Business Valuations

for SBA Lending Programs

Despite the pandemic, the number of small businesses started continues to increase. This article discusses the various Small Business Administration (SBA) programs and the value of serving these lenders.

“Success is a full-time job.” Grant Cardone

Any entrepreneur or a small business owner would agree that running a successful small business is a full-time job. To run it well requires an enormous commitment of time and dedication. Over the last few years, the number of small businesses in the United States has continued to climb up. In fact, according to the U.S. Small Business Administration (SBA), in 2020 and despite the pandemic, there were approximately 31.7 million small businesses in the United States. This number is up from the prior year of 30.7 million small businesses. As the economy continues to recover and baby boomers age, retire, and exit their businesses, the number of SBA loans will continue to rise. In 2018, a QuickRead article titled “Business Exit Tsunami” https://quickreadbuzz.com/2018/01/17/business-exit-tsunami/ provided a thoughtful discussion on this subject.

Along with the U.S. Small Business Administration’s support, banks and other lending institutions offer several programs to small businesses, including microloans, SBA 7(a), or 504/CDC loans. The SBA 7(a) loans assist prospective and current business owners with their “change of ownership” (i.e., business acquisition) transactions. According to the SBA Standard Operating Procedures (SOP) guidelines, lenders are required to order an independent, certified business appraisal from a qualified source. SBA defines a qualified source as an individual who regularly performs valuation services and gets compensated for their services, and has at least one of the following credentials:

- Accredited Senior Appraiser (ASA) accredited through the American Society of Appraisers

- Accredited in Business Valuation (ABV) accredited through the American Institute of Certified Public Accountants

- Certified Valuation Analyst (CVA) accredited through the National Association of Certified Valuators and Analysts

- Business Certified Appraiser (BCA) accredited through the International Society of Business Appraisers

A business valuation is generally required when the loan amount (excluding the value of the real estate and/or equipment) exceeds $250,000. If the loan amount (excluding the value of the real estate and/or equipment) is below $250,000, the lender may perform their own valuation analysis if it is permitted in accordance with their lending policies. The SBA SOP highlights two types of valuation engagements: special-purpose properties and non-special purpose properties. The special purpose properties include entities whose market use is limited by their unique design, construction, or layout, such as amusement parks, bowling alleys, wineries, tennis courts, swimming pools, golf courses, etc. When valuing a special-purpose property, the appraiser must allocate the value of the business to its individual components, including land, building, equipment, and intangible assets (p. 363 of the SBA SOP), which is somewhat similar to a simplified purchase price allocation analysis. According to the SOP, “The value of the intangible assets is determined by either the book value as reflected on the business’s balance sheet, a separate appraisal for the particular asset, or the value of the business as identified in the business valuation minus the sum of the working capital assets and the fixed assets being purchased” (pp. 235–236 per SBA SOP). Furthermore, “Any amount(s) of the loan proceeds that will be used to facilitate a change of ownership may not exceed business valuation. In addition, the lender must obtain a copy of the financial information relied upon by the individual who performed the business valuation and verify that information against the seller’s IRS transcripts to ensure the accuracy of the information” (p. 364 per the SBA SOP).

Overall, business valuation analysis for SBA loan financing purposes is like other types of engagements. The standard of value to use is the fair market value (FMV), and the premise of value is going concern. A going concern is an accounting term for a company that has the resources to operate indefinitely until it provides evidence to the contrary. The valuation analyst typically obtains three years of historical financial information and the year-to-date data provided by the lender. In addition, the seller (or the owner of the business) is asked to complete a comprehensive qualitative questionnaire, which discusses the company’s products and services, customers, business facilities, capacity, competitive position, management and employees, strengths, weaknesses, opportunities, and threats (SWOT analysis), along with Michael Porter’s Five Forces qualitative assessment.

Once the financial statements are received and reviewed, certain normalization adjustments are typically made. The company’s historical statements are normalized (i.e., adjusted) to remove any discretionary, personal, or non-recurring charges. In addition, since small-company business owners tend to over-or-under pay themselves, oftentimes, the company’s owner’s compensation is adjusted to market-level, commensurate with the role and responsibilities that the owner undertakes. The company’s personal and/or discretionary expenses typically include meals, travel and entertainment, use of cellphone, automobile expenses, etc. At times, business owners get creative with running their personal expenses through the company’s financial statements. For example, one of my clients has classified boat storage and fuel expenses as his marketing expense.

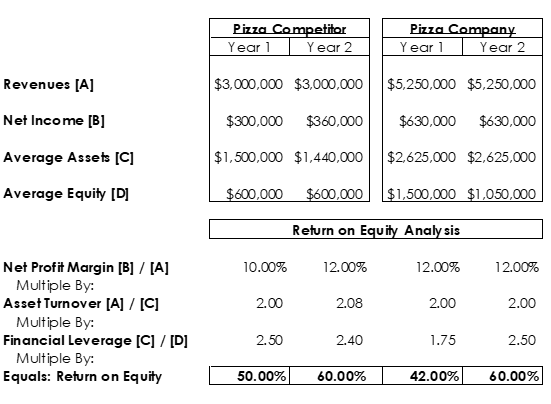

As with any other business valuation assignment, we must consider the macro and micro-economic environments, along with the industry in which the subject company operates. Additionally, the industry ratio analysis compared to the appraisal subject provides further insights into the company’s liquidity, solvency, efficiency, and profitability positions, which help the appraiser assess the company’s growth prospects and risk on a forward-looking basis. In my practice specifically, I find it helpful to decompose the return on equity (ROE) analysis, at least three-ways: ROE = (Net Income / Sales) x (Sales / Assets) x (Assets / Equity). To illustrate: if you are reviewing a pizza restaurant vs. the industry (or a competitor) and observe the following inputs over the past two years. Based on the example below, we can clearly see that the company’s overall ROE improved; however, this improvement was largely driven by an increase in financial leverage, which inherently is riskier.

When valuing an operating business for SBA business valuation purposes, we primarily rely on income and market approaches. Although theoretically, the discounted cash flow method and the capitalization of earnings methodology ought to yield the same result, the capitalization of earnings methodology under the income approach is the preferred technique. If the valuation analyst decides to use the discounted cash flow methodology, any forecast or financial projections should be vetted and approved by the lender. It has been common for valuation practitioners to use the discounted cash flow analysis during the ongoing coronavirus pandemic. Furthermore, based on the type of business, its historical growth patterns, the outlook on the forward-looking basis, and the industry considerations, the discounted cash flow analysis may serve as a better tool to arrive at an indication of value. The income approach analysis would not be complete without applying the appropriate discount rate and capitalization rate. To determine the discount rate, the appraiser would either rely on the cost of equity or the weighted average cost of capital, depending on the type of cash flows being considered. The individual components for the cost of equity can be derived from the Duff & Phelps (Kroll) cost of capital navigator, BVR cost of capital, Professor Damodaran’s data, or others. The company-specific risk premium is derived based on the appraiser’s professional judgment. In our practice, as part of the qualitative questionnaire, we ask our clients to address various risk considerations that they believe their business enterprise faces, such as: customer concentration risk, reliance on the key supplier, key person risk, limited capacity, etc. and assign a risk factor such as “no risk,” “average risk,” or “above or below average risk.” We then calibrate and assign percentage points to each factor to arrive at the appropriate company-specific risk premium. For the cost of debt, typically, the lender specifies the rate, e.g., WSJ Prime Rate + 2.5%.

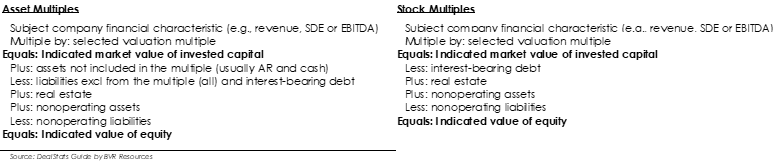

In terms of the market approach, the guideline public company method may not be appropriate due to significant differences between the public companies and the subject of appraisal. The use of the merged and acquired company method would be more appropriate. Transactional data can be found in a number of databases. The transactional data provided by the DealStats database is voluminous; however, caution should be exercised about what type of transactions are being selected. Specifically, the valuation analyst should pay attention to whether the selected transactions are structured as stock or asset deals. When reviewing transactions structured as asset purchases, certain adjustments for assets not included in the sale, such as cash and accounts receivables, should be made.

If multiple approaches and methodologies are used, the appraiser will assign the appropriate weighting to each technique and provide their rationale for the decision. Ideally, various techniques should corroborate and support the selected indication of value.

According to the PR Newswire, approximately 12 million baby boomers own at least one business and near retirement. The SBA loans provide a significant advantage to buyers as they offer access to capital at lower interest rates, with favorable repayment terms. SBA loans typically require an equity injection or down-payment between 10%–20% for SBA 7(a) or a CDC/504 loan. The SBA’s microloans do not require a down-payment. The SBA’s loan proceeds can be used to refinance existing debt, purchase equipment or inventory, land, fund working capital requirements, etc. The SBA’s CDC/504 loan offers less flexibility; the proceeds can only be used to finance real estate and/or equipment. In addition, SBA provides a multitude of resources to support small business owners, including but not limited to SCORE, Office of Women’s Business Ownership, Office of Native American Affairs, and more. As the number of small businesses continues to grow, valuation professionals’ unique set of skills can play an integral role not just in appraising the business for lending purposes, but the deliverable report can also provide valuable insights to new business owners. These considerations can help the new business owners survive and thrive, take their new company to the next level, and create value for years to come.

Ms. Kalava, MS, CVA, ABV, is a finance professional with over ten years of professional experience in the financial services industry, including business valuations, public accounting, financial planning, and analysis (FP&A). Ms. Kalava primarily works with private, closely-held companies. She earned a Master of Science Degree in Finance from the University of Tampa and a Bachelor of Science in International Business and Management. Ms. Kalava is the owner and founder of Araliya Valuation Consulting LLC, dba American Valuations.

Ms. Kalava can be contacted at (813) 777-9706 or by e-mail to nataliya@amervalue.com.