks (e.g., salary dump trade with Sacramento Kings) instead of using it to sign cost-effective players that could help the current team. These steps virtually ensured losing records during the medium-term, which included the 2015-16 season.

This extreme approach to team building may be unprecedented. Short-term tanking[10] has occurred[11] but examples of longer-term tanking to this degree are difficult to find. The 76ers’ apparently unique plan became known as “The Process.”

The 76ers’ long-term plan was to collect as much high-end young talent as possible. This plan was undertaken due to the “depressingly simple” strategy needed to compete for NBA championships.[12] Star players have an outsized impact on the game because only five players on a team are on the court at a time. These star players are also underpaid when they are relatively young (due to the rookie wage scale) and older (due to maximum salaries). The salary cap and other drafting team-friendly advantages means the best way to acquire the needed star players is through the draft. The best way to draft these star players is to accumulate as many high-end first round draft picks (and other draft picks, which are essentially lottery tickets) as possible.

Pivot by 76ers’ Ownership

The 76ers’ record-tying poor start to the 2015-16 season coincided with (and potentially caused) a shift in management that suggests ownership might have been tiring of “The Process.” A proven team builder, Jerry Colangelo, was hired as the team’s chairman of basketball operations on December 7, 2015[13] when the team’s record was one win against twenty losses.[14] Perhaps a shift in team building approach was forthcoming, which would result in the team abandoning its long-term goal of competing for the championship at extreme short-term costs in favor of the short-term goal of competing for the playoffs. This suggests that future assets (e.g., draft picks) could be monetized (i.e., traded to other teams) in order to obtain players that could help the current team. Thus, it is possible that ownership considered repudiating “The Process” and that the team might try its best to compete during the current season.

Thought Exercise: Basis for this Article

Colangelo’s hiring opens the door to an interesting thought exercise: what if an expert testified that the 76ers, when looking forward as of the date Colangelo was hired (December 7, 2015), were expected to make the 2016 playoffs? Could such an opinion survive a Daubert challenge? If yes, what are the implications for other Daubert challenges? This article attempts to address these questions.

The 76ers did not monetize their future assets and ended the 2015-16 season thirty-four games out of the playoffs. However, our assessment date is December 7, which was only one quarter of the way through the 2015-16 season. It may be reasonable to assume that ownership was willing and able to make the trades contemplated in Part II of this article. Thus, the fact the team did not make the playoffs is hindsight and may have little to no bearing on this analysis, particularly in the context of a Daubert challenge.

Overview of a Daubert Challenge

Judges have a gatekeeping role related to testifying experts. Some expert testimony is inadmissible due to its lack of relevance and/or reliability. A party seeking to exclude expert testimony on these grounds is often said to be making a Daubert challenge. This nomenclature stems from the Supreme Court’s ruling in Daubert v. Merrell Dow Pharmaceuticals, Inc.[15]

Some studies suggest financial expert testimony is often held to be inadmissible under Daubert grounds. For example, PwC reports almost half (forty-four percent) of the Daubert challenges against financial experts they identified were successful (in part or in whole) between 2000 and 2015.[16]

Of course, any study is subject to limitations. For example, in the case of the PwC study, it is not clear how many experts are not subject to Daubert challenges.[17] Thus, there is selection bias when the universe consists only of instances where a moving party was willing to invest the time, money, and reputation to assert a Daubert challenge.

Nevertheless, it seems reasonable to conclude that Daubert challenges against financial experts, when asserted, are often successful. It also seems reasonable to conclude that an expert proffering an opinion that one of the worst teams in history will make the playoffs is the textbook example of an opinion ripe for a Daubert challenge.

Daubert Challenge Against Our Expert

We will assume the testifying expert in this situation is eminently qualified. Perhaps this expert is a well-respected former general manager or a leading sabermetrician. Thus, this expert’s testimony will not be excluded due to his/her lack of qualifications.

The basis for a Daubert challenge would likely be lack of reliability. The spirit of the challenge might be best captured in Jim Mora’s epic rant when discussing the Indianapolis Colts team he coached in 2001:

Playoffs? Don’t talk about—playoffs?! You kidding me? Playoffs?! I just hope we can win a game! Another game![18]

However, some expert opinions that may appear unreliable on the surface can survive a Daubert challenge because the criticisms are better suited for cross-examination at trial.  For example, consider a valuation dispute in which one expert values the company at $100 million while the other expert values it at ten million dollars. One (or both) of these valuations is probably unreliable given the massive chasm between these values. Nevertheless, both experts’ testimony may be admissible if reliable methodologies were used and the dispute stems from the underlying assumptions that have some potential (which will be assessed at trial) for being deemed reliable.

Define “Will Make the Playoffs”

What does “will make the playoffs” mean? The first part of the testifying expert’s assignment is to address this question.

The testifying expert will likely define “will make the playoffs” in a fashion similar to the expected value of an asset in valuation parlance. There are many potential valuation outcomes for an asset but it is not unusual for all of those outcomes to be distilled into one value. The expected value of an asset is equal to the probability-weighted average of all future outcomes.

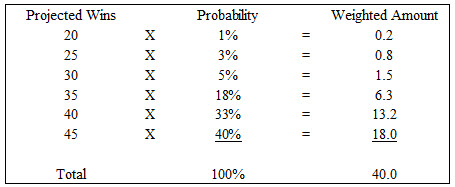

For example, the testifying expert may believe the appropriate range for the 76ers’ projected amount of wins, as of December 7, 2015, for the 2015-16 season is between twenty and forty-five. This expert may further believe that outcomes within this range are skewed towards the high end, which implicitly assumes the trades contemplated in Part II of this article are consummated. As shown in Figure 1, these beliefs might result in an expected value of forty wins.

Figure 1

The focus on expected value matters because it grounds “will make the playoffs” in expectations, not guarantees. (Thus, Joe Namath, who famously guaranteed that the New York Jets would win Super Bowl III, might not be a suitable expert.) This testifying expert expects the 76ers to make the playoffs if forty wins is at, or above, the expected threshold for playoff qualification. This result is obtained notwithstanding the fact that s/he believes the team could win as few as twenty games, which would undoubtedly be too few to qualify for the playoffs.

Identify Amount of Wins Needed to Make the Playoffs

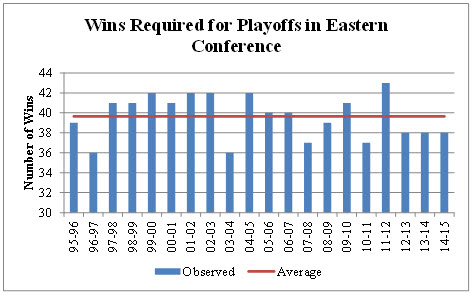

A logical place to start is to review contemporaneous projections made by third parties. One such example is FiveThirtyEight.com’s weekly forecast.[19] As shown in Figure 2, the expected number of wins required to qualify for the Eastern Conference (the 76ers are in this conference) playoffs was in the low forties during the course of the 2015-16 season. More importantly, the projection as of our assessment date (December 7) was forty-three wins.

Figure 2[20]

Nevertheless, other methodologies may also be deemed reliable enough to survive a Daubert challenge. For example, our expert may focus on historical requirements. This approach, as will be explained below, results in a lower threshold for making the playoffs.

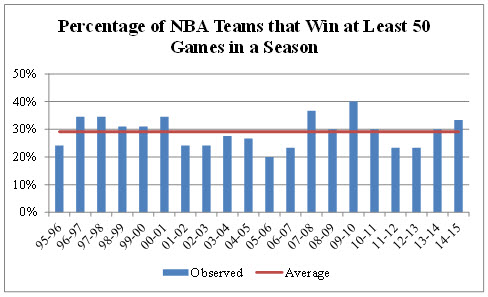

The structure for the Eastern Conference playoffs has remained unchanged since 1995-96. The top eight teams in this conference of fifteen teams made the playoffs between the 1995-96 and 2014-15 seasons. We will focus on this twenty-year period.

We will assume the lowest supportable threshold for making the playoffs in the Eastern Conference is thirty-seven or thirty-eight wins. As shown in Figure 3, the threshold was thirty-seven or thirty-eight wins in four of the preceding five seasons.

Figure 3

The prior discussion demonstrates how opposing experts may draw on different information sets to support different results. One expert focused on contemporaneous observers’ views, whereas the other expert focused on historical precedent. We will assume both experts’ conclusions on this front would survive a Daubert challenge.

Identify Amount of Wins Needed After Assessment Date

The 76ers needed a quick reversal of fortune. Their record was 1-21 (4.5% winning percentage) at the end of the day when Colangelo was hired. The team would have to go, over the remainder of the season, 36-24 (sixty percent winning percentage) to obtain thirty-seven wins or 37-23 (61.7% winning percentage) to obtain thirty-eight wins. This translates to a pace of approximately fifty wins over the course of an eighty-two game season.

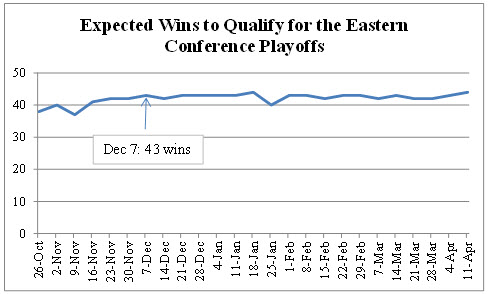

For context, approximately thirty percent of NBA teams win at a pace of fifty or more wins over the course of an eighty-two game season. See Figure 4. Thus, the 76ers would have to immediately transition from historically bad before Colangelo’s hiring, to slightly better than a top third team during a typical year after Colangelo’s hiring.  Â

Figure 4

Address Comps

There are no instances where a team started as poorly as the 76ers and subsequently made the playoffs. This fact would undoubtedly be part of the Daubert challenge.

However, the lack of precedent may not automatically result in exclusion of our expert’s testimony. Our expert would likely opine that the 2015-16 76ers were unique for two reasons. First, they had an inordinate amount of future assets that could be monetized in order to benefit the current team. Second, tiring of “The Process” could have led to a desire by ownership to cash in these future chips to save the current season.

Moreover, it is not unprecedented for a team to start out very poorly and subsequently qualify for the playoffs. Perhaps the best example is the 1996-97 Phoenix Suns.  They lost their first thirteen games yet finished the season with forty wins and made the playoffs.[21]

Conclusion

Our expert has a difficult task. S/he has to demonstrate the largest projected in-season turnaround in history (from record-tying worst start to making the playoffs) was the product of a methodology that could withstand a Daubert challenge. This seems, on the surface, to be the textbook case of an opinion based on “junk science.”

The second part of this article will explain how a reliable methodology could be constructed. The third part of this article will address its implications for valuation-related Daubert challenges.

The author is not an attorney and is not offering legal advice. This article is written from a business valuation practitioner’s perspective, who works on, among other things, litigation-related matters.

[1] https://www.law.cornell.edu/wex/daubert_standard

[2] http://www.americanbar.org/content/dam/aba/administrative/litigation/materials/sac_2012/18-2_daubert_turning.authcheckdam.pdf

[3] http://projects.fivethirtyeight.com/2016-nba-picks/

[4] Ibid.

[5] http://www.cbssports.com/nba/eye-on-basketball/25394675/philadelphia-76ers-tie-worst-start-in-nba-history-with-0-18-record

[6] http://espn.go.com/nba/features/worstteams

[7] They were eliminated on February 29, 2016: http://www.si.com/nba/2016/03/01/philadelphia-76ers-eliminated-playoff-contention

[8] http://espn.go.com/nba/standings

[9] Teams must spend at least ninety percent of the salary cap each season. The salary cap was seventy million dollars for the 2015-16 season, which means at least sixty-three million dollars had to be spent on player salaries.  http://www.nba.com/2015/news/07/08/nba-salary-cap-2016-official-release/

[10] “Tanking” can have different meanings. The players on the team tried to win, which means they did not “tank.” “Tanking” in this article refers to the strategic decision made by management/ownership to not acquire the best players they could for the present team in order to maximize the value of players they could acquire in, or develop for, the future. Thus, management/ownership “tanked” the season(s).

[11] The draft lottery was put into place at least in part due to criticism that teams tanked (i.e., did not try their hardest to win) during the 1983-84 season in order to increase their chances (the team with the worst record got the first pick) to draft Hakeem (the Dream) Olajuwon.

[12] http://espn.go.com/nba/story/_/id/12318808/the-philadelphia-76ers-radical-guide-winning

[13] http://www.nba.com/sixers/news/jerry-colangelo-joins-philadelphia-76ers

[14] http://espn.go.com/nba/team/schedule/_/name/phi

[15] Daubert v. Merrell Dow Pharmaceuticals, Inc., 509 U.S. 579, 113 S. Ct. 2786, 125 L. Ed. 2d 469 (1993).

[16] http://www.pwc.com/us/en/forensic-services/publications/assets/pwc-daubert-study-whitepaper.pdf at 24.

[17] The PwC study states “[o]ur study is limited to written opinions citing Kumho Tire. As such, the related results should not be presumed to represent all possible financial expert challenges (e.g., opinions on financial experts that do not specifically cite Kumho Tire, bench decisions, motions in limine, etc.)” PwC also states that “[s]ome case opinions citing Kumho Tire cover challenges to more than one expert. In addition, some case opinions cite Kumho Tire but do not specifically relate to a Daubert challenge.” PwC explains that Kumho Tire is the Supreme Court decision which “clarified that the Daubert criteria were applicable to all types of expert testimony in federal jurisdictions, including financial expert testimony. Subsequently, many state courts also adopted the Daubert standard.”

[18] https://www.youtube.com/watch?v=40mhBE5MpbA

[19] This is the only source I found that maintained a repository of its previous forecasts.

[20] Data from http://projects.fivethirtyeight.com/2016-nba-picks/ (last visited on 5/9/16).

[21] http://www.basketball-reference.com/teams/PHO/1997_games.html

Michael Vitti, CFA, joined Duff & Phelps in 2005. Mr. Vitti is a Managing Director in the Morristown office and is part of the Disputes and Investigations practice. He is also a member of the firm’s Complex Valuation and Bankruptcy Litigation group, focusing on issues related to valuation and solvency. Mr. Vitti has twenty years of valuation experience.

Mr. Vitti can be reached at (973) 775-8250 or by e-mail to michael.vitti@duffandphelps.com.