The Growth, Development, and Difficulties

of the Current Marijuana Business (Part II of II)

In November of 2018 there are some 28 thousand marijuana/cannabis businesses in operation and employing about 150,000 people in the United States and they manage and control some nine billion dollars in essentially cash revenues. This industry continues to grow. In this second part, the author illustrates the importance of choice of entity, provides an overview of the taxation of a cannabis business, and provides readers a high-level breakdown of the patchwork of state laws.

[su_pullquote align=”right”]Resources:

[su_pullquote align=”right”]Resources:

The Marijuana Business Plan: From Seed to Sale

[/su_pullquote]

In this second part of this two-part publication, the author discusses the choice of entity, illustrates the taxation of a marijuana/cannabis entity, and shows readers the patchwork of state laws.

Choice of Entity

The Sole Proprietorship: a type of business entity that is owned and run by one individual and in which there is no legal distinction between the owner and the business. The owner receives all profits (subject to taxation specific to the business) and has unlimited responsibility for all losses and debts. Every asset of the business is owned by the proprietor and all debts of the business are those of the proprietor—the owner has no less liability than if they were acting as an individual instead of as a business. A sole proprietor usually uses a trade name or other business name other than their own legal name. There is, however, a general requirement to file a Doing Business As (DBA) statement with the local authorities and there may be unincorporated business tax filing requirements. Individual income tax rates for 2018 are based on prescribed income brackets for various filing statuses and range from a low of 10% to a high of 37%.

The General Partnership: § 201 of the Revised Uniform Partnership Act (RUPA) of 1994 provides: “A partnership is an entity distinct from its partners.”

- The assets of the business are owned by the partnership on behalf of the partners, and each partner is personally liable, jointly and severally, for business debts, taxes or tortious acts, and other liabilities.

- Profits and losses are shared equally among the partners unless the partnership agreement provides the way profits and losses are to be shared.

- Each general partner is deemed the agent of the partnership: if a partner is apparently carrying on partnership business, all general partners are held liable.

- Unless otherwise provided in the partnership agreement, a partnership will terminate upon the death, disability, or even withdrawal of any one partner.

- Each general partner has an equal right to participate in the management and control of the business: in a partnership of any size the partnership Operating Agreement will provide for named designees to manage the partnership.

A general partnership is a pass-through entity whose taxable income is determined and allocated to each of its partners in accordance with the agreement and reportable by each of them on their income returns. Individual income tax rates for 2018 are based on prescribed income brackets for various filing statuses and range from a low of 10% to a high of 37%.

The Limited Partnership: a form of partnership is like a general partnership, except that in addition to one or more general partners, there are one or more limited partners. Family partnerships are a form of limited partnerships that have been used for certain income and estate (transfer) tax planning purposes.

- Only one partner is required to be a general partner. The general partner(s) are generally in the same legal position as partners in a general partnership—they have management control; share the right to use partnership property; share the profits and losses in predefined proportions; have joint and several liability for the debts of the partnership; have actual authority, as agents of the partnership, to bind all the other partners in contracts with third parties that are in the ordinary course of its business.

- Limited partners have limited liability—they are only liable for debts incurred by the partnership up to the amount of their capital investment.

- Limited partners have no management authority over the business of the partnership.

- Limited partners earn a return on their investment, similar to a corporate dividend, the nature and extent of which is usually defined in the partnership’s operating agreement.

A limited partnership is a pass-through entity whose taxable income is determined and allocated to each of its partners in accordance with the agreement and reportable by each of them on their income returns. Individual income tax rates for 2018 are based on prescribed income brackets for various filing statuses and range from a low of 10% to a high of 37%.

The Corporation: a legal entity created under the laws of a State and designed to establish the entity as a separate legal entity having its own privileges and liabilities distinct from those of its shareholders. There are four essential characteristics of a business corporation: separate legal identity; limited liability; transferability of equity interest (shares); and centralized management.

- Shareholders normally enjoy limited liability (up to the amount of their capital investment) for corporate debts and obligations.

- Corporations are unlimited in life and can only be “dissolved” by operation of law, order of court, or by the voluntary action of shareholders.

Corporations may be taxed at the corporate level (C corporations [a flat 21%]) or, if qualifying, at the shareholder level (S corporations [individual income tax rates for 2018 are based on prescribed income brackets for various filing statuses and range from a low of 10% to a high of 37%.]).

The Limited Liability Company (LLC): an unincorporated business organization of one or more persons who have limited liability for the contractual obligations and other liabilities of the business. All States have limited liability company Laws which govern the formation and operation of an LLC. An LLC may organize for any lawful business purpose or purposes. An LLC is a hybrid form of legal entity that combines corporation-style limited liability with partnership-style flexibility. The flexible management structure allows owners to shape the LLC to meet the needs of the business. The owners of an LLC are “members” rather than shareholders or partners. A member may be an individual, a corporation, a partnership, another limited liability company, or any other legal entity. LLCs have been used for certain income and estate tax planning purposes.

An LLC is a pass-through entity whose taxable income is determined and allocated to each of its members in accordance with the agreement and reportable by each of them on their income returns. (LLC owners may also be eligible for an income tax deduction of up to 20% of their “qualified business income” from the entity.) Individual income tax rates for 2018 are based on prescribed income brackets for various filing statuses and range from a low of 10% to a high of 37%.

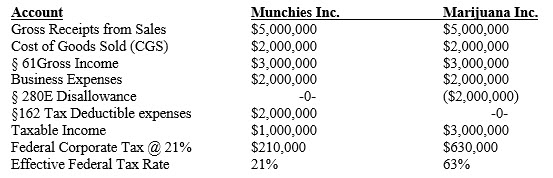

After considering and assessing all the licensing, liability, legal, Federal and State income, franchise and other tax impositions, it will be assumed for illustrative purposes that the C corporation is adopted to operate the marijuana/cannabis business. The impact of the Draconian IRC § 280E on a marijuana/cannabis business (Marijuana Inc.) is demonstrated by a comparison with that of a non-marijuana/cannabis business (Munchies Inc.).

The above is illustrative of the near confiscatory corporate Federal income tax imposed on a marijuana/cannabis business. As noted above, the top individual income tax rate imposed on sole proprietors and individual partners and/or S corp shareholders is 37% and if Marijuana Inc. was operated in those entity forms, the Federal income tax would be $1,110,000 or 111%. Operating as an LLC, even if it could be successfully argued that its taxable income was qualified business income, the tax would be $880,000 or 88%.

Of course, the marijuana/cannabis business operator must be prepared for Internal Revenue Service (IRS) audit scrutiny not only of what expenses are CGS and deductible, and what expenses are ordinary and necessary business expenses that are disallowed under the provisions of IRC § 280E, but also of the entity’s gross cash receipts.

Commercial banks, savings banks, credit unions, and credit card issuers likely will not carry an account, accept deposits or have any disbursing, lending or other relationship with marijuana/cannabis businesses that are operating illegally under Federal law, albeit operating completely legal under State law and this presents a daunting compliance issue for the marijuana/cannabis business operator.

The IRS has been increasingly focusing on marijuana/cannabis businesses that are misfiling, or not filing at all, IRS Form 8300: Report of Cash Payments Over $10,000 Received in a Trade or Business in order to invoke the application of Code § 280E instead of their alternative of filing formal drug trafficking charges.

While it is a daunting task for some 28 thousand marijuana/cannabis businesses to operate, manage, and control their $55 billion in essentially cash revenues, it is perhaps an even more daunting task to navigate the complexities of both Federal and State income tax laws and the State and local governmental regulatory mandates.

Seventeen States follow Federal law and classify marijuana/cannabis growth, distribution, possession, or use as a criminal offense: Alabama; Georgia; Idaho; Indiana; Iowa; Kansas; Kentucky; Mississippi; Nebraska; North Carolina; South Carolina; South Dakota; Tennessee; Texas; Virginia; Wisconsin; and, Wyoming.

There is no standard, nor is there any rational consistency to the State laws that have been enacted to decriminalize and legitimize the growth, processing, testing, wholesale and/or retail distribution, possession, or use of medicinal and/or recreational marijuana/cannabis. As each state develops its own unique set of rules for the tax and legal administration of marijuana/cannabis decriminalization laws, it is expected that the complexity will result in enhanced tax and legal audit activity, and the potential for civil and/or criminal law violations and liability.

Twenty-three States have legalized medical marijuana/cannabis: Arizona (2010); Arkansas (2016); Connecticut (2017); Delaware (2011); Florida (2016); Hawaii (2000); Illinois (2013); Louisiana (2016); Maryland (2014); Minnesota (2014); Missouri (2018); Montana (2014); New Hampshire (2013); New Jersey (2010); New Mexico (2007); New York (2014); North Dakota (2016); Ohio (2016); Oklahoma (2018); Pennsylvania (2016); Rhode Island (2016); Utah (2018); and, West Virginia (2017). This election, voters in North Dakota rejected a ballot initiative, while voters in Michigan approved an initiative; in Ohio voter-initiated initiatives were passed and in Wisconsin voters approved a non-binding ballot initiative. Missouri voters approved one of the three medical initiatives, while Utah voters approved a medical initiative that is now the subject of negotiations with the State legislative branch.

More than 10 States and Washington, D.C. have legalized medical marijuana/cannabis and have legalized marijuana/cannabis for recreational use for adults over the age of 21. See https://www.usatoday.com/story/news/politics/elections/2018/11/06/election-results-2018-florida-votes-restore-felons-voting-rights/1895272002/. The legal and financial landscape is quickly evolving and use for medical and recreational use is being more readily accepted. https://www.marijuanamoment.net/more-banks-welcome-marijuana-business-accounts-new-Federal-report-shows/.

Alaska: Since 2015, resident adults may use, possess, and transport up to one ounce of marijuana/cannabis for recreational use.

California: Since 1996, the use of medical marijuana by resident adults has been legal. Since 2016, resident adults may use and carry up to one ounce of marijuana/cannabis and, in addition, may buy up to eight grams of edible concentrates. Further, resident adults may grow up to six marijuana/cannabis plants per household. Note, however, that the cities of Fresno and Bakersfield ban recreational sales of marijuana/cannabis.

Colorado: Since 2012, adult residents and tourists can buy up to one ounce of marijuana/cannabis or eight grams of concentrates. However, some Colorado counties and cities have more restrictive laws on the sale of recreational marijuana/cannabis.

Maine: Since 2018, adult residents may not legally buy, but may possess up to two and one-half ounces of marijuana/cannabis.

Massachusetts: Since 2016, adult residents may carry and use one ounce of marijuana/cannabis and grow up to 12 plants in their homes. Three retail vendors of marijuana/cannabis were open for business in November 2018.

Michigan: Since 2018, adult residents may possess up to two and one-half ounces of marijuana/cannabis and grow up to 12 plants in their homes.

Nevada: Since 2017, adult residents and tourists can buy one ounce of marijuana/ cannabis and one-eighth of an ounce of edibles or concentrates. To be eligible for a grower’s license residents must live 25 miles beyond the nearest dispensary.

Oregon: Since 2015, adult residents may possess one ounce of marijuana/cannabis and grow four plants in their homes. Edibles may be gifted but must be ingested privately.

Vermont: Since 2018, adult residents may possess up to one ounce of marijuana/cannabis and grow up to four plants in their homes. However, there is no legal market for the production and sale of marijuana/cannabis.

Washington: Since 2012, adult residents may possess up to one ounce of marijuana/cannabis. However, adult residents must require the marijuana/cannabis for medicinal purposes in order to be eligible for a grower’s license.

Washington, D.C.: Since 2015, adult residents may possess up to two ounces of marijuana/cannabis and gift up to one ounce of marijuana/cannabis if neither money nor goods or services are exchanged.

It is painfully obvious from the above short synopsis that each of the thirty-three states that have legalized marijuana/cannabis business operations have their own unique set of rules, restrictions, and regulations. Whatever that compliance complexity may be, it is only a precursor to the Federal and State tax compliance and filing responsibilities imposed on the business and on its proprietors. The marijuana/cannabis business, in all of its forms, from growing, processing, testing, wholesale and retail distribution, etc., is and will continue to be a growth industry and, as such, will be closely scrutinized, regulated, and monitored, and subjected to a myriad of Federal, State, and local income and other taxes that will be limited only by the imaginations of the various governmental taxing authorities.

In addition to Federal, State and local income tax filing and tax payment obligations, marijuana/cannabis cultivators and growers; infused product fabricators, processors, distillers, cooks/bakers of marijuana/cannabis edibles; manufacturers/fabricators of consumption devices; testing facilities; software or online services; delivery services; and, retail sellers have broad based cultivation tax; cannabis excise tax; and, sales and use tax filing responsibilities and payment obligations.

Filing a false or fraudulent return or the willful evasion of tax, will draw serious monetary and/or regulatory penalties—the State licensing authorities generally have the power to impose monetary fines and have the power to suspend or revoke a license after holding a public hearing for any violations to the retail marijuana/cannabis licensing laws.

It is anticipated that the seventeen States now prohibiting marijuana/cannabis will accede to the findings of the medical profession and the growing popular support among their citizenry for its legalization.

At the Federal level, H.R. 1227 Ending Federal Marijuana Prohibition Act of 2017 was introduced in the House of Representatives in February 2017. This bill amends the Controlled Substances Act to provide that the Act’s regulatory controls and administrative, civil, and criminal penalties do not apply to with respect to marijuana/cannabis.

It removes marijuana and tetrahydrocannabinols from schedule I. (A schedule I controlled substance is a drug, substance, or chemical that has a high potential for abuse; has no currently accepted medical value; and is subject to regulatory controls and administrative, civil, and criminal penalties under the Controlled Substances Act.)

Additionally, it eliminates criminal penalties for an individual who imports, exports, manufactures, distributes, or possesses with intent to distribute marijuana/cannabis.

Code § 280E now provides no deduction or credit shall be allowed for any amount paid or incurred during the taxable year in carrying on any trade or business if such trade or business (or the activities which comprise such trade or business) consists of trafficking in controlled substances (within the meaning of schedule I and II of the Controlled Substances Act) which is prohibited by Federal law or the law of any State in which such trade or business is conducted will no longer be applicable to the marijuana/cannabis business and all ordinary and necessary business expenses will be deductible. The effect of this is a reduction of the Federal corporate tax rate from confiscatory rates now exceeding 70% (sometimes more than 100%) to a normalized rate of 21%.

Please reference The Marijuana Business Plan: From Seed to Sale in the QuickRead Resources section on the landing page.Â

James P. Crumlish is a Westhampton Beach, NY-based CPA. His firm provides tax preparation, planning, bookkeeping, and accounting needs. Mr. Crumlish is also a Chartered Global Management Accountant.

Mr. Crumlish can be contacted at (212) 996-3788 or by e-mail to jamespcrumlish@gmail.com or http://jamespcrumlishcpas193.vpweb.com.