Pay for Delay

Quantifying the Lost Opportunity of Being First (Generic Entrant) to Market

The authors in this article explore the scale of first mover advantage in generic pharmaceuticals and the methods behind quantifying the value of being first generic to market, or the loss when being prevented from doing so. They discuss, how much is it worth to be the first generic entrant to the market?

Introduction

The recent European Court of Justice (ECJ) ruling that the GSK-Generics UK-Alpharma pay-for-delay arrangement was potentially “by object”-restrictive, confirms the continued regulatory spotlight on treatment of intellectual property and entry in generic pharmaceutical markets.[1]

Of course, there are several other ways than pay-for-delay for generic entry to be delayed. Many are valid, while some might be found restrictive and include tactics such as: product hopping, ever-greening, patent clustering, challenges of IP infringements and associated injunctions, disinformation tactics, and denial of samples/trial data.[2] For example, there are examples of originator companies benefiting from delays to competing generic entry due to a temporary injunction against alleged patent infringement, during which time they are able to launch their own generic versions of the branded medicines.[3]

One of the key questions in such cases is the scale and duration of any harm suffered by the delayed entrants.[4] In this paper, we explore the scale of first mover advantage in generic pharmaceuticals and the methods behind quantifying the value of being first generic to market, or the loss when being prevented from doing so.

The Benefit of Being First

So, how much is it worth to be the first generic entrant to the market?

The answer, it turns out, is “a lot.” For example, Yu and Gupta (2014) find that, after controlling for the impact of other potentially relevant factors, the first generic entrant enjoyed on average, 80 percent higher market share for at least three years over second generic to market, and 250 percent market share advantage over a third entrant.[5] Hollis (2002) found a 25–30 percentage point long term market share advantage in Canada, with a very different market and regulatory environment closer to that in Europe than the USA. Market share advantage of 25 percentage points translates to tens of millions of sold units per year, if applied to most popular generics.

There are also significant benefits that the first entrant can obtain through premium pricing compared to the long run equilibrium, as it shares some of the market power of the branded originator drug, even if only temporarily, prior to more generics entering to push prices down towards longer run marginal costs.

What Drives the First Entrant Advantage?

Such a first mover advantage would not exist, or last very long, typically in markets for undifferentiated products. Generics are…generic, meaning they are easily substitutable between one another.[6]

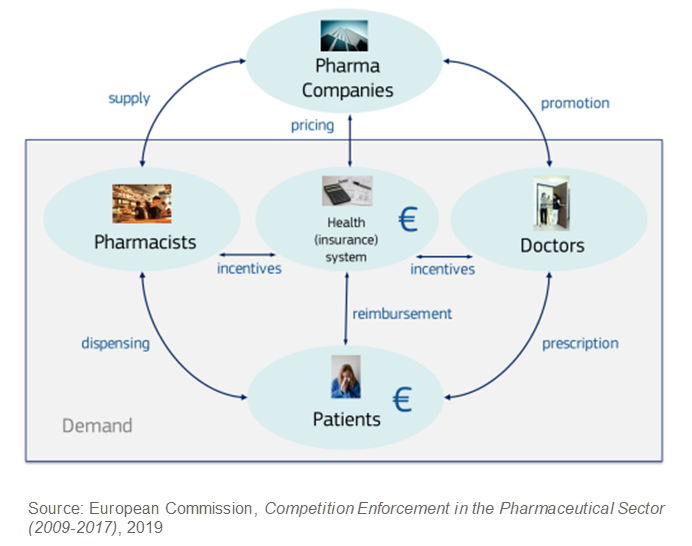

The markets for generics, however, have complex dynamics with a multitude of regulations and layers of decision makers. Below is a simplified illustration of the interactions of key players for prescription drugs applicable to most European countries. Crucially, for first mover advantage, the health system, doctors, and pharmacists all act as agents of patients, who are the end customers. They assume the following responsibilities:

- Health systems determine what drugs are available, agree on pricing, and cover most of the cost.

- Doctors prescribe drugs to patient needs from those available, influenced by incentives and regulations from the health system.

- Pharmacists dispense drugs to patients on a prescription basis, again governed by incentives and regulations.

The observed first mover advantage is driven by hierarchical choice patterns and agent inertia within this complexity, rather than the products themselves. The implication is that the advantage can apply to any product of any company, depending on the specific circumstances around the product.

More specifically, generic entry after patent expiry has two effects on the market that are particularly relevant for the long lasting first mover advantage:

- The market size for the molecule expands as a lower price drives further availability and/or use, e.g., of milder dosages or for less severe cases of the therapeutic indications.[7] This means that in cases of delayed entry, attributing a share of branded drug sales to the generic in the but-for scenario with entry would not be sufficient to recognize loss suffered.

- Market share shifts towards the entrant generic away from the branded incumbent, driven by lower price and incentives for generic substitution put in place by health systems.

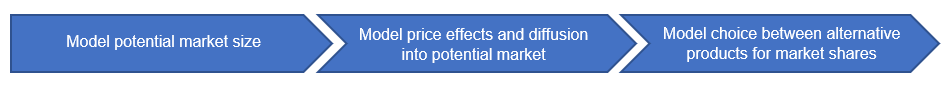

The market expansion effect of generic entry can be the more straightforward of the two permanent effects to quantify. It requires an anchoring total potential market size for the molecule across its therapeutic indications, and an estimation of market price elasticity of demand of the diffusion rate into that total potential market.

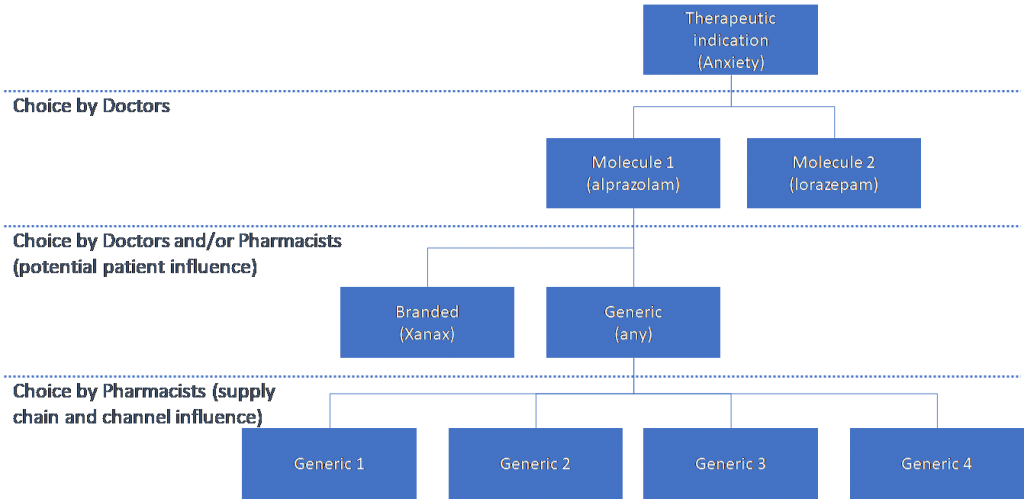

Quantifying the impact of different factors on the choice of the first generic among the available products, i.e. the factors that lead to long lasting market share advantage for the first entrant, is more nuanced. It requires modelling of the hierarchical or nested competition created by the prescribing and dispensing pathways, potentially between available molecules for a therapeutic indication; between the branded originator and any generic versions available; and finally, between the available products when a pharmacist fills a generic prescription.

Within the context of these layered decisions, Yu and Gupta (2014) find that the first mover advantage arises from the retail pharmacy distribution channel, with the main driver being inertia in stocking and dispensing patterns. They find that stock management costs in retail pharmacies lead them to carry only a limited range and possibly only one generic. They also find that price sensitivity is lower in the retail pharmacy channel compared to hospital pharmacies.[8] This is intuitive, particularly as in some jurisdictions pharmacists also receive a flat fee for dispensing any generic, so they face no incentive to change between generics depending on price. They also find differential marketing mix effectiveness between the first and subsequent generic entrants, as a secondary effect supporting the first entrant advantage.

There may also be direct regulatory reasons for at least temporary first entrant advantage. Depending on market, the regulator and payor approved lists might be updated only periodically and limit the available generics to earlier entrants until the lists are refreshed again.

Quantifying the (Lost) Advantage

Quantifying the (lost) advantage of being a first entrant requires isolating and attributing the effect of order entry and timing from all other factors that drive sales and market share.

In practice, it is necessary to go beyond the usual stylized demand and supply modelling frameworks to consider the dynamics and decision-making processes in the generic markets in question. The order and timing of entry can be considered as interactions or product attributes in a model of simultaneous determination of market size and market shares within the overall potential market. The diffusion into potential markets would incorporate also the modelled, potentially premium, pricing paths following entry.

The quantification has to account for different end market segments with varying prescribing and dispensing structures and incentives, and explicitly model the hierarchical structure of choices and the factors that affect those choices. Careful attention should be paid to switching costs and behavioral inertia in dispensing patterns and the market/regulatory structures that influence those in devising the estimation strategy. It may also be helpful to define separate channels where they are not linked to simplify the estimation, such as separate estimations for hospital and retail pharmacy.

There are several modern-yet-proven econometric techniques suited for such a task, which explicitly model the size, market, and the nested decision structures based on product characteristics and/or interactions. For example:

- Hierarchical statespace models with diffusion of generics into separately estimated potential market size driven by underlying need and price-income effects, like those used for price optimization and sales forecasting in commercial settings.

- Nested random coefficient logit models that also allow for inertia, similar to those that would be deployed, e.g., in merger assessments to account for dynamics of consumer behavior on price effects of mergers.[9]

Although more involved than more stylized models of demand and supply, without the ability of the estimation to sufficiently reflect the market and decision-making processes, the results would at best be partial and at worst biased, unable to stand up to scrutiny.

How Can A&M Help?

A&M Economics is a specialist economics practice comprising professional competition economists and economic modelers with industry experience. By closely working within our Disputes and Investigations practice, our economists are brought together with industry and forensic expertise to support clients and their advisors through all stages of investigation and disputes into alleged restrictive practices such as:

- Causal analysis and inference to support basis of claims.

- Forensic investigation, e.g., substantiating and demonstrating the basis of the claim.

- Expert valuation/quantification and testimony during trial or arbitration.

Key Takeaways:

- Recent ECJ rulings and various other IP dispute cases demonstrate continued focus on patent protection strategies that have the effect of delaying generic entry, with risk of being a potentially restrictive and prohibited practice.

- First to market generics after originator protections expire, enjoy a very significant and long-lasting benefit to their market share, even if others enter the market shortly after. They can also benefit from being able to charge a premium price in the short term.

- Robust quantification of the first mover advantage, or loss thereof, requires explicit modelling of the complex market dynamics and behaviors that give rise to the first entrant advantage.

- Methods developed for modelling demand of differentiated goods, combined with models of product diffusion into a quantified potential market, could be well-suited to the task.

This article was previously published in Alvarez & Marsal Insights, May 28, 2020, and is republished here with permission.

[1] For example: https://www.gov.uk/government/news/cma-welcomes-eu-court-ruling-in-pay-for-delay-drug-case

[2] https://www.oecd.org/daf/competition/generic-pharmaceuticals-competition.htm

[3] https://www.pharmaceutical-journal.com/news-and-analysis/news/delayed-market-entry-for-generic-buprenorphine-patches-could-have-cost-nhs-500000-study-concludes/20206914.article?firstPass=false

4] Clearly, questions regarding harm to consumers are of interest also, particularly to competition authorities. For there to be harm to consumers also does not require that a potential entrant is harmed, as, e.g., pay-for-delay could compensate the entrant in an economic fair way while leading to consumer harm.

[5] Further, they found the effect persisted even in cases of fast subsequent entry.

[6] Of course there are exceptions to this, where for some isolated pharmaceuticals medical guidelines indicate market definition at the molecule-manufacturer level.

[7] For example: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4832488/

[8] Yu and Gupta (2014) do not find a persistent advantage for the first generic entrant in the hospital pharmacy channel. They attribute this partly to higher price sensitivity, arising from drug costs typically being wrapped into the overall reimbursement mechanism for hospital treatment meaning that hospitals have a stronger incentive to cost minimize than retail pharmacies. This makes them more likely to continue to switch to the cheapest generic available regardless of order of entry.

[9] https://www.alvarezandmarsal.com/insights/accounting-dynamic-consumer-behaviour-merger-assessments-0

Jyrki Kolsi is a Senior Director at Alvarez & Marsal Disputes and Investigations LLP in London. He joined the A&M Economic Consulting practice in August 2019 and brings over 15 years of experience as a professional economist. His primary area of concentration is focused in using economics and advanced analytics techniques to support strategic, commercial, and regulatory decision making at the executive level.

Mr. Kolsi has worked with clients across a range of industries, including healthcare and life sciences, financial services, transport, telecoms, media, and utilities. His work introducing ways to take advantage of new analytical techniques and data to improve profitability has been recognized for innovation by the Management Consulting Association.

Mr. Kolsi can be contacted at jkolsi@alvarezandmarsal.com.

Chris Williams is a Managing Director with A&M in London. He leads our economic consulting practice focusing on the use of economic analysis within regulatory, competition, and strategic analysis for corporate clients and within disputes and investigations.

With more than 25 years of experience, Mr. Williams initially focused his work within the telecommunications, media, and technology sectors, advising many of the world’s leading operators. He spent 11 years as the partner leading the economics practice for Deloitte, where he built a market leading team. He has also spent 12 years with KPMG’s economic consulting practice, serving as a partner during the last three.

Mr. Williams can be contacted at Chris.Williams@alvarezandmarsal.com.

Jerry Lay is a Managing Director with Alvarez & Marsal Disputes and Investigations in Zurich, Switzerland. He brings over 12 years of experience in conducting major investigations and in advising clients on enhancing compliance frameworks and functions.

Mr. Lay has led numerous high-profile investigations related to allegations of fraud and corruption, misappropriation of assets, conflict of interest, market manipulation and data theft. He has worked with clients across a range of industries including pharmaceuticals and life sciences, financial services and industrial products. Mr. Lay also has extensive experience working in emerging markets with a strong focus on Asia and is often invited to speak at conferences on effectively managing risks when doing business in Asia.

Mr. Lat can be contacted at JLay@alvarezandmarsal.com.