Valuation Treatment of the ESOP

Repurchase Obligation Liability

There are certain valuation aspects that are unique to employee stock ownership plan (ESOP) sponsor company valuation engagements. The ESOP repurchase obligation is one of those aspects. There is a diversity of practice in the valuation profession as to how to treat the repurchase obligation for sponsor company valuations performed for ESOP administration purposes. There are several alternatives that may be appropriate depending on the facts and circumstances of the assignment, and the analyst’s interpretation of the fair market value standard of value for ESOP administration engagements. This discussion provides a hypothetical ESOP sponsor company valuation to illustrate the alternative valuation treatments for the repurchase obligation on the sponsor company share price conclusion.

Introduction

This discussion is intended to clarify and enhance the ongoing discussion among valuation analysts (analysts) related to the treatment and presentation of the repurchase obligation in valuations performed for employee stock ownership plan (ESOP) administration and regulatory compliance purposes.

There are several procedures that analysts have applied to account for the repurchase obligation in the sponsor company valuation analysis. Additionally, the argument can be made that the repurchase obligation should have no effect on the sponsor company valuation.

The Repurchase Obligation

The term “repurchase obligation” refers to the statutory “put” requirement for sponsor company shares held in ESOP participant accounts. The put option requires the sponsor company to purchase participant shares “under a fair valuation formula.”1

The put option generally provides that the sponsor company will purchase the ESOP sponsor company shares held by ESOP participants who:

- Depart employment from the sponsor company, or

- Qualify for and elect to diversify their sponsor company shares.

This provision provides a higher degree of liquidity than is typically attributed to the shares of a closely held corporation.

The economic liability resulting from the statutory “put” requirement for the ESOP sponsor company shares is referred to as the repurchase obligation liability. However, the term repurchase obligation liability is slightly misleading because:

- Under U.S. generally accepted accounting principles, the repurchase obligation is not presented as a liability on the sponsor company balance sheet, and

- The repurchase obligation may have liability and equity characteristics depending on the sponsor company’s method for handling share repurchases.

Sponsor companies have several ways of handling share repurchases. A sponsor company can select one, or any combination, of the following alternatives to repurchase shares that are “put” to the sponsor company by the ESOP participants:

- The sponsor company may repurchase the subject shares using sponsor company funds and hold the subject shares in treasury. This alternative is generally referred to as “redeeming.”

- The sponsor company may repurchase the subject shares and subsequently contribute the subject shares to the ESOP as an employee compensation expense. This alternative is generally referred to as “recycling.”

- The ESOP trust may repurchase the subject shares with cash held in the trust. This alternative is also referred to as “recycling” within the ESOP community. For clarity purposes in this discussion, we refer to this alternative as “ESOP investing.”

- The sponsor company may repurchase and “releverage” the subject shares. Releveraging involves the sponsor company contributing shares to the ESOP in exchange for a note. The contributed shares are allocated to participant accounts as the new internal note is amortized, in the same fashion that a leveraged ESOP is structured.

There are pros and cons to each of the repurchase obligation alternatives listed above. These considerations are outside of the scope of this discussion.

Valuation Theory

The nexus for the lack of consensus among analysts trying to address the repurchase obligation liability is uncertainty regarding the application of the fair market value standard of value to ESOP valuation assignments.

Under the Employee Retirement Income Security Act of 1974 (ERISA), an ESOP may purchase or sell sponsor company stock from/to a party in interest if:

- The purchase or sale is for adequate consideration, and

- No commission is charged to the ESOP.

Further, the ESOP trustee may not agree to the terms of a transaction that are less beneficial to the ESOP than adequate consideration.

Adequate consideration for closely held corporations is defined in ERISA Section 3(18)(B) as “the fair market value of the asset as determined in good faith by the trustee or named fiduciary pursuant to the terms of the plan and in accordance with regulations promulgated by the U.S. Secretary of Labor.”

The DOL “Proposed Regulation Relating to the Definition of Adequate Consideration” (the Proposed Regulation) defines fair market value as “the price at which an asset would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, and both parties are able, as well as willing, to trade and are well-informed about the asset and the market for that asset.”2

The terms in the Proposed Regulation are very similar to the terms set forth in Internal Revenue Service Revenue Ruling 59-60, which is applicable for valuations that are performed for estate and gift tax purposes. Both definitions of fair market value assume hypothetical and knowledgeable willing buyers and willing sellers.

The Proposed Regulation and Revenue Ruling 59-60 each list the following eight factors that an analyst may consider when performing a fair market value analysis:

- The nature of the business and the history of the enterprise from its inception

- The economic outlook in general and the condition and outlook of the specific industry in particular

- The book value of the stock and the financial condition of the business

- The earning capacity of the company

- The dividend-paying capacity

- Whether or not the enterprise has goodwill or other intangible value

- Sales of the stock and the size of the block of stock to be valued

- The market price of stocks of corporations engaged in the same or a similar line of business having their stocks actively traded in a free and open market, either on an exchange or over the counter.

The eight factors listed above represent a complete list of the factors listed in Revenue Ruling 59-60. The Proposed Regulation adds the following factors to the Revenue Ruling 59-60 list:

- The marketability, or lack thereof, of the securities. Where the plan is the purchaser of securities that are subject to “put” rights and such rights are taken into account in reducing the discount for lack of marketability, such assessment shall include consideration of the extent to which such rights are enforceable, as well as the company’s ability to meet its obligations with respect to the “put” rights (taking into account the company’s financial strength and liquidity).3

- Whether or not the seller would be able to obtain a control premium from an unrelated third party regarding the block of securities being valued, provided that in cases where a control premium is taken into account:4

- actual control (both in form and in substance) is passed to the purchaser with the sale, or will be passed to the purchaser within a reasonable time pursuant to a binding agreement in effect at the time of the sale, and

- it is reasonable to assume that the purchaser’s control will not be dissipated within a short period of time after the acquisition.

In response to the Proposed Regulation guidance with respect to put rights, analysts have generally decreased the explicit discount for lack of marketability for ESOP valuations relative to discounts typically attributed to the shares of closely held corporations valued for non-ESOP purposes.

The consideration of the subject shares’ put rights is an investment value consideration—not a typical fair market value consideration—at least to the extent that analysts have typically adjusted the discount for lack of marketability to account for the put rights.

In other words, the put rights are an investment-specific characteristic that are limited to certain shares (i.e., shares held by the ESOP trust) and shareholders (i.e., the ESOP participants via the ESOP trust), rather than the hypothetical investor population.

A non-ESOP-owner would not benefit from the ESOP put rights. A hypothetical non-ESOP-buyer would not pay for put rights that are no longer attached to the subject shares.

From an economic standpoint, the consideration of the ESOP put rights is appropriate to analyze in a sponsor company stock repurchase transaction. The fair market value (i.e., a hypothetical willing and able buyer and a hypothetical willing seller) and marketability (i.e., consideration of the ESOP put right) provisions within the Proposed Regulation are at odds with each other. A hypothetical willing buyer would not compensate the seller for the put rights because the buyer would not benefit from the inherent ESOP put rights.

This inconsistency gives the analyst three immediate fair market value interpretations (FMV interpretations) to consider when performing a valuation for ESOP administration purposes. This discussion refers to these FMV interpretations as “transfer tax,” “ESOP-hybrid,” and “within-ESOP.”

Transfer Tax Fair Market Value Interpretation

Under the “transfer tax” FMV interpretation, value is estimated based on a hypothetical sale of the block of shares held by the ESOP trust. The appropriate levels of control and of marketability in the block of shares, and resulting explicit or implicit adjustments to value, are assessed based on the investment-specific characteristics conveyed to a hypothetical third party.

A hypothetical third party would not incur expenses related to the ESOP, so the ESOP contribution expense associated with the repurchase obligation is typically adjusted to a normal retirement contribution expense level based on industry and market data.

This analysis is consistent with a gift and estate valuation engagement, and it ignores the Proposed Regulation guidance regarding the ESOP put right.

All else equal, a noncontrolling interest valued under this FMV interpretation:

- Will likely have a higher discount for lack of marketability (the ESOP put rights are ignored) than the other FMV interpretations, which would decrease the indicated value, and

- Will normalize ESOP-related expenses, which would typically increase the value conclusion relative to the within-ESOP FMV interpretation (the ESOP-hybrid FMV interpretation also normalizes ESOP-related expenses).

All else equal, a controlling interest valued under this FMV interpretation:

- Will have a similar discount for lack of marketability as the other FMV interpretations (despite ignoring the ESOP put rights, a controlling interest can create a market for the subject shares), and

- Will normalize ESOP-related expenses, which would increase the value conclusion relative to the within-ESOP FMV interpretation.

ESOP-Hybrid Fair Market Value Interpretation

Under the “ESOP-hybrid” FMV interpretation, the analysis is performed in a similar fashion to the transfer tax FMV interpretation. A sale of the ESOP interest is assumed.

The analyst applies normalization adjustments to remove ESOP-related expenses. If the ESOP holds a controlling interest, controlling interest adjustments are considered.

The consideration of the discount for lack of marketability under the ESOP-hybrid FMV interpretation differs from the “transfer tax” interpretation. The analyst’s selection of the discount for lack of marketability considers the statutory put right for the ESOP shares, resulting in a lower discount for lack of marketability for a noncontrolling sponsor company subject ownership interest.

All else equal, the ESOP-hybrid FMV interpretation will likely produce a higher indication than the other FMV interpretations for a noncontrolling interest.

On a controlling ownership interest basis, the ESOP-hybrid will generally result in a similar valuation conclusion to the transfer tax FMV interpretation and a greater valuation conclusion than the within-ESOP FMV interpretation conclusion.

Within-ESOP Fair Market Value Interpretation

The “within-ESOP” FMV interpretation is not based on the hypothetical buyer and hypothetical willing seller premise. The subject transaction is between:

- A noncontrolling shareholder (i.e., an ESOP participant), and

- The sponsor company or the ESOP.

The within-ESOP FMV interpretation assumes that the sponsor company will operate indefinitely with the ESOP in place under the sponsor company board and management’s direction.

Control-level adjustments are not applied under the within-ESOP FMV interpretation without a reasonable and quantifiable expectation for changes in cash flow, capital structure, and so forth. The discount for lack of marketability considers the ESOP put right.

The following factors may decrease the value conclusion using the within-ESOP FMV interpretation relative to the other FMV interpretations:

- Heightened retirement expenses stemming from the repurchase obligation, and

- Lack of control-level adjustments.

The discount for lack of marketability using the within-ESOP FMV interpretation is generally lower than the discount for lack of marketability in a noncontrolling valuation using the transfer tax FMV interpretation.

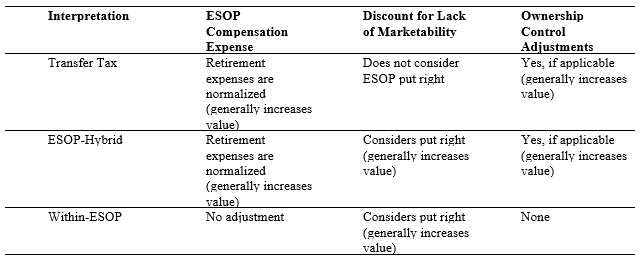

Figure 1 summarizes the different considerations for each FMV interpretation and their effect on value.

Valuation Treatment of the Repurchase Obligation

Valuation analyses developed under the ESOP-hybrid and within-ESOP FMV interpretations can be said to consider the repurchase obligation. These are two common FMV interpretations for ESOP administration purposes and will be the focus of the remainder of this discussion.

Valuation exhibits that underscore the valuation treatment of the repurchase obligation are presented in this discussion. The illustrative company, Professional Services Firmco (PSF), is a professional services firm that is structured as a C corporation. PSF is in the mature business lifecycle stage.

All of the PSF equity is held by the private company’s ESOP trust. The PSF ESOP trust was established in 1990, and all shares held by the trust are allocated to participant accounts.

PSF also sponsors a 401(k) plan and makes contributions to the plan that are consistent with the retirement contributions of its primary competitors.

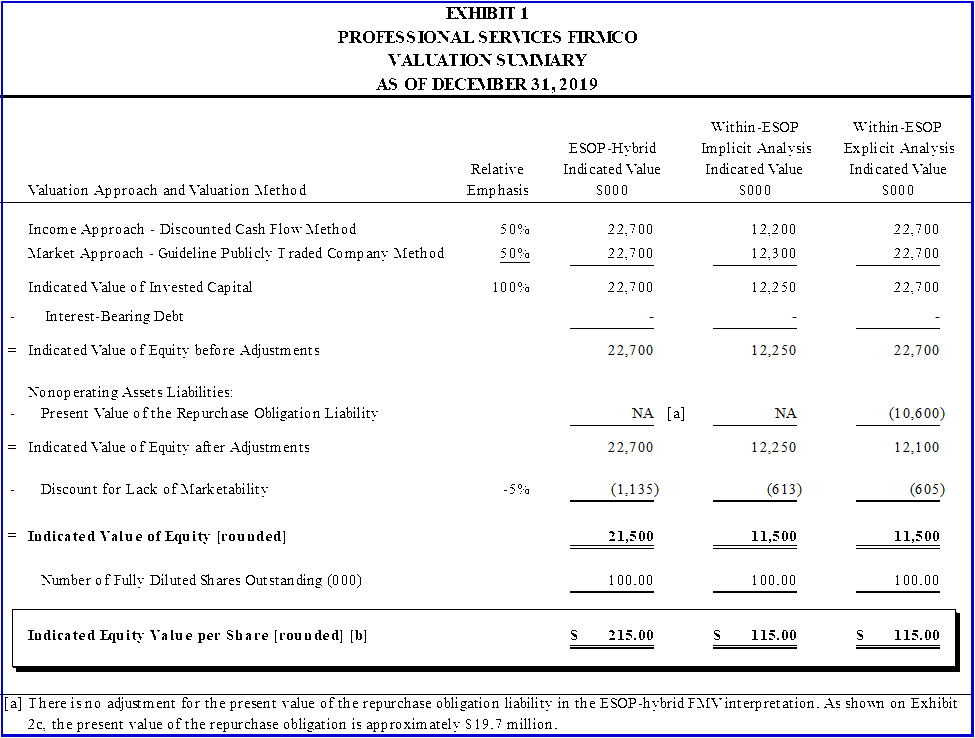

Exhibit 1 compares the value conclusion for PSF under the ESOP-hybrid and the within-ESOP FMV interpretations.

Value Under the ESOP-Hybrid FMV Interpretation

The ESOP-hybrid FMV interpretation considers the repurchase obligation only to the extent that the repurchase obligation provides liquidity (therefore decreasing the lack of marketability) for the subject shares.

The repurchase obligation “liability” does not directly affect the share value conclusion under the rationale that the repurchase obligation liability would cease to exist if the ESOP sold its interest to a non-ESOP third party.

Analysts may increase or decrease the discount for lack of marketability based on the sponsor company’s ability to meet its repurchase obligation.

While these assumptions are valid, they may have unintended consequences for the ESOP sponsor company. A higher share price under this FMV interpretation due to normalizing retirement expenses also increases the repurchase obligation.

Depending on the sponsor company’s cash flow, balance sheet sources of liquidity, and funded status of the ESOP, this could cause the sponsor company to be cash constrained.

The hypothetical sale transaction assumed under the ESOP-hybrid interpretation may ultimately lead the sponsor company shareholders to enter into an actual sale transaction to eliminate the repurchase obligation.

There are various financial planning and ESOP structural measures that can reduce the financial burden related to the repurchase obligation.

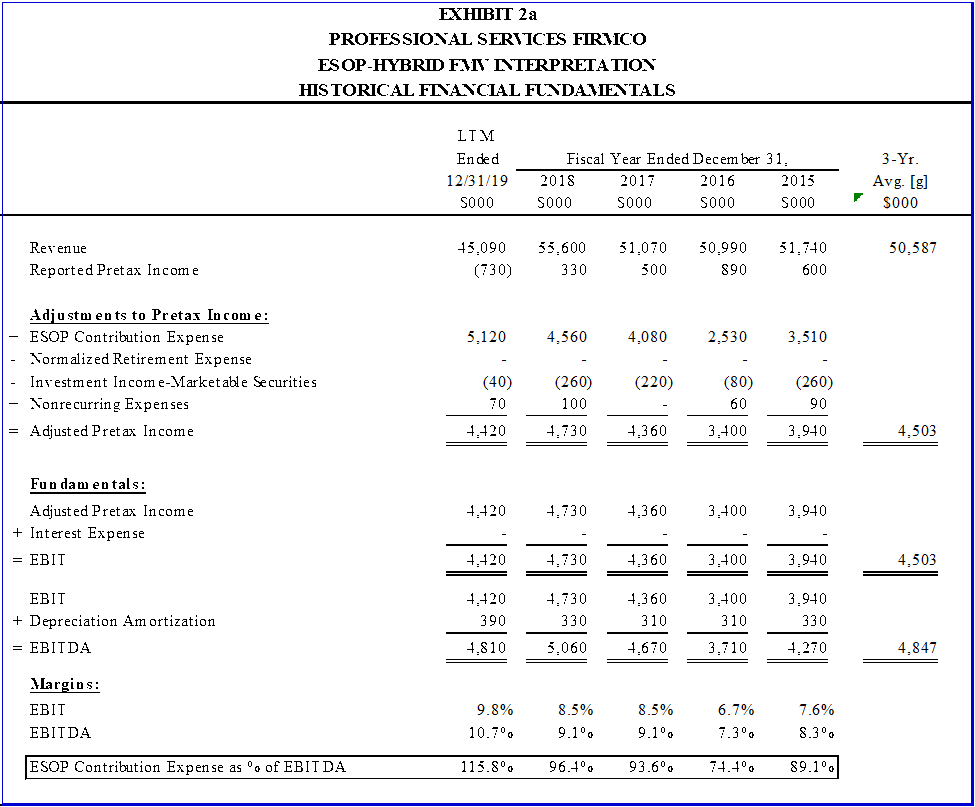

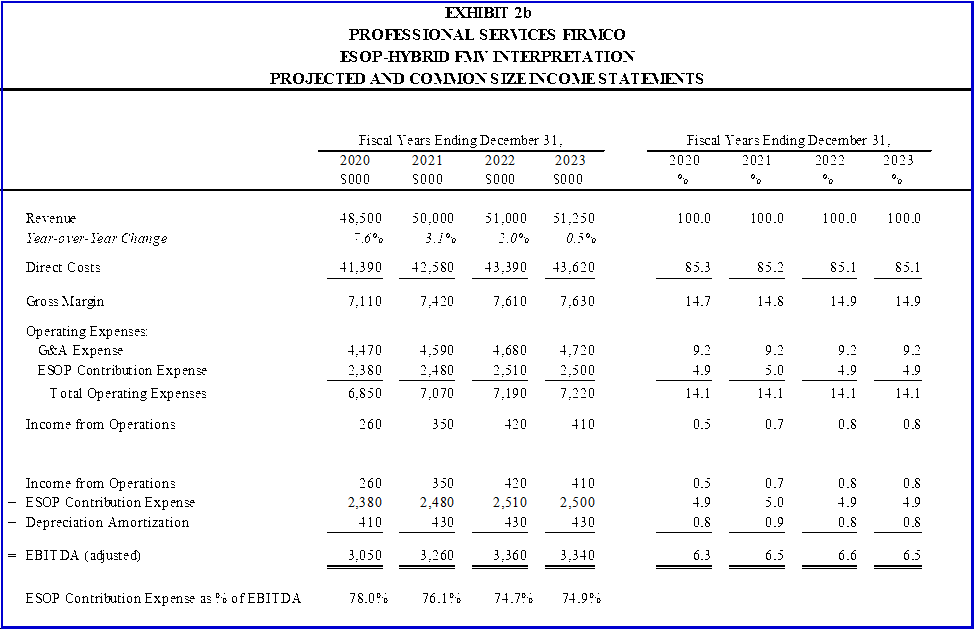

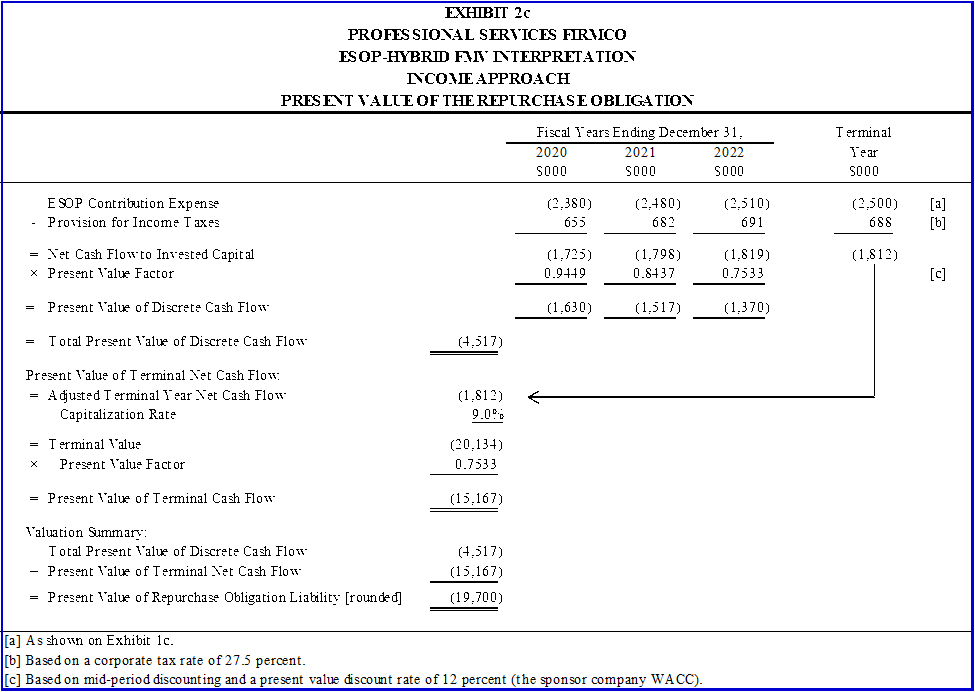

Exhibits 2a and 2b present the PSF adjusted historical financial fundamentals and projected income statements under the ESOP-hybrid FMV interpretation, respectively.

As presented in Exhibit 2a, ESOP contribution expense ranged from 74.4 percent to 115.8 percent of adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) over the five years ending December 31, 2019.

As presented in Exhibit 2b, ESOP contribution expense is expected to range from $2.38 million (or 78.0 percent of adjusted EBITDA) in 2020 to $2.51 million (or 74.7 percent of adjusted EBITDA) in 2022.

As presented in Exhibit 1 (in the ESOP-hybrid FMV interpretation column), the value of PSF invested capital of $22.7 million was estimated using the discounted cash flow method and the guideline publicly traded company method. PSF had no interest-bearing debt. PSF did not have any nonoperating assets or liabilities.

A discount for lack of marketability of 5 percent was applied to the equity value conclusion based, in part, on the ESOP put rights. This discount resulted in an equity value of $21.5 million on a controlling, nonmarketable basis, or an equity value of $215 per share based on the 100,000 shares outstanding in PSF.

The present value of the repurchase obligation is estimated in Exhibit 2c by applying the discounted cash flow method. The repurchase obligation is not considered in the valuation analysis—it was only included for comparison purposes.

The present value of the repurchase obligation is $19.7 million.

Summarized below are the strengths and weaknesses of analyses performed using the ESOP-hybrid FMV interpretation:

- Strengths—Indicates the value of the ESOP shares as part of a sale transaction; provides a threshold for assessing acquisition offers

- Weaknesses—Differs from the sponsor company’s expected cash flow as an ESOP sponsor company; may increase the repurchase obligation liability and hinder the sustainability of the sponsor company/ESOP trust; noncontrolling interests held by the ESOP may be overstated if the ESOP were to unilaterally divest its ownership interest to a third party

Value Under the Within-ESOP FMV Interpretation

Analyses developed under the within-ESOP FMV interpretation assume that the sponsor company ESOP will remain in place (at least for several years). There are several factors that influence the repurchase obligation and, therefore, expected ESOP contribution expenses.

These factors include the following:

- The size of the ESOP trust ownership interest in the sponsor company

- The number of shares allocated to participant accounts (term and remaining time to maturity of the internal loan)

- Sponsor company share price growth

- Age of the workforce

- Workforce turnover and average tenure

- Plan vesting requirements

- Terms for cashing out participants

- Redeeming, recycling, releveraging, or ESOP investing participant shares

- Life cycle stage of the company (paying dividends versus reinvesting for growth)

- Funded status of the ESOP

Company management expectations with respect to the repurchase obligation should be reflected in the financial statement projections. A repurchase obligation study may be conducted to inform the sponsor company management and board of the magnitude of the repurchase obligation in light of various scenarios (such as the number of shares redeemed, recycled, or releveraged).

Implicit Adjustment for the Repurchase Obligation

The valuation adjustments for the repurchase obligation may be implicit or explicit. When the adjustment is implicit, the underlying historical financial fundamentals and the projected financial statements include ESOP contribution expenses.

In other words, the cash flow metrics that are relied on in the valuation methods (i.e., EBITDA, cash flow to invested capital, etc.) reflect the ESOP contribution expenses reported on the sponsor company financial statements.

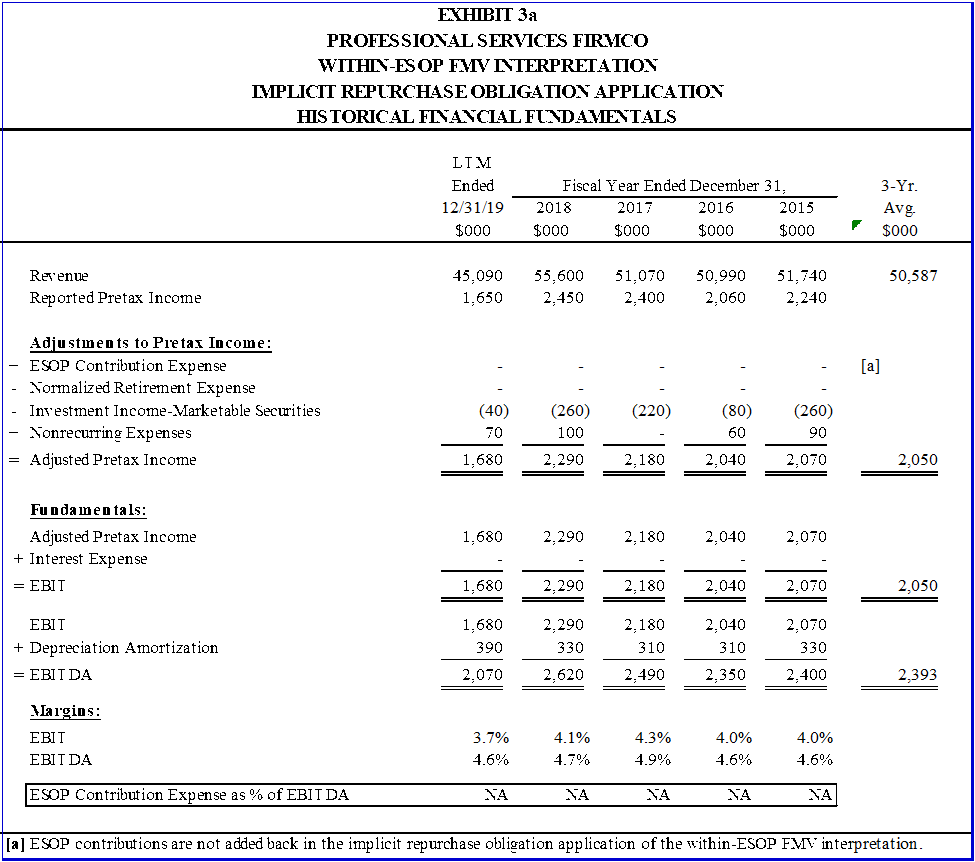

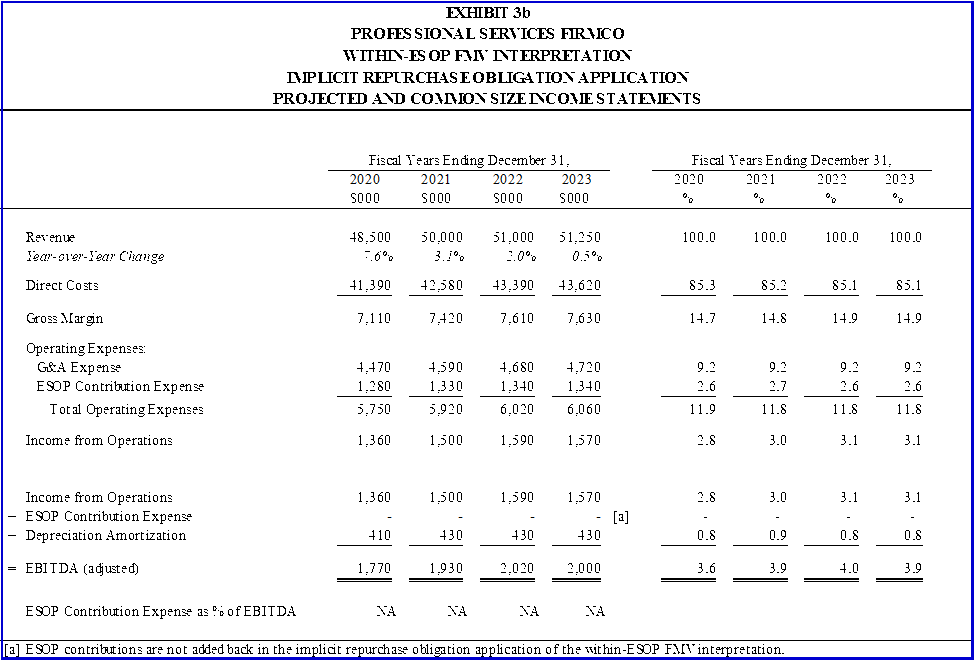

Exhibits 3a and 3b present the historical financial fundamentals and projected financial statements, respectively, with an implicit adjustment for the repurchase obligation.

As presented in Exhibits 3a and 3b, historical and projected earnings before interest and taxes (EBIT) and EBITDA are significantly lower than in the ESOP-hybrid valuation exhibits.

On the other hand, reported pretax income is higher under the within-ESOP FMV interpretation—the lower share price conclusions directly affect ESOP compensation expense.

The indicated value of invested capital of approximately $12.3 million (presented in Exhibit 1) is more than 45 percent less than the indicated value of invested capital for the same company valued using the ESOP-hybrid FMV interpretation.

The equity value per common share is $115 in the within-ESOP FMV interpretation compared to $215 per share under the ESOP-hybrid FMV interpretation.

Explicit Adjustment for the Repurchase Obligation

The repurchase obligation may also be adjusted explicitly. An explicit adjustment involves an analysis of:

- The business without the repurchase obligation liability, and

- The present value of the repurchase obligation liability.

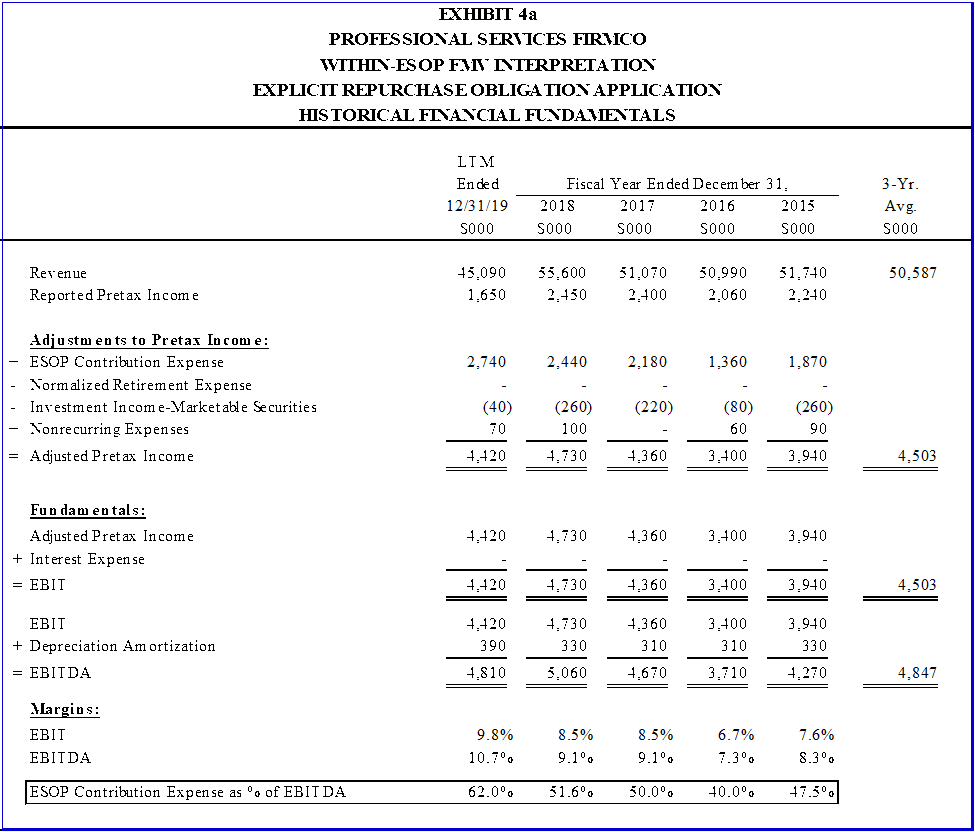

ESOP contribution expenses are added back to the historical and projected financial fundamentals and cash flow (i.e., just as performed in Exhibits 2a and 2b).

The present value of the repurchase obligation liability can be estimated using a discounted cash flow method. The present value of the repurchase obligation liability is subtracted from the sponsor company equity value as a nonoperating liability.

There are various assumptions that the analyst can use to estimate the present value of the repurchase obligation liability. The projected repurchase obligation is a function of the number of shares expected to be repurchased multiplied by the share price. ESOP shares that are redeemed by the sponsor company are typically not included in this calculation because the share redemption is a capital transaction.

A repurchase obligation study that includes the sponsor company management’s expected strategy for share repurchases may be a helpful tool for performing this analysis.

In this example, the present value of the repurchase obligation analyses, presented in Exhibits 2c and 4c, are simplified. These value estimates are based on projected ESOP contribution expenses provided by PSF management, not a repurchase obligation study.

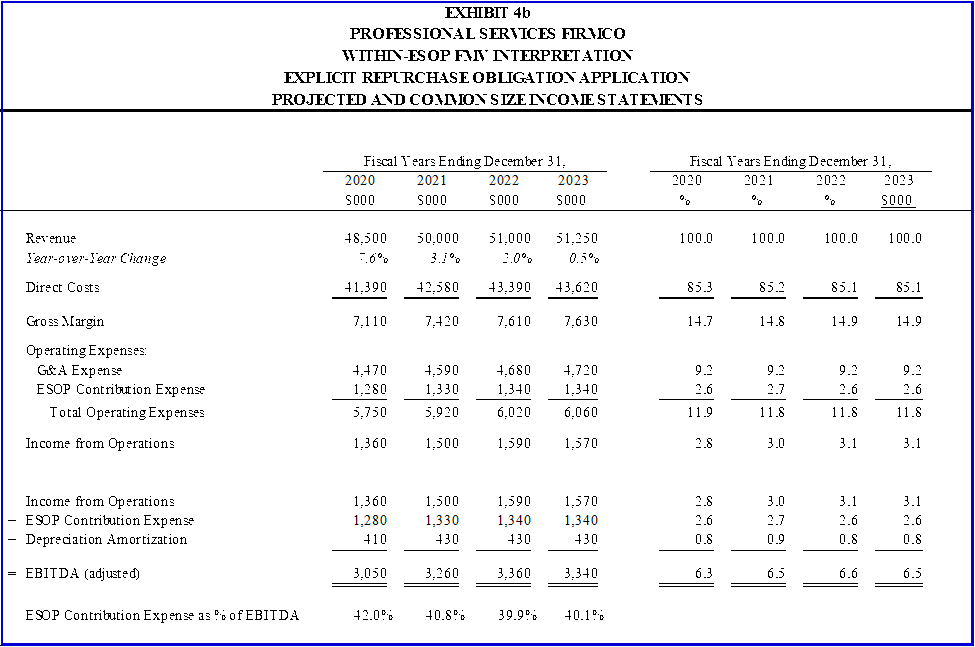

Exhibits 4a and 4b present the PSF historical financial fundamentals and the projected income statements with an explicit adjustment for the repurchase obligation.

In this analysis, adjusted EBITDA is the same as the adjusted EBITDA in the ESOP-hybrid FMV interpretation and reported pretax income matches reported pretax income when applying the implicit within-ESOP FMV interpretation.

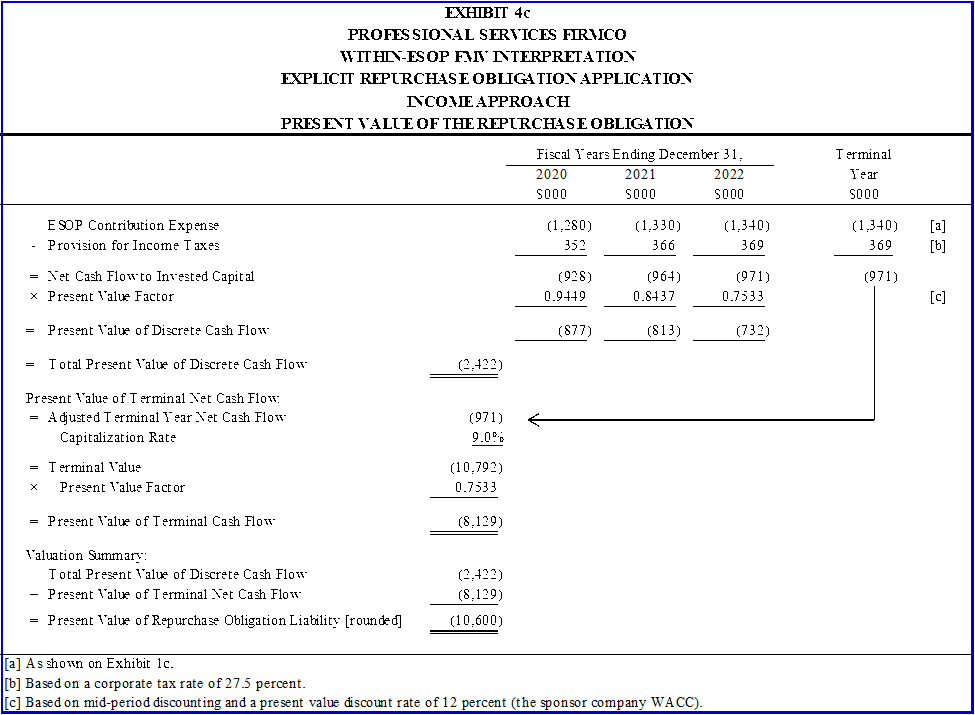

Exhibit 4c presents the present value of the repurchase obligation liability calculation.

The value of invested capital of $22.7 million applying the explicit within-ESOP FMV interpretation is the same value of invested capital estimated using the ESOP-hybrid FMV interpretation (see Exhibit 1).

The equity value is decreased by $10.6 million for the present value of the repurchase obligation. The equity value per share conclusion of $115 per share is the same conclusion in both the explicit and implicit within-ESOP FMV interpretations.

Depending on the facts and circumstances of the analysis, the analyst may decide to blend the ESOP-hybrid and within-ESOP FMV interpretations—assuming, for instance, that the repurchase obligation will continue to be met for a certain number of years before a sale transaction is initiated, when retirement contributions would return to a normalized level.

Summarized below are the strengths and weaknesses of analyses performed using the within-ESOP FMV interpretation:

- Strengths—These are based on the sponsor company’s actual historical and projected cash flow,5 which promotes ESOP (and sponsor company) sustainability.

- Weaknesses—The value conclusion may be depressed due to the repurchase obligation liability, relative to the price that a hypothetical buyer would pay for the company. If the repurchase obligation adjustment analysis is performed implicitly, the trustee will not have an indication of the sponsor company (or ESOP subject interest) value in the marketplace.

Implications from the PSF Example

The PSF example was constructed to illustrate the difference in value due to the treatment of the repurchase obligation in the valuation analysis.

The difference in the value indications is increased due to the following:

- The ESOP holding all of the outstanding stock in PSF,

- The ESOP stock being fully allocated to the participant accounts (i.e., the internal loan has reached maturity), and

- The PSF board electing to recycle the shares that are repurchased.

The repurchase obligation is significantly higher under the ESOP-hybrid FMV interpretation—the repurchase obligation liability of $19.7 million is greater than the equity conclusion under the within-ESOP FMV interpretation.

In the ESOP-hybrid FMV interpretation, ESOP contributions are expected to consume more than 70 percent of projected EBITDA. This level of share repurchases would certainly limit capital availability for business initiatives and potentially cause financial distress and restructuring.

The failure to include the repurchase obligation cash burden in the valuation analysis may be unsustainable for the sponsor company from a cash flow perspective.

The explicit adjustment for the repurchase obligation under the within-ESOP FMV interpretation may provide the most meaningful information to the ESOP trustee because the repurchase obligation liability is quantified.

The explicit repurchase obligation valuation gives the trustee an idea of the value of the sponsor company without the repurchase obligation (though the valuation will likely be on a noncontrolling basis).

The trustee will also be informed of the present value of the repurchase obligation.

Summary and Conclusion

The repurchase obligation is a financial obligation that is unique to ESOP sponsor companies. There are various factors that may affect the repurchase obligation.

For long-term sustainability and corporate planning purposes, it is important for the sponsor company board, the ESOP trustee, and the analyst to have a mutual understanding of the expectations for the sponsor company business, including the financing of the repurchase obligation.

The current dichotomy in valuation practice related to the repurchase obligation for ESOP administration valuation assignments can lead to a wide range in value conclusions for the same sponsor company.

Value conclusions under the ESOP-hybrid FMV interpretation could result in value conclusions that are not sustainable for the sponsor company. On the other hand, value conclusions under the within-ESOP FMV interpretation may understate the value of shares held by the ESOP relative to market prices.

The example included herein is intended to demonstrate the potential difference in value conclusions due to different FMV interpretations.

In circumstances where the following conditions are present, the value conclusions under the ESOP-hybrid and within-ESOP FMV interpretations will be closer:

- The ESOP owns a smaller ownership interest in the sponsor company.

- A majority of the ESOP shares have not been allocated to participant accounts.

In lieu of regulatory guidance or valuation industry convergence on the treatment of the repurchase obligation, the ESOP trustee may be in the best position to decide the extent that the repurchase obligation affects the valuation analysis.

Among other things, the ESOP trustee has the task of:

- Overseeing plan assets for the benefit of employee participants, and

- Establishing the sponsor company share price for ESOP administration purposes.

The analysis performed by the valuation analyst can inform the ESOP trustee of the value implications of the repurchase obligation. To this end, the ESOP trustee, with the help of the analyst, can determine a share price that is in the best interest of ESOP participants.

Notes:

- See Internal Revenue Code Section 409(h)(1)(B). This requirement is for all ESOPs formed since 1979 and leveraged ESOPs formed since 1976.

- DOL Proposed Regulation Section 2510.3-18(B)(2)(i).

- Ibid., Section 2510.3-18(4)(ii)(H).

- Ibid., Section 2510.3-18(4)(ii)(I).

- The caveat here being cash flow to an S corporation ESOP sponsor company. S corporation cash flow is typically tax-affected regardless of FMV interpretation.

This article was previously published in Willamette Insights Spring 2020, Issue 124, and is republished here with permission.

Kyle Wishing is a manager in our Atlanta practice office.

Mr. Wishing can be contacted at (404) 475-2309 or by e-mail to kjwishing@willamette.com.