The Impact of the Tax Cuts and Jobs Act

On Business Valuations

The Tax Cuts and Jobs Act (TCJA) changes many aspects of how business analysts perform valuations. Upon passing of the TCJA, Jim Hitchner moved quickly to gather and disseminate information about the TCJA and its effect on business valuation. He has written two comprehensive articles in Issues 72 and 73 of Financial Valuation and Litigation Expert. The information in this article summarizes some of the main points expressed in those publications.

The Tax Cuts and Jobs Act (TCJA) changes many aspects of how business analysts perform valuations.¬† Upon passing of the TCJA, Jim Hitchner moved quickly to gather and disseminate information about the TCJA and its effect on business valuation.¬† He has written two comprehensive articles in Issues 72 and 73 of Financial Valuation and Litigation Expert.¬† The information in this article summarizes some of the main points expressed in those publications.¬† Through Valuation Products and Services (VPS), Hitchner also presented a webinar on ‚ÄúThe Impact of the New Tax Law on Business Valuation‚ÄĚ on May 15, 2018, and will present another webinar, ‚ÄúUpdate: Business Valuation and the Tax Cuts and Jobs Act,‚ÄĚ on July 18, 2018.¬† The upcoming webinar will feature S corps experts Chris Treharne and Don Drysdale.¬† More information about the journal articles and the webinars can be found at www.valuationproducts.com.

Summary of Important Factors to Consider When Valuing a U.S. Operating Company

- Lower taxes will increase value, all other factors staying the same

- It is the effective tax rate, not the marginal tax rate

- The effect of state income taxes

- The cost of debt will go up due to lower tax rates, i.e., the after-tax cost of debt is higher

- Unlever and relever betas

- This results in higher equity returns and a higher WACC

- Interest deductibility needs to be modeled to determine the impact on the costs of debt, equity, and the WACC

- Do not outright assume all the tax savings will go to the bottom line‚ÄĒrevenue may be less in competitive markets

- Bonus depreciation affects normalized depreciation

- Assume any built-in sunset provisions will remain

Value Changes

For the most part, the TCJA will have an upward impact on company value.

Nonetheless, many factors are facts and circumstances specific.  Companies that have historically incurred high effective tax rates and/or invested heavily in capital expenditures will pay less in taxes, thus likely contributing to an increase in business value.  In the meantime, companies that have historically incurred low effective tax rates, operating at a loss for tax purposes, investing little in capital expenditures, and are heavily leveraged, such that interest expense is greater than 30 percent of earnings before interest, taxes, depreciation, and amortization (EBITDA), will be negatively impacted by the TCJA, thus potentially contributing to a decline in value.

For many companies, the factors move in opposite directions; however, as stated previously, on a net basis, we expect the TCJA to be value accretive.[1]

What happens to expected earnings when we compare the new tax rate with the old rate?  For a given dollar of pre-tax earnings, less taxes will be paid, so after-tax earnings will rise…Earnings should be up under the new tax law so, other things being equal, value should rise.[2]

Cost of Capital

The cost of capital for most businesses will go up.  This is due to the lower tax rate on interest expense and the effect on beta in the modified capital asset pricing model (MCAPM).

Cost of Debt

As can be seen in Table 1, all other things held the same, the lower tax rate of 21 percent increases the after-tax cost of debt by 24 percent.

Table 1:[3] Adapted from ASA Webinar.  See complete endnote.

| Corporate Tax Rate = 35% | 35% | 21% |

| Pre-Tax Cost of Debt | 4.5% | 4.5% |

| After-Tax Cost of Debt | 2.9% | 3.6% |

| % Increase | 24.1% |

Net Interest Deduction

Net interest deduction is capped at 30 percent of EBITDA for four years.

Net interest deduction is capped at 30 percent of earnings before interest and taxes (EBIT) after initial four-year period.[4]

Note that non-deductible interest expense can be carried forward, which adds value.

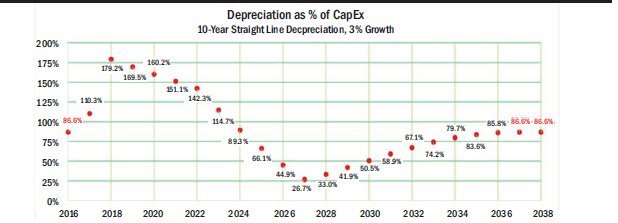

Capital Expenditures and Depreciation

The impact of bonus depreciation on the cash flows of a business will be over 20 years.[5] [see Table 2 below]

Table 2:[6] Adapted from ASA Webinar.  See complete endnote.

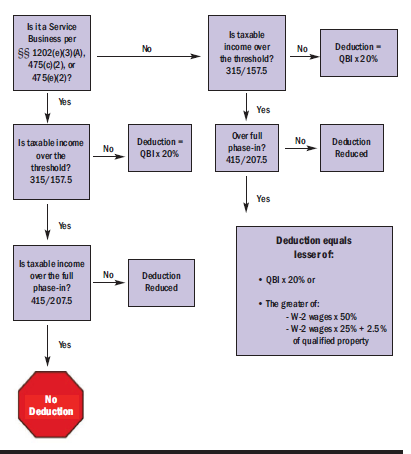

Pass-Through Entities

[The law] enacts a 20 percent deduction of qualified business income for certain pass-through businesses, limited to the greater of:

- 50 percent of wage income or

- 25 percent of wage income plus 2.5 percent of the cost of tangible depreciable property

Specified Service Businesses are not eligible for the deduction unless below the following thresholds:

- Joint filers with income below $315,000 and other filers with income below $157,500 can claim the deduction fully on income

- Specified Service Businesses include: health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services[7]

Table 3:[8] Adapted from Robert S. Keebler.  See complete endnote.

| Non-service | Service | |

| Taxable income < $315,000 (MFJ) | 20% deduction | 20% deduction |

| Taxable income > $315,000 < $415,000 | Limited phase-in | Deduction phased-out |

| Taxable income > $415,000 | Wage/capital testing | No deduction |

Table 4:[9] Adapted from Robert S. Keebler.  See complete endnote.

Business Valuation and the TCJA: Your Questions Answered

What Areas of Business Valuation are Affected by the TCJA?

- When the TCJA is known or knowable

- Overall, C corp values will be higher

- Effective vs. marginal tax rates

- Sunset provisions

- Income Approach

- Capitalized cash flow method

- Discounted cash flow method

- Cost of capital

- Guideline public company method

- Guideline company transactions method

- Bolt-on models, capital expenditures, and bonus tax depreciation

- S corps

- State taxes

- Interest expense limitations

- Revenues

- Industry and other carve-outs

- Miscellaneous

When is the TCJA Known or Knowable?

Q:  I have a valuation as of 10/31/2017 of a C corporation that will have primary weight on the Income Approach.  The TCJA effective for 2018 (signed into law at the end of December 2017) is now in effect.  Would this be an event that is known or knowable at 10/31/2017 for purposes of reducing the income tax rates to 21 percent federal rate in the discounted cash flow method?  Or would this be calculated under the old rates in effect on 10/31/2017 (40 percent) and disclosed in the report as a subsequent event?

A:  Take a look at the press releases around 10/31/17.  What were the political pundits and business pundits saying about the potential for the tax law passing?  Remember, it passed by very little; it passed by 51 votes in the Senate.  If you can support that there was a reasonable amount of certainty as of 10/31/17 about the tax bill being put into effect, then we think you would value it with the new rates.  You should disclose that is what you did and the reasoning for what you did and add a section or an addendum that has quotes from the various press.

Where the bright line is; no obviously December 22 is a bright line and probably a little earlier in December when the Senate passed the bill.  President Trump also had to wait a few days due to procedure issues before he signed the bill into effect.  There is no bright line, but you take a look at what the risk could be.  You could use the new tax rates and then increase your discount rate because of the uncertainty.  For further support, see the timeline in Exhibit A.  Given this information, I believe there is support to assume the new tax law as of the last quarter of 2017.

Exhibit A

TCJA Timeline

April 26           Trump releases a set of tax principles*

July 27                         Big Six** release statement of principles

Sept. 27 ¬†¬†¬†¬†¬†¬†¬†¬†¬† ‚ÄúUnified framework for fixing our broken tax code‚ÄĚ unveiled***

Oct. 5               House passes budget

Oct. 19                         Senate passes budget

Oct. 26                         Final budget passes

Nov. 2             TCJA introduced in House by Congressman Kevin Brady(R)

Nov. 6             Ways and Means Committee mark-up (through November 9)

Nov. 9             Ways and Means Committee passed the bill (24/16)

Nov. 9             TCJA introduced in the Senate

Nov. 13           Senate Finance Committee mark-up (through November 16)

Nov. 16           House passes TCJA (227/205)

Nov. 28           TCJA clears Senate Budget Committee

Dec. 2             Senate passes the TCJA (51/49)

Dec. 4             House moves to go to a conference committee

Dec. 6             Senate moves to go to a conference committee

Dec. 15            Conference committee signs the final version

– The final version contained relatively minor changes from the Senate version

Dec. 22            The President signed the bill into law

* National Economic Director Gary Cohn (R) and Treasury Secretary Steven Mnuchin.

** The ‚ÄúBig Six‚ÄĚ‚ÄĒHouse Speaker Paul Ryan (R-WI), House Ways and Means Committee Chair Kevin Brady (R-TX), Senate Majority Leader Mitch McConnell (R-KY), Senate Finance Committee Chair Orrin Hatch (R-UT), National Economic Council Chair Gary Cohn, and Treasury Secretary Steve Mnuchin.

*** The White House, Republican leaders of the U.S. House and Senate, and the chairs of the House and Senate tax-writing committees.

Sunset Provisions

Q: What is a sunset provision?

A: ‚ÄúA sunset provision is a clause that provides that a provision of the law is automatically repealed on a specific date, unless legislators reenact the law.¬† For instance, sunset provisions in tax cuts means that the tax-law provisions contained in the tax cut will expire or revert back to the original code unless extended by Congress.‚ÄĚ ¬†https://definitions.uslegal.com/s/sunsetprovision/.¬† Sunset provisions are also referred to as ‚Äútemporary‚ÄĚ provisions.

Q: What are the sunset provisions in the TCJA?

A: See Exhibit B for the major sunset provisions.

Exhibit B: Major Sunset Provisions

| Capital Expenditures and Bonus Depreciation | Sunsets beginning on Jan. 1, 2023; phased out 20% each year from 2023 through 2026 (80% 2023, 60% 2024, 40% 2025, 20% 2026, 0% 2027) |

| Interest Expense Limitations | Changes from 30% of EBITDA to 30% of EBIT beginning Jan. 1, 2022 |

| Personal/Individual Tax Rates | Sunsets on Dec. 31, 2025 |

| Qualified Business Income (QBI) for

Pass-Through Entities |

Sunsets on Dec. 31, 2025 |

| Repeal of expensing of research and

experimental expenditures |

For tax years beginning after Dec. 31, 2021 |

Q: Congress has normally extended tax provisions that are sunsetting.  How do we deal with that?

A: We are going to go with what is there now.  Based on conversations with many valuation analysts, that seems to be the most prevalent viewpoint.  That is what is in the law.  We do not want to be trying to determine four years and eight years out whether something is going to change.  Things could change next year.  It depends on the election.  In 2020, things could change.

Income Approach: Discounted Cash Flow vs. Capitalized Cash Flow Models

Q:  For companies with less than 10 million in sales that cannot reliably project five years’ worth of income, where can I find guidance for using the capitalization of cash flow method?

A:  You can find guidance right here.  Often, when you have smaller companies that cannot do projections, you do a capitalized cash flow method.  Just take your capitalized cash flow model, and if you were using, say, a four percent growth rate, grow your income, EBIT, and EBITDA, and then see if you are under the various thresholds or not.

We would recommend you do your capitalized cash flow model under normal conditions.  Then run a separate model out over 15 to 20 years and consider the following:

- Do any of these provisions apply in the first place? If not, you are done.

- If they do, take your capitalized cash flow model, run it out, and just grow your income at your long-term growth rate.

- Model various factors; e.g., bonus depreciation.

For those of you who do not believe your clients are going to be able to help with long-term projections, then just run it out in a separate model.  You are doing a capitalized cash flow model.  You are assuming, say, four percent growth per year.  Just run it out; run out the calculations.  If you are doing interest expense or bonus depreciation, you can do it in separate models.  (See section on bolt-on models.)

Q: Most small businesses just do not have forecasts for one year, let alone 10‚Äď20 years.¬† So, how can we use a DCF?

A:  If you do your normalization adjustments, and you have what you believe are next year’s cash flows, then you have to pick a long-term growth rate.  So, let’s say you pick a long-term rate of four percent.  Build your own DCF; take whatever the amount is you are going to capitalize into perpetuity at four percent and build a 10- to 20-year model.  That way you can build in the changes in the tax law, the phaseouts, the limitations, the sunsetting, and so on.  For some businesses, it is going to take a lot of time to do this.  If you are comfortable doing this and believe you have a normalized growth rate that is going to continue, just use a 10- to 20-year model and build all this stuff into it.  For another method, see prior Q&A and section on bolt-ons.

Q: If using CCF, do you think normalizing historical operations for the new tax law is appropriate?

A:  That is something you can do.  But if you go out another year, for some businesses it is going to be easier to use a capitalized cash flow method, especially for smaller businesses.  You could do that, but again, valuation is forward looking, so if you believe doing that will give you a forward-looking estimate, then sure.

Cost of Capital

Q: If COC data are based on historical returns, wouldn’t you expect the risk premiums to increase with the expected higher returns from public companies due to the decrease in the tax rate?

A: Dr. Aswath Damodaran addressed this issue in early 2018:

The cash flows that a firm generates on operations are after taxes, but the relevant tax rate is not the statutory tax rate but the effective tax rate.  It is true that the reduction of the statutory tax rate from 35% to 21% will reduce taxes paid, but the reduction will be from the aggregated effective tax rate that companies paid in 2017, not the marginal rate.  [Emphases added.][10]

Bolt-on Models, Capital Expenditures, and Bonus Tax Depreciation

Q: Would you outline your approach to determining a firm’s value and increasing the amount by adding ‚Äúbolt-on‚ÄĚ values for bonus depreciation?

A: You value the company as you would as if it is being depreciated normally.  Then you bolt on the differences.  You can do a capitalized cash flow with normalized depreciation and run a separate 15- to 20-year model that shows the fluctuation in CAPEX and tax depreciation.  Tax affect and present value, and then bolt that value on.  So far, in our experience, it has increased the value.  You can also use a five- or ten-year DCF model that reflects the bonus depreciation for five to ten years, respectively, then bolt on the value of the value beyond the five- or ten-year interim period.

S Corps

Q: What is the impact on the amount of tax affecting because the C corp tax rate is reduced?

A: For service businesses that do not qualify for the 20 percent QBI deduction, there is no real difference in value; meaning that there is no S corp premium.  For non-service businesses, Van Vleet has presented two SEAM calculations showing an increase in value over the C corp equivalent value of around five to nine percent.

State Taxes

Q: Should I assume that my state will follow the Federal tax code and apply the state/city tax as deductions?

A: No.  You need to check to see what kind of process your state has, if any, for adopting (or not) the various provisions on the TCJA.

Most states with personal and corporate income taxes link their tax codes to federal tax law in some way, also known as ‚Äúcoupling‚ÄĚ or ‚Äúconforming‚ÄĚ to the federal code, which helps simplify tax preparation.¬† The most common way of doing so is to begin state income tax calculations with the federal definition of income called adjusted gross income (AGI).¬† States then apply their own deductions, exemptions, and other adjustments to arrive at taxable income, apply state tax rates to the taxable income amount to determine taxes owed, and finally, apply any additional credits.¬† Some states conform to federal law even more closely, adopting the federal deduction and exemption amounts, and thus mirroring the federal calculation all the way to the determination of taxable income.¬† Still others calculate their own measure of AGI and taxable income but use federal definitions of the amounts included therein.

States vary not only in the extent to which they conform to the federal code, but also in their procedures for doing so.¬† When a federal law to which a state is coupled changes, states with automatic or ‚Äúrolling‚ÄĚ conformity generally adopt the federal changes automatically and must specifically decouple from changes they do not want to adopt.¬† States with ‚Äúfixed-date‚ÄĚ conformity adopt the federal rules from a particular year and must proactively choose to go along with federal changes.¬† No two states conform to the federal code in exactly the same way, and many couple to particular federal provisions beyond the calculation of AGI or taxable income.[11]

Revenues

Q: Does the lower tax rate mean that all the additional profits fall to the bottom line?

A: Not necessarily.  In a highly competitive business, some competitors may lower prices, meaning lower revenues and thus profits.  This needs to be evaluated.

[1] ¬† Chris Mellen, ‚ÄúThe Impact of the 2017 Tax Act on Business Valuation,‚ÄĚ VRC Perspectives, Feb. 5, 2018, https://www.valuationresearch.com/pureperspectives/impact-2017-tax-act-business-valuation/

[2] ¬† Chris Mercer, ‚ÄúValuation Implications of the Tax Cuts and Jobs Act of 2017, Focus on Privately Owned C Corporations,‚ÄĚ Feb. 1, 2018, http://chrismercer.net/valuation-implications-of-the-tax-cuts-and-jobs-act-of-2017/#more-8966

[3] ¬† ‚ÄúThe Impact of TCJA on Cost of Capital, ASA Ask the Experts Webinar,‚ÄĚ webinar, Mar. 12, 2018, American Society of Appraisers, Jay Fishman, Roger Grabowski, Gil Matthews, and Jeff Tarbell.

[4] ¬† ‚ÄúThe Final 2018 Tax Bill: Comparison Chart of What is Changing and What You Need to Know,‚ÄĚ Dec. 21, 2017, Moore Colson.

[5] ¬† ‚ÄúThe Impact of TCJA on Cost of Capital, ASA Ask the Experts Webinar,‚ÄĚ webinar, March 12, 2018, American Society of Appraisers, Jay Fishman, Roger Grabowski, Gil Matthews, and Jeff Tarbell.

[6]   Ibid.

[7] ¬† ‚ÄúThe Final 2018 Tax Bill: Comparison Chart of What is Changing and What You Need to Know,‚ÄĚ Dec. 21, 2017, Moore Colson.

[8]   Robert S. Keebler, Advanced IRC § 199A Small Business Deduction A Case Study Approach, Feb. 15, 2018, slide 7.

[9]   Ibid., slide 8.

[10] Dr. Aswath Damodaran, Musing on Markets, Jan. 12, 2018, ‚ÄúJan. 2018 Data Update 3: Taxing Questions on Value.‚ÄĚ

[11] Institute on Taxation and Economic Policy, https://itep.org/what-the-tax-cuts-and-jobs-act-meansfor-states-a-guide-to-impacts-and-options/

James R. Hitchner, CPA, ABV, CFF, ASA, is Managing Director of Financial Valuation Advisors, www.finvaluation.com and is president of The Financial Consulting Group, www.gofcg.org. He is also CEO of Valuation Products and Services, www.valuationproducts.com, which created and distributes the DLOM Guide and Toolkit, Q&A Guide to Financial Valuation, Lost Profits Damages and presents monthly webinars.

Mr. Hitchner can be contacted at (609) 822-1808 or by e-mail to jhitchner@finvaluation.com.