The Internet is Growing Up

The Future is Here

This article describes the background, concepts behind, and implications of blockchain technology deployment for commercial, governmental, and personal use. QuickRead readers are aware of proposals to move entirely away from cash (bills and coins) for daily transactions. Such a move is expected to create a major inconvenience for those without access to credit cards and basic banking services. Readers are also acutely aware of the huge number of significant cybersecurity events which continue to adversely affect millions of people all over the world, shaking user and consumer confidence in the dependability of the custodians of our sensitive data. The author proposes that we are at the threshold of a massive disruption to the technology managing our social, political, and financial lives.

We are at the threshold of a massive disruption to the technology managing our social, political, and financial lives.

The ultra-disruptive technology known as blockchain appears to have the potential to solve many of these issues. Testing and deployment on a large scale has already begun in all sectors of the economy and the potential for more widespread adoption plans appears imminent.

One key element of the blockchain ecosystem which has the potential to radically improve how business is conducted is the “smart contract”, which is essentially just a series of lines of computer code. Smart contracts have the ability to self-execute, automate the secure transfer of digital assets in accordance with the terms of the contract without the need for third-party intermediaries, and securely close and settle within minutes. Correct deployment of this facet of blockchain technology is one of the critical aspects of adoption.

No Cash…No Problem?

Are we really moving into a cashless society?

If Patrick Jenkins’ Financial Times article from May 2018 is any guide, some smart people predict that we appear to be heading in that direction.[1] The path, however, will not be linear, and it will not be short either. In some cases, things appear to be heading in the opposite direction:

“… the volume of notes and coins in the world is on the increase. Economists suspect a combination of factors—low interest rates available on bank deposits, a post-crisis distrust of financial institutions and a growing informal economy” (Jenkins).

This attempted move away from using cash in our daily lives is not a new phenomenon.

In 1950, the Diners Club introduced their special diner’s card to allow their members the exclusive privilege of buying their dinners on credit. Legend has it that the inventor, Frank McNamara, was out dining in New York in 1946. When it came time to pay the bill, he realized he had forgotten his wallet at home. He managed to negotiate with the restaurant and agreed to sign his commitment to come back and pay the bill with cash.

Alfred Bloomingdale, the grandson of the founder of the Bloomingdale’s store chain, was an original partner and co-founder of the Diners Club, quoted saying, “The day will come when the plastic card will make money obsolete.”

American Express and Carte Blanche soon followed in 1958 with their own exclusive “travel and entertainment card.” Visa’s bankcard launched that same year.

The credit card concept as a mainstream method to conduct purchases of all types had explosive growth starting in 1978. The Supreme Court allowed nationally chartered banks the ability to charge out-of-state customers an interest rate set in their home state. This has progressively allowed people of more modest means to enjoy the convenience of purchasing now and paying later.

In 2012, there were approximately two billion credit cards in circulation in the world.[2]

In 2000, a joint venture between John Malloy and Elon Musk launched PayPal. This innovative app facilitated secure, effortless, instant, free money transfers between individuals and businesses (using checking and savings accounts as well as credit cards) without direct dependence on the sender/recipient banks’ infrastructure. This was a dramatic improvement over the slow and expensive wire transfer methods used by the banks. Prior to that date, Western Union had already begun to offer its slightly quicker, fee-heavy service. Subsequently, Apple Pay, SquareCash, Venmo, Google Wallet, Facebook Messenger, Dwolla, Quickpay, Zelle, Nerdwallet, entered the fray—the list is endless and growing each month. Specialized international payment apps like Ripple, Wyre, Coins.ph, and BitPesa have also entered the arena.

Each time a new player releases their cash transfer app, it adds something not previously offered—dramatic speed improvements, zero fees, transfers across international borders, adding millions of local users in geographic locations, previously unserved or underserved with this vital function.

The welcome effect of these alternative cash transfer methods has been dramatically improved efficiencies and the steady decline of bank fees, heading towards zero.

Generally, merchants have frowned upon low value credit card transactions. The inherent transaction fees, with a minimum of a few dollars, and a low transaction value made the acceptance of credit card payments a poor business decision. Vendors now prefer credit card purchases, despite the fees. It turns out that the costs of cash management and recording, banking—and especially theft, by employees or armed robbers—far exceed the transaction fees.

There are other important factors at play. Approximately two billion people (28% of the world population) in the world do not make enough money or have sufficient financial assets to make it worthwhile for banks to offer them any services at all—the “unbanked.”[3] (The U.S. unbanked rate= 7.7% of 325M=approx. 25M.)

There are significant social implications regarding this “cashless” conversation when it comes to the unbanked at the bottom of the developed economies, as well as the world’s poorest economies and developing nations. How would they participate in their economies without cash? More on this later.

Experts hypothesize that we are experiencing multiple eras of internet technology, which is really a continuum and tough to break out into distinct phases. In simple terms:

- Early Internet—e-mail, World Wide Web—company brochure-ware (you may recall waiting five minutes or more while high resolution pictures loaded up on your screen, line by line, while your modem screeched and your dial up connection struggled to maintain connectivity).

- Next phase followed quickly with the heavy proliferation of dotcoms, and the resultant bust.

- Broadband connectivity replaced dial-up.

- Online shopping takes off and begins to significantly affect brick and mortar sales.

- Social media explosion and mobile web apps, allowing users to do previously unimaginable tasks with a tap of that small screen; from online banking, to getting turn-by-turn directions, to making travel or dinner reservations, to renewing medical prescriptions, to turning on house lights, or ovens, or car engines (see IoT below), to seeing who’s ringing our front door bell, to streaming video on demand—the list is endless.

- Big data and cloud computing.

- Internet of Things. (IoT refers to the ever-growing network of physical objects that feature an IP address for internet connectivity, and the communication that occurs between these objects and other Internet-enabled devices and systems.) With blockchain, IoT is entering a new era.

- Experts have said that we are now in Internet 3.0.

Despite optimizing every aspect of our lives, the explosion of our online activity has come with a significant price tag—the massive, widespread theft of our personal information. Besides the run of the mill fraudulent online vendors, the use of stolen IDs to transact online, we are constantly learning of fresh cyber-security breaches of major commercial, institutional, and government databases.

Multiple exemplary organizations have proven to have serious cybersecurity vulnerabilities and have fallen victim to significant data breaches over the years which have shaken the confidence of the American consumer. Similar situations affect users across the globe—this is a universal problem. No-one is safe anymore.

- Target[4], Home Depot[5], Garmin

- SEC[6]

- Equifax Credit Bureau: the massive data breach in August 2017 of their database was said to have affected 143 million credit files (later revised to 145.5m)—one in two American citizens had their social security numbers and confidential credit histories compromised.[7]

- PGA Championship was hit with a Bitcoin ransom attack on August 10, 2018.[8]

Macy’s/Bloomingdales announced on July 13, 2018 that their systems experienced a “cybersecurity threat” between April 26 and June 11, 2018[9]. They make it sound innocuous, but hackers gained access to an undisclosed number of customers’ first and last names, addresses, phone numbers, e-mail addresses, debit, and credit card numbers with expiry dates.

It appears that the firewall and intrusion detection technology set up to protect the databases containing our most sensitive information within these large corporations and institutions has simply been rendered ineffectual and the situation appears to be deteriorating. The same goes for those organizations managing our medical records, voter rolls, and all the national databases that suffer from similar susceptibilities. They are only as secure as their latest firewall updates, which are constantly under attack. It seems like it is just a matter of time before the next breach occurs.

There must be a better way.

There is.

Let us rewind the clock a little.

It is 2008. In at least a partial response to the financial crisis of the mid-2000s, the pseudonymous Satoshi Nakamoto published his protocol for “a peer-to-peer electronic cash system” using a cryptocurrency known as Bitcoin[10].

A quick review of digital or cryptocurrencies is necessary. They differ from fiat (or sovereign issued currencies) in several ways; most importantly, they are not issued, controlled and backed by countries or sovereign governments.

A cryptocurrency[11] is digital asset designed to work as a medium of exchange that uses strong cryptography to secure financial transactions, control the creation of additional units, and verify the transfer of assets. Cryptocurrency is a kind of digital currency, virtual currency or alternative currency. Cryptocurrencies use decentralized control as opposed to centralized electronic money and central banking systems. The decentralized control of each cryptocurrency works through distributed ledger technology, typically a blockchain, that serves as a public financial transaction database. Bitcoin, first released as open-source software in 2009, is generally considered the first decentralized cryptocurrency. Since then, over 4,000 alternative coin (altcoin) variants of bitcoin have been created.

Overnight, a new concept for managing transactions between individuals without the need for a financial intermediary was born. A new push away from cash suddenly appeared—but with completely different motivation to those offered before—this time backed by a new method for peer-to-peer transactions, as explained in Satoshi’s white paper. The blockchain technology was born. The striking attribute about this new technology is that it contains a protocol that ensures the integrity of the data that could be shared between billions of individuals who do not know each other and have no reason to trust each other, without going through a trusted third party or intermediary.

There is another important characteristic about digital assets worth mentioning: digital scarcity.

The music and publishing industries both took a hammering when internet bandwidths increased dramatically, and the ability to copy and share published works without repercussions became available to anyone with an internet connection. The copyright owners saw the value of their copyrighted works evaporate overnight. If crypto assets could be copied and spent again, the “double-spend” problem would quickly render them valueless. The consensus algorithm described below helps solve this problem and prevents someone sending the same cryptocurrency to more than one recipient.

Blockchain is not an invention of “creation” rather one of “combination.” All the pieces of the protocol already existed—the genius of the idea is combining them to create blockchain.

- Internet technology—widely distributed, decentralized servers

- Peer-to-peer communication

- Encryption or more specifically, hash cryptography (SHA256)

- Consensus algorithms

The blockchain protocol as described has some compelling attributes which are important for this discussion:

- Distributed/decentralized data—no central authority with control over the data with the strength to extract unnecessary fees or databases to be hacked or shut down.

- Encrypted—using hash cryptography (SHA256) which had existed since WWII.

- Consensus algorithm—the method by which the “nodes” (participants in this system) agree on the validity of a new transaction. This aspect is rooted in a theory called the Byzantine General’s Problem (or Byzantine Fault Tolerance)[12], already in use with aeronautical systems and complex surgical procedures. The pilots or surgeons are all faced with imperfect information and all with life or death consequences if the wrong decision is made. Faulty decision making must be prevented in a systemic way to support the fallible human brains making these decisions.

- Peer-to-peer interactions and communication.

- Trustless—meaning the transactions can be completed and trusted by the parties because of the design of system, not because they need to trust the counterparty or human nature with all its frailties.

- Public and inclusive—anyone with a basic flip-phone can now participate in the global economy; no documentation is required to be trusted.

- Historical records are preserved and available for viewing by anyone at any time.

- Immutable—within seconds, transactions are completed, verified, cleared, and stored in the block with a permanent timestamp, linking it to the preceding block in the chain. This connection of the new block to the existing chain prevents any one party from altering a completed transaction. To alter the completed transaction, a majority of the nodes in the current and previous block would need to agree to that change. With current supercomputing power in existence, it would take about 20 years of computing effort to unilaterally (fraudulently) complete this alteration. In other words, the potential gain from such a fraudulent endeavor would be less than the costs of its execution.

In summary, we now have a distributed, stable system, ostensibly hack-resistant, attracting nominal fees, allowing for dramatically improved speed for closing transactions, which does not rely on a central authority, is open to anyone, anywhere and results in an unalterable record of transactions between individuals who do not know each other, have never met, and have no reason to trust each other.

The specific details of these attributes are somewhat complicated and have been omitted from this paper but can be found in Blockchain Revolution[13] Don Tapscott and Alex Tapscott; Chapter 1 pages 4–11, and BITCOIN: The Blockchain and Beyond[14], Jean-Luc Verhelst, Chapters 2–4 pages 11–30. Additional factors about blockchain’s potential along with governance challenges and multi-stakeholder stewardship and cooperation opportunities are detailed in the World Economic Forum white paper of June 2017[15], also authored by Don Tapscott and Alex Tapscott.

So here we have a brand-new draw towards “cashless” transactions, but not with the same fundamental shift as contemplated in Jenkins’ article discussed at the beginning of this paper. Jenkins is advocating the move away from the physical bills and coins but staying within the ecosystem of banks, government control of money supply and interest rates. He is also appearing to accept the banks’ existing arcane transfer systems which rely on centralized databases subject to hacking and system failure, the continued use of existing credit and debit cards and the range of third party cash transfer systems now in use, and, of course, the full collaboration with the infrastructure of the entire banking system.

The blockchain protocol has proposed a fundamental shift away from existing banking systems and fiat currencies; not just the “cash” aspect of it. Satoshi’s idea is to move towards a virtual or cryptocurrency, which only exists in the new world of blockchain. The apparent benefits, if this concept is fully embraced and widely adopted, are undeniable.

Satoshi’s vision was to enable every human on the planet to participate in the world economy via these freely available, immutable blockchain transactions without a central authority or intermediary, attracting only nominal fees. A shepherd in the African plains can buy cryptocurrency with his monthly wage. For the equivalent of a few dollars, he can make online purchases with funds in his cyber-wallet, accessed via his “flip-phone”. Panhandlers, car valets, and hotel bellmen in large urban centers can similarly accept gratuity payments in cyber-currency to their crypto wallets in seconds. This is impossible with current banking systems and their fee-heavy services.[16]

It is becoming more widely accepted that this protocol appears to be living up to its potential with increased proof of concept activity and wider adoption rates each month.

In addition, several major industries have created well-funded global consortia whose sole purpose is to investigate these principles and how they would apply to individual industries—banking, insurance, healthcare, hospitality, agriculture, shipping, entertainment, publishing—with new industry names being added regularly. These consortia are working with the blockchain development community to create and test scenarios proofs of concept (POC’s) pertinent to their business processes that could be vastly improved and made dramatically more cost effective using this new technology.

A key element of this protocol which will radically improve how business is conducted is the “smart contract”, which is essentially a series of lines of computer code existing on the blockchain.[17] They often self-execute and are used to digitally enforce the performance of the terms of a (digital) agreement. Smart contracts control the transfer of digital currencies or other crypto assets. No third-party intermediaries or title companies play any role in the process.

Definition: A smart contract is a computer protocol intended to digitally facilitate, verify, or enforce the negotiation or performance of a contract. Smart contracts allow the performance of credible transactions without third parties. These transactions are trackable and irreversible. Smart contracts were first proposed by Nick Szabo, who coined the term, in 1994.

Proponents of smart contracts claim that many kinds of contractual clauses may be made partially or fully self-executing, self-enforcing, or both. The aim of smart contracts is to provide security that is superior to traditional contract law and to reduce other transaction costs associated with contracting. Various cryptocurrencies have implemented types of smart contracts.

The adoption of smart contracts goes hand in hand with the acceptance of cryptocurrencies as a means of exchange. This adoption is being hampered by the wild fluctuations in these currencies. I believe that this issue is a significant stumbling block on the path to widespread acceptance and adoption of the technology in everyday life.

In other words, a currency is only considered a currency when all parties to a transaction can agree on its value, which typically has remained stable and is somewhat predictable within the realm of current geopolitical conditions. War, unstable governments, natural disasters, loss of confidence in commodity supply and prices, etc. all have a significant effect on the values of the currencies of a region.

Fiat currencies are backed by the faith and credit of the issuing government. The perceived stability of that government and that country’s economic engine add a measure of stability or instability depending on circumstances.

Cryptocurrencies have no such backing.

There has been a historical volatility in the values of existing cryptocurrencies. There are large numbers of new coins coming into existence each week via Initial Coin Offerings (ICOs)[18]. Similar in concept to the conventional method of raising public money via IPOs, with none of the protective laws or governance.

Unfortunately, many of these ICOs are either outright frauds or simply ill-advised. Investors stand to lose entire investments which are not subject to any regulatory oversight.

By their very nature, new cryptocurrencies can be launched by anyone, from anywhere in the world and attract investors across international borders, ostensibly not subject to any laws anywhere, and beyond the reach of all government regulators.

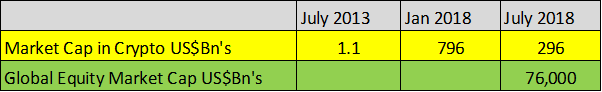

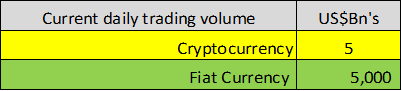

Following is some perspective on how cryptocurrency trading and asset values compare with equities and fiat currency.

Despite these issues, developments in the blockchain ecosystem are proceeding apace.

The startup activity in the blockchain space can be divided into three main categories:

- Transactions and payment services (merchant transactions, wallets, and remittances)

- Cryptocurrency exchanges and trading (exchanges, mining, clearing and settlement, crowdfunding platforms and tokenization)

- Ecosystem (referring to the underlying infrastructure and software development tools; application development, data, and document authentication)

Main areas of testing and partial implementation thus far cover the following:

- Financial services and insurance

- Healthcare

- Advertising

- Supply chain

- Compliance

- Social, networks, and gaming

There are strong advocates for similar blockchain upgrades for all critical databases necessary for managing key data in the postmodern world. Examples include state and federal IDs and passport/citizenship records, taxation, credit history, and medical records. Not only will blockchain offer the necessary protection from hacking and theft, but it allows for access for the owner of that data from anywhere at any time if the necessary encryption keys are in hand.

Critical supply chain app development is already in motion with controls to strengthen the supply chains for agricultural products, strategic defense and security systems, and prescription drugs.

It has been posed that we are still in the “dial up” stage of our blockchain voyage; however, the path to the next phase is already well underway with some heavyweight players:

- The Republic of Georgia is the first government to secure land titles using blockchain technology.[21]

- The Bank of Thailand is considering blockchain technology for fraud reduction in cross-border payments.[22]

- Hyundai is developing smart contract technology for smart homeowners to be able to pay their utilities from a pad in the home using cryptocurrencies.[23]

- The UK government has published a white paper describing the use of blockchain technology to manage their ongoing relationship with the European Union post-Brexit.[24]

- A team from China’s Tsinghua University has filed patents detailing the use of blockchain technology for use in the protection of Chinese cultural heritage.[25]

- Taiwanese electronics company, HTC Corp., has announced that it will release a blockchain enabled smart phone in Q0318.[26]

- G20’s Financial Stability Board has issued a framework to monitor the implications of blockchain tokens on global markets.[27]

- The CFA institute has added cryptocurrency and blockchain to their curriculum, as a definitive statement that cryptocurrencies have arrived on Wall Street.[28]

- The World Bank is preparing for the world’s first blockchain bond.[29]

The above list is only a small set of examples of the countless major corporations, institutions, and governments preparing for this inevitable wave of blockchain adoption.

The number of startup app developers and new blockchain technologists is growing every single day in every sector imaginable. Anecdotally, it appears that the average age of blockchain ecosystem, app developers, programmers, and their promotors is 20s to 30s; while the average age of C-suite officers in large corporations, the decision-makers for new technology review and adoption, is 50s to 60s.

The huge multi-generational gap between the innovators and proposed end users is arguably as large as it could possibly be. As a result, the communication chasm between those two groups is hampering the understanding of the technology in the user group and preventing the developers from fully appreciating the issues faced by their intended customers.

Maxelerate has been studying and examining this fast-moving landscape for the past couple of years. We perceive a large and growing opportunity for seasoned business advisors with the following attributes to close the gap between these two groups.

- An understanding of time-proven business systems and procurement and contracting processes along with their necessary approval and new application evaluation procedures.

- An appreciation of the value as well as the risks of this burgeoning technology.

There is a significant need in the business community for two main areas of expertise:

- An advisory service related to the applicability of a range of proposed technologies to solve a business problem, and evaluation of the related risks inherent in the testing and adoption of the new blockchain technology.

- A gatekeeper function to ensure that the developers being considered for their technology offering appear to respond to the problem correctly and their background and experience do not pose an unreasonable risk of failure. This service also continues throughout the visualization and conceptualization and roll-out of the proposed POC, all the way through testing, debugging, and implementation of the final product.

This article was previously published on Maxlerate.com and is republished here with permission.

Sel Bayhack is a principal with Anfield Road Advisors, a boutique Chicago-based firm offering expertise in three main areas: outsource financial and management services (CFO services, working capital management, strategic planning, profitability optimization.); Data analytics dashboards which extract and present customized, live data from company ERPs delivered to mobile and tablet devices as well as laptops; and Blockchain advisory services for companies considering Blockchain deployment projects.

Mr. Bayhack can be reached directly at (312) 543-4250, or via e-mail Sel.Bayhack@anfieldroadadvisors.com

[1] Jenkins, Patrick. “’We Don’t Take Cash’: Is This the Future of Money? – Financial Times – Medium.” Medium, Augmenting Humanity, 10 May 2018, medium.com/financial-times/we-dont-take-cash-is-this-the-future-of-money-aae28d20c4e6.

[2] “Number of Credit Cards Worldwide by Brand 2012 | Statistic.” Statista, www.statista.com/statistics/279257/number-of-credit-cards-in-circulation-worldwide/.

[3] Hodgson, Camilla. “The World’s 2 Billion Unbanked, in 6 Charts.” Business Insider, Business Insider, 30 Aug. 2017, www.businessinsider.com/the-worlds-unbanked-population-in-6-charts-2017-8.

[4] The banks lost millions when they were forced to reimburse customers who lost money in the massive 2013 hack of Target’s database., CNN MONEY. “Target Settles for $39 Million over Data Breach.” CNNMoney, Cable News Network, 2 Dec. 2015, money.cnn.com/2015/12/02/news/companies/target-data-breach-settlement/index.html.

[5] Stempel, Jonathan. “Home Depot Settles Consumer Lawsuit over Big 2014 Data Breach.” Reuters, Thomson Reuters, 8 Mar. 2016, www.reuters.com/article/us-home-depot-breach-settlement/home-depot-settles-consumer-lawsuit-over-big-2014-data-breach-idUSKCN0WA24Z.l.

[6] Osborne, Charlie. “SEC Admits Data Breach, Suggests Illicit Trading Was Key.” ZDNet, ZDNet, 21 Sept. 2017, www.zdnet.com/article/sec-admits-data-breach-suggests-insider-trading-was-the-key/.

[7] Whittaker, Zack. “Equifax Says Millions More Americans Affected by Hack than First Thought.” ZDNet, ZDNet, 2 Mar. 2018, www.zdnet.com/article/equifax-confirms-more-americans-were-affected-by-hack-than-first-thought/.

[8] “PGA Championship Hit with Bitcoin Ransom Attack.” Bitcoinist.com, 10 Aug. 2018, bitcoinist.com/pga-championship-hit-with-bitcoin-ransom-attack/.

[9] Hanbury, Mary. “Macy’s Is Warning Customers That Their Information Might Have Been Stolen in a Data Breach.” Business Insider, Business Insider, 10 July 2018, www.businessinsider.com/macys-bloomingdales-hack-disclosed-2018-7.

[10] Nakamoto, Satoshi. “Bitcoin: A Peer-to-Peer Electronic Cash System.” Bitcoin – Open Source P2P Money, 2008, bitcoin.org/en/bitcoin-paper.

[11] “Cryptocurrency.” Wikipedia, Wikimedia Foundation, 9 Aug. 2018, en.wikipedia.org/wiki/Cryptocurrency.

[12] “Byzantine Fault Tolerance.” Wikipedia, Wikimedia Foundation, 5 Aug. 2018, en.wikipedia.org/wiki/Byzantine_fault_tolerance.

[13] Tapscott, Don, and Alex Tapscott. Blockchain Revolution: How the Technology behind Bitcoin and Other Cryptocurrencies Is Changing the World. Portfolio/Penguin, 2018.

[14] Verhelst, Jean-Luc. Bitcoin, the Blockchain and beyond: the 360-Degree Onboarding Guide to the Future of Money and Blockchain. Self-Published., 2017.

[15] “Realizing the Potential of Blockchain.” World Economic Forum, June 2017, www.weforum.org/whitepapers/realizing-the-potential-of-blockchain. Don Tapscott and Alex Tapscott.

[16] The Economist, The Economist Newspaper, 5 May 2018, www.economist.com/special-report/2018/06/30/blockchain-technology-may-offer-a-way-to-re-decentralise-the-internet.

[17] “Smart Contract.” Wikipedia, Wikimedia Foundation, 12 Aug. 2018, en.wikipedia.org/wiki/Smart_contract.

[18] “Initial Coin Offering.” Wikipedia, Wikimedia Foundation, 12 Aug. 2018, en.wikipedia.org/wiki/Initial_coin_offering.

[19] “Cryptocurrency Market Capitalizations.” CoinMarketCap, coinmarketcap.com/.

[20] Bank for International Settlements, www.bis.org/publ/rpfx16fx.pdf.

[21] Shin, Laura. “The First Government To Secure Land Titles On The Bitcoin Blockchain Expands Project.” Forbes, Forbes Magazine, 17 July 2017, www.forbes.com/sites/laurashin/2017/02/07/the-first-government-to-secure-land-titles-on-the-bitcoin-blockchain-expands-project/.

[22] https://cointelegraph.com/news/bank-of-thailand-considers-blockchain-for-cross-border-payments-fraud-reduction.

[23] Mu-Hyun, Cho. “Hyundai Pay to Expand Hdac Blockchain Services.” ZDNet, ZDNet, 13 July 2018, www.zdnet.com/article/hyundai-pay-to-expand-hdac-blockchain-services/.

[24] Amaro, Silvia. “The UK Government Wants a ‘New Arrangement’ for Its Banks after Brexit.” CNBC, CNBC, 12 July 2018, www.cnbc.com/2018/07/12/this-is-what-the-uk-wants-after-brexit.html.

[25] “University Researchers Turn to Blockchain to Preserve Cultural Heritage.” CoinDesk, CoinDesk, 13 July 2018, www.coindesk.com/university-researchers-turn-to-blockchain-to-preserve-cultural-heritage/.

[26] Huang, Zheping. “HTC Develops ‘Blockchain Phone’ – but How Does It Work?” South China Morning Post, South China Morning Post, 12 July 2018, www.scmp.com/tech/social-gadgets/article/2154876/htc-develops-blockchain-phone-how-does-it-work.

[27] Perry, Joe. “FSB Report Sets out Framework to Monitor Crypto-Asset Markets.” FSB, 16 July 2018, www.fsb.org/2018/07/fsb-report-sets-out-framework-to-monitor-crypto-asset-markets/.

[28] Perry, Joe. “FSB Report Sets out Framework to Monitor Crypto-Asset Markets.” FSB, 16 July 2018, www.fsb.org/2018/07/fsb-report-sets-out-framework-to-monitor-crypto-asset-markets/.

[29] Ming, Cheang. “The World Bank Is Preparing for the World’s First Blockchain Bond.” CNBC, CNBC, 10 Aug. 2018, www.cnbc.com/2018/08/10/world-bank-picks-commonwealth-bank-for-worlds-first-blockchain-bond.html.