Application of the Sales Projection Method

In Measuring Trustee Breach of Fiduciary Duty Damages (Part II of II)

The second part of this article focuses on the methodologies employed to quantify the economic damages when a fiduciary breach is claimed.

[su_pullquote align=”right”]Resources:

[su_pullquote align=”right”]Resources:

10 Common Errors in Lost Profits Calculations and Business Damages

Taking a Deeper Dive into the Lost Profits “But-For” World

[/su_pullquote]

In the first part of this two-part article, the author discussed how a breach of fiduciary duty claim may arise and how counsel and expert should work together. The first article also set forth the underlying facts that are employed to calculate damages under the various methodologies.

Measuring Economic Damages in a Trustee Breach of Fiduciary Duty Tort Claim

There are several generally accepted methods to measure economic damages in a trustee breach of fiduciary duty tort claim. While the application of these methods is more commonly used to quantify lost profits economic damages for business operations, they can also be tailored to effectively analyze and quantify investment management economic damages as a result of a trustee breach of fiduciary duty.

The underlying theory of lost profits damages, as it relates to business operations, is that “but-for” the actions of the defendant (or but-for the damaging event) the plaintiff would have experienced a higher level of revenue and profits. Considering the example presented in the previous section, this method can be applied to trustee breach of fiduciary duty tort claims where, but-for the actions of the trustee, the beneficiary would have experienced (received) an appropriate level of trust distributions.

In addition to the Sales Projection Method (referred to herein as the “Projection” Method), the following list presents the three other generally accepted methods to quantify lost profits and lost revenue for business operations:

- Before-and-After Method

- Yardstick Method

- Market Model Method

As mentioned, while initially constructed to analyze lost profits and lost revenue for business operations, the above methods, in addition to the Projection Method, may be used to quantify economic damages attributable to trustee breach of fiduciary duty.

Before-and-After Method

As presented in The Comprehensive Guide to Lost Profits and Other Commercial Damages, the Before-and-After Method is described as follows:

The Before-and-After Method determines economic revenues for the damages period by comparing the performance of the business before the event occurred and after the effects of the damaging event are over. The underlying theory is that, but-for the event, the plaintiff would have experienced the similar revenues and anticipated lost profits during the damages period before the event occurred and/or after the event has subsided.6

Many damages analysts refer to the Before-and-After Method as the “Book Ends” Method. This reference is because this damages measurement method uses historical financial information (before and after the damaging act) as proxies to quantify what would have happened during the wrongful act time.

To correctly apply the Before-and-After Method, the damages analyst should identify and quantify any other factors that may have affected profitability or revenue during the damages period, as well as before and after the damages period (i.e., the book ends period).

For example, if the damages analyst is attempting to quantify damages for a real estate development company over a 2009 to 2010 damages period, the effects of the industry performance, as well as the performance of the regional, national, and global economy, should also be considered in measuring damages attributable to the wrongful act.

Yardstick Method

As presented in The Comprehensive Guide to Lost Profits and Other Commercial Damages, the Yardstick Method is described as follows:

The Yardstick Method utilizes guideline company or industry measures to serve as proxy for what the revenues and profits of the affected business would have been but-for the damaging event.7

One component of the Yardstick Method is for the damages analyst to identify guideline companies (namely guideline publicly traded companies) that are reasonably comparable to the subject business.

The damages analyst should also appropriately consider any changes, other than the wrongful act, that may have affected the subject company performance over the damages period (such as changes in management, changes in product design, unrelated litigation, etc.).

Market Method

As presented in The Comprehensive Guide to Lost Profits and Other Commercial Damages, the Market Method is described as follows:

The fourth methodology for determining lost profits, the Market Model, is not used as often as the first three models already discussed. According to this methodology, the expert considers the plaintiff’s market share prior to the defendant’s alleged act to determine lost revenues/sales. For example, in a market in which the plaintiff and defendant are sole competitors, the plaintiff needs only to show “evidence defining the market, demonstrating what share of the market would have been but-for the defendant’s breach, and establishing the profit he would have earned on the increased sales.”8

While this method is sometimes applied in patent infringement matters, it may be applied in other damages scenarios, if appropriate data are available.

As mentioned above, each of these methods can be tailored to measure trustee breach of fiduciary duty economic damages. For purposes of the following illustrative example, it is more appropriate to apply the Projection Method.

Projection Method

As presented in The Comprehensive Guide to Lost Profits and Other Commercial Damages, the Projection Method is described as follows:

The Sales Projection Method utilizes company-specific forecasts for certain items, preferably by using forecasts that the company has prepared in the ordinary course of business or for some purpose other than the litigation. Some businesses are more sophisticated than others, and their projections (formatted like a typical income or operating statement) may specify revenues by product lines, detailed expenses, income taxes, and miscellaneous income/expenses.9

Many courts have concluded that the Projection Method for calculating commercial economic damages is reliable. However, as presented in The Comprehensive Guide to Lost Profits and Other Commercial Damages:

[T]he challenge for the financial expert remains how to make the appropriate estimates and analyses and then relate them to the performance that the specific event impacted so the conclusions are reliable.10

Based, in part, on the court’s view that the Projection Method is generally reliable, it is a common method used to estimate commercial economic damages. And, the Projection Method can be easily tailored to quantify other damages, such as trustee breach of fiduciary duty economic damages.

The following illustrative example presents the application of the projection method in measuring economic damages attributable to a trustee breach of fiduciary duty.

Illustrative Example

Let’s consider an example of a trustee damaging act involving a two million dollar trust that had been set up for two 20-year-old beneficiaries. Specifically, the example encompasses the following information:

- The beneficiaries are two 20-year-olds who are unable to work.

- The two 20-year-old beneficiaries are required to receive an annual $100,000 (in aggregate) distribution from the trust.

- The term of the trust was 50 years.

- A further goal of the trust was to ensure that the two million dollar principal balance is available for the beneficiaries at the end of the 50-year term.

- The trust was initially invested in dividend-paying common stocks.

- The trustee, upon appointment, sold all of the dividend-paying common stocks and subsequently invested the entire proceeds in non-dividend-paying, growth-oriented common stocks.

- The trust was unable to distribute the required $100,000 in each year over the three years after the trustee appointment.

In tailoring the Projection Method to measure the trustee breach of fiduciary duty economic damages, the damages analyst should attempt to quantify the amount of income generated by the trust assets but-for the trustee damaging act. This analysis would entail:

- Holding the trust portfolio of assets at a “standstill” over the three years after the trustee appointment and

- Subtracting all income generated by the “new” trust portfolio investments (initiated by the trustee) over the three years after the trustee appointment.

The annual difference between the income generated by the “standstill” trust portfolio of assets and the income generated by the “new” trust portfolio assets would represent the damages attributable to the trustee breach of fiduciary duty.

Mathematically, this procedure would be:

(Year 1 Standstill Assets Income – Year 1 New Assets Income)

+         (Year 2 Standstill Assets Income – Year 2 New Assets Income)

+         (Year 3 Standstill Assets Income – Year 3 New Assets Income)

=Â Â Â Â Â Â Â Â Â Breach of Fiduciary Duty Damages

For purposes of the example, let’s also assume that the three-year damages period is January 1, 2013, through January 1, 2016. Further, let’s assume that the trust assets prior to the appointment of the trustee were investments in the common stock of (1) Ford and (2) AT&T.

Finally, let’s assume that the investments made by the trustee (i.e., the new trust portfolio assets) resulted in zero dividends/income over the three-year damages period.

Based on these assumptions, the measurement of the trustee breach of fiduciary duty economic damages is summarized below.

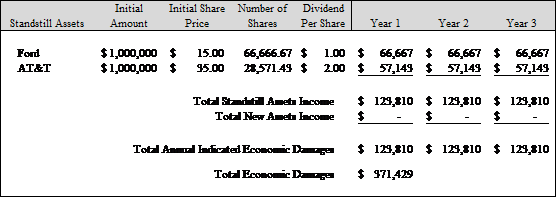

As presented in Exhibit 1, let’s assume the following:

- The initial purchase amount for each dividend-paying stock was one million dollars.

- The initial share prices of Ford and AT&T on January 1, 2013, were $15 per share and $35 per share, respectively.

- The annual dividend per share for Ford and AT&T was one dollar and two dollars, respectively.

Exhibit 1: Illustrative Economic Damages Analysis

Based on the application of the projection method, as presented in Exhibit 1, the trustee breach of fiduciary duty economic damages are measured at $371,429. This simplified example is one of the many ways the Projection Method can be applied to measure economic damages based on a trustee breach of fiduciary duty.

Conclusion

This discussion presented an overview of investment management trustee fiduciary duties including how and when a damages analyst can be utilized to measure potential economic damages as a result of a trustee breach of fiduciary duty.

Legal counsel should consult the damages analyst early on in the process of reviewing a potential trustee breach of fiduciary duty claim. This early consultation is recommended because the damages analyst can:

- Assist with assessing the merits of the case (including providing some initial analysis to determine the scale of the potential economic damages associated with a breach of fiduciary duty),

- Assist with weighing the merits and risks of going to trial, and

- Assist with reviewing and critiquing other valuation analyst’s work that may be transmitted during the engagement.

There are several generally accepted methods that can be used to measure economic damages, including:

- The Before-and-After Method,

- The Yardstick Method, and

- The Market Model Method.

The Sales Projection Method may be the most common method to measure economic damages.

However, with appropriate considerations, all four measurement methods may be tailored to measure potential economic damages because of a trustee breach of fiduciary duty.

This article was previously published in Willamette Insights, Spring 2018.

Notes (continued from part I of II):

- Nancy J. Fannon and Jonathan M. Dunitz, The Comprehensive Guide to Lost Profits and Other Commercial Damages (Portland, OR: Business Valuation Resources, 2014), 219.

- Ibid., 220.

- Ibid., 226.

- Ibid., 223.

- Ibid., 225.

Justin Nielsen is a vice president in our Portland, Oregon, practice office. Mr. Nielsen holds an MBA, with a concentration in finance, and is a certified valuation analyst (through the National Association of Certified Valuators and Analysts). He specializes in providing valuation and consulting services related to divorce and shareholder dissent/oppression matters, gift and estate tax, employee stock ownership plans (ESOP’s), lost profits and economic damages, and intangible assets.

Mr. Nielsen can be contacted at (503) 243-7515 or by e-mail to jmnielsen@willamette.com.