Assessing Lost Profits

After the COVID-19 Pandemic

The COVID-19 pandemic put a strain on the U.S. and global economies as well as individual lives throughout the world. As much as most people would like to put 2020 behind us, experts will have to continue to review financial returns from 2020 in the historical data for businesses claiming to have been injured by wrongful acts in 2021 and the future. As much as an expert would like to disregard the 2020 results, questions need to be asked as to how the injured business’ market and customers were affected by the pandemic and what level of economic growth has been seen in 2021. This article offers ideas to consider when estimating lost profits for recovery periods that begin after 2020.

The COVID-19 pandemic put a strain on the U.S. and global economies as well as individual lives throughout the world. As much as most people would like to put 2020 behind us, experts will have to continue to review financial returns from 2020 as a part of the historical data for businesses claiming to have been injured by wrongful acts in 2021 and the future. As much as an expert would like to disregard the 2020 results, questions need to be asked as to how the injured business’ market and customers were affected by the pandemic and what level of economic growth has been seen in 2021.

As the economy continues to expand, private and government economists expect a return to the “new normal” by the end of 2021.[1] This will allow financial experts to start putting the unusual year of 2020 in the rearview mirror. Even if the economic expectations come to fruition, experts will still need to consider the impact of 2020 when estimating commercial damages to businesses injured in 2021. This article offers ideas to consider when estimating lost profits for recovery periods that begin after 2020. In other words, this article is directed at assignments to estimate lost profits for businesses whose injuries occurred after 1/1/2021.

Moving On After the Pandemic

Reviewing the early economic data for 2021, experts may see expansion in most sectors of the U.S. economy. Some of the largest growth has been in the restaurant and hospitality industries.[2] These sectors were greatly impacted by the closure of non-essential services and the deep drop in business and vacation travel during 2020. Other industries that remained open, like construction and transportation, are also showing growth. Of course, their growth rate is being measured from a higher starting point than the non-essential businesses.

However, this does not mean 2021 will result in revenue and profits consistent with 2018 and/or 2019. Various forms of COVID-19 restrictions remain throughout the country. As an example, in some states, restaurants and bars have been able to offer inside dining and drinking with up to 100 percent occupancy since late March and early April. In other states, restaurants are only allowed to offer outside dining until the summer. These factors will have to be considered when an expert receives an assignment to estimate losses beginning in 2021.

New Assignments and Historical Data

After taking a lost profits assignment, one of the first actions taken by an expert will be to review the historical financial data for the injured firm. For an established business, the financial records (income statements, balance sheets, tax returns, etc.) should show data for at least the past five years and any year-to-date information for 2021. The prior five-year data will include 2020.

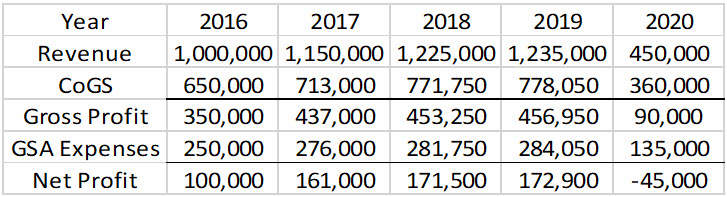

Assume the five-year historical data appears this way.

CoGS represents Cost of Goods Sold

GSA represents General, Administrative, and Sales Expenses

From 2016 through 2019, the alleged injured business generated increasing annual revenue and reduced costs relative to its sales. In 2020, revenue fell by 74%. The percentage for the expense categories increased and the business reported its only loss for the five-year period.

It would be easy to discard 2020 as a one off. The parties on both sides of this lawsuit, the jury, the judge, and just about everyone walking past the courthouse knows of the economic downturn and the economic stress in 2020. An expert can say, “I have considered 2020 as an aberration and excluded that year’s results from this analysis.” However, he or she should do so at their own risk.

Before excluding the 2020 results, an expert should dig down into why the revenue dropped.

- Was the injured business closed due to COVID-19 restrictions?

- Was its primary market or several of the markets it served closed or greatly restricted by COVID-19 restrictions?

- Have the injured business customers returned to “normal” operations or did 2020 cause permanent damage to them?

- If damaged, what impact will that have on their need for the products or services provided by the injury business?

- How long will it take for the customers or markets served by the injured business to return to pre-COVID-19 buying patterns?

These are just some of the questions that will need to be answered before putting 2020 aside.

An example of why these questions are important can be seen with the farming industry. COVID-19 did not prevent farmers from growing their vegetable and fruit products. Their wholesale purchasers remained open as did their grocery store clients. But the demand for their products from the restaurant, hospitality, and school sectors dropped dramatically. Schools closed to go virtual. Therefore, no school cafeterias were open. With vacationers, conference attendees, and business travelers not staying in hotels, the hospitality industry had far less need for farming products. Even though many restaurants remained open for takeout or delivery services, without indoor or even outdoor dining during part of 2020, restaurants demand for farming products also fell. This negatively impacted the farming industry and its profits even though it remained open during 2020.

How quickly will the U.S. economy open to allow for these three critical buyers of farming produce to return to pre-COVID-19 demand levels?

This is the type question an expert should consider when estimating damages beginning in 2021.

Management Projections for 2021 and Beyond

The injured business may provide the expert a projection for its cash flow or profitability for 2021 and beyond. This data may come as a part of the expert’s meeting with the management of the injured business. Usually at these meetings, the expert will gather the historical financial records, business’ history, management structure, competitors list, customers list, ownership structure, and other essential data.

Any projections provided by management must be reviewed and scrutinized. They may be precise and accurate or could be “pie in the sky,” hoped for returns. Only by assessing the current market conditions can the expert make an informed decision on the credibility of the projections.

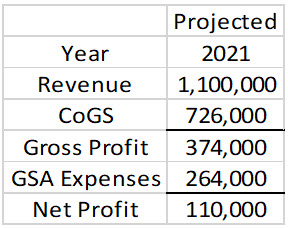

Consider the previously discussed historical data. Assume management provided the expert with the following 2021 projection.

The management has projected a 2021 revenue in excess of one million and a return to profitability. On its face, these projections appear reasonable and usable for the expert.

However, an expert must continue to ask questions. This is because if the alleged injury to the business occurred in 2021, the injury would, more likely than not, keep the business from achieving its profit projections.

Some of the questions could be:

- What is the year-to-date financial performance for the injured business?

- How has the alleged wrongful act impacted revenue, expenses, and profits?

- How has the injured business’ competitors performed in 2021?

- Are they returning to their pre-2020 sales levels?

- How has the injured business’ markets or its products and services changed between 2019 and today?

- And if there are changes, how has the injured business addressed them and how have they affected the business’ profitability?

These questions will assist in the expert’s assessment of other causations that need to be included in a lost profit analysis.[3]

Recovery Period

Financial literature will call the period in which the company may claim lost profits as the recovery period or the loss period. Both terms reflect the same thing, the period in which the injured business lost profits. This period runs from the time of injury until the business has been able to mitigate its loss or the contract or agreement related to the alleged wrongful act would have been completed.[4]

For many lost profit cases, the losses are only in the past. This means by the time an expert completes a report, the injured business has been able to reallocate resources and/or locate new suppliers to mitigate the alleged loss. Based on the assumption that the alleged wrongful act was incurred after 1/1/2021, the loss period would run from some time in 2021 and run until the injured business had mitigated its loss (possibly as early as late 2021 or 2022).

However, the drag on the economy from the lingering impact of the pandemic may reduce the profitability for years in the future. If this is true for the injured business or its industry, calculations for future lost profits will have to factor in the future loss caused by the pandemic and separate that loss from the loss caused by the alleged wrongful act.

Should the loss period run into 2023 or longer, the ability of the business to return to its new normal performance may not be easily assumed. The answer will depend on responses to questions concerning the injured business, its markets, customers, and changes in demand. In addition, the discount rate applied to the future lost profits may need to be adjusted to include a risk factor for the ongoing COVID-19 impact on the economy.

Reasonable Certainty/Sanity Check

When developing pro-forma cashflows for businesses in Chapter 11 bankruptcy, a feasibility study is needed to ensure the projections have a reasonable probability of success. When estimating lost profits, a similar standard needs to be met, the standard of reasonable certainty. The expert needs to show that the business would have, “more likely than not,” made a profit “but for” the wrongful act and that the estimate of lost profits is reasonable and reliable.[5]

A recent QuickRead article stated the following regarding feasibility. “[F]easibility is a fact driven concept turning on the specific facts and circumstances of each case. However, the projections in support of a plan’s feasibility must be credible. They must be rooted in objective fact and not wishful thinking. Credible projections require both a firm grounding in the facts of the case, as well as the application of reasonable methodology.”[6]

Any lost profits calculation must be based on reasonable methodology and the facts of the case. The question to ask is, “On review, do the calculations and explanations tie to the nature and facts of the case and have the appropriate methodologies and approaches been applied?”

This sanity check includes the analysis of possible other causations and the injured business’ actions to control costs, replace lost raw materials or supplies, and increase revenue after the wrongful act occurred. The inclusion of this information and showing how they tie to the estimated losses enhances the acceptance of the results as reasonably certain.

Conclusion

The COVID-19 pandemic put a strain on the U.S. and global economies, and individual lives as well. As much as most would like to put 2020 behind us and not have to revisit it, experts will have to continue to review financial returns from 2020 in the historical data for businesses claiming to have been injured by wrongful acts in 2021 and the future. As much as the expert would like to disregard the 2020 results, questions need to be asked as to how the injured business’ market and customers were affected by the pandemic, and what level of economic growth has been seen in 2021.

Armed with this information, an expert may estimate the impact of the wrongful act after adjusting for the aftermath of the pandemic as an additional proximate causation. By addressing this issue, the resulting report will be able to provide a loss calculation that gives a result with reasonable certainty. This will fulfill the standards of the courts and give credibility to the expert.

[1] Economic Forecast for the U.S. Economy, The Conference Board, 5/7/2021, www.conference-borad.org, U.S. Economy Grew Robustly in First Quarter, Josh Mitchell, Wall Street Journal, 4/29/2021, www.wsj.com.

[2] 49 states and DC added restaurant jobs in March, National Restaurant Association, 4/16/2021, www.restaurant.org.

[3] Proximate Cause, Recovery of Damages for Lost Profits, Robert Dunn, Supplemental Editors Sharon Rutberg, Windy Malkin, Supplemental March 2021, 1.1.

[4] Loss Recovery Period, The Comprehensive Guide to Lost Profits and Other Commercial Damages, Nancy Fannon, Jonathan Dunitz, Business Valuation Resources, 2014, pp. 332–334.

[5] Reasonable Certainty, Recovery of Damages for Lost Profits, Supplemental March 2021, 1.6.

[6] Chapter 11 Bankruptcy Expert Assignments and the Impact of COVID-19, Allyn Needham, PhD, J. Robert Forshey, JD, Dylan Ross, JD, 8/19/2020, QuickRead. The language in this quote comes from four court cases: In Re: St. Cloud, 209 B.R. 801, 809 (Bankr. D. Mass. 1997), In Re: Lakeside Global II, Ltd., 116 B.R. 499, 508 n. 20 (Bankr. S.D. Tex. 1989), In Re: Archdiocese of St. Paul and Minneapolis, 579 B.R. 188, 203 (Bankr. D. Minn. 2017), and In Re: Howard, 212 B.R. 864, 879 (Bankr. E.D. Tenn. 1997).

Allyn Needham, PhD, CEA, is a partner at Shipp Needham Economic Analysis, LLC, a Fort Worth-based litigation support consulting expert services and economic research firm. Prior to joining Shipp Needham Economic Analysis, he was in the banking, finance, and insurance industries for over twenty years. As an expert, he has testified on various matters relating to commercial damages, personal damages, business bankruptcy, and business valuation. Dr. Needham has published articles in the area of financial and forensic economics and provided continuing education presentations at professional economic, vocational rehabilitation, and bar association meetings.

Dr. Needham can be contacted at (817) 348-0213, or by e-mail to aneedham@shippneedham.com.