A Valuation Practitioner’s Musings

on Corporate Income Taxes

What corporate tax rate should valuation practitioners use going forward given the current environment? Despite corporate rates being “permanent”, is that so?! How should practitioners handle temporary differences? How do we decode a financial statement? In this article, the author shares his thoughts on how valuation professionals should approach a valuation engagement in this uncertain tax environment.

[su_pullquote align=”right”]Resources:

Trending Matters in Business Valuation

Financial Statements—Written Confessions

Transaction Advisory Services—Beyond Accounting Due Diligence

[/su_pullquote]

Nothing is certain but death and taxes. This well-known perspective should make corporate income taxes a relatively easy assumption in business valuations. However, there are many nuances that extend beyond the traditional (e.g., what rate should apply to pass-thru entities) tax-related debates. This article addresses some of those nuances.

Statutory Rate

Statutory tax rates are easy to observe. For example, the federal corporate tax rate is currently 21%.

However, future statutory tax rates can be difficult to predict. While the requirement to pay taxes may be “certain,” the statutory rate in the future is clearly not guaranteed to be the same as it is today. This is true notwithstanding the fact that the current statutory corporate tax rate is “permanent.”[1]

It seems reasonable to assume that the current statutory corporate income tax rate is more likely to increase than decrease in the future. It is easy to foresee a scenario where the Democrats enact a higher corporate tax rate the next time they control the Presidency, Senate, and House at the same time.[2] It seems harder to foresee scenarios where a lower corporate tax rate is put into place.

The asymmetrical outlook (if that is in fact the case) matters because business valuations are based on expected cash flow, which is the probability weighting of all possible outcomes. If the probability weighting of all possible outcomes is greater than 21%, the federal corporate tax rate used in the valuation as of a current date should be greater than 21%.

Alas, business valuation practitioners are not political prognosticators. It is easy to “punt” on the issue and use the statutory tax rate in place on the valuation date.

As a practical matter, this seems like the tension between relevance and reliability for financial reporting. The statutory tax rate in place on the valuation date is clearly reliable because it can be easily confirmed. However, it is clearly not the most relevant estimate when the statutory tax rate going forward is expected to be different than the current statutory tax rate.

This same issue applies to retrospective valuations with valuation dates prior to when the current 21% statutory tax rate went into effect. Many observed that the U.S. had a higher statutory corporate tax rate than most other countries. Politicians from both parties seemed to agree that the U.S. statutory rate should be lower, with the points of contention over how much lower and what other trade-offs should be made. It seems reasonable to assume that the expected statutory tax rate on some of these valuation dates was less than the 35% statutory corporate tax rate that was in effect at the time. This seems to especially be the case after the results of the 2016 election were known, but before the current tax legislation was passed.

Determination of Pre-Tax Income

Applying corporate income tax rates is easy in theory. Just apply the appropriate tax rate(s) to taxable income.

Unfortunately, applying corporate income tax rates is often much harder in practice. Many business valuations are based on financial projections prepared on a GAAP financial reporting basis, not a tax reporting basis. That often leads to valuations that use the wrong pre-tax income levels when arriving at projected corporate income taxes.

“Temporary” Differences

Temporary differences occur when there are differences between tax and GAAP financial reporting that reverse over time. Some are easy to analyze while others are much more difficult.

Perhaps the easiest to understand, at least at the conceptual level, is net operating loss (NOL) carry forwards. These are losses that were incurred in the past for tax reporting purposes that can be used to offset taxable income in the future. NOL carryforwards are temporary because of differences in recognizing the losses for financial reporting (when incurred) and tax reporting (when there are subsequent taxable profits to offset) purposes. Not surprisingly, NOL carryforwards, when they exist, are frequently incorporated into the business valuation.

Other temporary differences are less clear cut. For example, consider the difference in depreciation for financial reporting and tax reporting purposes. Assume an asset has a 25-year estimated useful life with a 20% salvage value that is depreciated on a straight-line basis for financial reporting purposes. That same asset might have a five-year estimated useful life with no salvage value that is depreciated on an accelerated basis for tax reporting purposes. This company will have (significantly) lower taxable income on a tax reporting basis than on a financial reporting basis when it is buying many of these assets during a growth stage due to this difference.

Some will argue that is a strong reason for applying an effective tax rate that is less than the statutory rate to pre-tax income on a financial reporting basis. That is a logical position for the period when depreciation is higher for tax reporting purposes than financial reporting purposes and other factors are the same.

Others will observe that what goes up must come down because the temporary differences are a zero-sum game. In this case, the tax benefit that occurs during the growth period will reverse after the growth slows/stops. The tax benefit can also reverse while the company is still growing if it benefits from bonus depreciation that will not be available in the future (e.g., the current accelerated depreciation methods sunset in the current law, but may be renewed in the future).

Companies record deferred tax liabilities to account for this situation. However, it seems unusual to see a business valuation that applies a corporate income tax rate to financial reporting-based income that is greater than the statutory rate. A higher than statutory tax rate seems to be required when temporary tax advantages are expected to be reversed (i.e., become temporary tax disadvantages) in the future.

Nevertheless, it does not necessarily follow that the failure to take the reversal of temporary differences into account results in a faulty valuation. Sometimes the temporary differences are expected to essentially be rolled over into perpetuity. In this case, the deferred tax liability on the balance sheet is not an accurate depiction of the company’s liabilities on a going concern basis.

Difficulty in Decoding Financial Statements

It may not be easy to identify how much money a company pays in income taxes each year. The tax footnote in the financial statements helpfully allocates the income tax provision for financial reporting purposes into “Current” and “Deferred” categories. Based on that labeling, it appears that the amount in the “Current” category is what the company paid in income taxes that year.[3] Unfortunately, that does not (always) seem to be the case.

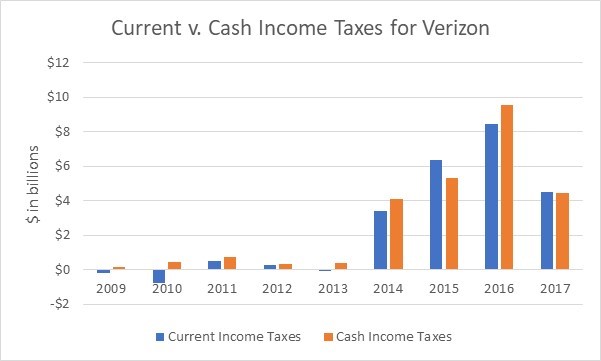

For example, consider Verizon, which helpfully lists the “cash income taxes” it pays each year within the tax footnote. (Many companies do not disclose this information.) Verizon paid $4.432 billion in cash income taxes, net of amounts refunded, for the 2017 fiscal year. This amount is similar, but different, from the $4.507 billion in “Current” income taxes for the 2017 fiscal year. As shown in the table, there is a difference (with some differences larger than others) every year between 2009 and 2017.

Closing Thoughts

Business valuations are based on many explicit and implicit assumptions. We often spend most of our time focused on explicit assumptions for obvious reasons. However, sometimes the implicit assumptions (such as the tax-related assumptions discussed in this article) can have a material effect on the valuation outcome.

[1] All “permanent” means is that the current statutory corporate tax rate remains in place until it is changed via subsequent legislation.

[2] They presumably would only need 50 seats in the Senate (i.e., not need a filibuster-proof 60) to make changes using the same procedures the Republicans used to pass the current tax legislation.

[3] SFAS 109 Accounting for Income Taxes states that “[a] current tax liability or asset is recognized for the estimated taxes payable or refundable on tax returns for the current year.”

Michael Vitti, CFA, joined Duff & Phelps in 2005. Mr. Vitti is a Managing Director in the Morristown, NJ office and is a member of the firm’s Disputes business unit. He focuses on issues related to valuation and solvency. This article represents the views of the author and is not the official position of Duff & Phelps, LLC.

Mr. Vitti can be contacted at (973) 775-8250 or by e-mail to Michael.Vitti@duffandphelps.com.