The Asset-Based Valuation Approach

Asset Accumulation Illustrative Example

The previous discussion in this series, part III, described the typical methodology and application of the asset accumulation (AA) method of the asset-based business valuation approach. This discussion presents an illustrative example of an AA method business valuation analysis.

[su_pullquote align=”right”]Resources:

10 Common Errors in Valuation and How to Address These Issues

The Three Valuation Approaches—Challenges and Issues

Business Valuation Accelerator Clinic 2: Asset Approach

Business Valuation Certification and Training Center

Advanced Valuation: Applications and Models Workshop

[/su_pullquote]

Introduction

The previous discussion in this series, part III, described the typical methodology and application of the asset accumulation (AA) method of the asset-based business valuation approach. This discussion presents an illustrative example of an AA method business valuation analysis.

Illustrative Example Fact Set

An analyst has been retained to estimate the fair market value of the total equity of Alpha Client Company (Alpha) as of December 31, 2016. Let’s assume that Alpha is a construction contractor company. The analyst decided to use the Asset-based Approach and the AA method.

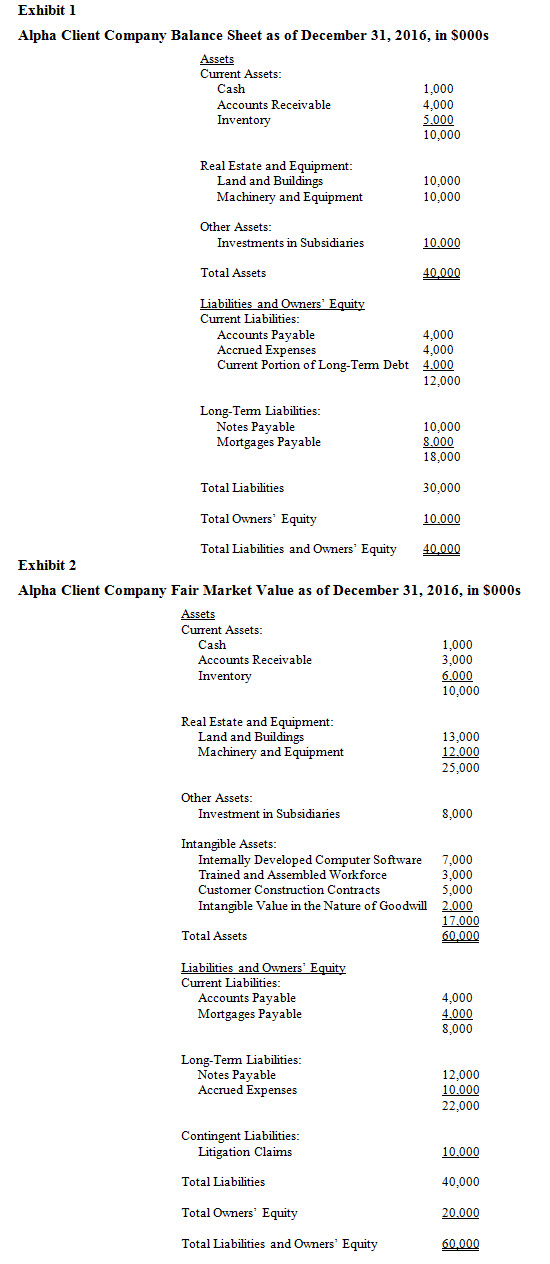

The Alpha GAAP basis balance sheet for December 31, 2016, is presented in Exhibit 1. On this GAAP basis balance sheet, tangible assets are recorded at historical cost less depreciation. No internally developed intangible assets are recorded on this balance sheet.

The analyst documented the AA method valuation analysis in Exhibit 2.

First, the analyst considered all the Alpha current asset accounts. Based on an analysis of the aged accounts receivable balance, the analyst revalued this account from $4,000 to $3,000. (All the figures are presented in $000s.)  In addition, the analyst restated the inventory balance from the $5,000 LIFO accounting convention to a $6,000 replacement cost value.

Second, the analyst considered all the Alpha real estate and TPP. The analyst used the Cost Approach and the RCNLD method to value both the real estate and the TPP. Based on the RCNLD analysis, the analyst estimated the fair market value of the real estate to be $13,000—compared to a historical cost less depreciation (HCLD) of $10,000. And, based on the RCNLD analysis, the analyst estimated the fair market value of the TPP to be $12,000—compared to an HCLD of $10,000.

Third, the analyst separately valued the Alpha unconsolidated ownership interest in its subsidiary, Beta Roadbuilders (Beta). The analyst used the Market Approach and the guideline publicly traded company (GPTC) method to value the Beta total equity at $20,000. Alpha owns 40 percent of the Beta equity. Accordingly, the analyst valued the Alpha ownership interest at $8,000. This $8,000 fair market value estimate represents a value decrement compared to the $10,000 carrying value of this investment.

Fourth, the analyst performed a comprehensive due diligence analysis to identify all the IRP and IPP. This due diligence revealed the following intangible assets: internally developed computer software, customer contracts (for, let’s say, construction projects in progress), and a trained and assembled workforce.

Alpha uses its internally developed and proprietary computer software for all its administrative and project management functions. The analyst used the Cost Approach and the RCNLD method to estimate a $7,000 fair market value for this intangible asset.

Over the years, Alpha has assembled an executive, technical, and operations staff of considerable experience and expertise. This assembled workforce is a valuable intangible asset. The analyst used the Cost Approach and the RCNLD method to estimate the $3,000 cost to recreate a workforce of comparable experience and expertise.

At any point in time, Alpha has several dozen customer construction projects in various stages of completion. The analyst used the Income Approach and the MEEM to value the customer contracts. Working with management, the analyst projected the remaining profit (measured as net cash flow) to be earned on each contract. The analyst present valued that future cash flow projection at the Alpha 10 percent weighted average cost of capital (WACC). This analysis indicated a $5,000 fair market value for this customer-related intangible asset.

Finally, with regard to intangible assets, the analyst used the Income Approach and the CEEM to estimate the fair market value of the goodwill. At this point in the analysis, the analyst had concluded the fair market value of the working capital assets (current assets minus current liabilities), real estate and TPP, and identifiable intangible assets. The analyst assigned a fair rate of return (based on the WACC) to this total asset value to conclude the Alpha required earnings. The analyst compared the actual earnings (measured as EBIT) to this required earnings level. Based on this comparison, Alpha was generating a small amount of excess earnings. The analyst capitalized these excess earnings as an annuity in perpetuity to conclude a $2,000 fair market value for the goodwill.

Fifth, the analyst moved from the asset side of the balance sheet to the liability side of the balance sheet. The analyst next considered the current liability accounts. The analyst concluded that the recorded balances for accounts payable ($4,000) and accrued expenses ($4,000) indicated the fair market values of those accounts. The analyst included the current portion of long-term debt in the valuation of the noncurrent liabilities.

Sixth, the analyst considered notes payable and mortgages payable. The analyst concluded that the embedded interest rates on these debt instruments were sufficiently close to current market interest rates so that no liability revaluation was required. The analyst included the current portion of the long-term debt in the noncurrent liability account.

Seventh, the analyst performed additional due diligence procedures to identify and value any contingent liabilities. The analyst identified several litigation claims against Alpha; all related to previous construction projects. The analyst worked with both management and legal counsel to estimate expected future claim payment amounts, including probabilities and timing of payments. The analyst calculated a present value of the mathematical (probability weighted) expectation of future claims payments of $10,000. The analyst recorded this $10,000 contingent liability value on the valuation balance sheet.

Eighth, the analyst calculates the net asset value by reference to the Exhibit 2 fair market value-basis balance sheet. At this point in the valuation, the analyst has concluded the fair market value of all the Alpha assets (both tangible and intangible) of $60,000. At this point in the valuation, the analyst has concluded the fair market value of all the Alpha liabilities (both recorded and contingent) of $40,000. The difference between these two value indications (i.e., total asset value minus total liability value) is the fair market value of the total equity.

As indicated in Exhibit 2, and based on this illustrative AA method analysis, the analyst concluded $20,000 as the fair market value of the Alpha total equity.

Summary

The Asset-based Approach is a generally accepted business valuation approach. And, the AA method is a generally accepted Asset-based Approach valuation method. The AA method is applicable to the valuation of asset-intensive companies, whether the company is tangible-asset-intensive or intangible-asset-intensive.

The AA method is applicable for business valuations performed for transaction, taxation, or controversy-related purposes. That is because this method not only provides a business value conclusion, it also identifies each tangible asset and intangible asset component of the total business value.

This discussion presented an illustrative example of the application of the AA method to value the hypothetical Alpha Client Company. The next discussion in this series, part V, describes the methodology for the adjusted net asset value (ANAV) method of the Asset-based Approach.

Robert Reilly, CPA, ASA, ABV, CVA, CFF, CMA, CBA, is a managing director of Willamette Management Associates based in Chicago. His practice includes business valuation, forensic analysis, and financial opinion services. Throughout his notable career, Mr. Reilly has performed a diverse assortment of valuation and economic analyses for an array of varying purposes.

Mr. Reilly is a prolific writer and thought leader who can be reached at (773) 399-4318, or by e-mail to rfreilly@willamette.com.