A Method for Calculating

The Excess Earnings Capitalization Rate

This article presents a method for calculating the capitalization rate for excess earnings. The good news is that this capitalization rate can be calculated. The bad news is that with the calculated excess earnings capitalization rate, the excess earnings method gives the same value as the single period capitalization method under the Income Approach, i.e., the excess earnings method is not an independent valuation method.

This article presents a method for calculating the capitalization rate for excess earnings. The good news is that this capitalization rate can be calculated. The bad news is that with the calculated excess earnings capitalization rate, the excess earnings method (EEM)gives the same value as the single period capitalization method under the Income Approach, i.e., the EEM is not an independent valuation method.

The typical approach used to verify that the value indication from the EEM is “reasonable”, is to check it against the value obtained using the single period capitalization method (SPCM). If there is not reasonable agreement, one adjusts the excess earnings capitalization rate until there is reasonable agreement. The question is why not adjust the excess earnings capitalization rate until the EEM gives the same value indication as the SPCM? Or why not calculate the excess earnings cap rate using the approach outlined below which guarantees that the EEM will give the same value as the SPCM? The answer to both questions is that the EEM would not add any new information, i.e., it is not an independent method!

Shannon Pratt[1] states that for the EEM (used with the adjusted book value method as a subset to value the net tangible assets) is “[t]he weighted average of the capitalization rates for the tangible assets and excess earnings (weighted by the value ascribed to each of the two components) should be the same as the company’s overall capitalization rate.” Equation 1 describes this situation.

CNCF = [kNTA x NTA + Ci x Intangible Asset Value]/Total Value[2] (Eq. 1)

In other words, the EEM, as described above, and the single period capitalization method should give the same indication of value if both methods are properly applied. Equation 2 gives the value of the subject using the adjusted book value and EEM.

The value of the subject = NTA + [NCF – (KNTA x NTA)]/Ci (Eq. 2)

Where, NTA = net tangible asset value

KNTA = required rate of return on net tangible assets

CNCF = capitalization rate for net cash flow[3]

NCF = forecast net cash flow for next year[4]

Ci = capitalization rate for excess earnings

As indicated, the first term on the right side of Equation 2 is the value of the net tangible assets from the adjusted book value method. The second term is the value of the intangible assets from the EEM.

Equation 3 gives the value of the subject using the single period capitalization method.

The value of the subject = NCF/CNCF (Eq. 3)

Equation 2 and Equation 3 should give the same value indication, therefore:

NCF/CNCF = NTA + [NCF – (knta x NTA)]/Ci (Eq. 4)

Rearranging terms, one can write:

[(NCF/CNCF) – NTA] = [NCF – (knta x NTA)]/Ci

Dividing both sides of the equation by [(NCF/CNCF) – NTA] and rearranging terms gives:

Ci = [NCF – (knta x NTA)] / [(NCF/CNCF) – NTA] (Eq. 5)

Equation 5 has a singularity where (NCF/CNCF) = NTA, i.e., NCF/NTA = CNCF. This means that Ci = ∞ at this point. From Equation 5, one can see that this singularity occurs where the value of the subject is equal to the value of the net tangible assets (NTA). One can come to the same conclusion from Equation 3. That is if CI = ∞, the right side of the equation equals NTA; and, and NCF/NTA = CNCF. If the value of the subject is less than NTA, the intangible value in Equation 2 would be negative. Therefore, for values of NCF/NTA<= CNCF, the EEM is not applicable.

For very small values of NTA, i.e., knta x NTA << NCF; and, NTA << NCF/CNCF, Equation 5 becomes:

Ci = NCF / (NCF/CNCF) = CNCF (Eq.6)

Ci will always be higher than CNCF5, therefore it can be inferred that Ci increases with increasing values of NTA.

Dividing the numerator and denominator of the right side of Equation 5 by NTA, and factoring CNCF out of the denominator, one can write:

Ci = {[(NCF/NTA) – knta] / [(NCF/NTA) – CNCF]} x CNCF (Eq. 7)

For convenience, one can re-write Equation 7 by dividing each side by CNCF:

CI / CNCF = {[(NCF/NTA) – knta] / [(NCF/NTA) – CNCF]} (Eq. 8)

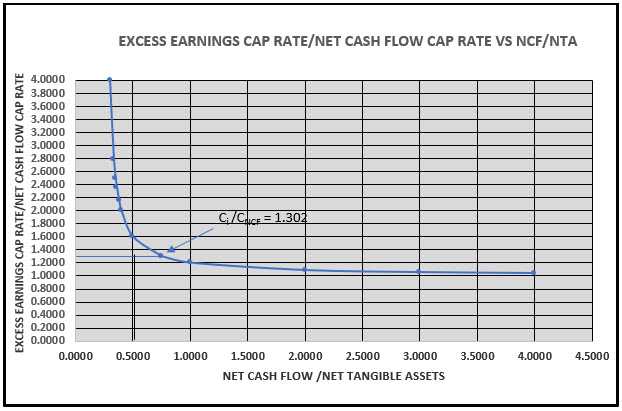

The following chart graphically presents solutions of Equation 8 for the specific values of parameters used in the analysis (as listed on the following page).

The chart verifies the previous discussion, namely:

- The minimum value of the excess earnings cap rate, as NCF/NTA approaches infinity, is equal to the net cash flow cap rate as one would expect; and

- The excess earnings cap rate increases as the value of the subject’s NTA increases. One would also expect this since, if the value of NTA is small, the return on NTA will be small, and, essentially, all the cash flow will be excess earnings. For this situation, Equation 1 would be essentially equivalent to Equation 2, and the excess earnings cap rate would approach its minimum value, i.e., the same value as the net cash flow cap rate[5].

This paper is not provided for the purpose of allowing an appraiser to determine the excess earnings cap rate for use in the EEM. Rather, it is provided to demonstrate the difficulty of independently determining the excess earnings cap rate.

One could use Equation 8 to determine the excess earnings cap rate. However, the EEM as described above (i.e., the EEM with the Adjusted Book Value as a subset) would then give the same value indication as the single period capitalization method. That is, the EEM would provide no new information.

Rather than using the EEM to value intangible assets, it is the author’s opinion that one is better off using the single period capitalization method, or the multiple period discounting method, under the Income Approach to value the tangible and intangible assets together, and then subtracting the value of net tangible assets to determine the value of the intangible assets. From this article and the data on the following chart, one can see there is no method to independently determine the value of the excess earnings cap rate.

Chart / Subject Parameters

Knta = 10.0%

NTA = $500,000 For the subject

ncf = $373,633 For the subject

NCF/NTA = 0.747 For the subject

Cncf = 25.0% For the subject

g = 3.6% For the subject

Value Indications

value = ncf/cncf = $1,494,652 (Single Period Capitalization)

value = (ncf – nta x Knta)/Ci + nta = $1,494,652 (EEM)

Wayne Quilitz, CMEA, CTEP, is president of Murphy Valuation Services, LLC.

Mr. Quilitz can be contacted at (727) 725-7090 or by e-mail to WQuilitz@murphybusiness.com.

[1] Pratt, et al., “Valuing Small Businesses and Professional Practices”, Third Edition, McGraw-Hill, 1998, p 414.

[2] Equity Value or Market Value of Invested Capital.

[3] Capitalization rate for net cash flow to equity or net cash flow to invested capital.

[4] Net cash flow to equity or net cash flow to invested capital.

[5] “Valuing Small Businesses and Professional Practices”, Pratt, et al., third Edition, McGraw-Hill, 1998, p 413, “…the capitalization rate applicable to excess earnings normally would have to be higher than the company’s overall required equity (capitalization) rate”.