How to Value

Privately Held Promissory Notes

How should a privately held promissory note be valued? In this article Bruce Johnson answers this question. Bruce notes that the key issues to consider when valuing a privately held promissory note are the interest rate, amortization term, collateral, payment history, covenants and marketability of the note being valued. Once this information is assessed, an appraiser can conclude whether the subject note’s interest rate is below or above the market rate for a comparable investment with the same level of risk. The author advocates the use of rates from Business Development Companies because they are more comparable than corporate bond rates to privately held notes.

The key issues to consider when valuing a privately held promissory note are the interest rate, amortization term, collateral, payment history, covenants, and marketability of the note being valued. Once this information is assessed, an appraiser can conclude whether the subject note’s interest rate is below or above the market rate for a comparable investment with the same level of risk.

If the interest rate is below the current market rate, the note will trade at a discount to its current balance. If the note’s rate is above the current market rate, the note will trade at a premium to its current balance. Taxpayers commonly use the Applicable Federal Rate (AFR) when issuing privately held promissory notes. AFR rates are typically low relative to third party notes or investments. As of August 2019, the long-term AFR is currently about 2.3%.[1] The yield for publicly traded corporate bonds typically range from four percent to seven percent and reflect less risk than the majority of privately held promissory notes. Publicly traded high yield corporate bonds, which are even riskier than corporate bonds for large companies, have even higher interest rates ranging from eight percent to 12%.

As noted, an appraiser’s primary task is to examine alternative bond rates and calculate a market rate for the privately held promissory note being appraised. An investor comparing a small privately held note with an AFR interest rate would obviously invest in a corporate bond because it represents less risk and has a higher return. Privately held notes used in gift and estate transactions are typically not comparable to corporate bonds issued by large publicly held companies because publicly held companies are much larger and do not reflect the same level of risk as a small privately held note. A third-party investor would require an interest rate of 12% to 20% for a small privately held note to reflect the true risk of the investment. Accordingly, appraisers should look at other comparable investments instead of corporate bonds to determine a market rate of interest.

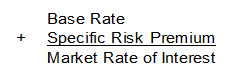

The value of a privately held note is based on the present value of the future principal and interest payments of the note using a market rate of interest based on the risk of the note. This requires an analysis of the risk of the promissory note including an analysis of the amortization, collateral, payment history, note covenants, and marketability of the privately held note. The first step is to determine a market interest rate followed by discounting the future expected payments to present value. In order to calculate a market interest rate, an appraiser must determine a base rate and increase that by a specific risk premium for the additional risks not accounted for in the base rate.

As discussed, the base rate should be determined using measurable alternative investments with comparable levels of risk. The interest rates of notes held by publicly traded Business Development Companies (BDCs) provide the most comparable rates to privately held promissory notes. BDCs were created by Congress in 1980 and are usually incorporated as closed-end registered investment companies. BDCs lend to small- and medium-sized private companies that carry a rating of BBB- by Standard and Poor’s. Since BDCs are regulated, they must provide certain shareholder protections and meet government compliance regulations, including SEC filings. Like real estate investment trusts (REITs), BDCs are exempt from corporate income taxes as long as they pay out at least 90% of their taxable income to shareholders in the form of dividends.

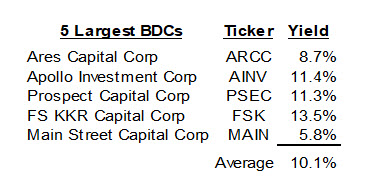

Approximately 50 BDCs are actively traded in the public market. The lending rates for collateralized loans of publicly traded BDCs typically range from seven percent for large companies to 16% for smaller companies. The lending rates of non-traded BDCs can be as high as 20% for non-collateralized short-term loans with personal guarantees. The interest rates for loans issued by BDCs can be used to determine a base rate by appraisers or the current yield of publicly traded BDCs can be used as a proxy. As of August 2019, the average yield for debt focused BDCs was approximately 9.9%. The current yield for the five largest BDCs are shown below:

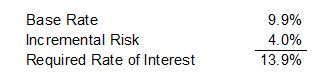

Because small, privately held promissory notes are riskier than a diversified BDC, a specific risk premium should be added to the base rate to determine a market rate of interest. Specific risk premiums for privately held promissory notes usually range from two percent to six percent and compensate an investor for the additional risk factors that are not reflected in the base rate. The factors to consider when determining the specific risk premium include the term of the note, payment history, amortization structure, protective covenants, collateral, personal guarantees, and marketability. If a privately held note has a 10-year term, is interest only, and is not collateralized, the market rate of interest will be higher than a BDC and a specific risk premium of four percent to six percent should be considered.

Using a market rate of interest, the forecast of future interest and principal payments per the note’s amortization schedule are discounted to present value to determine a value. The use of a higher interest rate to represent the risk of the investment will result in a discount from the current balance of the privately held promissory note. Since a hypothetical buyer has several alternative investment choices when investing in a fixed income security, it is important to base any rate of return analysis on measurable alternative investments with comparable levels of risk. Based on the term of the note, its risk of repayment and the stated interest rate, some notes will trade at large discounts while others will trade at small discounts. Publicly traded BDCs are more comparable than corporate bonds when determining a market rate of interest for a privately held promissory note. Using the methodology outlined above will result in an appraisal of a privately held promissory note that is more accurate due to the comparability of BDC fixed income securities with privately held promissory notes.

Bruce A. Johnson, ASA, is a partner in the business valuation firm of Munroe, Park & Johnson, Inc. based in San Antonio, Texas. He holds a degree in Engineering and an MBA from Texas A&M University. He was the taxpayer expert in the first family limited partnership court case and has been published on a wide range of valuation topics including S corp tax treatment, discounts for lack of, marketability, and the valuation of family limited partnerships.

Mr. Johnson can be contacted at (210) 545-7332 or by e-mail to Bruce@mpjonlin

[1] https://www.irs.gov/pub/irs-drop/rr-19-17.pdf