Castle of Dreams

or a Ball and Chain

In this article, the author discusses his views on how to value a funeral home.

Location, location, location…the old mantra for real estate value still may hold true for a funeral home business.  However, ensuring the cash flow is apportioned in the proper way can be just as critical if not more than being in the right place. Given the challenges to grow revenue and control other operating costs in this industry makes managing the facility’s financial health an ever-increasing important part of a funeral home owner’s plan going forward.

Location, location, location…the old mantra for real estate value still may hold true for a funeral home business.  However, ensuring the cash flow is apportioned in the proper way can be just as critical if not more than being in the right place. Given the challenges to grow revenue and control other operating costs in this industry makes managing the facility’s financial health an ever-increasing important part of a funeral home owner’s plan going forward.

The benchmark for years has been to target net rent expense (i.e., the dollars paid to use the space, excluding taxes, utilities, and other related operating expenses) to be between 6% and 10% of revenue. This may be a great place to start; however, consider the funeral home business that embraces a standard service fee approach for the basic death care service (whether it is a cremation or not). Let’s say they are successful at implementing such a pricing model and are able to capture more revenue per call than before—do they need to spend any more on the rent expense line as their revenue increases? Determining the right rent for any facility is a challenge—financially, many operators use the mortgage payment as a proxy for their rent. So, they are covering the basic “cost” of investing in the facility although this may be totally out of synch with what market-based rent is reasonable. Since most funeral home owners own their facilities in the same entity or a separate entity or even personally, rent is rarely, if ever, published. As a result, real estate appraisers tend to rely on finding comparable sales (can be few and far between as well) and the Cost Approach. In the end, once a value has been placed on the facility (including the land), there is an implied net rent that supports that value, although it may not be stated or disclosed in the real estate appraisal report. The rubber meets the road when that implied rent is disclosed or developed outside the real estate appraisal or estimate and making the business pay its own way.

Many times, when I do that analysis, it turns out that the funeral home business can ill afford to pay that level of rent. So, are the facilities over valued because the business is not generating enough income to make a good return (and increasing value) or is the business under-performing? Many real estate appraisers I have talked to suggest that the business is under-performing. In other cases, the facilities are well appointed with the latest and greatest materials; no expense was spared in completing the finish either. Truly a great statement of presence in and for the communities that these businesses have become an integral part of over the years. The question is, at what cost?

This situation is not unique to the death care industry. Other real estate centered businesses face the same conundrum—how do you balance the facility and operating aspects of the business so you really understand how much the business is worth? Absent this insight, how can a plan be developed that meets your client’s goals?

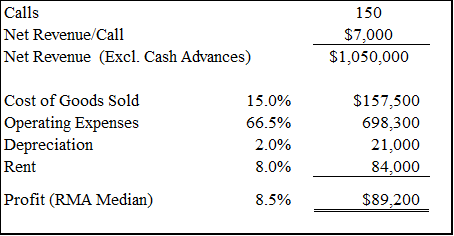

Okay, let’s look at an example. Take the ABC Funeral Home—a 30-year-old, well established firm; 150 service call operation; runs efficiently; owner/funeral director all in compensation is fair; replaces vehicles and updates furnishings on a regular schedule; pays rent that mirrors the principal and interest payments with all other expenses paid directly by the funeral home; reported profitability in line with RMA data. The facility is owned by the owner/funeral director albeit in a separate entity (the issue is the same if the facility is owned by the same entity). The facility has received awards from the town and investment in amenities continues; the owner is proud of what has been built. This is what the basic financial results look like:

A recent appraisal of the facility put the fair market value at $1,750,000—the owner was beaming; the investment has paid off…or has it? Of all funeral home facility appraisals I have seen, only one used an Income Approach (i.e., a market rent analysis) to determine the value; they tend to use a combination of cost and market-based approaches. In this case, the $1,750,000 value seemed to fit the data; let’s look at that a bit more though. While the facility appraisal did not consider an income-based approach, it is safe to say that there at least must be some level of rent implicit in the conclusion that supports such a value, otherwise there would be a disconnect from the market data used. Make sense? I think so. Based on analysis of real estate returns (www.realtyrates.com) and discussions with real estate professionals, an appropriate rent for this facility, based on the value determined by the real estate appraiser, would be in the range of $149,000. Wait—but that is $65,000 more than what the funeral home is paying! And on top of that, it is 14% of revenue—well above the benchmarks that have been used for years!

If this rent figure is used as market rent for the ABC Funeral Home, cash flow decreases and so will the value—let’s digress for a moment and get back to the basics of value.  The value of an investment is a function of the expected cash flow, the expected return, and the risk associated with receiving the cash flow as expected. The principal and interest payments made for the purchasing of and improvements in the facility are based on bank return requirements and the cost of procuring the assets—financial commodity returns. When these amounts are used as proxies for rent there is a disconnect—the facility is an illiquid asset and has several other risks associated with ownership; high risk means higher returns, the rent generally needs to be higher than the loan payment on the facility to compensate for the higher return expectations. Consider the operating business—an even riskier investment than the facility itself. The facility value is perhaps easier to estimate, and investment can be seen almost immediately—a new roof, a tile floor, a new chapel—while investment in the business is not so visible and may take some time to realize the impact on value. In this case, adjusting for rent that supports the facility value (is the funeral home under-valued or is the facility over-valued) the total value pie does not change—where does the cash flow go?

The premise for this anecdote is that a strategic buyer is not making the decision to buy…if that is the case, strange things can happen—that is a story for another time. Although the previous example is fictional, it does illustrate similar patterns I have seen in many firms today.

There are many facilities that are worthy of praise in architectural design and finish—the question is at what cost? If the overall goal is to build value in the enterprise (the funeral home operation and the facility) there must be a balance of the investment and expected returns for each. If the decision to disproportionally invest more in the facility is a conscious one, then so be it. If it is not—it will be a very sobering reality. I have sat across the table from many funeral home owners and delivered such a sobering message—the value of the funeral home is not in balance with their facility. Recall that this issue is common across a variety of real estate centric operating businesses. How do your clients stack up?

Steven Egna is a Senior Advisor at Valuation Resource Group, LLC, an East Greenbush, New York M&A Advisory Services valuation and litigation support firm. Mr. Egna has over 30 years of diversified financial leadership and management experience specializing in transition planning and valuation analysis of all sorts. He brings a practical, hands-on approach to all of his work. Mr. Egna is a Certified Business Appraiser™ (CBA™) accredited by the Institute of Business Appraisers™; a Certified Valuation Analyst® (CVA®) and Accredited in Business Appraisal Review™ (ABAR™) accredited by the National Association of Certified Valuators and Analysts®; he is also a Certified Merger and Acquisition Advisor (CM&AA®) accredited by the Alliance of Merger & Acquisition Advisors®.

Mr. Egna can be contacted at (518) 479-1008 or by e-mail to segna@valuationresource.com.