Lease Accounting 2018 Update

Overview‚ÄĒPutting it on the Balance Sheet

In February 2016, the FASB issued Accounting Standards Update (ASU) 2016-02, Leases (Topic 842). The existing standard has been criticized because its bright line classification criteria enabled entities to structure leases in such a way as to avoid putting them on the balance sheet. The new standard aims to improve and simplify the financial reporting for leases and create a model that provides for faithful representation of leasing transactions for both lessees and lessors. This article summarizes the change.

[su_pullquote align=”right”]Resources:

Impact of Leases Standard on Business Valuation Metrics

[/su_pullquote]

In February 2016, the FASB issued Accounting Standards Update (ASU) 2016-02, Leases (Topic 842).  The existing standard has been criticized because its bright-line classification criteria enabled entities to structure leases in such a way as to avoid putting them on the balance sheet.  The new standard aims to improve and simplify the financial reporting for leases and create a model that provides for faithful representation of leasing transactions for both lessees and lessors.  To accomplish this, the standard requires:

- Lessees to recognize lease assets and lease liabilities on the balance sheet; and

- Lessees and lessors to disclose significant information about lease transactions.

Valuation experts should be mindful of the potential impact of the new standard on equity valuation and metrics used in valuations.

Lessors

The focus of the FASB was specifically to improve the guidance for operating leases in the financial statements of lessees.  Therefore, the Board decided not to make fundamental changes to lessor accounting.  However, some changes were made to lessor guidance to conform and align it to the new guidance for lessees and the new revenue recognition guidance, Revenue from Contracts with Customers.  The new lease standard is aligned with the revenue recognition standard.

Lessor accounting remains substantially unchanged.  However, leveraged lease classification is eliminated.

Lessees

Lessees will recognize all leases, other than short-term leases, on the balance sheet.  Lessees will recognize a right-of-use (ROU) asset and a lease liability for those leases.  This may significantly increase reported assets and liabilities for some lessees for some leases.  For the first time, long-term operating leases will appear on the balance sheet as non-debt liabilities.  The new guidance offers some relief by exempting leases with terms of less than 12 months.  Consequently, some lessees may request new or renewal renewed leases of terms less than 12 months.

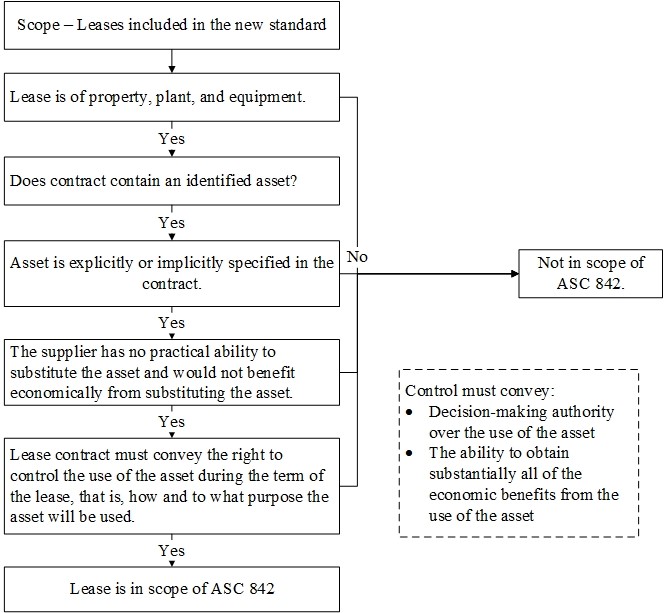

The critical determination is whether a contract contains a lease.  Lessees will classify leases as either operating or financing leases.  Under current GAAP, the classification of a lease determines whether or not it is on the balance sheet.  Under the new standard, because all leases will generally be on the balance sheet, the classification determines how entities measure and present lease income and expenses and cash flows.  A lease is present in the contract if the contract includes:

- An identified asset, that is:

- The asset is explicitly or implicitly specified.

- The supplier has no practical ability to substitute or would not economically benefit from substituting.

- The right to control the use of the asset during the term of the lease, that is:

- The lessee has decision-making authority over the use of the asset.

- The lessee has the ability to obtain substantially all economic benefit from the use of the asset.

Below is a flowchart of the decision-making process for determining if a lease is present in the contract.

Effective Dates and Transition

The new standard is effective for public companies in calendar year 2019 and for all others in calendar year 2020.  Bear in mind that early adoption is allowed, and some entities may want to take advantage of the synergies between the new revenue recognition standard and the lease standard by early adopting.  The leases standard provides for a transition approach using the modified retrospective transition approach.  The approach must be applied to all comparative periods presented.

Practical Expedients

The standard setters provide practical expedients to ease the transition.  The expedients must be applied consistently to all leases.  The expedients include:

- An entity may elect not to reassess:

- Whether expired or existing contracts contain leases under the new definition of a lease.

- Lease classification for expired or existing leases.

- Whether previously capitalized initial direct costs would qualify for capitalization under the new standard.

(The above expedients must be elected as a package at the date of adoption.)

- Use of hindsight when determining the lease term and in assessing impairment of right-to-use assets.

- Making an accounting policy election by class of underlying asset not to separate lease components from non-lease components. Entities making this election account for the non-lease components and the lease components as a single lease component.

To address concerns that it is costly to determine a discount rate, nonpublic entities may elect an accounting policy to use a risk-free rate to measure liabilities.

Significant Changes from Current U.S. GAAP

Collectibility Uncertainties

Under current GAAP, a lease with uncertainties related to collectibility cannot be classified as a sales-type lease.  This changes with the new standard.  Where collectibility of the lease payments plus any amount necessary to satisfy a lessee residual value guarantee is not probable for a sales-type, the entity accounts for the lease as follows:

- Lease payments received are recognized as a deposit liability rather than income.

- Generally, the underlying asset is not derecognized until collectibility of the remaining amounts becomes probable.

For a lease that otherwise would be a direct financing lease, collectibility uncertainties require that the lease be classified as an operating lease.

Significant Variable Lease Payments

The new standard permits leases with predominantly variable payments to be classified as sale-type or direct financing leases.

Definition of Initial Direct Costs

The new standard’s definition is narrower than under current GAAP.  The new definition excludes:

- Legal fees

- Costs of evaluating the prospective lessee’s financial condition

- Costs of negotiating lease terms and conditions

- General overhead expenses

Those expenses must be expensed as incurred.  This change may have the effect of some lessors recognizing more expenses before the lease begins, and it may create higher margins on lease income earned over the lease term.

Allocation of Consideration to Lease and Non-lease Components

The new standard only applies to accounting for leases.  So, if an entity has a lease that has a non-lease component, like a service component, that component is accounted for under the new revenue recognition standard.  (Also see Practical Expedients section above.)

The lessor may have executory costs to cover ownership of the underlying asset, like property taxes or insurance.  Those costs do not represent payment for a good or service and under current GAAP are excluded from lease accounting.  Under the new lease standard, such costs are allocated to the lease and non-lease components in the same manner as all other payments in the contract.

New Disclosures

The standard significantly expands qualitative and quantitative disclosures for both lessees and lessors.  Valuation experts may want to look to an entity’s lease disclosures to better understand the changes.

Sale-Leaseback Accounting

Under current GAAP, a failed sale for the seller-lessee is not accounted for as a failed purchase by the buyer-lessor.  The new standard requires buyer-lessors to evaluate whether they have purchased the underlying asset based on the transfer of control guidance in the new revenue recognition standard.  The buyer-lessor must also account for a failed purchase as a financing arrangement.

The new standard brings sale-leaseback transactions onto the balance sheet by requiring seller-lessees to recognize a right-of-use asset and a lease liability for the leaseback.

If the transaction does not meet the qualifications for sale under the revenue recognition guidance, the seller-lessee accounts for it as a financing transaction.  Purchase options preclude sale accounting unless:

- The strike price of the repurchase option is the fair value of the asset at the option exercise date, and

- Assets that are substantially the same as the underlying asset are readily available in the marketplace.

If the sale-leaseback transaction qualifies as a sale of the underlying asset, the seller-lessee recognizes the entire gain from the sale at the time of sale as opposed to recognition over the leaseback terms.  The gain is the difference between the selling price and the carrying value of the amount of the underlying asset.  The sale-leaseback guidance is the same for all assets, including real estate.

Build-to-Suit Lease Guidance Eliminated

Build-to-suit lease guidance is eliminated by the new standard.  The standard states that a lessee is the owner for accounting purposes of an asset under construction if it controls the asset before the lease commencement date.  The rules for determining control of an asset will likely result in fewer instances where the lessee is deemed the accounting owner of an asset during the construction period.  Under current GAAP, build-to-suit assets and liabilities may have remained in the balance sheet after the end of the construction period.  When those entities transition to the new guidance, many will be able to derecognize those assets.

This article is an update to FASB Issues New Standard for Lease Accounting published in QuickRead March 30, 2016.

Joanne Flood, MBA, CPA, (Rockville Centre, NY) has accounting experience within both a Big 4 international firm and a small firm. She has worked as a senior manager in the AICPA’s Professional Development group. Ms. Flood received her MBA in Accounting Summa Cum Laude from Adelphi University. She has written and produced training materials in a wide variety of media, including print, video, and audio, and pioneered the AICPA’s e-learning product line.

Ms. Flood can be contacted at (516) 536-4374 or by e-mail to jmflood3@optonline.net.