Exploring the Pluris® Restricted Stock Database and DLOM Calculator

A White Paper Detailing Use of the Pluris Database to Develop a DLOM (Part II of III)

In this second part, of a three-part series, Marc Vianello examines whether discounts reported in PLURIS DLOM Database are consistent with past changes in SEC Rule 144 required holding periods; How the PLURIS Restricted Stock Discounts Correlate with other reported Metrics; How to use PLURIS Database for Benchmarking; and the two challenges practitioners attempting to benchmark will encounter using the PLURIS Database. Read Part I here.

Section IV

The Discounts Reported in the Pluris DLOM Database™ are not Consistent with Past Changes in SEC Rule 144 Required Holding Periods

[su_pullquote align=”right”]Resources:

Pluris DLOM Valuation Advisors

20 Valuation Databases & Resources in 60 Minutes (Fasten Your Seatbelts!)

[/su_pullquote]

The Pluris DLOM calculation methodology does not use time as a factor in DLOM estimation. As shown previously in Tables 3 and 4, the “quarters to sell” reported in the Pluris DLOM Database offer little explanation of the changes in the observed discounts. Nevertheless, we considered whether a better explanation of the restricted stock discounts reported in the database could be obtained by considering the changes that have occurred in Rule 144 holding periods. Informed readers will be aware that the original Securities and Exchange Commission (SEC) Rule 144 required restricted stocks be held for two years past the issue date before they could be “dribbled out” into the public marketplace. The SEC changed the required holding period to one year effective April 29, 1997, and to six months effective February 15, 2008.[1] None of the transactions in Version 4.2.0 of the Pluris DLOM Database predates April 29, 1997, so the large holding period change from two years to one year cannot explain any of the changes in the reported restricted stock discounts.

Conventional wisdom, supported by several restricted stock studies, is that smaller restricted stock discounts have resulted from the successive changes in Rule 144 holding period.[2] A reduction in discount is logical when the restriction goes from two years to one year to six months, because the restricted block of stock can be liquidated quicker. Quickness of sale (i.e., increased liquidity) reduces holding period risk.

Table 5 summarizes the transactions reported in the Pluris DLOM Database based on issue dates before and after the SEC’s November 15, 2007, announcement date of the change from a one-year to a six-month required holding period. The announcement date is the appropriate demarcation because the rule change was applicable to stocks acquired both before and after the February 15, 2008, effective date.[3] We assume that negotiators of a restricted stock transaction would have known of the rule change upon the announcement by the SEC.

| Table 5 | |||||

| Issue Date | Restriction

Period |

All 3,632 Transactions | 3,189 Transactions

with Discounts Greater than Zero |

||

| Count | Discount | Count | Discount | ||

| 1/2/2001 – 11/14/2007 | 1 Year | 2,379 | 23.0% | 2,160 | 27.6% |

| 11/15/2007 – 6/30/2014 | 6 Months | 1,253 | 21.2% | 1,029 | 30.0% |

| All reported transactions | 3,632 | 22.4% | 3,189 | 28.4% | |

Table 5 discloses that the average observed discount for all transactions in the Pluris DLOM Database decreased only slightly from 23.0% to 21.2% upon the announcement that the Rule 144 holding period would change form one year to six months, respectively. But the opposite is observed when only transactions with positive discounts (i.e., common stock discounts greater than zero) are included. For the latter set, the average discounts reported by Pluris increased from 27.6% to 30.0% for one-year and six-month restriction periods, respectively.

The restricted stock discounts observed in the Pluris DLOM Database do not seem to behave consistently with the conventional wisdom regarding the effect of Rule 144 time restrictions. Therefore, one must consider that some, one or more, things other than Rule 144 holding periods explain the discounts reported in the database. A possible explanation is that the negotiators of restricted stock transactions of the size comprising the database anticipate block sales instead of dribble-out sales of their holdings.

Section V

How the Pluris Restricted Stock Discounts Correlate with Other Reported Metrics

Pluris DLOM Database Version 4.2.0 reports 76 fields of data for each restricted stock transaction. We used linear regression to calculate the R-squares of correlation and regression formula slopes for 62 of these metrics relative to the discounts reported by Pluris. The results are presented in Table 6-A. None of the calculations resulted in a large R-square of correlation, and few exhibit a regression line slope that is not essentially flat. Flat regression lines display a lack of correlation and offer no predictive power.

The largest correlations occurred with the transactions that have discounts greater than zero and the corresponding reported price volatility data. These R-squares of correlation range from 8.9% to 12.4%, and have very shallow regression line slopes that range from 0.0588:1 to 0.0879:1. With an R-square of 12.4%, linear regression of price volatility, the best metric provided by the Pluris DLOM Database, explains about an eighth of the variation in discounts reported in the database. Obviously, practitioners would prefer to see R-squares that are closer to 100%.

It would be unreasonable to benchmark a restricted stock DLOM on the strongest correlations reported in Table 6-A. Benchmarking DLOMs on the even more poorly correlated parameters used in the Pluris DLOM calculator seems problematic.

| Table 6-A | ||||

| Linear Regressions of Pluris DLOM Database Financial Metrics with the Observed Discounts | ||||

| All 3,632 Transactions | 3,189 Transactions with Discounts

Greater than Zero |

|||

| R2 | t-Ratio of Slope | R2 | t-Ratio of Slope | |

| Price Volatility Data | ||||

| Daily volatility over 12 months | 2.7% | 0.0470 | 12.4% | 0.0641 |

| Daily volatility over 12 months or applicable period prior to issue date | 3.0% | 0.0445 | 12.4% | 0.0588 |

| Daily volatility over six months | 2.1% | 0.0450 | 12.0% | 0.0709 |

| Weekly volatility over 12 months | 3.5% | 0.0753 | 11.9% | 0.0864 |

| Weekly volatility over six months | 2.9% | 0.0695 | 11.2% | 0.0879 |

| Daily volatility over three months | 2.1% | 0.0435 | 11.0% | 0.0662 |

| Weekly volatility over three months | 2.7% | 0.0560 | 8.9% | 0.0653 |

| Price Data | ||||

| Effective purchase price per share | 3.1% | (0.0056) | 10.2% | (0.0067) |

| Purchase price | 2.9% | (0.0054) | 9.9% | (0.0066) |

| Closing price on announcement date (A+0) | 2.1% | (0.0047) | 9.2% | (0.0067) |

| Closing price three days after announcement date (A+3) | 2.1% | (0.0047) | 9.2% | (0.0066) |

| Exercise Price | 2.6% | (0.0102) | 8.3% | (0.0132) |

| Closing price 10 days after issue date (C+10) | 1.4% | (0.0035) | 7.2% | (0.0050) |

| Closing price seven days after issue date (C+7) | 1.5% | (0.0035) | 7.1% | (0.0050) |

| Closing price seven days prior to issue date (C-7) | 1.5% | (0.0035) | 7.1% | (0.0050) |

| Volume-weighted average price 10 days prior to issue date (VWAP) | 1.4% | (0.0035) | 7.1% | (0.0050) |

| Closing price three days after issue date (C+3) | 1.4% | (0.0034) | 7.0% | (0.0050) |

| Closing price one day after issue date (C+1) | 1.4% | (0.0034) | 6.8% | (0.0049) |

| Closing price one day prior to issue date (C-1) | 1.3% | (0.0034) | 6.8% | (0.0049) |

| Closing price on the issue date (C+0) | 1.3% | (0.0033) | 6.7% | (0.0049) |

| Restricted Stock Data | ||||

| Fair market value per warrant | 1.6% | (0.0254) | 6.7% | (0.0377) |

| Number of warrants | 1.9% | 0.0000 | 6.3% | 0.0000 |

| Block size (shares outstanding) | 2.4% | 0.4692 | 3.9% | 0.3929 |

| Shares sold | 0.9% | 0.0000 | 3.2% | 0.0000 |

| Gross proceeds | 0.2% | (0.0000) | 0.8% | (0.0000) |

| Common stock portion of proceeds | 0.3% | (0.0000) | 0.8% | (0.0000) |

| Warrants portion of gross proceeds | 0.4% | 0.0000 | 0.0% | 0.0000 |

| Block Size (Volume) | 0.0% | (0.0000) | 0.3% | 0.0000 |

| Block size (quarters to sell) | 0.0% | (0.0000) | 0.4% | 0.0000 |

| Issue date | 0.0% | 0.0000 | 0.5% | 0.0000 |

| Placement ID number | 0.0% | (0.0000) | 0.4% | 0.0000 |

| Financial and Market Data | ||||

| Market-to-book ratio | 4.6% | 0.0040 | 8.7% | 0.0036 |

| Price divided by book value per share (P/BV) | 4.6% | 0.0040 | 8.7% | 0.0036 |

| Enterprise value divided by revenue for last 12 months (EV/Revenue) | 1.4% | 0.0017 | 3.0% | 0.0016 |

| Dividend yield | 0.9% | (1.6625) | 2.2% | (1.9705) |

| Net profit margin for last 12 months | 1.0% | (0.0995) | 2.0% | (0.0718) |

| Revenue growth in 12 months prior to most recent 10-Q | 0.3% | (0.0345) | 1.4% | (0.0468) |

| Price divided by average earnings per share for last 12 months (P/E) | 0.1% | (0.0003) | 1.4% | (0.0007) |

| Shares outstanding | 0.0% | 0.0000 | 1.0% | 0.0000 |

| Market capitalization | 0.2% | (0.0000) | 0.8% | (0.0000) |

| Price divided by the estimated average earnings per share for the next two years (P/E FY+2) | 1.3% | 0.0009 | 0.6% | 0.0005 |

| Total equity on most recent 10-Q | 0.2% | (0.0000) | 0.5% | (0.0000) |

| Total revenues 12 months prior to most recent 10-Q | 0.2% | (0.0000) | 0.5% | (0.0000) |

| Beta relative to S&P 500 for 12 months prior to issue date | 0.2% | (0.0001) | 0.5% | (0.0001) |

| Trading volume over twelve months or applicable period | 0.9% | (0.0000) | 0.4% | (0.0000) |

| Trading volume multiplied by the issuer’s closing stock price on issue date | 0.1% | (0.0000) | 0.4% | (0.0000) |

| Average daily trading volume over 12 months prior to issue date | 0.8% | (0.0000) | 0.4% | (0.0000) |

| Expiration Date | 0.2% | 0.0000 | 0.2% | 0.0000 |

| Average daily trading volume over six months prior to issue date | 1.1% | (0.0000) | 0.2% | (0.0000) |

| VIX as of the issue date | 0.7% | (0.3533) | 0.2% | (0.1261) |

| Z-score | 0.1% | (0.0000) | 0.2% | (0.0000) |

| Enterprise value | 0.0% | (0.0000) | 0.2% | (0.0000) |

| SEC Filing Data | ||||

| Total debt on most recent 10-Q | 0.0% | (0.0000) | 0.1% | (0.0000) |

| Average daily trading volume over three months prior to issue date | 1.0% | (0.0000) | 0.1% | (0.0000) |

| Total assets on most recent 10-Q | 0.0% | (0.0000) | 0.1% | (0.0000) |

| Average daily trading volume over one month prior to issue date | 0.7% | (0.0000) | 0.1% | (0.0000) |

| Total liabilities on most recent 10-Q | 0.0% | (0.0000) | 0.1% | (0.0000) |

| EBITDA 12 months prior to most recent 10-Q | 0.0% | (0.0000) | 0.1% | (0.0000) |

| Average daily trading volume over seven days prior to issue date | 0.1% | (0.0000) | 0.1% | (0.0000) |

| Price divided by the estimated average earnings per share for the next year (P/E FY+1) | 0.2% | 0.0003 | 0.0% | 0.0001 |

| Pre-tax income 12 months prior to most recent 10-Q | 0.0% | (0.0000) | 0.0% | (0.0000) |

| Net income 12 months prior to most recent 10-Q | 0.0% | (0.0000) | 0.0% | (0.0000) |

We considered whether other forms of regression analysis would show improved R-squares of correlation of the observed discounts and the available metrics. We limited this analysis to the restricted stock transactions with observed discounts greater than zero. The reported discounts exhibit the highest R-square of correlation with 12-month price volatility, but over 77% of the discount variation remains unexplained. [4]

| Table 6-B | |||

| R-squares for 3,189 Pluris Restricted Stock Transactions

with Observed Discounts > Zero |

|||

| Exponential | Linear | Logarithmic[5] | |

| Volatility (Daily 12M) | 8.05% | 12.45% | 22.58% |

| Market to Book Ratio | 5.61% | 8.69% | N/A (zeros) |

| % of Shares Outstanding | 2.51% | 3.83% | 2.36% |

| Total Assets | 0.37% | 0.11% | N/A (zeros) |

| Enterprise Value/Revenue | 1.84% | 3.00% | 2.18% |

| Market Capitalization | 1.52% | 0.81% | 5.91% |

| Trading Volume | 0.15% | 0.42% | 3.48% |

| Total Debt | 0.35% | 0.12% | N/A (zeros) |

The Pluris DLOM calculator gives users eight valuation parameters by which to input a subject company’s financial statement traits. Those parameters are: total assets, total revenues, EBITDA, net income, net profit margin, equity (book value), enterprise value, and ratio of market price-to-book value. The calculator also provides two custom fields whereby users can input other factors. Table 7 summarizes the average (mean), standard deviation, and the coefficient of variation that we calculated for each of eight valuation parameters using the Pluris data. The ratio of market value-to-book value offers the tightest distribution of discounts around the mean reflected by a coefficient of variation of 1.4:1, which represents a still-broad distribution of the data.

| Table 7 | ||||||

| Financial Parameters Used in the Pluris DLOM Calculation Methodology | ||||||

| All 3,632 Transactions | 3,189 Transactions with Discounts > Zero | |||||

| Average | Standard Deviation | Coefficient of Variation | Average | Standard Deviation | Coefficient of Variation | |

| Total Assets | $1,535,520,816 | $55,612,171,960 | 36.2 | $1,658,322,427 | $59,281,730,272 | 35.7 |

| Revenues | 194,563,230 | 2,152,944,264 | 11.1 | 190,652,639 | 2,252,841,333 | 11.8 |

| EBITDA | 33,622,178 | 1,138,721,628 | 33.9 | 34,695,161 | 1,210,638,417 | 34.9 |

| Net Income | (9,182,288) | 135,947,965 | 14.8 | (9,006,978) | 140,872,735 | 15.6 |

| Net Profit Margin | -16.7% | 31.4% | 1.9 | -17.4% | 31.8% | 1.8 |

| Total Equity | 99,717,239 | 1,156,263,919 | 11.6 | 96,301,461 | 1,208,685,423 | 12.6 |

| Enterprise Value | 805,238,151 | 19,858,204,899 | 24.7 | 854,743,284 | 21,150,553,918 | 24.7 |

| Market-to-Book Ratio | 10.2 | 14.7 | 1.4 | 10.5 | 14.9 | 1.4 |

Our research indicates that the restricted stock discounts reported in the database correlate poorly with the parameters employed in the Pluris calculator. We describe our analyses in the following paragraphs. Perhaps other techniques we did not consider would find better correlations. We leave that research to others.

We considered whether the eight parameters used in the Pluris DLOM calculator[6] are statistically significant individually, as a group, or as sub-groups of variables. We performed a multivariate regression analysis using a 1,137-transaction subset of the Pluris database for which values were reported for all eight of the Pluris calculator parameters. Table 8 reports the results of our regression model:

| Table 8 | ||||

| Statistical Significance Relative to Observed Discounts Using Linear Regression | ||||

| 1,137 Restricted Stock Transactions with Complete Parameter Data | ||||

| t-Stat | P-value | Statistically Significant? |

R-Square[7] |

|

| Total Assets | 0.285 | 0.776 | No | n/a |

| Revenues | -0.604 | 0.546 | No | n/a |

| EBITDA | 0.300 | 0.764 | No | n/a |

| Net Income | 1.005 | 0.315 | No | n/a |

| Net Profit Margin (LTM) | -4.081 | 0.000 | Yes | 2.0% |

| Total Equity | -1.186 | 0.236 | No | n/a |

| Enterprise Value | -0.156 | 0.876 | No | n/a |

| Market-to-Book Ratio | 2.943 | 0.003 | Yes | 1.3% |

Table 8 shows only Net Profit Margin (LTM) and Market-to-Book Value Ratio result in t-Stats that are significant at the 95% level of confidence or better. Importantly, none of the six other firm attributes used in the Pluris calculator has a statistically significant bearing that helps to explain the variation in the observed discounts after controlling for the potential influence of the other parameters. Based on this linear regression, the six other parameters are therefore not reliable for predicting the restricted stock discounts observed by Pluris, or for estimating DLOM using the Pluris methodology.

Although it is appropriate to conclude that the Net Profit Margin and Market-to-Book Value Ratio variables may influence investors regarding the appropriate discount for a restricted stock transaction, these variables exhibit very low R-squares of correlation with the observed discounts within the 1,137-transaction dataset—2.0% for the Net Profit Margin variable and 1.3% for the Market-to-Book Value Ratio variable as shown in Table 8. These values leave virtually all of the variation in the observed discounts unexplained. Coupled with exceptionally flat trend lines as shown in Table 6-A, we conclude that even these variables are unreliable predictors of the restricted stock discounts observed by Pluris.[8]

We also considered whether price volatility influences the restricted stock discounts observed by Pluris. We performed a regression of the twelve-month price volatility reported by Pluris against the observed discounts for the 1,137-transaction analysis reported in Table 8. This test yielded a t-Stat of 2.403 and a P-value of 0.016, which is a statistically significant result. But, the R-square of the regression remained a tiny 0.5%, leaving virtually all of the fluctuation in the observed discounts unexplained.

Section VI

Using the Pluris Database for Benchmarking

Perhaps concerns regarding the small correlation between observed restricted stock discounts and the underlying financial metrics of the restricted stock issuer can be overcome by directly benchmarking a discount against one or more carefully selected transactions deemed to be comparable to the valuation subject. (Such an approach would not employ the Pluris calculator.) We now explore whether benchmarking against the restricted stocks comprising the Pluris transaction database is reliable.

The Pluris DLOM Database is Thinly Populated Over Time and Industries

The limited number of transactions in the Pluris DLOM Database makes the identification of appropriate benchmarks unlikely for most valuations. Although the Version 4.2.0 of the database consists of 3,362 restricted stock transactions, as noted in Section II, there are only 2,085 unique issuers. Even the larger number is likely to be insufficient for reasonable benchmarking. The transactions comprising the database stretch over a period beginning January 2, 2001, and ending June 30, 2014—a period of 4,928 days. On average, there is less than one transaction per database day. Even if the number of days is reduced to the approximate number of stock-trading days during the database period (about 3,375 days), there are only 1.1 transactions per day on average. Table 9 shows the distribution of transaction occurrences by day for the 3,632 transactions in the database.

| Table 9 | ||||

| All Database Days | Stock Trading Days | |||

| Number of Occurrences | Number of Days | Percent | Number of Days | Percent |

| 0 | 2,843 | 57.69% | 1,290 | 38.23% |

| 1 | 1,151 | 23.36% | 1,151 | 34.10% |

| 2 | 554 | 11.24% | 554 | 16.41% |

| 3 | 245 | 4.97% | 245 | 7.26% |

| 4 | 77 | 1.56% | 77 | 2.28% |

| 5 | 34 | 0.70% | 34 | 1.0% |

| 6 | 12 | 0.24% | 12 | 0.36% |

| 7 | 9 | 0.18% | 9 | 0.27% |

| 8 | 2 | 0.04% | 2 | 0.06% |

| 9 | ____1 | __0.02% | ____1 | __0.03% |

| Total Days | 4,928 | 100.00% | 3,375 | 100.00% |

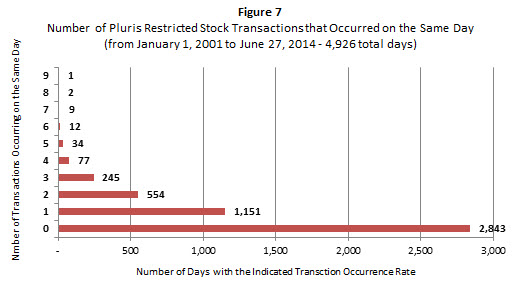

Figure 7 shows the number of transactions in the database that occurred on the same day. One day—December 30, 2005—had nine stock transactions. Two days had eight transactions. Nine days had seven transactions. And so forth. No transactions are reported for 2,843 days in the 2001 to 2014 data range.

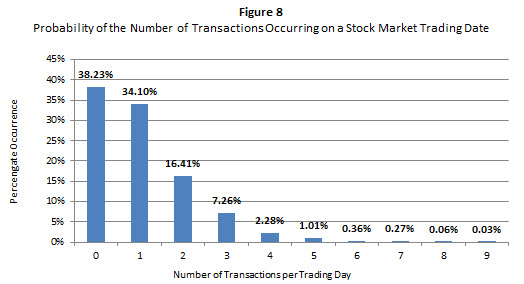

Table 9 shows the percentage distribution of transactions in the Pluris database. About 58% of the potential valuation days have no transactional data. Table 9 also shows that about 38% of all trading days have no transactional data. Figure 8 presents the distribution of transactions based on stock market trading days.

Identification of Pluris Transactions Comparable to a Valuation Subject is Challenging

One problem represented by a small volume of transaction data is the likelihood that none or only one transaction is reported for a particular valuation date. Another problem is the reporting lag that occurs with the database. Before a transaction can be added to the database, it must be reported by the issuer and then picked up by Pluris. This imposes a limitation on data availability for contemporary valuations. But, it may be that practitioners can compensate for the problems of too-limited of transaction data by selecting transactions that occurred over a longer period than the one day represented by the valuation date. Of course, the longer the time span required to capture the number of transactions that a practitioner may deem sufficient, the more risk there is that economic circumstances may have changed during the span.

Lack of comparability of the reported transactions to a valuation subject is another problem associated with too little transactional data. The fewer the number of transactions, the more work the analyst must do to establish comparability. It is problematic that nothing is known about how the transaction negotiators actually priced their restricted stocks. Accordingly, there is a significant risk of appraisers failing to consider the same things considered by the stock negotiators. Unlike the public marketplace for which it can be presumed that investors’ decisions are based on publicly available information, restricted stock pricing is a matter of private negotiation. It is speculation to assume that their motivations align with any particular piece of information selected for benchmarking. It is further problematic that narrowing transaction selection to seek comparability inhibits the ability to find any potentially relevant transaction to use as a benchmark for a valuation subject.

The 3,632 transactions in the Pluris database cover 377 four-digit SIC codes. However, the official SIC system identifies at least 1,005 four-digit industries.[9] The database therefore covers only 37.5% of the potential industry classifications. The database is also highly concentrated. More than half of all transactions in the database are comprised of just 17 four-digit codes—less than two percent of the possible classifications. These 17 are shown in Table 10. Furthermore, more than 25% of all transactions in the database fall into just four SIC codes: 2834, 7372, 8731, and 1311. If a practitioner is valuing a business that operates in one of these four industries, then the chance of finding one or more reasonably comparable transactions is enhanced. Identifying a satisfactory comparable transaction involving one of the 13 remaining SIC codes comprising the group of 17 most frequently occurring codes would be much more difficult. It is particularly speculative to benchmark DLOM for one industry using the privately negotiated discount for an entirely different industry.

| Table 10 | |||

| Industry | SIC Code | Frequency of Occurrence | Percent of Pluris Transactions |

| Pharmaceutical Preparations | 2834 | 368 | 10.1% |

| Prepackaged Software | 7372 | 232 | 6.4% |

| Commercial Physical and Biological Research | 8731 | 187 | 5.1% |

| Crude Petroleum and Natural Gas | 1311 | 143 | 3.9% |

| Subtotal | 25.5% | ||

| Surgical and Medical Instruments and Apparatus | 3841 | 113 | 3.1% |

| Gold Ores | 1041 | 94 | 2.6% |

| State Commercial Banks | 6022 | 94 | 2.6% |

| Oil and Gas Field Exploration Services | 1382 | 76 | 2.1% |

| Information Retrieval Services | 7375 | 73 | 2.0% |

| Biological Products, except Diagnostic Substances | 2836 | 68 | 1.9% |

| Electromedical and Electrotherapeutic Apparatus | 3845 | 67 | 1.8% |

| Business Services, not elsewhere classified | 7389 | 65 | 1.8% |

| Semiconductors and Related Devices | 3674 | 64 | 1.8% |

| Computer Integrated Systems Design | 7373 | 59 | 1.6% |

| In Vitro and In Vivo Diagnostic Substances | 2835 | 51 | 1.4% |

| National Commercial Banks | 6021 | 42 | 1.2% |

| Telephone Communications, except Radiotelephone | 4813 | 37 | 1.0% |

| The Above 17 Four-Digit SIC Codes | 1,833 | 50.5% | |

| The 360 Other Four-Digit SIC Codes | 1,799 | 49.5% | |

| Total Pluris Database | 3,632 | 100.0% | |

The 17 four-digit codes represent 1,833 restricted stock transactions, ranging in count from 368 transactions involving the pharmaceutical preparations industry to 37 transactions involving the non-radio telephone communications industry. But industries falling outside of the top-17 are represented by just five transactions on average; and 119 of these transactions have unique SIC codes within the database. Coupled with the fact that the database covers a 13.5-year period, it may be impossible to identify time-relevant transactions in the four-digit industry classification of a valuation subject. Adding other elements of comparability to the benchmarking process greatly exacerbates the task.

When practitioners are faced with an impossible task at an initially desired level of detail, they often zoom out their analyses to base conclusions on a broader analytical view. With that in mind we analyzed the industry distribution of the Pluris DLOM Database on a two-digit SIC code basis.[10] See Table 11. We found that just eight broad industries account for 2,546 (over 70%) of the 3,632 transactions in the database. The remaining 1,086 transactions are spread over 61 broad industries—an average of less than 18 transactions per industry, and about one per nine months of time range in the database.

| Table 11 | |||

| Industry | SIC Code | Occurrences | Percent of Transactions |

| Chemicals and Allied Products | 28 | 591 | 16.3% |

| Business Services | 73 | 574 | 15.8% |

| Measuring, Analyzing, And Controlling Instruments | 38 | 298 | 8.2% |

| Oil and Gas Extraction | 13 | 262 | 7.2% |

| Electrical and Other Electrical Equipment and Components except Computer Equipment | 36 | 235 | 6.5% |

| Engineering, Accounting, Research, Management, and Related Services | 87 | 214 | 5.9% |

| Metal Mining | 10 | 198 | 5.5% |

| Depository Institutions | 60 | 174 | 4.8% |

| The Above 8 Two-Digit SIC Codes | 2,546 | 70.1% | |

| The 61 Other Two-Digit SIC Codes | 1,086 | 29.9% | |

| Total Pluris Database | 3,632 | 100.0% | |

Assuming a practitioner wanted to identify a single benchmark transaction from the four-digit SIC code with the most transactions (Pharmaceutical Preparations, code 2834) for a single generic database day, the probability of a successful outcome would be about 4.3%.[11] This, of course assumes an even spread of the database transactions over time. Assuming the practitioner wanted to benchmark against a single generic stock trading day, the probability of finding a benchmark would increase to about 6.2%.[12] This is because there are only about 3,375 stock trading over the 13.5-year time period of the database, and assumes that all database transactions are spread evenly over time and occurred on stock trading days. Assuming, however, that two or more transactions in that four-digit industry classification were desired, the 6.2% probability would fall to about 2.8%.[13] This is because about 72.3% of potential stock trading days have zero or only one transaction occurrence. See Table 9. Obviously, the fewer transactions there are for a particular industry in the database, and the more daily occurrences desired by a practitioner, the less likely it is that a potentially comparable transaction will be found.

The problem of lack of comparability becomes much more pronounced if a practitioner sets out to benchmark against a particular company within an industry. Few companies within an industry issue restricted stocks, and those that do may not be comparable to other industry participants (including the valuation subject). Substantial professional judgment is required to justify comparability.

Examining the stock issuers that comprise the Pluris DLOM Database reveals a total of 2,085 issuers, of which 1,271 (61%) have one restricted stock transaction reported. These 1,271 single-transaction issuers account for 35% of the transactions in the database. The other 814 issuers (39%) have multiple stock transactions reported, accounting for 2,261 of the stock transactions in the database. Thus, 39% of the issuers account for 65% of the transactions reported in the database, which give these issuers a dramatically disproportionate influence on reported values. Table 12 summarizes the occurrences of restricted stock transactions by stock issuer.

| Table 12 | ||||

| Number of Transactions | Number of Issuers | Percentage of Issuers | Number of Issues | Percentage of Issue |

| 15 | 1 | 0.0% | 15 | 0.4% |

| 11 | 1 | 0.0% | 11 | 0.3% |

| 10 | 1 | 0.0% | 10 | 0.3% |

| 9 | 3 | 0.1% | 27 | 0.7% |

| 8 | 6 | 0.3% | 48 | 1.3% |

| 7 | 10 | 0.5% | 70 | 1.9% |

| 6 | 27 | 1.3% | 162 | 4.5% |

| 5 | 44 | 2.1% | 220 | 6.1% |

| 4 | 88 | 4.2% | 352 | 9.7% |

| 3 | 180 | 8.6% | 540 | 14.9% |

| 2 | 453 | 21.7% | 906 | 24.9% |

| 814 | 39.0% | 2,361 | 65.0% | |

| 1 | 1,271 | 61.0% | 1,271 | 35.0% |

| 2,085 | 100.0% | 3,632 | 100.0% | |

The limited number of issuers and disproportionate number of stock issues per issuer pose two problems for practitioners. First, transaction concentration among a subset of issuers makes the likelihood of matching a preferred issuer with a particular valuation date even more remote than discussed above. Second, the average of the discounts observed by Pluris is disproportionately influenced by a few active restricted stock issuers. These circumstances undermine the usefulness of basing DLOM conclusions directly benchmarked transactions in the Pluris database.

[1] “Discount for Lack of Marketability Job Aid for IRS Valuation Professionals – September 25, 2009,” p 15.

[2] Ibid, p 17.

[3] https://www.sec.gov/rules/final/2007/33-8869.pdf

[4] We also found that the R-squares of correlation of the observed discounts and the Pluris metrics called “Effective Purchase Price per Share” and “Purchase Price” improved dramatically using logarithmic regression. These metrics are not, however, useful for DLOM estimation since the observed restricted stock discounts derive directly from the publicly traded and restricted stock prices.

[5] Pluris reports zero or negative market-to-book value ratios or zero or negative total assets for some transactions. A logarithmic value cannot be calculated for non-positive numbers. Hence, some logarithmic values are shown as “N/A.” A smaller dataset of transactions would eliminate this shortcoming, but we did not perform that particular analysis. However, see Table 8-B, which reports the results of a multivariate regression analysis of 713 transactions on a natural logarithm basis.

[6] Those parameters are: total assets, revenues; EBITDA; net income; net profit margin; total equity; enterprise value; and market value-to-book value ratio.

[7] Based on single-parameter regression.

[8] We considered Net Profit Margin and Market-to-Book Value Ratio as a two-parameter predictor of the observed discounts. This grouping increased the R-square of correlation to 2.9%.

[9] http://siccode.com/en/pages/what-is-a-sic-code

[10] As of this writing, there are 83 two-digit codes in the SIC system. Fourteen SIC codes are not represented in Version 4.2.0 if the Pluris DLOM Database.

[11] That is 10.1% per Table 10 times 42.31% of the database days that have at least one transaction occurrence.

[12] That is 10.1% per Table 10 times 61.75% of the database stock trading days that have at least one transaction occurrence.

[13] That is 10.1% per Table 10 times 27.67% of the database stock trading days that have at least two transaction occurrences.

Marc Vianello, CPA, ABV, CFF is the Managing Member of Vianello Forensic Consulting, LLC. He is the inventor of the concept of probability-based discount for lack of marketability and is the developer of the VFC DLOM Calculator. Mr. Vianello has written extensively regarding DLOM, the time periods needed to sell privately held businesses, the specific company risks associated with abnormal debt levels, and adjusting cost of capital for prevailing market conditions. Mr. Vianello has testified extensively in Federal and State courts around the country in complex, high dollar financial litigation of all types, including valuation, intellectual property, breach of contract, and shareholder disputes, among others.

Mr. Vianello can be reached at (913) 432-1331 or by e-mail to vianello@vianello.biz.