Operating in the Post-Coronavirus Period

What Do We Do Moving Forward in Time?

The coronavirus and the events unleashed by the outbreak were unforeseeable to professionals preparing reports as of the end of 2019. What do we, as valuation and litigation support professionals, do moving forward in time when we are engaged to value a business? Here, the author, Ron Rudich, answers these questions.

Gary R. Trugman wrote in his tome, Understanding Business Valuation, A Practical Guide to Valuing Small to Medium-Sized Businesses, Second Edition, beginning on page 510, the following:

Valuation as of a Specific Date

A business valuation is similar to a balance sheet, as it is a picture of the business at a specific moment in time. Values change as factors around the business change. This is especially evidenced in the public stock market. Therefore, the information used in performing a business valuation should be only that information that was known or knowable as of the valuation date. This can best be illustrated by a real situation that I encountered. A valuation of a bicycle shop was to be performed as of June 10, 1992, the date of the divorce complaint. The business burned down on March 14, 1993. In this instance, the value as of June 10, 1992, was the real issue. An appraiser cannot forecast a fire nine months after the valuation date.

After speaking with many other professionals, I have come to the conclusion that if we are preparing a valuation as of December 31, 2019, we should not consider the impact of the coronavirus on the historic financial statements, which is definitely a subsequent event. There is no way the impact of the coronavirus on the U.S. economy and the stock market was known or knowable as of that date.

So, what do we do moving forward in time?

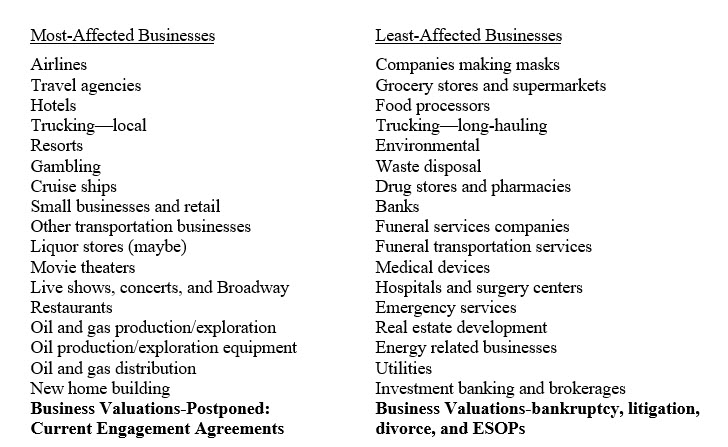

We certainly must consider the impact on the U.S. economy but, to what degree and on which industries? As is the instance with any emergency, many businesses will be adversely affected, while many businesses will not be affected at all and maybe even flourish beyond historic measures. Some of these businesses are as follows:

Therefore, it will be incumbent on us to ascertain explicitly (to cite some):

- How and to what degree the company was affected?

- How long it is expected to attain pre-virus levels?

- Will the company be able to recover at all?

- How much money will be required to facilitate the re-growth of the company?

- Can the company even prepare a forecast to be utilized in a DCF?

- Would we have to concentrate on the value of the adjusted equity of the business?

- Are we only able to consider the capitalization of earnings method with growth into the next year?

- Will we have to consider additional items and/or accounts to normalize?

- How long will it take to reopen?

- How long will it take to re-staff?

- Understand that unemployment costs may increase because of layoffs as well as other expenses.

- Understanding the impact on the business due to the new law passed by Congress.

- Do we “stop” at Dec. 31, 2019 and not consider the present economic circumstances if the company can get back up to speed in a short period of time?

- Are we even able to consider market comparable transactions?

- Inspecting either the checkbook and/or credit cards for extraordinary personal expenses paid by the subject company?

If we can concentrate on the discount rate to determine the capitalization rate, I feel that we need to pay more attention to the Company Specific Risk analysis portion of the discount rate. This is the section “that we own.” It is imperative that we analyze and evaluate the “new” strengths and weaknesses of the business like never before. Therefore, consider for the company these possible stress (risk) factors:

- Not able to obtain financing or a level of financing that was enjoyed in the past.

- The lender may require a shorter time frame for the return of the amount loaned.

- Additional covenants may be imposed that may be stricter than before.

- The ability to still purchase from suppliers either because they will not be sold to or the supply chain has dried up.

- They may have lost revenue to other companies.

- Interest rates that seem to be low may be higher due to some supposed risk.

- The possibility of liquidation due to the lack of ability to recover quickly.

- Stability of the industry.

- The Company’s ability to rehire employees that were laid off.

- The Company’s ability to train new employees and get them to an optimum level quickly.

- The Company may have to change the way they provided fringe benefits or implement ones that were never given before.

- Understand that employees may cost more not to make-up for the time of lost wages (could be accounted for in a DCF but not in a capitalization of earnings).

- Dependence on the Company’s economy; notwithstanding the country’s economy as a whole (it could be regional, state-wide and/or national in scope).

- Stability of earnings and how long will it take for the Company to enjoy the level of earnings it obtained pre-coronavirus.

- Determine if they were able to diversify (i.e., specialized medical equipment and/or supplies) and if this new product line is something that would be sustained into the future.

- Determine if abnormal present or pending competition has emerged.

- Understand if there are pending lawsuits (i.e., wrongful termination).

- Understand if special environmental problems now exist (i.e., along with possible retooling via a new diversification).

- Understand that the new diversification may be “seasonal” in nature or not long-lived and not sustainable.

- Understand if new pending or initiated pending local and/or state regulatory laws have been implemented.

- Understand that the business model may have drastically changed.

- Understand that they may have decided to rely on the Internet more heavily than before and the risk associated with that new line of business versus companies that already command the space.

- If they were already on the Internet, has their distribution and logistics structure been compromised?

- Determine if the Company’s customer base has changed or diminished.

- Determine if the Company is now able to serve the area in which it operated in the past.

- Determine if the “brain-trust” (management) can accept what has happened to the business and is able and willing to finance with increased effort and time for the Company’s future.

It is quite understandable that the previous sections of risk factors seem to cross each other, but they are presented as a guide to your thinking knowing that you will give credence to them in the correct section of your valuation during this period of financial upheaval.

If we strive to consider all that is before us, our business valuations will be reasonably correct rather than horribly wrong!

Ronald D. Rudich, CPA, ABV, CFF, MS, MCBA, CVA, ABAR, MAFF, CMEA, CM&AA, BCA, is the founder of the business valuation and litigation support services company, Business Valuation Group, LLC. His responsibilities include: valuations of closely held and publicly traded companies, machinery and equipment appraisals, strategic business planning, budget and forecasting services, business consulting, business loss computations, depositions, and court testimony.

Mr. Rudich has written five white papers: (1) Multiple Uses of Comparative Industry Data, published in IBA’s Business Appraisal Practice, Third/Fourth Quarter 2015, (2) Why Valuation Experts Should Not Use the Term ‘Nonmarketable’, published in Business Valuation Update, September 2015 by Business Valuation Resources, LLC, (3) Rudich DLOM Verification Formula, published in IBA’s Business Appraisal Practice, 2013 Third Quarter, (4) Valuing the Difference Between Voting and Non-Voting Shares of Stock, published in Business Valuation Update, November 2010, and (5) Analyzing the IBA Database Transactions Results, published in the Business Appraisal Practice, Winter 2006/2007.

Mr. Rudich was named a “Business Valuation and Financial Forensic Master”, as part of the National Association of Certified Valuators and Analyst’s Industry Titans awards at their June 2016 Conference. He was selected into the Founders Circle of the of the Alliance of Merger & Acquisition Advisors in January 2013, elected to the Advisory Board in 2004, and received the 2008 Chair of the Year award in January 2009. He was admitted to the Westlaw Round Table Group, Washington, DC expert network as a Round Table Scholar in January 2009, and recognized by SmartCEO as one of the Top CPAs in the Baltimore/Washington, DC area in their September 2008 issue.

For the Institute of Business Appraisers, he was elected as Chair of the Board of Governors for a two-year term in June 2012 and appointed to the Board for a three-year term in June 2011, appointed as Chair of the Accredited in Business Appraisal Review (ABAR) Appeals Task Force that provides technical guidance and support on ABAR reviews as of January 2011, and was a report reviewer for the Quality Review Committee (QRC) for those seeking a credential certification from 2008 to 2016.

Mr. Rudich can be contacted at (410) 581-1888 or by e-mail to Ron.Rudich@bvgllc.com.