Big MAC II

Fresenius is the First (General) MAC in Delaware History (Part II of II)

This is a follow-up article about the first seller that successfully terminated a deal in Delaware due to a MAC clause. The previous article addressed the General MAC clause. This article addresses the Regulatory MAC clause.

Introduction

This is a follow-up article about the first seller that successfully terminated a deal in Delaware due to a Material Adverse Change (MAC) clause. The previous article addressed the General MAC clause. This article addresses the Regulatory MAC clause.

Recap of the Dispute

This case is about a merger agreement dated April 24, 2017, in which Fresenius Kabi AG (the Buyer) agreed to acquire Akorn, Inc. (the Seller) for $34 per share, which valued Sellerâs equity at $4.3 billion. Seller is a specialty generic pharmaceutical company. Buyer is a wholly owned subsidiary of a German healthcare company with a U.S. presence. The deal was expected to take a while to close due to the need to get antitrust approvals.

Seller agreed to acquire Buyer, but closing the deal was subject to certain conditions. One of these conditions was that Seller did not suffer from a MAC. Buyer gave notice on April 22, 2018, that it was terminating the merger agreement per its right under the MAC clauses. Seller countered by arguing there was no MAC and demanded specific performance: that Buyer acquire Seller for $34 per share. The Delaware Chancery and Supreme courts had to decide this issue.

What is a Regulatory MAC Clause?

In âoverly simplistic terms,â the Regulatory MAC clause pertains to Sellerâs compliance with regulatory obligations.[1] According to Vice Chancellor (VC) Laster, Seller represented that it was in full compliance with these regulatory obligations, which were primarily with the Federal and Drug Administration (FDA). Buyer can terminate the merger agreement when those regulatory-related representations are materially wrong.

Whistleblower Letters

Buyer received three whistleblower letters. The second whistleblower letter raised allegations about Sellerâs development processes and flaws in Sellerâs quality control processes.[2] The second whistleblower letter provided a reason for Buyer to investigate the allegations. This investigation opened the door for Buyer to develop the argument that it could terminate the merger agreement due to a Regulatory MAC.

Why is the Regulatory MAC Clause Important?

In some respects, the Regulatory MAC is not particularly important to this story. Buyer was ultimately able to terminate the merger agreement under both the General MAC and Regulatory MAC clauses. Thus, the opinions in this case suggests Buyer would have prevailed without the Regulatory MAC clause.

However, contemporaneous parties placed a lot of weight on the Regulatory MAC. Two groups stand out. First, VC Laster believes the possibility of a Regulatory MAC led Buyerâs executives to seek terminating the merger agreement if they could. Buyerâs legal advisors were skeptical that they could win with just a General MAC given Delawareâs history of never allowing a buyer to terminate a deal due to a MAC.[3] Second, as will be shown below, Sellerâs stock price did not suggest Buyer could successfully assert a MAC argument until the possibility of a Regulatory MAC was disclosed.

Sellerâs Stock Price

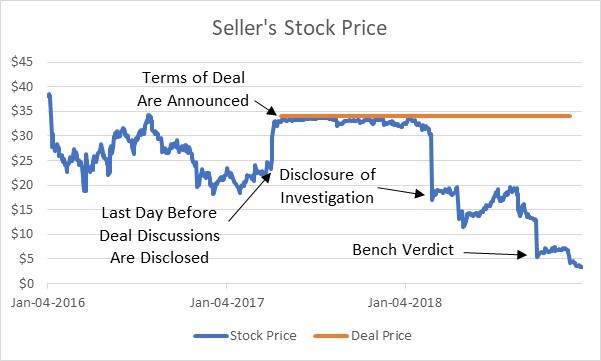

Sellerâs stock price can be used as a tool to identify whether contemporaneous market participants believed the deal would close. As shown in Figure 1, Sellerâs stock price is a tale of two periods.

Figure 1[4]

During the first 10 months after the deal was announced, Sellerâs stock price generally tracks the present value of the $34 per share deal price to be received when the deal closes. Given the large decline in Sellerâs financial performance that was discussed in the first article, maintaining a price near $34 per share suggests a near 100 percent probability that the deal would close.

Contemporaneous market participantsâ view changed dramatically when Seller announced, after the markets closed on February 26, 2018, that it was âinvestigating alleged breaches of FDA data integrity requirements relating to product development at the company.â[5] This investigation related to the Regulatory MAC. Sellerâs stock price declined by 55% the next day and stayed well below the $34 deal price going forward. Notably, Sellerâs stock price generally traded close to the $5 to $12 range standalone value that was determined by equity analysts,[6] which suggests a low expected probability that the sale for $34 per share would close.

Regulatory MAC: Qualitative Prong

VC Laster did not have trouble finding enough evidence to support a MAC under the qualitative prong. He said there was âoverwhelming evidence of widespread regulatory violations and pervasive compliance problemsâ at Seller.[7] This âoverwhelming evidenceâ matters because â[t]he value of [Sellerâs] pipeline depended on [Sellerâs] ability to comply with the FDAâs regulatory requirements.â[8]

Regulatory MAC: Quantitative Prong

Arriving at a determination for the quantitative prong was more complicated. VC Laster had to answer two difficult questions:

- What was the âvaluation hitâ caused by the misrepresentation?

- What level of âvaluation hitâ should be used for identifying the threshold for materiality?

Quantifying the âValuation Hitâ

Not surprisingly, there was a chasm between the amounts proffered by Buyer and Seller. Buyer said the valuation hit was very large: approximately $1.9 billion. Seller said the valuation hit was very small: less than $50 million.[9]

VC Laster acknowledged that â[i]t is not possible to define with precision the financial impact of [Sellerâs] data integrity issues.â[10] He essentially picked a number near the middle: $900 million.

In the appeal briefs, Seller characterized the $900 million as a made-up number based on splitting-the-baby wheras Buyer characterized it as conservative because VC Laster also said the remediatation plan would be much closer to Buyerâs plan than Sellerâs plan. A discussion about the valuation-related issues is beyond the scope of this article because they are based on many case-specific factors that donât seem likely to affect a typical MAC-related case.

The $900 million valuation hit results in a 21% reduction in equity value. This is based on the observation that the merger agreement valued Sellerâs equity at $4.3 billion.[11] The follow up-question is: Does a 21% reduction in equity value qualify as material?

Identifying the Threshold for Materiality

Based on his opinion, VC Laster did not appear to have much to work with. There is not much guidance on defining the materiality threshold and neither company provided testimony on this subject. VC Laster said:

In Hexion, the court agreed that materiality for purposes of an [MAC] should be viewed as a term of art that drew its meaning from Regulation S-K and Item 7, âManagementâs Discussion and Analysis of Financial Condition and Results of Operations.â It would have been helpful to have access to expert testimony or studies about the thresholds companies generally use when reporting material events, such as material acquisitions. It also would have been helpful to understand the thresholds that [Buyer] and [Seller] have used. No one addressed these issues.[12]

VC Laster first used the negotiating process as a benchmark. He observed that Buyer identified approximately $200 million of potential downside due to various reasons.[13] The valuation hit was $900 million, which was 4x to 5x the identified downside. VC Laster appears to have relied on this comparison to identify a material change, while also acknowledging that it is difficult to benchmark.

As a âcross-check,â VC Laster considered âexternal sourcesâ that âmight suggest how a reasonable buyerâ would view a valuation hit of approximately 20%.[14] These sources are:

- Stock market data: A 20% decline in stock prices from their peak is considered a bear market. Also, a 20% decline in the Dow Jones Industrial Average would be the second largest single-day drop in history.[15]

- Deal renegotiations: An âunpublished study found that â[w]hen the target experiences a firm-specific [MAC], the subsequent renegotiation reduces the price by 15%, on average.ââ[16]

- Collars: Deals involving stock consideration typically have collars with lower bounds of 10%. âIf parties establish a lower bound for collars (on average) around 10% below the initial deal consideration and cause the deal pricing to change significantly at that point, then this suggests that they view a drop in value of 10% as material and would therefore also view a drop of more than 20% as material.â[17]

- Reverse termination fees: VC Laster referenced studies that showed fees in the single digit range.

VC Laster acknowledged that none of these cross-check indicators are âdirectly on point.â[18] Nevertheless, he considered them to evaluate his âintuitive beliefâ that the valuation hit in Fresenius cleared the materiality threshold.[19]

The order of operations is also relevant. For the General MAC, where there was more guidance, VC Laster identified the framework for defining materiality and then assessed the situation in Fresenius. Conversely, for the Regulatory MAC, VC Laster assessed the situation in Fresenius and then tried to identify whether it was material. The approach for the Regulatory MAC leaves a key question for future cases unanswered: How much lower than 21% could the valuation hit be and still be material?

Closing Thoughts

Fresenius uses the decline in equity valuation to arrive at the framework for identifying whether a material decline occurred under the Regulatory MAC framework. From a financial analystâs perspective, this is a logical approach that should also be considered when identifying whether a material decline occurred under the General MAC framework.

Michael Vitti, CFA, joined Duff & Phelps in 2005. Mr. Vitti is a Managing Director in the Morristown, NJ office and is a member of of the firmâs Governance, Risk, Investigations & Disputes business unit. He focuses on issues related to valuation and solvency. This article represents the views of the author and is not the official position of Duff & Phelps, LLC.

Mr. Vitti can be contacted at (973) 775-8250 or by e-mail to michael.vitti@duffandphelps.com.

The author is not an attorney and is not offering legal advice. This article is written from a business valuation practitionerâs perspective, who works on, among other things, litigation-related matters.

[1] VC Lasterâs opinion (Opinion) at 114. The Opinion can be found here: https://courts.delaware.gov/Opinions/Download.aspx?id=279250

[2] Opinion at 66.

[3] Opinion at 67.

[4] This chart has stock price data for the 2006 thru 2008 period. The first trading day in 2006 was January 4.

[5] https://globenewswire.com/news-release/2018/02/27/1387757/0/en/Akorn-Issues-Statement-on-Investigation.html

[6] Opinion at 138.

[7] Opinion at 163.

[8] Opinion at 164.

[9] Opinion at 179.

[10] Opinion at 184.

[11] Opinion at 184.

[12] Opinion at 185.

[13] Opinion at 186.

[14] Opinion at 187.

[15] Opinion at 187.

[16] Opinion at 187â188.

[17] Opinion at 189.

[18] Opinion at 191.

[19] Opinion at 191.